On April 20th, I wrote about how CNBC had reported that something looked rather rigged about the government’s new jobless-claims data in this election year:

What A Wonderful World

“Something strange” (REALLY STRANGE) “has been happening with jobless numbers lately” says the CNBC headline. You know it is strange anytime the mainstream media starts agreeing with my longtime criticism of government reports, even using my blunt language—that “the books look cooked.” In fact, the Bidenomics unemployment claims reports don’t just look

Indeed, it was strange at the level of just about statistically impossible:

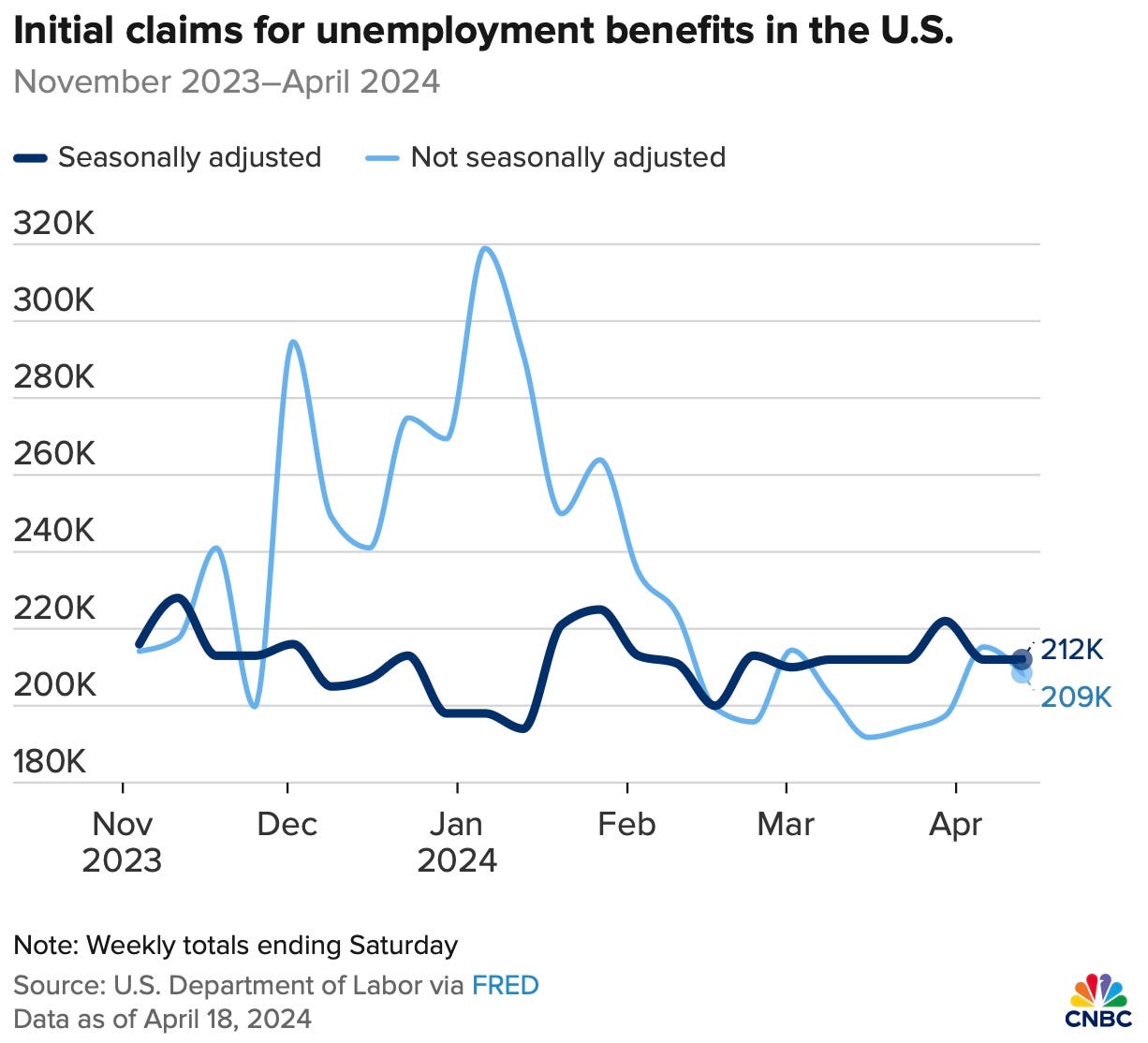

CNBC just noted that five out of the last six jobless reports gave an identical reading of 212,000 new claims and quoted someone observing that the odds against that exact number happening over and over are astronomical.

As CNBC reported, none of the raw numbers for all of those reports were even close to matching each other, but somehow the government’s “seasonal adjustments” always brought the derived numbers to the same 212K. Imagine that! One would almost think, I commented, they were goal-seeking the headline numbers in order to hit the sweet spot for this election year so that the labor market would look neither too hot for inflation nor two cold for the economy. One would almost think.

Well, they did it again. So, think again. Only this time, having been called out with suspicion by one of their usual parrot-press operations that normally takes all government data as gospel truth, they must have decided they needed to tweak the outcome just a bit. So, they reported 208,000 new jobless claims.

I don’t know about you, but for me, that difference there is one of toh-MAY-toh versus toh-MAH-toh. It still fits very nicely within the unusually tight range achieved by the goal-seekers:

With layoffs having bounced all over recently, I find the flatlining of unemployment numbers to be a bit hard to believe.

It also turned out that this particularly tight flatlining was due to some admitted tweaks in calibrating the government’s seasonal-adjustment formula:

“Using the new seasonal adjustment factors, initial claims have been at a fairly consistent level since around mid-September 2023 and even more so since the start of February 2024,” the spokesperson said.

Imagine that! They used new adjustment factors. Now, if that doesn’t reek of goal-seeking, I don’t know what does. It’s as if they just said, “We found that with just a little more change to our ‘adjustment factors’ we could get the number of jobless claims into a perfect 208-212,000 range every time. We’re happy with that.”

They’ve got it down to a science now. We need never see all those senseless big swings in jobless claims that one might have expected in other less make-believe times—such as when men were men and women were women—to see during a period of fairly high layoffs. Thank goodness, we have the government to create reality for us!

When hot is not

This seems to beg the question as to …

Why the job market has stayed so hot for so long

That, of course, is from the parrot press. They seem to be asking a sound question. The problem is the wrong question. They have asked why labor has stayed so hot when it is not hot at all. What they should have asked, as I’ve been imploring, is “Why has labor remained broken for so long.”

In case you’re new here and missed that argument, here it is in a nutshell: (I’ll exaggerated the example, just to make the application clear.)

If labor is tight because all laborers in the world died, then it is not appropriate to call that tight labor market a “hot” market. It is, in fact, a DEAD market. Now, reduce the extremes, and you understand what is happening here. To the extent that the market is tight because labor is declining, the market is not hot at all. It is on ice. It is declining. The only “hot” labor market is one where there is such a high demand for additional labor that labor is scrambling to keep up. That is certainly not the case in a year when layoffs have been rising.

The article (highlighted in the headlines that follow this editorial for paying subscribers) takes great pains to explain why jobless claims are not rising, noting that,

the latest data out Wednesday morning reveal a job market that is decisively cooling, yet also better by many measures than it ever was in the years before the pandemic.

Cooling, but better than ever?

How is it in any way better if laborers are wasting away? The more the vitality of the labor pool declines, the tighter the labor market gets for reasons having absolutely nothing to do with a hot economy or a correspondingly hot labor market. Somehow, the mainstream media just NEVER figures this out, and this has been going on (and explained here) for a couple of years now. It really is not that hard to figure out.

The Job Openings and Labor Turnover Survey shows the number of job openings fell by 325,000 in March, while the number of people hired fell by 281,000. The number of people voluntarily quitting their jobs also fell, by 198,000, a signal of less confidence among would-be job-hunters.

What is happening at this point is all the layoffs are starting to bring the number of jobs down closer to the number of available labors in this declining (on the supply side) labor market. Therefore, naturally, there are finally fewer people who are quitting to find other jobs as other options are growing more limited. As layoffs continue, causing even fewer jobs but also more newly available laborers, we’ll eventually get to the point where the match between available jobs and available workers aligns. From there unemployment will rise as jobs continue to decline.

The desire to cast this as “hot” is a misnomer that seriously misreads the real situation. So, by the time we get down to that point where labor and jobs align (and we may be getting close) so that the Fed’s unemployment gauge starts to rise, the damage to the economy necessary to have brought jobs down that much will be much worse than during normal periods of Fed tightening. The broken labor gauge will have caused the Fed to tighten deep into a recession.

Fed officials have often cited the ratio of job openings to unemployed workers as an indicator of just how tight the labor market really is, and this data series tells the story.

Well, it might tell the story if one half of that ratio were not lying; but when there is abundant, solid evidence that the unemployment side of the books is being cooked into dust, then the ratio doesn’t tell any story. How can you have confidence in “seasonally adjusted” numbers that are statistically beyond possibility in their near perfect agreement week after week after week?

Even in trying to say the ratio tells the story, they have to admit,

Essentially, the numerator — job openings — has fallen a lot, while the denominator — unemployed people — has barely budged, contrary to historical patterns.

Again, not just contrary to historical patterns but contrary to statistical possibilities. The fact that the consistency in the numbers fits nothing in history should help you grab a clue and realize the astronomical statistical improbability of hitting the same (or even nearly the same) number so many times means the books are cooked. Yet, the financial media is so ignorant, I saw only one publisher that woke up and caught the extreme peculiarity.

A prefect consistency may be the hobgoblin of small minds, as Oscar Wilde once said, but it is also, in this case, the evidence of perfectly faked numbers. You would think they would try a little harder to hide their fakery; but in a world where the press parrots whatever the government feeds it, the government gets lazy about the need to even create cover for its cookery.