Blue Wave Fizzles

Local Dilemma

Shot in the Arm

Puerto Rico and Dallas

Last week I talked about the polls misleading us. I, for one, didn’t see a high probability of a Biden presidency combined with a Republican Senate. But, pending recounts, legal actions, and some run-off elections, that’s probably what will happen. We will muddle through.

Last week I talked about the polls misleading us. I, for one, didn’t see a high probability of a Biden presidency combined with a Republican Senate. But, pending recounts, legal actions, and some run-off elections, that’s probably what will happen. We will muddle through.

In fact, the optimist in me says this outcome is probably better than some of us think. Divided government isn’t necessarily bad. It can actually help force the different factions to bend a little and avoid extremes. I think, or at least I hope, they will come out of their ideological holes and talk to each other.

President-Elect Joe Biden has been a natural deal doer for the 47 years he has been in politics. In his Senate days he was clearly able to work across the aisle. He and Mitch McConnell are friends. With Republicans gaining seats in the House combined with a significant number of moderates within the Democratic House, there is the potential to get things done.

It is not unlike the Bill Clinton/Newt Gingrich years. Who knew we would be nostalgic for Clinton and Gingrich? While they may not have been pals, in the 1990s they worked together to forge a political package. Both gave a little on their preferred positions. If I remember correctly, this is called “compromise.” It produced the first balanced budget in decades.

Is hoping for more of that unduly optimistic? Maybe, but I’m a natural optimist. But I also recognize we have some big challenges. Today we’ll talk about the political changes, what they mean for the economy, and then how the latest vaccine news may affect the outlook.

First, let me remind you our AI Masterclass is still open. Artificial intelligence is a huge and growing industry that’s going to change life in profound and permanent ways. You’ll get to see exclusive interviews with George Gilder, Cathie Wood, and several other experts. The class will show you how to take advantage of this trend that will continue, no matter what the politicians do. Click here to learn more.

Going into this election, Democrats hoped for a “blue wave” that would give them solid control of the White House, House, and Senate. Then what? That was less certain. But some of the progressive agenda would probably have passed, including tax increases, vast new spending, and major new regulations.

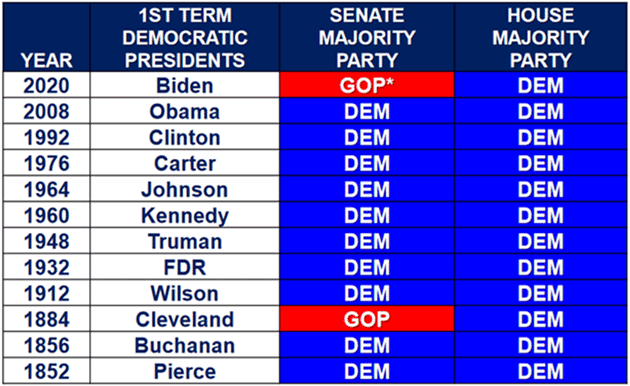

Democrats thought Biden’s coattails would deliver the Senate, and history was on their side. This chart from Bruce Mehlman’s latest slide deck shows every newly elected Democratic president since 1884 began his term with a Democratic Senate and House. This year broke the streak.

Source: Bruce Mehlman

My friend Ian Bremmer, in his exclusive weekly letter, outlined all the things that now won’t happen, and a few that will.

There will be no voter rights act, no redo of the census, obviously no potential for ending the filibuster, no making Washington DC or Puerto Rico a state and adding to the Senate, no “packing” the Supreme Court. Cabinet appointments have to be confirmed by the (Republican) Senate, which means some positions (Department of Labor, for example) may stand with acting posts, State/Treasury and other key positions will go to centrists. Biden’s broader social democratic policy agenda, attempting to align centrist Democrats with the more progressive wing of the party, is effectively stillborn—no nationwide increase of the minimum wage, no healthcare redo [JM—I’m not so sure], no dramatic legislative agenda on sustainability, and no tax increases to pay for increased outlays (while Republicans in Congress immediately shift to concerns about the deficit and fiscal responsibility).

Most importantly, in the middle of a pandemic, the ability of Biden to pass what would’ve been a $3 trillion stimulus has now evaporated—with prospective infrastructure, state and municipal outlays being chopped. A limited stimulus focusing on business support and extended unemployment benefits is now feasible in the lame duck session, though it’s likely to be hard fought and small, in part because overlap in spending agenda remains limited, in part because Democrats will hold out hope that they can swing the Senate.

All of which creates an interesting dynamic. Overall, Biden’s orientation on domestic policy is radically different from that of President Trump, but he’s likely to be far more constrained in implementing it. While the Biden administration will be less constrained in their foreign policy... but there the agendas and orientations are actually more aligned with those of the Trump administration.

On domestic policy, it’s going to be rule by executive order (also reined in by a more conservative judiciary, at every level)... With Biden as quick to undo Trump’s orders as Trump was in undoing Obama’s. That will mean a significant reassertion of the administrative state and heavier regulatory oversight in every area of the US economy, most particularly around environment and big industry.

(Over My Shoulder members can read Ian’s full letter here.)

Biden will (appropriately) have more freedom on foreign policy, and I think we can expect a different approach on trade policy. It won’t be free trade as I think of it, but neither will the Trump-style trade wars continue. He will have to confront China whether he wants to or not; the Chinese will give him little choice. There is a real chance Biden can improve our Chinese policy. This should not surprise long-term readers, but I have opposed tariffs for decades, and specifically the Trump tariffs. They are clumsy and they cost the US money.

This week Trump targeted a number of companies with links to the Chinese military. That is far more useful than tariffs. China is indeed a problem, but tariffs were/are the wrong tool. Huawei, as an example, and as my kids would say, has issues. So do scores of other Chinese companies. We should not be working with them. There are others that are of no consequence and we can work with them. Let’s figure it out. I am hopeful the Biden administration can do this, whereas Trump would never walk back his tariffs. The architect of our current Chinese strategy, Peter Navarro, euphemistically called an economist, cannot leave too soon in my estimation. (I should point out that I’ve been consistent in my criticism on this front.)

We may see more trade cooperation elsewhere. Biden may revive the WTO mechanisms that Trump stifled, for instance. The WTO has problems and we should work to fix them, but it is a useful forum.

Biden will also bring the US back into the Paris Climate Accord, but it will be symbolic without legislation to impose new rules within the US. That’s unlikely with a Republican Senate. That being said, the US has significantly reduced its carbon emissions in the last four years, just as we have done for the last 40. China, in contrast, just announced approval for up to 500 new coal plants. The Paris Climate Accord doesn’t deal with the real problems.

Let me make it very clear: I’m a strong environmentalist. I don’t want to see the air I breathe or anything in my water other than scotch. I am seriously working with a group of investors/managers here in Puerto Rico to build large solar fields to help replace our coal plants. It’s actually quite the opportunity given the cost of electricity on the island. Solar has the potential to be more than competitive.

I truly believe that by the end of the decade it will be cheaper to build solar farms than to build even a natural gas plant. I would like to see the conversion of coal plants to natural gas as a transition to cleaner power production. That is potentially possible under a Biden administration.

In fact, with the Senate looking so narrowly divided in any scenario, we may be overthinking how much “control” matters. Neither party will be able to pass major legislation if even a couple of its own members disagree, and both have a few rebels. That makes big changes (of any kind) unlikely to pass—unless they get bipartisan support. As Clinton/Gingrich demonstrated, bipartisan legislation actually has the chance of making a difference.

That doesn’t mean nothing will change, though. “Stuff” flows downhill, as they say, and events in Washington have effects elsewhere.

The summer economic bounce seems to have run its course, and I think we know why. The growth was mostly artificial, generated by the trillions of dollars consumers received from government and central bank programs. These have now expired, or will soon, and the politicians have been unable to agree on a new package.

The prime sticking point is aid to state and local governments, which Republicans oppose. Now the only way it can happen is if Democrats win those Georgia runoffs. And even then, it wouldn’t happen until January. Unemployed people and small businesses can’t wait that long. So I strongly hope Congress will pass a smaller package in the next few weeks that gets help to individual citizens and businesses.

Many states and cities were already in deep financial trouble before the pandemic. Now they have simultaneously lost tax revenue and seen expenses rise. This will be a serious problem, as explained in this recent note by Bain’s Macro Trends Group.

US states will face a large budget shortfall in the next few years due to the COVID-19 pandemic’s effects on the economy. States will have to choose between raising taxes and cutting spending to close the gap. We expect most will choose the latter given worsening pension liabilities and the current US economic trajectory. Businesses that rely on government contracting demand should prepare for a slow recovery from the COVID-19 recession.

According to a new analysis from Moody’s Analytics, US states could be facing an aggregate budget shortfall of up to $430 billion for the 2020–22 years. Nevada, Louisiana, and Florida are facing the greatest budgetary gaps, while Illinois is the most indebted US state due to its $230 billion in pension liabilities. Connecticut has the highest debt-obligation ratio, allocating 31% of state revenues to bond, pension and retiree health obligations.

This will be a problem in multiple ways. First, those states (and many cities within them) will have to either raise taxes or cut spending. Their ability to raise taxes is limited by the simple fact that residents can leave. So, as Bain says, they will have to cut spending, but that may drive people away, too.

But the problem is really everyone’s, because the money these governments spend goes to workers, who are also consumers, or to contractors. Somebody gets paid to build new roads, schools, fire stations, and so on. While it may not be in the local community, somebody manufactures police cars and fire trucks, stop lights and the multiple hundreds of things that cities need so that things work. If that spending disappears, so will many jobs, and not necessarily in the same locations.

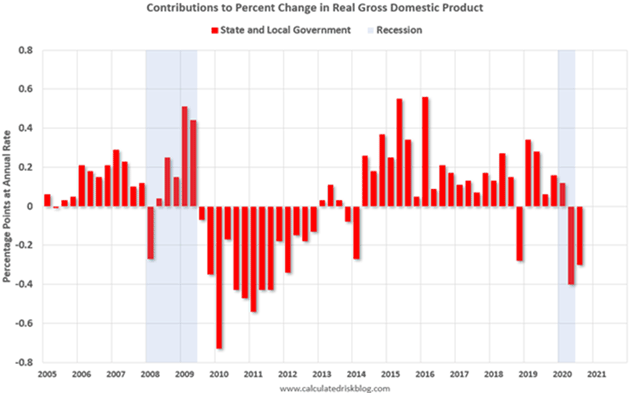

This isn’t a small problem. State and local spending is 10% of GDP. Knock 2% of that off and it makes coming out of a recession much more difficult. Here’s a chart from Calculated Risk showing the contribution state and local government makes to real GDP.

Source: Calculated Risk

You can see a quarter after the last recession where state and local spending (or lack of it) knocked something like 70 basis points off the GDP change, and a smaller amount for years afterward. The recession we are in now is considerably worse than that one, and may well last longer.

That doesn’t mean Congress should bail them out, though. That would simply transfer the problem from one pocket to another one, and the federal government has its own debt problems. There’s really no good solution here.

That said, it would help a lot if we could get past this virus problem. And on that point, we may have some new hope.

This week Pfizer (PFE) said its coronavirus vaccine trial was 90% effective in preventing infections vs. the placebo control group, with no major side effects. That’s impressive and, if further data confirms it, will be just what the doctor ordered for both our health and the economy. And other companies may not be far behind. Moderna will release its data any day now, and the preliminary report sounds quite encouraging. We may have several vaccines by March/April. The problem will be actually getting them.

The sources I’ve consulted believe Pfizer could get FDA approval before year-end, and possibly others, too. Then we have to start thinking of logistics and timing. Pfizer says it will have 50 million doses available before January. Each patient receives two doses four weeks apart, so that means 25 million people. The drugs have to be frozen and shipped at super-cold temperatures, so distribution will be a challenge. They will figure it out, but not without some problems. Freezers malfunction, syringes break, records get mixed up. Stuff happens. Nonetheless, it will be a start. If all goes well, we could have most of the country immunized by mid-2021, and worst case by the end of Q3 2021.

But there are more questions. Will most people want the vaccine? That remains to be seen. Many Americans have trust issues, as the election just highlighted. And will the vaccine really be 90% effective in the real world? That’s unknown, too. By the way, a 90% effective vaccine is statistically at the far-right edge of the charts. Flu shots are in the 50% range. The measles vaccines we took as kids were 93% (and eliminated the measles crisis).

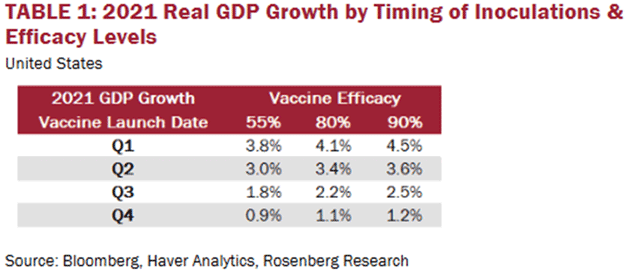

Economically, will everyone immediately resume their prior spending and movement, or will some stay cautious? For how long? As we’ve seen, even a few can make a big difference. Dave Rosenberg put a pencil to this and came up with these 2021 GDP estimates, based on vaccine timing and efficacy.

Source: Rosenberg Research

Those numbers are full-year 2021 GDP estimates. They suggest we can expect 3% or better growth next year if the vaccine is at least 55% effective and is widely distributed in the first half of the year. But as Dave notes, everything has to go right for that to happen. Realistically, the recession will continue at least through Q1 2021, even if the vaccine campaign goes well.

However, remember that GDP is down by 10% from where we were. We are not going to be back to “normal” by the end of 2021. Recoveries in GDP and employment typically take about 46 months. But Rosie is right, a vaccine is critical.

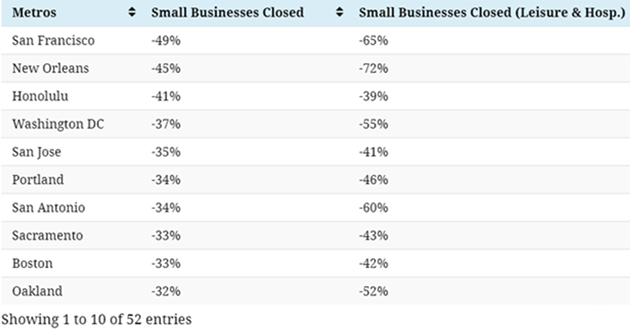

Let’s take a quick look at what we are facing. Some 20% of small businesses are closed. Most of those will never reopen. Chain stores have closed 47,000 locations and are aggressively renegotiating rents. Some are simply refusing to pay their rent because they don’t have the money. They are trying to hold on until the economy turns around. They can’t do that if they don’t hoard cash. The longer this goes on, especially if we see more closure orders, the more businesses we are going to lose. That means local tax revenue and jobs.

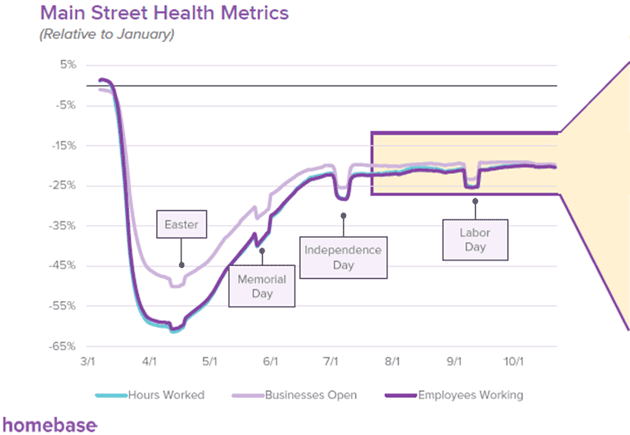

The Homebase data, which I’ve shared before, shows improvement has flatlined since July.

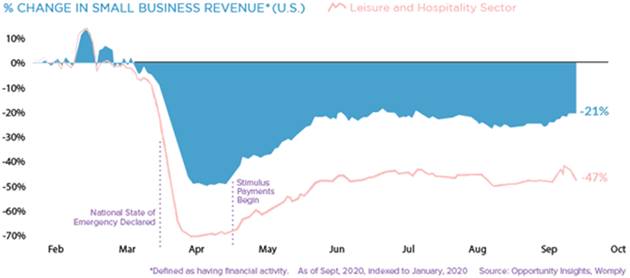

It’s even worse for industries. Overall, small business revenue was down 21%. Leisure and hospitality were down 47% as of October. The new restrictions we are seeing in many states are going to make it much worse.

Source: WEF

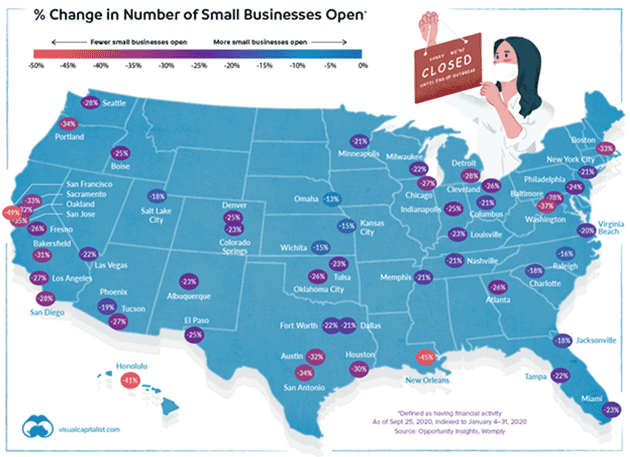

It gets worse from city to city, as you can see in the map and table below.

Source: WEF

I could literally bury you in data on business closures and government revenues. Back in June, Mike Roizen and I wrote a joint letter saying the first priority should be protecting the vulnerable, wearing masks and social distancing. We were not in favor of further lockdowns. The data continues to agree but states are again doing it. This is going to further hurt small businesses.

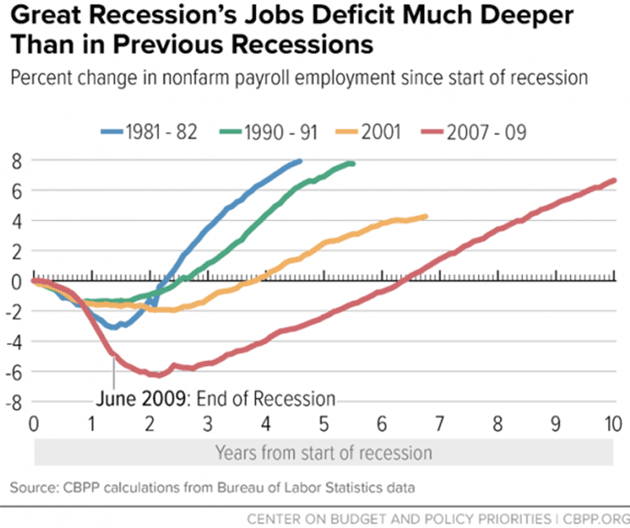

It is unrealistic to assume we will go back to some kind of “normal” in 2021. I think even 2022 will be a stretch. We have had a massive and severe blow to our economy. The chart below from the Center on Budget and Policy Priorities shows how it took four years to recover from the 2001 recession in terms of jobs and over six years for the Great Recession. The current recession is much worse than either of those.

Source: CBPP

The recovery is going to be longer and slower and more costly in terms of stimulus and Federal Reserve involvement.

I am an optimist. I think our entrepreneurs will come back as quickly as they can, but they are going to need capital and resources. For those of you with resources, look around your neighborhood. There are businesses that had to close with experienced and proven successful management. It wasn’t their fault. You may have an opportunity to invest in “startups” with proven management.

Between vaccines and the positive reports I’m getting on the far-UVC technology (lights that kill bacteria and viruses on surfaces and in the air and don’t harm humans), the world is going to be a much more positive place in 3 to 4 years. Maybe even sooner.

We have a chance to return to the next new normal. Just don’t expect it to show up in 2021. We will see the green shoots, of course, but it will look more like the recovery of 2009-14. It helps that we can now rule out the possibility of higher tax rates. Raising taxes during a recession is never a good idea and would have created a double-dip.

The stock market is a different animal. All the stimulus and Federal Reserve largess, along with technological breakthroughs and vaccines, may be enough to keep the markets levitating. Stay tuned.

I still plan to visit Dallas for Thanksgiving with my kids, though I will admit the recent upsurge in virus cases has me a little nervous. We’ll see…

And with that, I will hit the send button. I am learning more about Zoom and am starting to use it, as I miss the face-to-face contact. I look forward to being able to fly again later next year. You have a great week, and call a friend that you can’t see today but maybe next year…

Your wanting some normal in my life more than you know analyst,

|

|

John Mauldin |

P.S. Want even more great analysis from my worldwide network? With Over My Shoulder you'll see some of the exclusive economic research that goes into my letters. Click here to learn more.