- The US stock market is at incredible heights and a reduction in central bank money printing could theoretically create… an all-markets waterfall.

- Many gold stock investors worry that mining stocks (already with the summer doldrums) could also crash.

- Should investors be concerned?

- Please click here now. Double-click to enlarge. My suggestion for stock market investors is to use my key moving average signals.

- When a sell signal happens, they can safely move to the sidelines. At this late stage in the US stock market cycle (which, horrifically, is mainly a function of the US money printing cycle), a significant reaction is likely in the August-October period. The good news:

- A major crash and bear market for stocks probably doesn’t happen until later in 2022.

- There is simply too much stock market “slush fund” money printed by the central bank and borrowed/spent by the government for the market to disintegrate now.

- The main catalyst to make it happen is likely inflation. That’s a long-term cycle, but only in its infancy now. It will take time to become a death knell for the stock market. Another catalyst is war (both civil and global).

- What about the miners? It’s true they are already mired in the summer doldrums and a major stock market reaction could drag them significantly lower.

- Please click here now. Double-click to enlarge this GDX advance/decline line chart. That’s negative, but it’s not a guarantee of lower prices.

- Please click here now. Double-click to enlarge. For investors who are heavily invested in miners and worried about a crash, put options are the simplest form of insurance/protection.

- For myself, I like an allocation of 60%-70% to gold bullion and fiat, and 30%-40% to miners and silver.

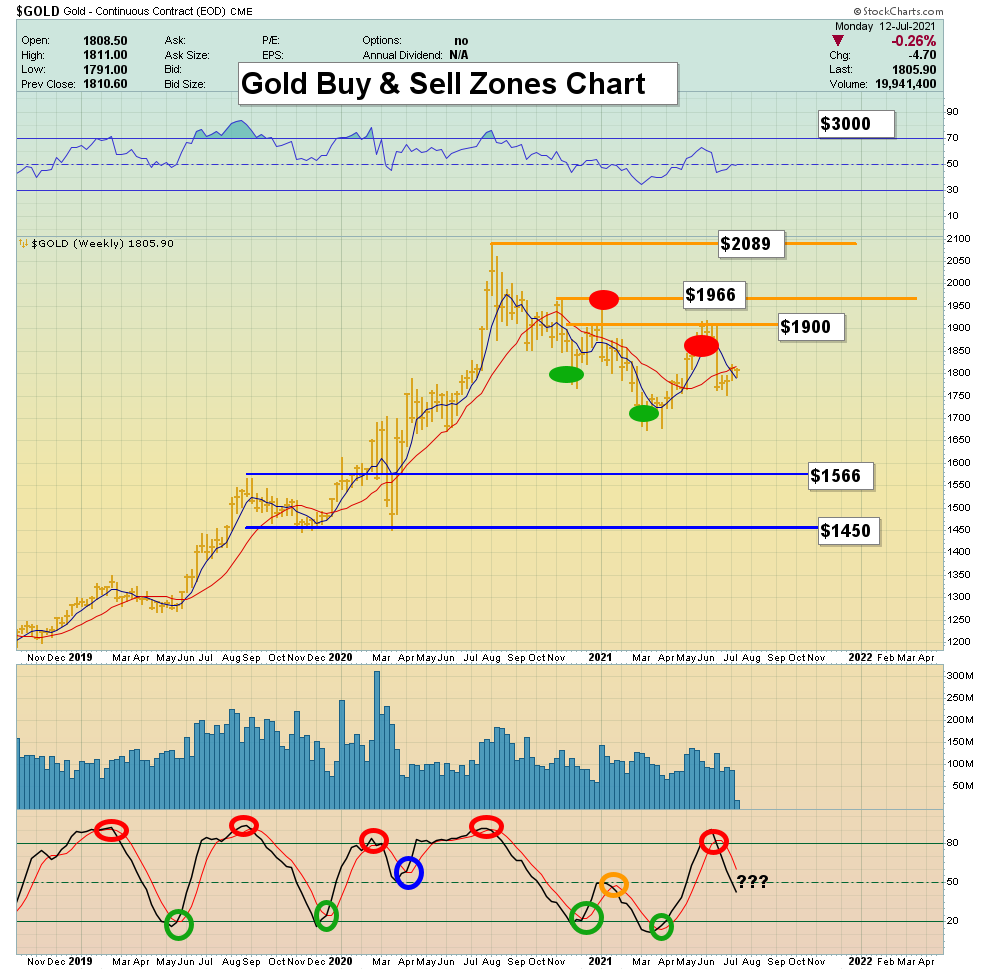

Another great tactic for investors is to maintain a strong focus on the support and resistance zones on the weekly gold chart.

Another great tactic for investors is to maintain a strong focus on the support and resistance zones on the weekly gold chart.- I like to buy miners only when gold bullion is at significant weekly chart support.

- Patience is required, but from these support zones, intermediate and senior miners tend to rally 20%-30% in a month or two, and there are gains of 100% and more for many juniors!

- With the above tools at an investor’s fingertips, there should be minimal (or zero) concern about a US stock market reaction or meltdown.

- Please click here now. Double-click to enlarge this important rare earths ETF chart.

- I cover rare earths and lithium in my junior stocks newsletter and resource investors should give them serious consideration. Here’s why:

- Going forwards, electric cars will dominate the auto industry. That means lithium and rare earths will have minimal downside risk and massive potential reward!

- This is the earliest stage of what is destined to be an inflationary era. It starts as “growflation”, and morphs into stagflation. While precious metal investors wait for the enormous institutional money manager surge into the gold/silver miners (a surge that only stagflation or hyperinflation can bring), the resource “grow” sectors of energy, rare earths, base metals, and lithium can be an exciting and enriching addition to any portfolio.

- Please click here now. Double-click to enlarge this fabulous platinum ETF chart. Note the spectacular buy signal in play now on the 14,5,5 series Stochastics oscillator. Clearly Palladium and platinum are two more “growflation” stalwarts for metal investors to consider as portfolio pillars.

- As most investors know, I sold a lot of bitcoin and alt coins into the recent highs and urged all crypto enthusiasts to do so too. While some of the proceeds went into gold, a lot went to platinum too!

- In the medium term (1-2 years), platinum has a good chance of doubling in price against US fiat. Some of the miners should play out as “ten baggers”.

- All in all, I think gold and silver stock enthusiasts are in a very good spot here. There are minor short-term concerns, but I have outlined lots of great tactics and tools to turn those concerns into smiles!

Thanks!

Cheers

St