NEWS &VIEWS

Forecasts, Commentary & Analysis on the Economy and Precious Metals

Celebrating our 49th year in the gold business

DECEMBER 2022

“… [D]ollars, yen, and euros will not always glitter in a storm, and they will never be mistaken for gold.”

Sir Peter Tapsell

––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

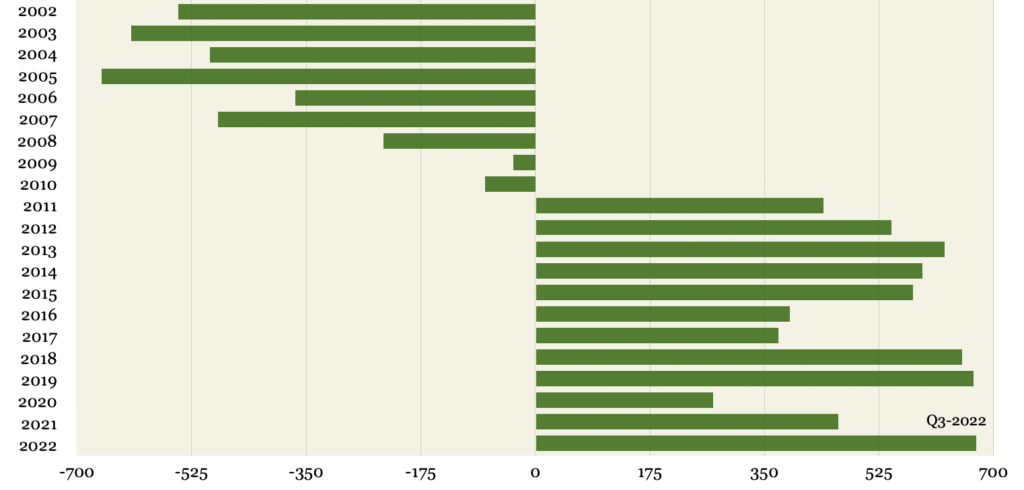

Is China the mystery whale in the gold market?

‘The barbarous relic now flashing a red alert for dollar bulls’

Since the World Gold Council reported that it could not identify the source for 300 tonnes in official sector gold demand in early November, speculation has been rife about who the whale might be. Opinion is now coalescing around China as the buyer in question, according to a recent Nikkei Asia report. “China likely bought a substantial amount of gold from Russia,” analyst Itsuo Toshima told Nikkei. There is some evidence to support the claim. Chinese customs authorities, according to the same report, announced an “eightfold” surge in gold purchased from Russia in July. In addition, the report cites China selling $121.2 billion in U.S. Treasuries this year, “the equivalent of roughly 2200 tonnes of gold.”

Likening central bank gold buying to an elephant jumping into an already full swimming pool, Lombardi Letter’s Moe Zulfiqar says he “can’t help but be bullish” on gold’s future prospects based on the enduring presence of central bank demand. “Something amazing is happening in the gold market,” he says in an advisory released in mid-November, “but it’s largely going unnoticed: central banks are buying gold at a record pace. This could be a big catalyst that sends gold prices toward $3,000 per ounce much sooner than previously expected.…”

“One of the worst-kept secrets in global central banking is the extent to which Chinese officials are swapping dollars for gold,” writes analyst William Pesek in an Asia Times piece. Though it is impossible to get a fix on China’s involvement in the gold market without an admission from the Peoples Bank of China, Pesek’s article does a good job of sifting through some of the inferences. He saves his most intriguing comment for last: “[T]he longer-term trajectory for global currency markets remains dollar-negative as China and other top Treasuries-holding powers switch into an asset John Maynard Keynes once dismissed as a ‘barbaric relic.’ That relic is now flashing red alert for dollar bulls.”

Central Bank Gold Sales and Purchases

2002-2022 (Q3) (net; metric tonnes)

Chart by USAGOLD [All rights reserved] • • • Data Source: World Gold Council

––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

The six keys to successful gold ownership

This eye-opening, in-depth introduction to precious metals ownership will help you avoid many of the pitfalls that befall first-time investors. Find out who invests in gold, what role gold plays in serious investors’ portfolios, and the when, where, why, and how of adding precious metals to your holdings. To end right, it is critical that you start right, and the six keys to successful gold ownership will point you in the right direction.

––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Short & Sweet

“FOR MOST ANALYSTS, THE LIQUIDITY PROBLEMS in the Treasury market are not just about rapidly changing prices, they are also a reflection of a dearth of buyers or an inability or unwillingness of the buyers in the market to mop up all the supply,” reports Financial Times. That absence of buyers is the result, for the most part, of both the Fed and the Bank of Japan withdrawing from the Treasuries market as buyers. Those cracks, in short, could quickly become major fractures unless buyers are found elsewhere. As FT points out, in the event of another crisis, the Fed would likely halt quantitative tightening or even return to quantitative easing, as did the Bank of England under similar circumstances a few months ago. Such a retreat from stated policy, though, would not communicate “the kind of stability and security that investors around the world depend on,” says FT.

IN A BLOOMBERG ESSAY, STANFORD HISTORIAN NIALL FERGUSON walks us through the anatomy of the FTX scam and how it fits into the long history of such misadventures……Ferguson does not have nice things to say about Bankman-Fried, but what happened with FTX is nothing new in financial markets. “Time and again,” he writes in an extended essay titled FTX kept your crypto in a crypt, not a vault, “share prices have soared to unsustainable heights only to crash downwards again. Time and again, this process has been accompanied by skullduggery, as unscrupulous insiders have sought to profit at the expense of naive neophytes.” And crypto, let us not forget, was promoted with great enthusiasm (and disdain for those who questioned it) as a New Age alternative to gold.

Cartoon courtesy of MichaelPRamirez.com

Cartoon courtesy of MichaelPRamirez.com

[WE’RE LONG-STANDING FANS OF INVESTING IN GOLD,” says Money Week magazine. “We think it’s a great way to provide insurance against any future financial crisis. Or inflation. If you want a truly diversified portfolio, invest some of your assets in gold.… Classic European and world gold coinage is an often overlooked, but extremely important sector in today’s gold market. These coins are rare which means they have more potential to appreciate in price yet, they can often be bought at bullion prices.” It goes on to specify British sovereigns as an item that enjoys “excellent liquidity in most countries in the world.” At USAGOLD, we have placed large numbers of this item with investors over the years. It remains our most popular classic gold coin with the Swiss 20 franc a close second.

“TODAY WE ARE EXPERIENCING THE WORST ELEMENTS of both the 1970s and 2008. … Everyone should be preparing for what may be remembered as the Great Stagflationary Debt Crisis,” Nouriel Roubini writes in an apocalyptic assessment he calls The Age of Megathreats (Project Syndicate). Dr. Doom outdoes himself in this extended essay in which he concludes: “Avoiding a dystopian scenario will not be easy.” He reiterates his investment advice covered in this letter previously, i.e., the need to hedge the risks just listed in a stagflationary environment. He recommends “short-term government bonds and inflation-indexed bonds, gold and other precious metals, and real estate that is resilient to environmental damage.”

ELLIOT MANAGEMENT, THE HIGHLY INFLUENTIAL HEDGE FUND managed by Paul Singer, warned recently that the world is on the road to “hyperinflation” and the worst financial crisis since World War II. According to a recent Financial Times report, the fund blamed central bank policymakers for the “looming crisis,” saying they have been dishonest about the cause of the inflation problem, which, in its view, is the result of ultra-loose monetary policy, not supply chain bottlenecks. Despite the regularity of financial shocks since the 1970s, “investors should not assume they have seen everything,” says the firm. Elliot warns that hyperinflation could lead to a “global societal collapse and civil or international strife.” Singer is a long-time advocate of gold as a hedge against the kind of uncertainties covered in his firm’s latest advisory.

WISDOM TREE, THE DUBLIN-BASED INVESTMENT FIRM, says the United States is already in a technical recession and sees that as a positive for gold. “Gold stands out as an asset that performs well in recessionary scenarios,” it says in a detailed report released in early November. “As recessionary risks rise, we expect gold to outperform most other asset classes. Gold is facing headwinds from a strong US dollar and a bond sell-off. Despite that, it is holding value better than expected. Gold is currently higher than where real bond yields would indicate they should be.… [T]he US bond yield has inverted, which is consistent with an upcoming recession. Bear flattening inversions have been good for gold in the past.… Today, we are in one of the strongest bear-flattening inversions we have seen since 1981. That points to a source of strength for gold we have not seen in decades.”

INVESTING HAVEN POSTED AN UPDATE to its 2023 silver forecast overnight, citing the annualized 194 million ounce supply shortfall recently reported by The Silver Institute as a “divergence of epic and historic proportions.” Even before TSI’s revelation on the supply-demand gap, Investing Haven had a very bullish outlook on the white metal. “Silver will move higher in 2023 because we expect a top to be set in the US Dollar,” it says in its full forecast published last month. “Moreover, leading indicators like inflation expectations and certainly the CoT positions in the silver market are strongly bullish for 2023. That’s why our silver price forecast for 2023 is 34.70 USD. Note that this is our first bullish target, also a longstanding target that we expected to be hit in 2022. Once silver trades near 36 USD it will be a matter of time until it will attack ATH. In our gold forecast 2023 we mentioned that our preference goes to silver investments in 2023 and beyond. We also tipped silver as the precious metal to buy for 2023.”

Notable Quotable

“Physical investment in 2022 is on track to jump by 18% to 329 million ounces, which would also be a new record. Support has come from investor fears of high inflation, the Russia-Ukraine war, recessionary concerns, mistrust in government, and buying on price dips. The rise was boosted further by a (near-doubling) of Indian demand, a recovery from a slump last year, with investors often taking advantage of lower rupee prices.” – The Silver Institute, Interim Silver Market Review

Editor’s note: TSI also reports a record annualized deficit between supply and demand – 194 million ounces.

Silver surplus or deficit

(Millions of troy ounces)

Chart by USAGOLD [All rights reserved] • • • Data source: The Silver Institute

“After 14 years, [crypto] is still a solution in search of a problem. It’s not building a new financial system. It’s not building a new internet. It’s not an asset uncorrelated with the market. It’s not a hedge against inflation. It is a vehicle for pure, naked speculation detached from anything in the economy. It’s a casino that’s wrapped in all of these lies. When you tear back those lies, what’s left looks like a net negative for the world.” – Phillip Diehl, Financial Times

“When you look around the world for a big, liquid, globally accepted safe haven, there is only one, and that is gold, which continues to reassert its status as the asset of last resort. Pre-1970, in the days of the gold standard, gold formally enjoyed this role. Today, after a 50-year break, the free market is putting gold back onto the pedestal where it belongs.” – Charlie Morris, Atlas Pulse Gold Report

“Last week was a huge turning point in the global financial markets. I’m not talking about the US stock market even though that is what all the financial media in the United States ever talks about. …What I’m talking about are the global currency markets. Last week the US dollar index had its biggest two-day decline in thirteen years. The volatility with currencies was extreme on a historical basis for them.… If you want to beat the markets you want to be in what benefits from a falling US dollar now and what is outperforming the S&P 500! A falling dollar helps gold and precious metals, but it also helps markets outside the United States perform better than the S&P 500.” – Michael Swanson, Wall Street Window

“Investors have been diversifying with gold and silver for decades to limit their exposure to poorly executed monetary and fiscal policies. As I shared with you last month, investors bought more American Eagle and American Buffalo gold coins between January and September of this year than in any other such period going back to 1999. I believe this is largely a reflection of Americans’ souring opinion of the state of the economy and the imbalance they see in monetary and fiscal policies.” – Frank Holmes, US Global Investors

“The great quantitative easing experiment was a mistake. It’s time central banks acknowledge it for the failure it was and retire it from their policy arsenal as soon as they’re able.” – Allison Schrager, Bloomberg

“All bull and bear markets eventually come to an end and this one in the Dollar Index will end eventually too. When will it end? When the Fed finally halts their rate hike regime, of course. However, you must keep in mind that most’ markets’ are generally forward-looking and proactive, not passive and reactive. With this in mind, perhaps we can look to the Dollar Index for clues before the Fed pauses and reverses. Maybe we should expect the Dollar Index to top and roll over in advance of this eventual policy shift and not as a response to the shift itself.” – Craig Hemke, Sprott Asset Management

Final Thought

Is Fed policy really as hawkish as it would like markets to believe?

Some applaud the current Fed chairman as drawing inspiration from the inflation vanquishing Paul Volcker. Others see him as charting a policy closer to that of Arthur Burns during the 1970s. One of Wall Street’s most famous Fed watchers, Henry Kaufman, says, “I am still waiting for him to act boldly. Today, the inflation rate is higher than interest rates. Back then, interest rates were higher than inflation rates. It’s quite a juxtaposition. We have a long way to go. Inflation has to come down or interest rates will go higher.”

Raising rates, in and of itself, is not necessarily hawkish (or Volckerian, for that matter). The central banks of Argentina, Venezuela, and Zimbabwe have been raising rates for years, yet their inflation rates are now 70%, 167%, and 257%, respectively, and climbing. No one would be so foolish as to characterize their central banks as hawkish (or channeling Paul Volcker). As we have said in the past, the Fed does not need to pivot to be dovish. It just needs to ensure the lending rate stays below the inflation rate. At the same time, we see signs that the interpretation of Fed policy might be shifting on that score, with the November surge in precious metals prices perhaps serving as early evidence. Gold is up 7.4% over the period; silver is up 11.6%. (11/25/2022)

Argentina inflation rate and interest rate

(%, 2008-2022)

Chart courtesy of TradingView.com • • • Inflation rate red, interest rate black • • • Click to enlarge

________________________________________

Worried about the sequel to the Great Financial Crisis?

DISCOVER THE USAGOLD DIFFERENCE

ORDER DESK:

1-800-869-5115 x100 • • • orderdesk@usagold.com • • • ORDER GOLD & SILVER ONLINE 24-7

––––––––––––––––––––––––––––––––––––––

Disclaimer – Opinions expressed on the USAGOLD.com website do not constitute an offer to buy or sell or the solicitation of an offer to buy or sell any precious metals product, nor should they be viewed in any way as investment advice or advice to buy, sell or hold. USAGOLD, Inc. recommends the purchase of physical precious metals for asset preservation purposes, not speculation. Utilization of these opinions for speculative purposes is neither suggested nor advised. Commentary is strictly for educational purposes, and as such, USAGOLD does not warrant or guarantee the accuracy, timeliness, or completeness of the information found here. The views and opinions expressed at USAGOLD are those of the authors and do not necessarily reflect the official policy or position of USAGOLD. Any content provided by our bloggers or authors is solely their opinion and is not intended to malign any religion, ethnic group, club, organization, company, individual, or anyone or anything.

–––––––––––––––––––––––––––––––––––––

Michael J. Kosares is the founder of USAGOLD, author of The ABCs of Gold Investing – How To Protect and Build Your Wealth With Gold [Three Editions], and the firm’s publications editor.

Michael J. Kosares is the founder of USAGOLD, author of The ABCs of Gold Investing – How To Protect and Build Your Wealth With Gold [Three Editions], and the firm’s publications editor.