DEMAND FOR GOLD

As investors and others continue to jockey for position in order to announce that “the bottom is in for gold” or that “gold owners received an early Christmas present” or “crypto failures will translate to higher prices for gold”, it is clear that most of them are thinking that increased demand for gold will drive its price higher.

That is not the way it works.

FACT NO. 1 The price of gold is NOT driven by demand for gold.

FACT NO. 2 The price of gold tells us NOTHING about gold.

DEMAND FOR MONEY

The value of gold is in its use as money. Gold is real money – original money. The U.S. dollar is a substitute for real money.

Question: How much does demand for dollars, i.e., money, increase the value of dollars?

Answer: It doesn’t.

The value of any money is in its purchasing power. The money does not have value unless it can be exchanged for things of real value – goods and services that we want and need. Or, if we so choose, we can save it for later use; but, only if we are confident that the money will retain its value/purchasing power.

People want and need dollars because they are an accepted medium of exchange and legal tender. The demand for dollars, however, does not make them more valuable. Nor, does any concentration of dollars in the hands of a limited number of individuals or entities increase their value.

The U.S. dollar has lost ninety-nine percent of its value (purchasing power) over the past century, but it is not because of a lack of demand for dollars, or money.

The loss in the U.S. dollar’s purchasing power is the result of more than one hundred years of practiced, intentional inflation (expansion of the supply of money and credit) by the Federal Reserve.

So, too, demand for gold does not increase its value. Gold is real money because it is a long-term store of value. The purchasing power of an ounce of gold has remained essentially the same over the centuries, regardless of demand for metal itself.

THE PRICE OF GOLD

Earlier in this article, we said that the price of gold tells us nothing about gold; which is true.

If that is the case, then why has the price of gold risen over the past century from $20.67 oz. to $2050 oz. in 2020 and earlier this year?

The one-hundred fold increase in gold’s price corresponds almost exactly with the ninety-nine percent loss in purchasing power in the U.S. dollar since the origin of the Federal Reserve in 1913.

FACT NO. 3. A higher gold price correlates directly to the loss in U.S. dollar purchasing power.

GOLD PRICE VS US DOLLAR

The higher price of gold reflects the effects of inflation that have already occurred and are evident in the financial system and the economy. It does not increase based on expectations for additional inflation or more severe effects. See the chart (source) below…

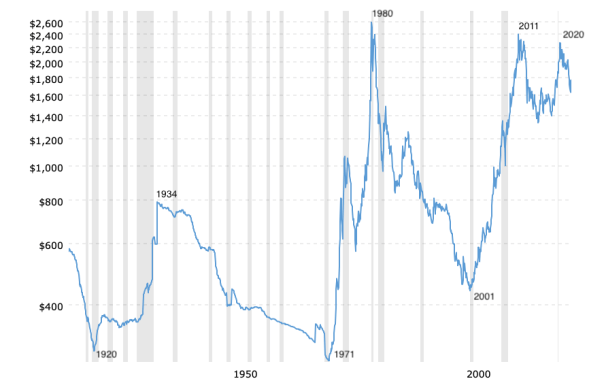

Gold Prices (inflation-adjusted) – 100 Year Historical Chart

All of the major turning points (1920, 1934, 1971, 1980, 2001, 2011, 2020) of the gold price in the chart above correspond to major changes in the U.S. dollar.

When President Nixon suspended convertibility of U.S. dollars into gold for non-U.S. citizens and foreign governments, the price of gold went up to a peak in 1980 that reflected the effects of inflation that had occurred over the previous five decades.

All through the 1980s and 1990s, the U.S. dollar found favor at home and internationally. The U.S. economy was in high gear and the effects of inflation were muted. Inflation hadn’t stopped but its effects were mitigated by other forces.

It is important to note that the gold price increase 1971-80 came after decades of dollar depreciation. Once the gold price found a level consistent with the effects of that inflation that were already evident in the increasing cost of goods and services, the price then declined for twenty years, before finally starting to reflect the inflation effects that it seemed to have been ignoring for the previous twenty years (1980-2000).

This led to a decade-long increase in the gold price which culminated in the 2011 price peak and a subsequent five-year decline. Between 2016-2020, the gold price increased again; this time to reflect the effects of inflation for the five years between 2015 -2020.

GOLD PRICE UPSIDE AND DOWNSIDE

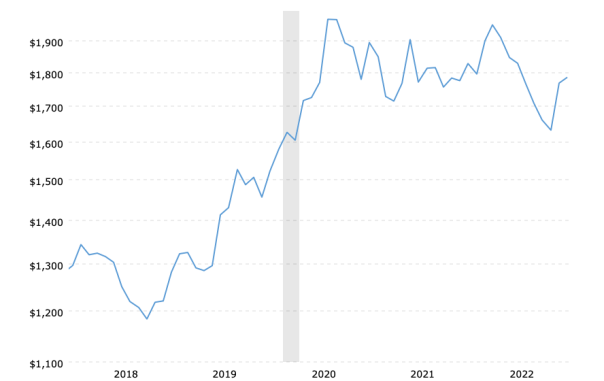

When the gold price touched $2058 oz. in August 2020 it reflected a ninety-nine percent decline in U.S. dollar purchasing power. After declining to an intraday low of $1675 in March 2021, it moved back up to a secondary high of $2043 oz. earlier this year (March 2022).

The peak in March of this year was a confirmation of the ninety-nine percent decline in U.S. dollar purchasing power over the past century.

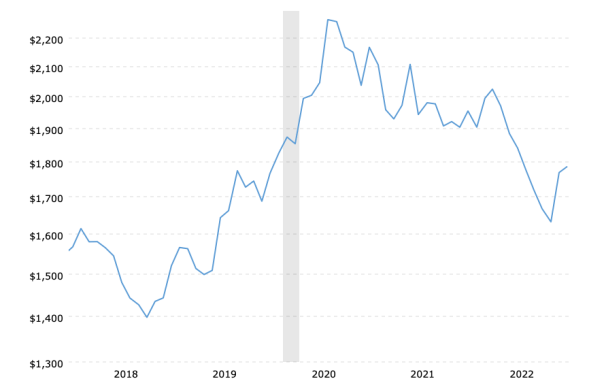

The nominal price peaks from August 2021($2058 oz.) and March 2022 ($2043 oz.) are nearly identical, but you don’t see that on the chart above. The reason you don’t is because of the effects of inflation.

Below are two five-year charts of the gold price. The first is in nominal (ordinary) prices and the second is in inflation adjusted terms…

Gold Prices – 5 Year Historical Chart

Gold Prices (inflation-adjusted) – 5 Year Historical Chart

The real (inflation-adjusted) decline in gold prices since August 2020 is significant. Gold’s low of $1626 oz. in early November represents a decline of nearly thirty percent from its inflation-adjusted 2020 peak of close to $2300 oz.

CONCLUSION AND SUMMARY

Any current price action in gold to the upside is a retracement of previously lost ground. This is true in both nominal terms and inflation-adjusted terms.

The gold price is in a well-established, significant downtrend. The downtrend could last for years. Expecting new highs in the gold price at this particular time is to expect results from gold that are inconsistent with the facts (FACT NO. 1, 2, and 3 above) and with gold’s price history over the past century.

(also see Gold And The Normalcy Bias and Gold Cannot Exceed Inflation’s Effects)

Kelsey Williams is the author of two books: INFLATION, WHAT IT IS, WHAT IT ISN’T, AND WHO’S RESPONSIBLE FOR IT and ALL HAIL THE FED!