We’re in for a weird ride, which I’ve been talking about for some time, where prices rise even as the economy settles into recession. Those who lived through the 70s remember it well. Stagflation is an odd situation, driven in part by shortages (oil last time because it drives the price of almost everything), where the economy is stagnant (at best), and prices still rise. It has to be driven into a harsh recession to bring prices down, so the Fed is forced to fight inflation even harder with interest hikes when it would normally be stimulating a flaccid economy with interest cuts to try to get it off the ground again.

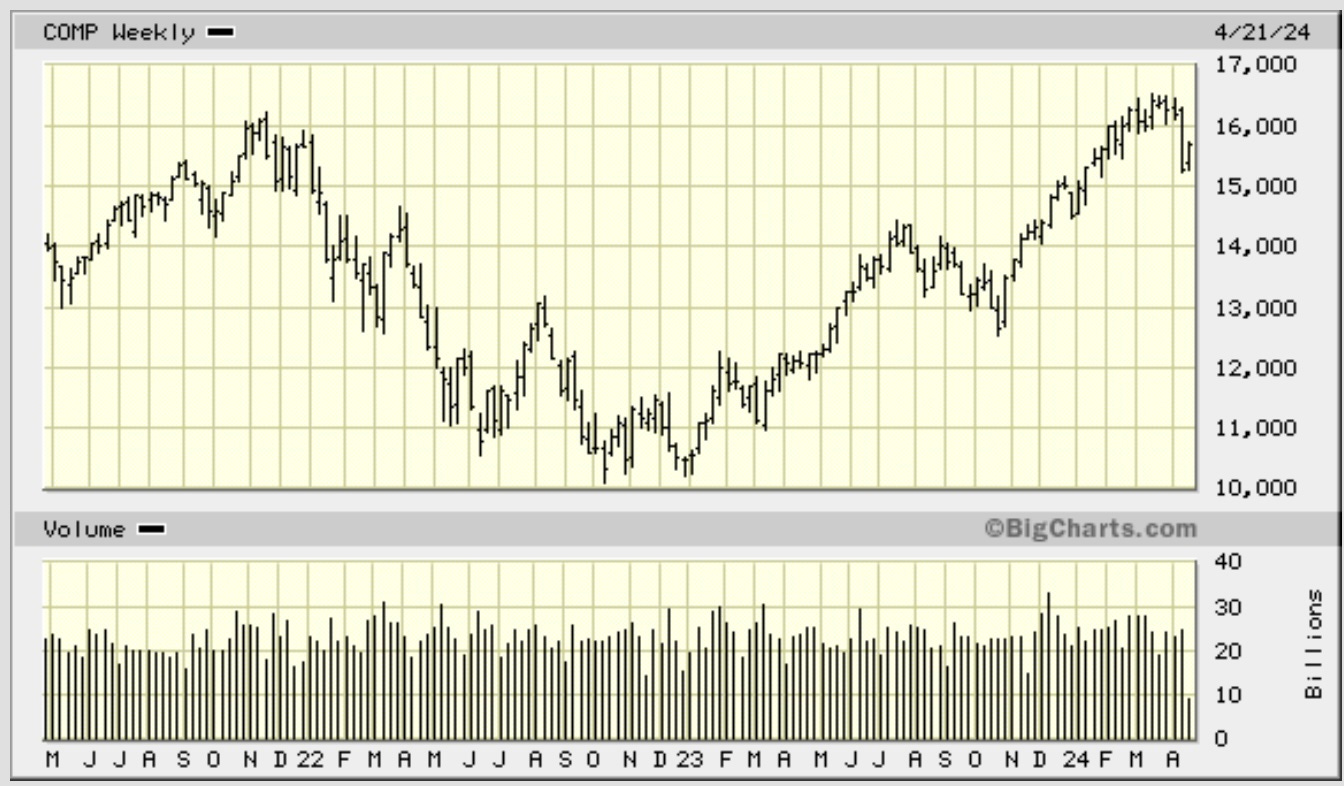

With the Magnificent-7 tech stocks having accomplished their individual crashes into bear markets already and the Nasdaq having chopped off all of the recent summit that had put it at a new high in 2024 …

… to where it is now resting back at the level it hit clear back around November, 2021 …

it’s still too early to know if the rest of the market will get sucked away this year in the downdraft; but, at least, a good part of the folly of the AI melt-up has melted back out of stocks, showing rather quickly what an illusion the MOMO there was.

With this first market plunge solidly before of us, let us now turn to the concern Jamie Dimon expressed, which is that we could be going into the stagflationary recession I have been saying for a few years is the place where all of this Fed folly will inevitably land us:

JPMorgan Chase (JPM) CEO Jamie Dimon is concerned the US economy could be in for a repeat of the problems that hampered the country during the 1970s….

The economy in that troubled decade was constrained by stagflation, a combination of low growth and high inflation, and Dimon said such a risk exists again.

"I worry that it looks more like the '70s than we've seen before…. There are circumstances in which it'll look more like the '70s than what we've had for the last 20 years."

The CEO of the largest US bank has been warning for months about a number of risks to a resilient US economy that could lead to "stickier inflation and higher rates than markets expect," as he put it in an April 8 letter to shareholders.

Federal Reserve officials backed up that view in the last week as Fed Chair Jerome Powell and several of his colleagues pivoted from earlier assurances about rate cuts and made it clear that rates were likely to stay elevated for longer than expected due to hotter-than-expected inflation.

Yes, the only Fed pivot that happened was a rapid turn away from vane rate-cut fantasies that dominated the market for the last few months to clear statements that rate cuts are further off than the market was dreaming or that rate hikes may even be forthcoming if the present inflation trends continue.

So, with those stagflation warnings from Dimon, which I’ve covered here recently, laid out more clearly by Dimon, don’t put any weight in the words of the chattering parrots who keep telling you the economy is strong and resilient. The jobs numbers/unemployment numbers that most of this mistaken belief rests upon are rigged, as reported in The Daily Doom last week, and are giving a sense of unmerited confidence in the nation’s current economic strength.

We can see the real weakness in the recent Purchase Managers Index reports, which show moves into recession in both the US and Europe, but especially in the US where Zero Hedge sums all of that up:

US PMIs Scream Stagflation As Manufacturing 'Contracts', Prices Rise, Heaviest Job Cuts Since GFC….

After a mixed bag from preliminary April European PMIs …

“Accelerated increases in input costs, likely driven not only by higher oil prices but also, more concerningly, by higher wages, are a cause for scrutiny Concurrently service-sector companies have raised their prices at a faster rate than in March, fueling expectations that services inflation will persist. ”

and after March US PMIs exposed the end of the disinflation narrative...

"Most notable was an especially steep rise in prices charged for consumer goods, which rose at a pace not seen for 16 months, underscoring the likely bumpy path in bringing inflation down to the Fed's 2% target….”

...S&P Global's preliminary [for US] April just dropped and they were ugly with both Manufacturing and Services disappointingly dropping further as the former dropped back into contraction….

Commenting on the data, Chris Williamson, Chief Business Economist at S&P Global Market Intelligence said:

“The US economic upturn lost momentum at the start of the second quarter, with the flash PMI survey respondents reporting below-trend business activity growth in April. Further pace may be lost in the coming months….

“The more challenging business environment prompted companies to cut payroll numbers at a rate not seen since the global financial crisis if the early pandemic lockdown months are excluded.

So, as I’ve been warning, the US economy is not the resilient powerhouse that the Fed and the Biden administration and most of the mainstream media that parrots those two entities keep telling you that it is. It’s a mirage … or, at best, a façade.

After March showed accelerating prices, flash April data confirmed the trend

“Notably, the drivers of inflation have changed.

"Manufacturing has now registered the steeper rate of price increases in three of the past four months, with factory cost pressures intensifying in April amid higher raw material and fuel prices, contrasting with the wage related services-led price pressures seen throughout much of 2023.”

Even ZH, once a proponent of the ever-elusive Fed flip to rate cuts, now says …

slower growth and much faster inflation - that does not sound like a recipe for rate-cuts... in fact quite the opposite.

You see, slower growth might seem like the recipe for rate cuts, but the 70s that Dimon talks about show us that the Fed raises rates without mercy when in a stagflationary situation. And it looks an awful lot like we’re slowly sinking into one.