Miles Franklin sponsored this article by Gary Christenson. The opinions are his and are not investment advice.

After consulting tea leaves, a crystal ball, the NY Times, several polls, voters in the Chicago Cemetery, CNN, 101 Uber drivers, and three unnamed sources, we know with high accuracy the winner is…

My apologies, I misled you. The winner of the Presidential election is unknown. However, the other “winners” in 2020 are clear. To name a few…

DEBT: The official national debt on January 1, 2020 was $23 trillion. It passed $27 trillion, on its way to $30 trillion and then $40 trillion in a few years. Add another $100 – $200 trillion in unfunded commitments. Congress promised funding for Social Security, Medicare, Medicaid, government pensions, student loan defaults, and others. Congress could hyper-inflate or default on those promises.

Regardless of how you count total debt, and how economists rationalize, DEBT is an obvious “winner” in this race toward self-destruction.

THE DEEP STATE: President Trump or President Biden (Harris) will pretend they are in charge. However, the Deep State will make the major decisions. How they control most of the U.S. is above my paygrade, but expect distractions from figureheads in public while the Deep State manages, for their own benefit, the government, banking cartel, military-industrial-security complex, big pharma, big ag, and the media.

Regardless of who is declared President, the Deep State is a winner.

THE FEDERAL RESERVE: Congress passed legislation over a century ago that created this monster. The result has been increasing influence by the banking cartel, massive wealth created for Wall Street and the elite, higher prices for everyone, debt-based currency (Federal Reserve Notes), loss of gold and silver as circulating money, never-ending debt creation (so far), and the Eccles Building.

Regardless of which party controls congress, the Fed and the banks that own it are winners in 2020.

THE PANDEMIC: Live in fear, arrest anyone not wearing a mask, obey the medical mafia, and destroy the economy. Blame President Trump, blame liberal politicians, blame Dr. Fauci, blame everyone, but live with anger and fear. Trash the economy for yet-to-be-determined reasons and squash everything fun, inspirational, or enjoyable. Restrict football games, Broadway productions, restaurants, bars, movie theaters, nail salons, church services, basketball, massages, baseball, dinner parties, casino gambling, concerts, walks in the park, and so much more. But don’t restrict riots, property destruction, drug abuse, murders, and craziness.

Yes, the pandemic, fear, anger, frustration, and nonsense are winners.

VACCINATIONS AND BIG PHARMA: COVID-19 vaccinations are the “nail” for Big Pharma’s “hammer.” Pound the message home—this vaccination will save you (maybe) and make $billions for Big Pharma (for sure).

Widespread vaccinations and profits for Big Pharma are winners.

RIOTS, CHAOS, POLITICAL NONSENSE, MONETARY CRAZINESS, AND BI-PARTISAN STUPIDITY: They will be big winners. Both political parties may reject election results. Post-election chaos, riots, and property destruction are likely. Pro-Trump and anti-Trump supporters are certain they have the correct viewpoint.

Chaos, craziness, and stupidity will be winners.

STIMULUS: Expect more “stimulus.” That includes legislation (paid with borrowed funds), QE from the Fed, pension fund bailouts, direct payments to individuals, corporate bailouts, a Universal Basic Income, payouts to cities and states, and many promises from politicians. Government revenues can’t pay for the “stimulus” so government will borrow funds. The solution to an excessive debt problem is NOT more debt, but that is the only plan. The discussion is only about who gets how much.

Yes, stimulus is an obvious winner.

GOLD AND SILVER: Debt is skyrocketing. Those extra dollars in circulation drive up prices for food, medical care, and S&P 500 stocks. People realize government and Fed policies are trashing the purchasing power of the dollar. Sensibly, people seek unprintable assets that preserve value, protect purchasing power, and have no counter-party risk in a world where counter-party risk and debt defaults will become important. The answer is assets that have intrinsic value, not debt. Gold and silver have been money for thousands of years, have never defaulted, will stay valuable beyond the next several financial resets, and will rise in price as Fed and government policies devalue dollars.

Yes, gold and silver will be clear winners in the coming years. Charles Nenner says gold will rise much higher in a bull market until 2026. I believe him.

COMMENTS FROM OTHERS:

Donald Trump:

“We like stimulus, we want stimulus. We think we should have stimulus.”

SUMMARY:

A president will be selected, but the “for-sure” winners will be:

- Debt

- The Deep State

- The Federal Reserve

- The Pandemic

- Vaccinations and Big Pharma

- Stimulus

- Gold and silver

WHAT AFFECTS GOLD AND SILVER PRICES?

- Debt increases. $30 and $40 trillion in national debt are coming. That excessive debt devalues dollars. Prices rise. Gold and silver prices increase.

- The Deep State will rake in profits, boost debt, escalate military spending, increase surveillance, expand control over the population, and push up gold and silver prices.

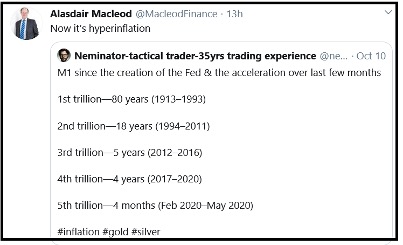

- The Federal Reserve increased its balance sheet (from “thin air”) by over $3 trillion in the past year. More $trillions are coming. Gold and silver protect us from central bank devaluations and “printing.”

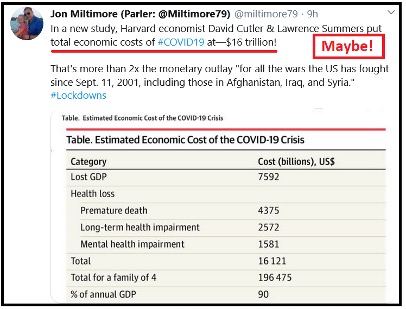

- The response to the pandemic has been to “lockdown” the economy, destroy jobs, devastate small businesses, and pray for a vaccine even though viral vaccines have been minimally successful. Expect more spending, panic, fear, anger, riots, suicides, and debt. The newly created fake dollars won’t fix real problems, but they will boost gold and silver prices.

- “Stimulus” includes boondoggles, payoffs, giveaways, “shovel ready projects,” currency “printing,” more debt, financial craziness, and monetary nonsense. Maybe it helps, but at what price? Those extra stimulus dollars flow into Wall Street, stocks, and boost gold and silver prices, which should rise for many years.

- Gold and silver prices: Going up! Corrections will occur, but the trend is higher because debt is increasing, the Fed is mismanaging the dollar, politicians spend more than revenues, and the needs of the Deep State are deemed important.

GOLD AND SILVER PRICES ARE INEXPENSIVE! PROVE IT!

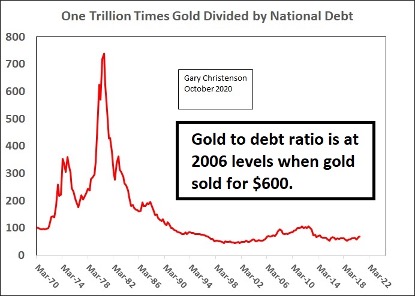

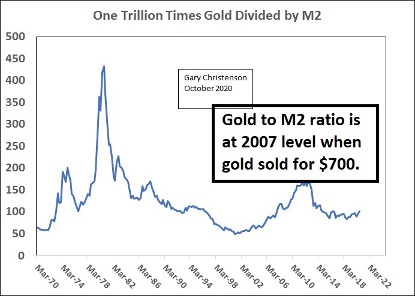

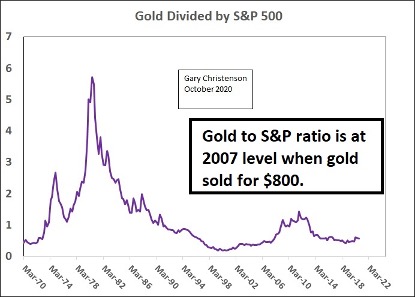

Examine five Decades of gold prices compared to national debt, M2, and the S&P 500 Index. Gold is low compared to debt, M2 and the S&P.

From: Alasdair Macleod: “Hyperinflation is here.”

“Definition: Hyperinflation is the condition whereby monetary authorities accelerate the expansion of the quantity of money to the point where it proves impossible for them to regain control.”

“… most, if not all governments have already committed their unbacked currencies to destruction by hyperinflation.”

From Howard Buffett in 1948:

“I warn you that politicians of both parties will oppose the restoration of gold, although they may outwardly seemingly favor it. Unless you are willing to surrender your children and your country to galloping inflation, war, and slavery, then this cause demands your support. For if human liberty is to survive in America, we must win the battle to restore honest money.”

From John Rubino: “The Least Important Election of Our Lifetimes?”

From John Mauldin: “Caught in a Debt Trap”

“Our political process can’t reduce spending and/or reduce taxes enough to balance the budget, so the debt grows and grows. As it does, paying the interest plus the accumulated debt load pulls more capital away from more productive uses. This depresses economic growth, thereby generating even more spending and debt.”

CONCLUSIONS:

- An election will occur. A winner will be decided. Many people will be angered by the result. Expect chaos and riots.

- Perhaps the winner will be determined by the Supreme Court. Or maybe someone will win because his political party was more successful at cheating, counting the votes, and working the system.

- Regardless of the outcome, debt, the Deep State, the Federal Reserve, the pandemic, big pharma, stimulus, gold, and silver will be “for sure” winners.

- Those “for sure” winners will boost gold and silver prices.

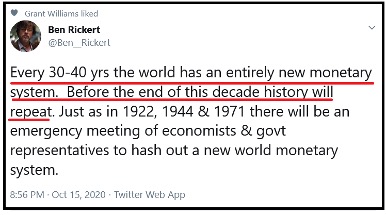

- A financial reset is possible in several years.

- Compared to national debt, M2, and the S&P 500 Index, gold (and silver—not shown) is inexpensive.

- Expect much higher prices for gold and silver.

Miles Franklin sells gold and silver. Take advantage of this correction in prices. There will be another correction, and another rally and other corrections, but the trend is up, and demand is strong and growing.

Protect the purchasing power of your savings and retirement with gold and silver – especially silver.

Gary Christenson