One of my reasons I started this website (thegreatrecession.info) years ago was to counter all the denial that I saw in the mainstream media about how long and deep the problems from the Great Financial Crisis would be and about how we were failing in every way to resolve the greed, decay and especially faulty thinking that would assure our next collapse would be even greater than the Great Recession.

Today, the same lame thinking still dominates, but not just in the media. It’s pervasive in the general public, too. Of course, it is particularly prevalent among high-flying stock investors, who actually think because stocks can float above it all, the world must be doing fine.

I found myself observing a … shall we call it … a balloon ride crowded with lightheaded investors floating over my little mountain this week? (I live in the mountains, you know?) Even as I tried to shout out a warning that their overcrowded gondola was starting to tear at the bottom and that the top of their balloon was on fire, they scoffed and sailed on past me on the trade winds out toward a vast and stormy looking reach of rocky peaks and deep canyons. They could have landed on the grassy uphill slope just before my little mountaintop and got off, but all they could seem to see was blue sky. It beckoned them.

I am still dismayed at how light heads can be at their level of floatiness. The thin air is obviously not conducive to clear thinking. While I believe it is vital to keep yelling warnings to those whose heads are in the clouds to try to wake the world out of its lunacy, sometimes breaking dreams that float on nothing but hope feels … hopeless.

Years of irrational thought about the economy and markets have kept us from making the many fundamental changes we need in order to get back to the solid ground of an actual capitalist economy. We cannot build structures that reach into the sky without respect to the laws of economics as well as a set of man-made rules that prevent behavior that is well known to be reckless and, so, destructive to others. I’m talking about behaviors that serve only a greedy few. We want, instead, to keep feeding dreams of clear and unrestrained flights of fancy to easy riches.

In economics, that means we’ve burned up regulations like Glass-Steagall and cast off such ballast as the illegality of stock buybacks in favor of sailing higher and faster with no restraints. We’ve untethered the high-flying market from solid economic ground. Worst of all, we’ve become so lightheaded about how economies and markets function, that we cannot see or understand the storm we are sailing into or heed warnings that might bring us safely down.

What follows is an example from my experience this week in the airy writings and oxygen-deprived comments of a small clutch of light-headed investors.

Inverted thinking about inverted yield curves

While I continue to come across many articles that exude lame thinking, I’m going to focus here on just one. I won’t name the person who wrote it or provide a reference to it because he’s small potatoes. If he were a big public media name like Krackpot Kudlow, I’d reference his article directly; but my point is not to lampoon the person but to show just how poor the prevalent arguments from stock investors and advisors continue to be.

The article I’m referring to asked whether a recession was coming based on recession indicators we talked about last year here on The Great Recession Blog. Only we talked about those indicators a year or more ago when they could actually indicate something. The author thought it good to say these economic wind socks, now relaxed, indicate we will not fly into a recession, promising calm, blue skies for market balloonists in the days ahead.

I had to wonder if the writer lived on mars and hadn’t noticed that a recession was already declared to have begun in the first quarter of 2020. I even had to look at the date of the article to see if I was reading a rerun of an old article. Nope. Current. Wow, I thought, as I looked at the tornado howling through the canyon they were about to fly over. Not a good time for balloon rides.

The windsock he pointed his passengers to was the yield-curve indicator to see if it is showing a recession to be likely. He noted that it was not yet inverted. He must have been asleep at the start of the storm I guess. Inversion already happened last year — twice.

I thought everyone who talks about this recession indicator knew the yield curve inversion is forward looking. This author even said it is forward looking, but apparently, he didn’t know it looks forward by more than six months and that it never keeps indicating recession once one has already started.

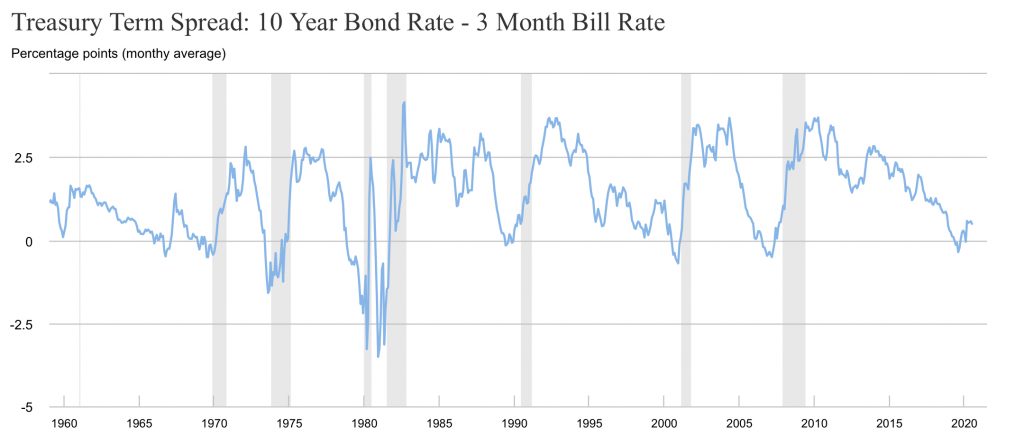

The indicator I’m writing about (and that he was writing about) is this one:

As you can see, each time the indicator dipped into inversion (a reading below zero) a recession ensued months after it dipped. In fact, as I often noted here last year, recessions do not start until after the yield curve reverts from its state of inversion back to normal — usually about three months after it reverts to normal. You can see that in the graph, too. (See: “BOND PRIMER: What is an inverted yield curve and what does it mean?” and “BOND PRIMER: Does Inverted Yield Curve Indicate Recession?“)

The yield curve inverted over a year ago, and it reverted many months ago, so it already predicted this recession more than a year ago. It’s not surprising, then, that the train arrived at the station right on time six months ago! Yet, this writer I was reading saw no recession currently marked on the graph (the gray zones) and sees the yield curve has reverted, so all must be fine ahead now that the indicator has stabilized. We must have already cleared out of the recession zone!

Really, the start of a recession just means this gauge’s messaging utility is long past. The yield curve was already 100% correct in having predicted a recession. It’s done its job! That train not only already arrived at the station, it’s now long on its way down the recessionary railroad. The yield-curve indicator has never been able to tell us anything about how long a recession would last or how deep it would go. As you can see, one of the slightest dips into inversion was followed by the largest, deepest recession on the graph.

The author even provided this chart from the Fed where you can plainly see the yield curve always inverts ahead of the recession by six months or more and, in most cases, returned to normal before the recession began. You’d think he could, at least, read the charts he presents; but that doesn’t happen when people are struggling to avoid seeing reality.

Let’s get our heads out of the clouds and look at bedrock reality!

This guy is nuts. We’ve already been declared in a recession, and he’s looking skyward at forward indicators to say they don’t show we are about to fly into one. On that basis, he argued the stock market might actually be right in indicating belief that the economy is going to get better and pricing accordingly because, “Look, the indicators shows there may be no recession ahead!” (As if the stock market knows anything!)

He also quoted the always lame Nobel economist Paul Krugman as backup to show hope waits ahead. Who on earth cares what economists are forecasting as a recession probability? No professional group has ever been worse at its own game.

Open your own eyes and think for yourself, Man! Economists didn’t see the recession of the dot-com bust coming and certainly didn’t see the Great Recession coming. So, who cares where they think we’ll be in six months? Look at the mud hole we’re already in. Wake up and smell the rotting cabbage!

The improvement in the unemployment rate that came with reopening the economy after the viral shutdown flattened much more than the viral infection rate or death rate over a month ago. It has only changed incrementally since then.

In fact, if you include all unemployed “gig” workers in the mix, who are now received special forms of unemployment benefits made just for this event, the unemployment rate has actually increased every week for more than a month and is over 32-million people. That’s 32-million and NOW RISING!

Here’s a reminder of the graph I published a couple of weeks ago in an article titled “Labor Dept. Trumps Its Own Numbers“:

This peaked and flatlining unemployment means there is no question the second half of this year gets worse because it’s already doing so, and a vaccine — if a vaccine even happens (given that scientists have never yet made a successful vaccine for a coronavirus) — isn’t going to repair the economic damage already accomplished and firmly holding.

A vaccine won’t restore businesses that already crashed and died. It may keep more businesses from going out, but there is a lot of loss that is already permanent, and the only reason we are not feeling the depth of pain is that we are receiving massive repeat doses of government anesthesia. That is what is allowing the market to float in delirium above it all.

The only things preventing the greatest storm of mortgage defaults and bankruptcies ever witnessed in US history right now — and this is straight fact, not opinion — are the equally massive government intervention programs that congress can no longer agree on — the $1,200 stimulus checks, the extended and enhanced unemployment benefits, the expanded unemployment benefits for gig workers, the payroll protection program, and the mortgage and rent forbearance act.

Why is that statement fact, not opinion? PRIOR TO the Coronacrisis, over 70% of Americans did not have enough money in savings to cover more than one month of living expenses. Fact. So, it is a certainty that, without those government emergency programs in place, 70% of the 32-million unemployed would have already defaulted on their loans and rents long enough to be in foreclosure or eviction! That’s 22 million people who would be in foreclosure or evicted from their rental homes!

And that was just the first wave! Even if we assume there will be no second wave of coronavirus infections (in spite of the fact that we are already seeing one), what would be the knock-on effects to other businesses from so many people driven out of their homes into destitution with no income and no savings???

All of this means there is absolutely zero chance that the second half of 2020 gets better just because unemployment has flatlined. The economy has already reopened for more than two months and has experienced as much benefit as it is going to from reopening. The benefits saving us from total despair are increasingly being battled in congress, and more than 50% of businesses on Yelp already reported they have closed “PERMANENTLY.” There is no reason to think the businesses that are not on yelp are somehow experiencing a different reality.

That is not going to change even with a vaccine. It has already happened, and vaccines are not retroactive! Yet, this high-flying balloonist of an author contended the stock market in its great wisdom may just be seeing the hope that lies ahead! I’d say the operative word there is “lies.”

On top of all these dead businesses with unemployment stalled at levels that may even exceed the Great Depression (except that clear statistics are not available from back then), we have the worst social unrest across the nation since the 60’s. That is clearly only going to get worse just before and especially after the election, which is less than three months away.

If Trump wins, the radicals will go insane! (They already are insane, but the arteries in their heads will burst from enflamed madness.) If Trump loses, Trump and his supporters will become enraged, claiming the election was totally rigged. Trump is already laying the ground for that claim with his constant complaints that mail-in-votes are ripe for fraud. (Maybe they are, in which case Trump voters will be right to be enraged; but, whether they are right or not, you know Trump is already laying the groundwork to make such a claim.) Democrats are laying the groundwork, too, by saying Trump is denying the post office essential funding so that it cannot deliver all ballots on time. So, no matter the outcome, this election bursts the nation into greater flames.

Congress is stymied over renewing the current efforts to renew all the emergency programs that are keeping the economy minimally alive on government life support. Trump saved only part of them by intervening via executive decree. The chances of yet a third round being approved in the final quarter go down drastically as Trump probably did this by decree to assure his re-election. After the election, he’s not as likely to fight his own party on this, and they will be even less likely to go for a third round. So, your experience of the situation is not going to get better anytime soon.

If these safety nets fail, then the bottom really falls out since unemployment is no longer improving.

And all of that is IF the virus doesn’t get worse! But, hey, maybe the market in its wisdom is flying toward real future earnings! After all, the big recession gauges don’t show any recession coming!

Who drives their car off the cliff then worries about the fuel gauge?

Afterward, a puzzled reader asks this writer who was floating on hopium, “Hasn’t a recession already started?”

You would think, “Duh!” (But apparently the question needed to be asked, given the dumb article.)

The author’s only lame answer is, “Yes … while, of course, the U.S. is in a recession, two of the three indicators mentioned in the article are forward-looking in nature.”

Oh, my gosh! He even sees it and still doesn’t see it!

Of course the gauges he uses are forward looking, but he raised the question of whether we are even now in a recession by talking about the probability of going into a recession. That is like asking what the probability is of your car going off a cliff when you have already gone over the cliff and your wheels are dangling in the air. It’s a dumb question to raise because it is already 100% fact! (And cars with dangly wheels don’t make good hot-air balloons.)

Moreover, the fact that the author actually responded that the indicators are forward looking in nature shows he should have known his article was dumb. They are likely to be looking BETTER after you’ve already entered the recession than they did before because you are now trying to work your way OUT of the recession you are already in; but they have never been known to indicate when that end will come.

That’s like staring at your gas gauge after you ran out of gas to see if it is indicating how long it will before your tank refills. It can tell you the probability of running out of gas. It has no predictive power for telling you when the tank will refill.

You have to figure the latter out by looking around at where you car sits. Is it resting beside a gas pump while your hand is running your credit card through the pump. Then it’s pretty likely the tank will be full soon. Or is it sitting at the bottom of a cliff in a pile of exploded rubble?

As another example, talking about the “probability” of my stepping on a tack in my bare feet is uh, err, pointless when I’m already standing on one while running the probabilities that the event could really be happening. It is an exercise in clownishness. I don’t need to waste time running my probability calculations to know what my shrieking foot is already telling me!

It’s unbelievable that you have to explain this stuff!

Another person even responded with glee, “It’s over already. I’d say 9M jobs recovered in 3 months shows that clearly.”

Seriously? What a fool’s pipe dream! 9-million jobs recovered out of 32-million lost! Yeah, it’s over already! We’ve recovered! Glory hallelujah!

That is how thick the clouds of denial are. It’s disgusting that one even has to write to correct such vain thinking. I’m explaining to those lost in the new politically correct math that five minus two doesn’t equal a million, no matter how much you want it to!

First, the meager 9-million jobs we got back compared to the 32-million lost were the low-hanging fruit. They are the jobs that could and did come back when the edicts that shut down the economy were removed. They were the jobs I said back in march would pop back immediately when the economy was reopened for business. Can’t these people figure out what the remaining 23M jobs mean? They are the ones that did not come back when the edicts were removed!

That means they are not going to come back for a long time because the edicts that shut them down were removed two months ago. IF THEY COULD COME BACK, they would have. If they remain lost because some places went back into shutdown, what does going back into shutdown so quickly tell you about the months ahead?

For the most part, these jobs can’t ever come back because the businesses that provided them we’re destroyed. They represent the actual economic wreckage that the permanent closure of restaurants and retail outlets already caused because the coronavirus hit an economy that was already faulty and feeble. The economy simply blew apart when it got this corona kick in the chops.

As I wrote just a few days ago,

I went to our local mall yesterday for the first time since the economy was shut down. Now two full months after reopening, more than 50% of the shops remained closed. Of those, 80% were stripped bare. That calculates out to no hope that, at least, 40% of all the businesses in the mall are EVER coming back….

The huge rebound quit as soon as it began, and the numbers of new hires are now just matching with the numbers of new layoffs. That’s if you look at real numbers and not just the BLS hype about its numbers. (As I wrote about in the article just referenced.)

More than half of the restaurants that have closed have not reopened. Most report on Yelp they are closed permanently. Those are services businesses that will never be rehiring their laid-off employees. So, real statistics add up with what my eyes tell me from a walkaround at the mall and what service businesses on Yelp are reporting.

Wake up!

The jobs are not coming back.

“US in Longterm Economic Decline“

The proof of that is that overall unemployment is already rising again. You hear in the parrot press’s headlines about unemployment dropping because the mainstream media just regurgitates what the government feeds it, and the government is conveniently not talking about the larger number that includes all of those on unconventional unemployment benefits (the very ones congress is now arguing about).

Total unemployment is rising because the damage of closing is still playing through. Can you even imagine how much worse that damage will be if congress does not renew those novel unemployment programs that are keeping people from defaulting on their mortgages and rent and that are protecting those who are defaulting?

Thank goodness for the readers who do still see straight

A wiser person commenting on the lame article put these unemployment numbers in perspective:

The unemployment rate fell to 10.2% in Friday’s report, but let’s put that in perspective. This rate is still higher than the peak of 10% that we hit in October 2009 during the Great Financial Crisis. We lost 22.2 million jobs from February to April, and now we have recovered 9.3 million, which leaves 12.9 million unemployed. There are millions more that are gig workers or self-employed, who are also out of work and not counted on payrolls, which is why we had more than 31 million on government benefits before the stimulus ended.

Additionally, the labor participation rate has fallen to 61.4%, which is the lowest level since 1976. This is because 5.8 million Americans who lost their jobs during the pandemic have presumably left the workforce. They are no longer looking for employment, which is not good news….

The lack of concern about our labor market crisis is unbelievable. The economy went over an income cliff two weeks ago, and Congress has its head in the sand. Perhaps that is because the stock market indicates that things are not that bad at all, unless you’re unemployed.

Indeed. Who cares about the rest?

So long as stocks are up, everything must be fine because the great wisdom of the market, according the writer I’m criticizing, knows there is hope in the near future. The Great Oz has spoken!

We’ve already fallen so the falling must be over. Right?

We’ve fallen through the bottom of the balloon’s gondola, but, hey, at least, we’re still in the air! That ground appears to be approaching quickly, but what does that matter, the balloon is now rising faster without our dead weight!

How could we possibly still have recession ahead when we’re only a mere 32-million jobs short of what we had the start of the year???

Whatever kind of crack they’re putting in their pipes where the writer of the article is from must be some pretty delusional stuff. People fall for it because we are all doped on government anesthesia with all those programs congress failed to re-approve, but which Trump partially reinstated.

People don’t feel the pain of hitting the ground yet, so they ignore the fact that they’re falling quickly. You cannot even imagine the economic catastrophe everyone would already be feeling without all that temporary shoring.

Hand me another pipe of whatever crack it is you have going over there, Man. I’m going to need a lot bigger hit to believe in your delusions.

If you want to talk probabilities, the unemployment level we are now experiencing and the knock-on effects without government support for those who were forced to stop working would likely be beyond anything the US has experienced in its history.

Millions more jobs would rapidly evaporate because the 32-million lost the ability to buy things. As millions of mortgages went into default, housing values would plummet from all the homes on the market. Rent values would fall through the floor because millions of evictions put millions of rental homes on the market at the same time. Those houses then have to try to rent out to people who cannot afford rent anyway. Thus, banks would go under. Landlords would be sunk. Construction would collapse.

Trump was smarter than his party and just ran out ahead of the party and quickly kicked some of the shoring back in place to avert immediate disaster. (But, hey, there is no recession anywhere in sight because the yield curve doesn’t say one is coming!)

Trump knew that, if people started actually feeling the pain of our self-inflicted catastrophe (not happening on this scale in Sweden, which didn’t shut down its economy and has far better viral recovery), he’d have no chance of getting re-elected, particularly if voters see their pain as resulting due to Republicans not realizing how bad the economic damage would be without this support.

In conclusion

When I wrote parts of the critique above in my own comments on the article’s page, another person replied with …

Equities have had a V recovery right? Are you saying today’s market levels don’t reflect a positive outlook for the economy to recover?

Wow! You can’t even beat the denial down with a stick! So, I replied as follows because years of market manipulation by Fed and government have turned the world into a rabbit hole where people no longer have a clue of how an economy and real markets actually work and where people are no longer even capable of grasping reality:

Equities are completely meaningless. I am definitely saying today’s market levels have nothing to do with a true outlook for the economy. The market has been delusional economically for a long time. It has totally disconnected from economic reality and is predictive of nothing but its own continuing delusions.

The market used to care about the economy, but stock markets like 2000 and housing markets like 2006 become completely irrational. On top of that, this market was built from the ground up for the past decade on nothing but corporate debt, financed by the Fed buying massive government debt that resulted from huge corporate tax cuts that were already breaking the nation because they were accompanied with huge spending increases before COVID-19 hit.

The market has from the commencement of the bull rally cared nothing about true business profits. Earnings were a complete joke the entire time! What are earnings? By that term, the market means “earnings per share.” And the “per share” part is the reason earnings have been going up for most companies for years. They were buying back their own shares at a rate never seen in history and broadly across almost the entire market. So, of course, earnings per share looked like they were improving because the denominator was constantly shrinking.

That’s as good as a baked number. At the same time, of course, it drives up stock prices because companies are using all of their own cash in many cases and all of the corporate credit in other cases to CREATE THEIR OWN MARKET FOR THEIR OWN SHARES! They drive up the price because they vote to buy the shares in sufficient enough numbers to force the price higher by creating their own demand!

Another term for this is “milking the company for all it’s worth” because you are not investing back in CAPEX (well established fact) but are burning cash and credit to make money off your stocks, not off your profits and are leaving the companies as empty shells because you don’t put enough back into them.

This market has been devoid of all business sense and all economic foresight for years!

That doesn’t mean it doesn’t make the owners rich. Of course it does! They buy into a company, profit themselves immensely by gutting it of every dime it makes and then use all of its available credit to line their pockets more, and then they sell to the dummies in the retail crowd who buy the momentum without a thought to the true value of a profitless, hopelessly indebted company during a time of global economic collapse!

So equity valuations are all hype, adrenaline and testosterone. Their rise has nothing to do with the economy now or its future; but one thing is certain (at least historically) all markets do catch back down to economic reality when the economy crashes for long enough, and this economy, which is now holding at 32-million lost jobs, clearly has a lot of crashing left in it.

Even the Fed, which tries to be as optimistic in every statement it makes as it can be, says it will take years to recover the lost jobs, even IF a vaccine is approved by January. The damage is in; and, if you cannot see that, you are intentionally blind to the obvious.

So, what kind of crack are you smokin’?