This was a volatile week to say the least but in a bull market this should be expected, especially after the metals essentially went straight up from March through early September. The mining equities sold off far more heavily and are trading with implied gold prices around $1,550-$1,625/oz. (depending on the company). If you learn to embrace these violent pullbacks, your returns could higher. For example, had you taken some profits in August or so, you would have been able to buy back the same companies today but get more shares. That is one strategy, with another being sit tight! If you can block out all the noise and understand why you bought precious metals and the underlying mining companies, this will be a much more enjoyable ride. As expected, with the metals getting smashed this week, especially silver, most companies likely held back news they would have otherwise released. Waiting for better market conditions increases the likelihood the market will react positively to a given piece of news. This could explain why this week's news was so light.

Note: Please be Sure to sign up for our free email list @ http://www.goldseeker.com. You can also give our subscription services a test run with a free 30-day trial.

$RZZ.V, $BCM.V, $BSR.V, $BTR.V, $FFOX.V, $GGD.TO, $GBR.V, $HL, $MMX, $MGG.V, $OMM.V

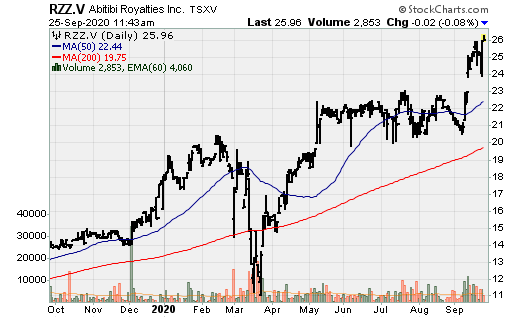

Abitibi Royalties: The company received conditional acceptance from the TSXV to conduct the normal course issuer bid. Under the 2020 NCIB, Abitibi may purchase for cancellation, from time to time at its discretion, up to 624.145k shares of its issued and outstanding, which represents 5% of the Abitibi Royalties’ issued and outstanding common shares.

Bear Creek Mining: has approved, and will shortly commence, construction of several capital projects in the Corani region to support the long-term health, education and economy of local communities and provide early construction infrastructure for the Corani mine. These projects include:

- Completion of the Antapata electrical substation started by the Company in 2018. Antapata will direct electrical power to communities and essential infrastructure within the Carabaya province, such as the forthcoming COVID treatment center, and will eventually connect the Corani mine to the existing Peruvian electrical grid.

- Installation of transmission towers from the Antapata substation, initially to the community of Isivilla, to deliver medium tension electrical service to the Carabaya Province, including the town of Macusani and communities within the Corani district and, eventually, high tension electrical service to the Corani mine site.

- Construction and upgrading of roads from the Interoceanic Highway, through the communities of Tantamaco, Huiquisa and Corani and eventually to the Corani mine site, which will increase security and accessibility for residents, reduce road hazards and traffic accidents and provide a route for the transport of heavy construction equipment to the Corani site.

- These projects will benefit the Carabaya Province residents and communities as well as the Corani mine. They will provide much needed infrastructure improvements and will generate local employment, helping families re-establish income lost to the economic downturn caused by the COVID-19 pandemic. They are additionally necessary for construction and operation of the Corani mine. All of the programs described above will be funded from Bear Creek's existing cash balances and are expected to total approximately US$6.0 M.

Bluestone Resources: Reported additional high-grade drill assays received from its infill drilling activities currently underway at the Cerro Blanco gold project. After a brief hiatus where the drilling activities were suspended to comply with COVID-19 related restrictions in Guatemala, a total of five drill rigs are now operational, located in the underground workings and on surface. The company is advancing the project rather quickly and we expect the mine plan to be updated, likely accommodating higher output.

Results from six underground and four surface holes are reported in this press release. Highlights include the following intercepts representing true widths of the veins:

- 7.2m @ 15 g/t Au and 55 g/t Ag

- 1.0m @ 210 g/t Au and 167 g/t Ag

- 2.3m @ 24 g/t Au and 22 g/t Ag

- 12.3m @ 5 g/t Au and 11 g/t Ag

- 2.1m @ 20 g/t Au and 16 g/t Ag

- 6.0m @ 12 g/t Au and 26 g/t Ag

Bonterra Resources: The company released some results from its on-going drilling campaign on the Barry project. Highlights include:

- 4m @ 5.6 g/t Au

- 15.8m @ 3.4 g/t Au

- 8.80m @ 5.3 g/t Au

- 4.2m @ 8.9 g/t Au

- 0.50m @ 8.90 g/t Au

- 1.80m @ 6.0 g/t Au

FireFox Gold: Renowned geologist has joined the technical advisory board.

GoGold Resources: Released the first assay results from the company’s Salomon-Favor target on the Los Ricos North project, located 5km southeast of the La Trini deposit. Highlights include:

- 41.7m @ 168 g/t AgEq

- Including 11m @ 529 g/t AgEq

- 14m @ 298 g/t AgEq

- Including 5m @ 737 g/t AgEq

- 4.10m @ 528 g/t AgEq

- 41.1m @ g/t AgEq

Great Bear Resources: provided an update on metallurgical testing underway at its 100% owned flagship Dixie Project in the Red Lake district of Ontario. Highlights include:

- Metallurgical testing will provide the Company with estimates of likely gold recoveries, fineness, and recommendations on metallurgical flow sheet development and design for the various gold zones at the Dixie project, which are required for maiden resource publication.

- 7,465 occurrences of visible gold have been recorded in drill core to date by Great Bear. Over 80% of the Company’s drill holes into the LP Fault, Dixie Limb and Hinge zones have been noted to contain visible gold mineralization occurring as free gold and not bound to or within sulphide minerals.

- In the Red Lake district, gold deposits that are similarly dominated by free gold typically yield very high gold recoveries. The primary example of this occurs at the Red Lake Gold Mine operated by Evolution Mining Ltd., where recoveries of 94 – 97% are typical.

- Great Bear has analyzed approximately 136,000 geochemical samples to date. Results suggest the gold mineralized system at Dixie generally has lower concentrations of trace elements such as arsenic, zinc and lead than are commonly observed within gold deposits across the Red Lake district, due to a lower content of accessory sulphide minerals. Other elements such as antimony and tellurium are also generally absent in the mineralized zones at Dixie.

Hecla Mining: The company reported strong production and cash generation as it released preliminary production results for Q3 and the anticipated cash position as of end Q3. Estimated silver and gold production for Q3 is 3.2-3.4m oz. Ag and 41-43k oz. Au. Operations should only improve as times goes on for two primary reasons; I) Production from Lucky Friday will essentially double to 5m oz. p.a. as grades increase at depth by a fair degree and II) The company will likely, several years down the road start building its next asset, Montanore, which will add material silver and copper production. The company has no need to make any additional acquisitions as it will also focus on optimizing its Nevada Gold assets as well as having another sizeable development project in Rock Creek.

Integra Resources: The company intersects additional high-grade gold and silver at Florida Mountain, which include:

- 87.48m @ 1.51 g/t Au + 102.12 g/t Ag

- Including 6.25m @ 8.91 g/t Au + 607.55 g/t Ag

- Including 1.37m @ 7.57 g/t Au + 652.54 g/t Ag

- 1.68m @ 11.75 g/t Au + 1,951.88 g/t Ag

- 0.61m @ 11.07 g/t Au + 1,480.13 g/t Ag

Maverix Metals: entered into a binding purchase and sale agreement to acquire a portfolio of 11 gold royalties from Newmont Corporation for upfront consideration of $75 million and contingent payments of up to $15 million. The portfolio consists of assets in Mexico, the US, Canada and Guatemala, ranging from construction to exploration stage.

Near-term cash flowing assets from the portfolio include Camino Rojo (production expected in 2021), which a 2% NSR royalty and early works activities are expected to commence at the Cerro Blanco project in Guatemala (being developed by Bluestone) which is a 1.0% NSR royalty. There are three other assets in the development stage and six exploration stage. These include:

- 1.0%-2.0% NSR on the Mother Lode project (Corvus Gold); development

- 1.0% NSR on Kore Mining’s Imperial project; development

- 2.0% NSR on Ana Paula (Argonaut just sold it to a private company); development

- 0.50% NSR on Trenton Canyon (SSR Mining); exploration

- 0.50% NSR on Buffalo Valley (SSR Mining); exploration

- 2.0% NSR on Cristina (Criscora); exploration

- 1.0% NSR on Yecora (Criscora); exploration

- 2.0% NSR on Algoma-Talisman (Red Pine); exploration

- 0.63% NSR on Sprogge (Seabridge); exploration

Minaurum Gold: Announced initial results from Phase II Europa-Guadalupe vein zone drilling. Highlights include:

- 3.50m @ 404 g/t Ag, 0.54% Cu, 1.30% Pb, 1.81% Zn

- Including 1.15m @ 999 g/t Ag, 1.29% Cu, 2.98% Pb, 2.98% Zn

- 6.35m @ 356 g/t Ag, 0.39% Cu, 0.42% Pb, 0.57% Zn

- Including 0.70m @ 2,090 g/t Ag, 1.98% Cu, 2.51% Pb, 2.43% Zn

- 1.30m @ 576 g/t Ag, 0.77% Cu, 0.29% Pb, 1.26% Zn

- 11.35m @ 221 g/t Ag, 0.29% Cu, 0.28% Pb, 0.44% Zn

- 1.70m @ 778 g/t Ag, 1% Cu, 2.50% Pb, 3.34% Zn

Omineca Metals: Announced it commenced its maiden diamond drill program at the Wingdam gold exploration project in the Cariboo Mining District of south-central British Columbia. Initial drilling is focused on an area within a one-kilometer radius adjacent to and upstream of the single underground crosscut that yielded 173.4 ounces of placer gold. The drill program follows initial exploration consisting of airborne geophysics, rock sampling and soil geochemical analysis.