NEWS &VIEWS

Forecasts, Commentary & Analysis on the Economy and Precious Metals

Celebrating our 49th year in the gold business

APRIL 2022

“Remember what we’re looking at. Gold is a currency. It is still, by all evidence, a premier currency. No fiat currency, including the dollar, can match it.” – Alan Greenspan, November 2014

––––––––––––––––––––––––––––––––

‘The world is being tested to the extreme.’

Protecting and building wealth in a new financial era

Interester Rate Observer’s James Grant referred to the current period as a “wild time in money.” Credit Suisse’s Zoltan Pozcar warned that “this crisis is not like anything we have seen since President Nixon took the US dollar off gold in 1971.” Mohamed El-Erian likened the Fed’s current monetary policy to that of a developing country central bank. “The Russian invasion of Ukraine and the corresponding Western sanctions and seizure of Russian FX reserves,” said long-time market analyst Lawrence Lepard, “are nothing short of a monetary earthquake.” Larry Fink, who manages BlackRock, the world’s largest investment fund, said the invasion marked “a turning point in the world order” and the end of globalization. Finally, George Soros went to the dark side calling Russia’s invasion of Ukraine “the beginning of World War III with the potential to destroy our civilization.”

If we have indeed embarked upon a new and turbulent financial era, as the above suggests, investors will be tasked with protecting and building their wealth under extraordinary and unpredictable circumstances. “History,” says James Grant, “would counsel us to be humble, prepared to listen and interpret correctly.” Swiss-based investment analyst Claudio Grass took a similarly philosophical approach (and one that we have counseled over many years). “It really does go a lot deeper than a comparison between gold and stocks, or considering the better ‘play’ for one’s portfolio performance,” he said. “The real counter-question now is ‘What is your peace of mind worth?’” Long-time money manager Stephen Leeb believes “the world is being tested to the extreme…Right now, as individuals, the best thing you can do for yourself is to buy protection, and that means investing in gold. Even under the best scenarios, a lot of turmoil lies ahead before we reach the other side, and gold will be the best way to get through it in good shape.”

Short & Sweet

THOUGH SILVER’S REACTION TO RUSSIA’S INVASION of Ukraine has been muted thus far, James Turk, the long-time precious metals market analyst, believes that is all about to change. “Given silver’s exceptional undervaluation at current prices,” he says in a recent report posted at King World News, “it appears to me that 2022 will be the year that silver completes the handle on this chart pattern by doubling in price from here. More importantly, 2022 is setting up to be the year that silver finally breaks above $50 per ounce to join the soaring prices we are seeing in so many other commodities because the dollar is being so badly debased.”

FOR MANY YEARS, ECONOMISTS HAVE SPECULATED on the impact of nation-states deciding to liquidate U.S. Treasuries en masse. Most of those discussions had to do with the dollar being unable to sustain its purchasing power. With the steady rise in Treasury yields signaling perhaps the beginnings of such a liquidation, some analysts like Craig Hemke, raise the prospect of the full-out event becoming a reality. For the most part, though, the selling thus far does not have to do so much with a decline of the dollar as it does, as Henke points out, hedging the complex reality of a widening economic war and sanctions.

“So what’s going on here?” he asks in a recent analysis posted at Seeking Alpha, “Is this simply inflation pressure and the impact of the Fed finally ending its 2020 QE program? Maybe. That’s certainly what the mainstream financial media is telling you. But what if that chart below also reveals a steady selling pressure from sovereign holders of U.S. Treasuries now that the U.S. has openly displayed a willingness to use its reserve currency status as a weapon? Put it this way… If you’re China or some other country whose long-term interests may not entirely align with what the U.S. likes and wants, would you be willing to continue with the current status quo of holding dollars and Treasuries in your foreign currency reserves?”

Editor’s note: Since Hemke’s piece was posted, some mainstream reports on the plight of the U.S. bond market have acknowledged directly the relationship between a sell-off in the bond market and rising yields.

Yield 10-year U.S. Treasury

(One year)

Chart courtesy of TradingView.com

“MILLIONS OF U.S. BANK DEPOSITORS FEEL SAFE in the knowledge that the Federal Deposit Insurance Corporation will protect their accounts, even if their bank goes under. Yes, it’s true that the FDIC says it will do so. As their website states: The standard insurance amount is $250,000 per depositor, per insured bank, for each account ownership category. However, the question is: Does the FDIC have the wherewithal to fulfill its promise? In the event of a major financial crisis, the answer is ‘no.’ Not even close.”

The problem reduces to a matter of counterparty risk. Whenever an asset pays a yield or interest, the depositor (or investor) depends upon the institution’s ability to pay – whether it be a corporation or government (in the case of a bond) or a bank (in the case of a deposit). Though the FDIC can cover losses when a bank or two fails, it cannot cover, as Stokes points out, a widespread banking system meltdown. On the other hand, gold is a stand-alone asset that does not rely on another party for value. It carries no counterparty risk. That is why some analysts portray it as the ideal defensive asset for the times.

CLAUDIO GRASS, A SWISS-BASED INVESTMENT ADVISOR who looks favorably upon gold, recently addressed a question he sometimes gets from first-time investors looking into gold: Is the metal simply too expensive at current prices? His standard reply, he says, is “expensive compared to what?”

“Now, while these are the sort of arguments I would usually bring up in conversations about ‘how high is too high’ when it comes to the gold price,” he says in a report posted at Eurasia Review, “the events of the last two years have made [me] realize that there [is] so much more to this question and led me to reconsider the way I answer these questions. It really does go a lot deeper than a comparison between gold and stocks or considering the better ‘play’ for one’s portfolio performance. The real counter-question now is ‘what is your peace of mind worth’? I’ve always outlined this deeper way of thinking about this issue, and I’ve always found many who agreed with me among the rational, responsible, long-term gold investors.”

Grass’ observations came on a day Bloomberg announced that the global bond market (gold’s chief competitor for strategic safe-haven capital flows) had “wiped out” $2.6 trillion in investor asset value, exceeding the losses incurred during the 2008 credit meltdown.

This eye-opening, in-depth introduction to precious metals ownership will help you avoid many of the pitfalls that befall first-time investors. Find out who invests in gold, what role gold plays in serious investors’ portfolios, and the when, where, why, and how of adding precious metals to your holdings. To end right, it is critical that you start right, and the six keys to successful gold ownership will point you in the right direction. Cartoon courtesy of MichaelPRamirez.com

Cartoon courtesy of MichaelPRamirez.com

IN A REPORT RELEASED EARLIER THIS MONTH, Zoltan Pozsar, the widely followed Credit Suisse economist, warns that “we are witnessing the birth of Bretton Woods III – a new world (monetary) order centered around commodity-based currencies in the East that will likely weaken the Eurodollar system and also contribute to inflationary forces in the West. A crisis is unfolding. A crisis of commodities.” He concludes: “Do you see what I see? Do you see inflation in the West written all over this like I do? This crisis is not like anything we have seen since President Nixon took the US dollar off gold in 1971 – the end of the era of commodity-based money.”

AN OLD PROBLEM WITH RESPECT TO SILVER COIN AVAILABILITY resurfaced late last month when the U.S. reported it would halt the production of Morgan and Peace silver dollars for the rest of 2022. The Mint periodically has problems keeping up with public demand for its gold and silver coins. “This calculated pause,” said the Mint in a press release, “is directly related to the global pandemic’s impact upon the availability of silver blanks from the Mint’s suppliers. The suspension will give the Mint time to evaluate the best way to allocate our limited supply of silver to ensure the best customer experience we can.” We pass along the Mint press release as a heads up for those planning to add to their silver bullion coin holdings. Though the shortage is restricted to the items mentioned and does not affect silver Eagle bullion coin production at this juncture, that could change overnight and without notice.

LONG-TIME COMMODITY MARKET ANALYST Andrew Hecht recently revisited an instructive chapter of gold history to point up the metal’s long-term value as a portfolio inclusion for both governments and private investors. “The last government to doubt gold’s value got burned,” he says in a report posted at Seeking Alpha. “At the turn of this century, the United Kingdom decided to part with one-half of its gold reserves. Ironically, London is the hub of the international gold market, so the UK sent a signal that gold had seen better days. In a series of auctions, the UK sold around 300 metric tons at prices mainly below the $300 per ounce level. Since 2003, gold never traded below $300 per ounce. Since 2010, the price has not ventured below $1,000, and since 2020, the price has remained above $1450 per ounce. … In 1999, gold reached a bottom at $252.50 per ounce. Since then, each price correction and consolidation period has been a buying opportunity in gold. The over two-decade-long bullish trend continues to take gold to higher highs.”

“GOLD PRICES,” ADVISES JP MORGAN in a recently released research paper, “are set to remain volatile. While this is not J.P. Morgan Research’s base case, a continued push lower in real yields (whether from a more dovish Fed than expected or higher inflation breakevens being priced in on the back of the commodities rally, or a combination of both) and additional boosted ‘safe haven’ / inflation hedging demand for precious metals on the back of a continued melt-up in other commodities, particularly energy, could likely send gold prices up towards $2,200/oz.” The bank predicts a trading range of $22.50 to $29.50 for silver, $100 to $185 for oil, and $1800 to $2200 for gold.

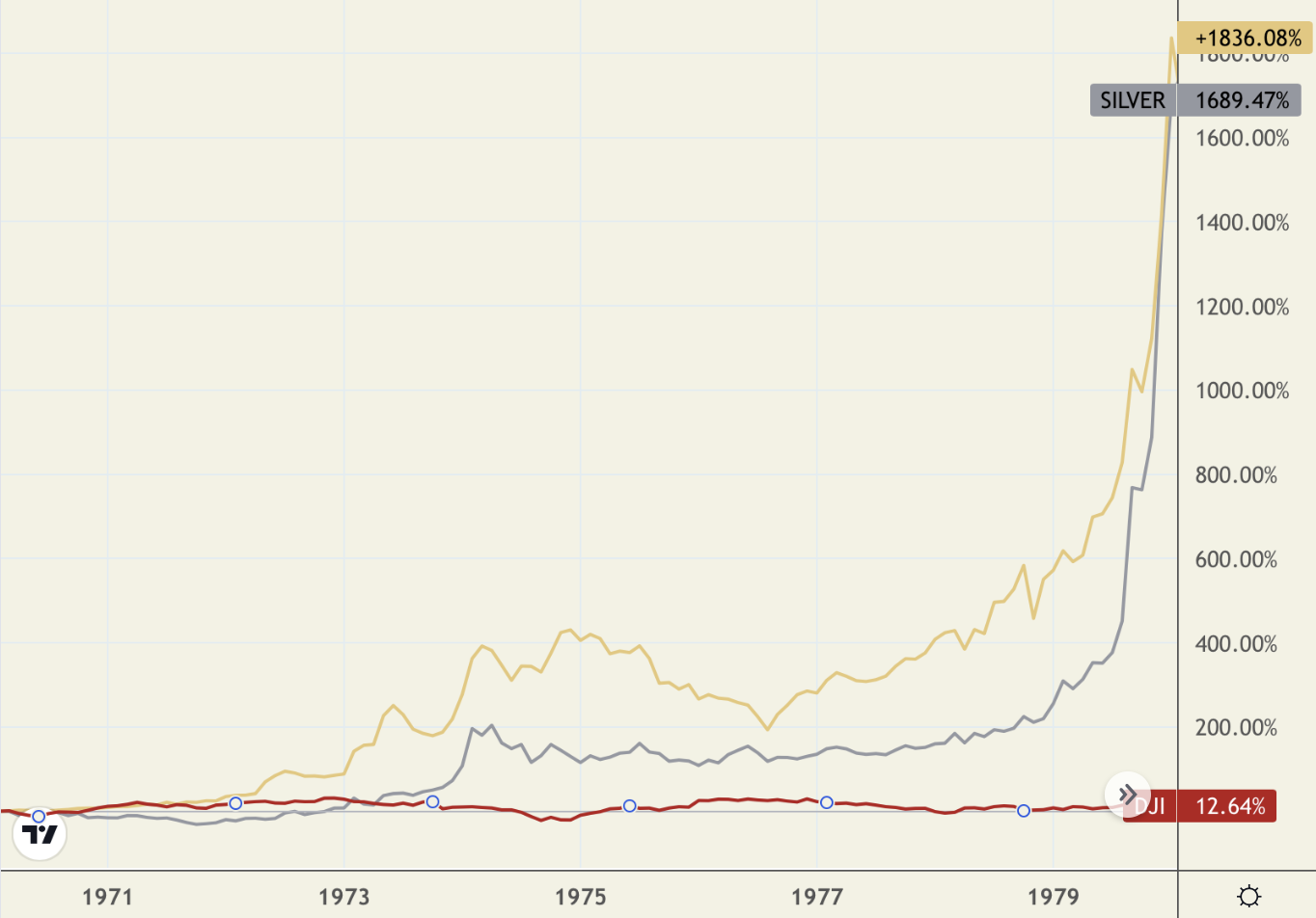

Gold, silver and stocks

(1970 – 1979)

Chart courtesy of TradingView.com

“RISING STAGFLATION RISKS in the U.S. and Europe,” reports MarketWatch’s Vivien Chen, “are raising the possibility of a ‘lost decade’ for the 60/40 portfolio mix of stocks and bonds, historically seen as a reliable investing choice for those with moderate risk appetites. Such a ‘lost decade’ is defined as an extended period of poor real returns, says Goldman Sachs Group Inc.” While stocks languished during the stagflationary 1970s rising about 13%, gold went on a tear rising 1836%. Silver rose 1689%.

“IT’S BEEN A LONG MONTH,” writes Bloomberg’s John Authers in an editorial earlier this week, “It’s been a long month, and not just for the luckless citizens of Ukraine. Russia’s invasion of its neighbor created Europe’s first full-blown land war between two sovereign states since 1945. Clarity is further away than ever, and the chances of an outcome with which anyone can be happy are dwindling.” With that, Authers launches into a lengthy discussion on where the global economy and financial markets might be headed as we move to month two of the Ukraine War. “Even if some ceasefire is agreed,” he warns, “lifting sanctions could be seen as rewarding [Putin’s] aggression.” That is an end game investors would be well served to consider.

Final Thought

Structuring your portfolio for the rest of the 2020s

“Precious metals are and always have been the ultimate insurance,” says Pro Aurum’s Robert Hartman in an interview with Claudio Grass. “They provide protection both against state failures and against mistakes in the monetary policy of the central banks. Every investor who looks into the history books sees that both have happened over and over again in the past centuries. From that perspective, investing in physical gold and silver is a common-sense precaution and a necessary part of any wealth preservation plan. Investors and ordinary savers ignore this at their peril and the failure to include precious metals in one’s portfolio is pure negligence.”

There are essentially two broad schools of thought alive and well in the gold market. The first holds that crisis is around the corner and, as a result, precious metals should be owned to profit from the event. The second holds that crisis is a permanent fixture in the market dynamic and that the portfolio should always include precious metals as the ultimate safe haven. The first buyer sees precious metals as investment products, i.e., buy now and sell later when the time is right. The second considers gold and silver, like Hartmann, as insurance products to be held for the long run. Some combine the two, allocating one part of their precious metals portfolio for trading purposes and another as a permanent, or semi-permanent, store of value. The novice precious metals owner must decide where he or she stands in this regard because it determines, in turn, which products to include in the portfolio and to what degree.

Investors often ask about the percentage commitment one should make to precious metals in a well-balanced investment portfolio. Analyst Michael Fitzsimmons offered an interesting take on that subject in a Seeking Alpha editorial last fall, “Assuming a well-diversified portfolio (which does include cash for emergencies),” he says, “my belief is that middle-class investors (net worth under $1 million), should own at least 5-10% in gold. I also believe that as an American investor’s net worth climbs, the higher that percentage should be because, in my opinion, he or she simply has more to lose by a falling US$. For instance, an investor with a net worth of $2-5 million might have a 15-20% exposure to gold; $10 million, perhaps a 30-40% exposure.” As it has for many years, USAGOLD recommends a diversification of between 10% and 30% depending on your view of the risks at large in the economy and financial markets.

––––––––––––––––––––––––––––––––––

Looking to prepare your portfolio for whatever uncertainty lies ahead

DISCOVER THE USAGOLD DIFFERENCE

ORDER DESK: 1-800-869-5115 x100/orderdesk@usagold.com

ORDER GOLD & SILVER ONLINE 24-7

Up-to-the-minute gold market news, opinion, and analysis as it happens.

If you appreciate NEWS & VIEWS, you might also take

an interest in our Daily Top Gold News and Opinion page.

Disclaimer – Opinions expressed on the USAGOLD.com website do not constitute an offer to buy or sell or the solicitation of an offer to buy or sell any precious metals product, nor should they be viewed in any way as investment advice or advice to buy, sell or hold. USAGOLD, Inc. recommends the purchase of physical precious metals for asset preservation purposes, not speculation. Utilization of these opinions for speculative purposes is neither suggested nor advised. Commentary is strictly for educational purposes, and as such, USAGOLD does not warrant or guarantee the accuracy, timeliness, or completeness of the information found here. The views and opinions expressed at USAGOLD are those of the authors and do not necessarily reflect the official policy or position of USAGOLD. Any content provided by our bloggers or authors is solely their opinion and is not intended to malign any religion, ethnic group, club, organization, company, individual, or anyone or anything

Michael J. Kosares is the founder of USAGOLD, author of The ABCs of Gold Investing – How To Protect and Build Your Wealth With Gold [Three Editions], and the firm’s publications editor.

Michael J. Kosares is the founder of USAGOLD, author of The ABCs of Gold Investing – How To Protect and Build Your Wealth With Gold [Three Editions], and the firm’s publications editor.