It appears cooling price inflation was “transitory” to borrow a favorite Federal Reserve term from a bygone era.

The Consumer Price Index (CPI) for March was hotter than expected by every metric.

The consensus was price inflation would show some resilience. As one analyst told Seeking Alpha, even meeting the consensus would constitute a "hot" report.

"A hotter-than-expected number would come as a surprise and not be well received because it would clearly indicate an unexpected uptick in the pace of inflation."

And that’s exactly what happened.

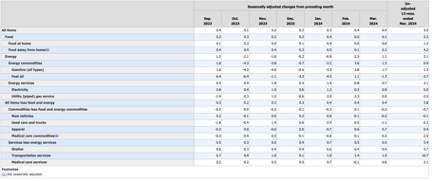

The headline annual CPI for March came in at 3.5 percent, according to the BLS report. That was up sharply from the 3.2 percent print in February and hotter than the projected 3.4 percent rise.

For folks keeping score at home, annual CPI was 3.1 percent in November.

On a monthly basis, prices rose 0.4 percent. That matched the February increase. The expectation was for the monthly number to fall slightly to 0.3 percent.

To put the numbers in perspective, prices have gone up by over 1 percent (1.3%) in the last four months. That annualizes to 3.9 percent. The trend is toward hotter price inflation, not cooler.

Excluding more volatile food and energy prices (as if anybody can exclude such things from their budgets) core CPI was up 0.4 percent in March just like it was in February. The consensus was for core CPI to cool slightly to 0.3 percent.

On an annual basis, the core CPI remained at 3.8 percent. The expectation was that the annual core number would fall to 3.7 percent.

The core data underscores the stickiness of price inflation. It has been hovering around the 4 percent range since July.

It’s important to note that none of these numbers are close to the Federal Reserve’s mythical 2 percent price inflation target. Core CPI is nearly double the target.

The Fed claims to be data-dependent. Well, the data tells us that the cooling trend we saw late last year was transitory. No matter how you slice, dice, or massage the numbers, nothing indicates the Fed is anywhere near winning the inflation fight.

And keep in mind, inflation is worse than the government data suggest. The government revised the CPI formula in the 1990s so that it understates the actual rise in prices. Based on the formula used in the 1970s, CPI is closer to double the official numbers. So, if the BLS was using the old formula, we’re looking at CPI closer to 6 percent. And using an honest formula, it would probably be worse than that.

Looking more closely at the data, energy costs and shelter costs continue to drive the CPI higher.

Energy prices rose 1.1 percent month-on-month after increasing 2.3 percent in February. Gasoline was up 1.7 percent.

Shelter costs were up by another 0.4 percent on the month and 5.7 percent on an annual basis.

Price inflation for food appears to be moderating, rising by just 0.1 percent month-on-month. But some food prices continue to increase at a significant pace. Meat, fish, poultry, and egg prices climbed by 0.9 percent, driven by a 4.6 percent jump in the price of eggs.

Excluding energy, the services index increased 0.5 percent in March. On an annual basis, it increased by 5.4 percent.

With the hotter-than-expected CPI print, most analysts now think a June interest rate cut is off the table.

The markets reacted accordingly.

Gold and silver charted their first significant corrections in several weeks. Gold fell over $18 in just the first couple of hours after the data was released. Silver was down about 28 cents. But after the initial sell-off, both metals recovered most of those losses.

Meanwhile, bond yields rose, and stocks slid. The Dow was down over 400 points by mid-morning and the NASDAQ dumped nearly 1 percent.

This has been the pattern every time we’ve gotten hot inflation data.

The Markets Are Missing the Big Picture

The markets are reacting to the likelihood that the Fed will hold rates higher for longer, but they are totally missing the big picture.

They are going to get their rate cuts – but not for the reason they think.

The fact of the matter is the Fed hasn’t done enough to slay price inflation. This is clear from the CPI trends. Despite the interest rate increases, monetary policy remains historically loose. But it is tight enough to wreck a bubble economy loaded up with debt. It’s only a matter of time before something breaks.

And when that happens, the markets will get their rate cuts in spades. The Fed will be forced to slash rates back to zero and relaunch quantitative easing. It’s just a matter of time.

This isn’t even on the mainstream’s radar.

The markets just want their easy money back. After well over a decade of artificially low interest rates, most people in the mainstream thinks that’s the norm.

Easy money is the mother’s milk of this economy. It can’t function without it. That’s why the markets are so desperate for rate cuts. The irony is they want price inflation to come down so the Fed can go back to the inflationary policies that got us here, to begin with. They want artificially low interest rates. They want the Fed’s big fat thumb on the bond market. They want money creation.

But that’s what got us here in the first place.

After the 2008 financial crisis, the Fed slashed rates to zero and held them artificially low for nearly a decade. It launched three rounds of quantitative easing, creating nearly $4 trillion out of thin air. It quickly abandoned its only effort to normalize monetary policy in 2018 when the economy got shaky and the stock market crashed. Then it doubled down during the pandemic, dropping rates to zero again and injecting almost $5 trillion more into the economy.

The question isn’t, “Why is the CPI still hot?” The question is, “Why is anybody remotely surprised CPI is still hot given the amount of money created?” (i.e. inflation)

This puts the Fed between a rock and a hard place. It needs to cut interest rates because this debt-riddled economy simply can’t function in a high-rate environment.

But the central bank can’t plausibly cut rates with price inflation still far above its target.

The Fed has been hoping against how the data would give them cover to cut rates. But ‘tis not to be. The March data just backs them deeper into the corner.