We have been looking at big historical/economic/political cycles for the past two months. We reviewed Neil Howe’s Fourth Turning concept, then George Friedman’s twin US institutional and socioeconomic cycles, then Peter Turchin’s “cliodynamics” concept, and then Ray Dalio’s Big Cycle.

None of these theories exclude the others. It is quite possible they are describing the same events through different lenses. In any case, they help us understand the times we live in. They are neither predictive nor prescriptive, but descriptive. They look back through history and try to interpret the past to help us understand what might happen in the future. I think all are at least partially correct. That’s disturbing… because in various ways, each points to serious global problems in the next few years.

Today we’ll start wrapping up the series by discussing the Debt Supercycle. I think we’ll probably need a few weeks, but this is important. I don’t want to rush through it.

Time-Traveling Money

Debt has a defined sequence: The lender and borrower agree on terms, the loan is funded, the borrower repays according to a schedule, eventually pays the full amount, then it’s over. Often the parties move on to more such deals, then others, then others… in an almost (dare I say it?) cyclical fashion.

As I’ve said many times, debt isn’t inherently bad. It’s an efficient way to finance new productive capacity. This helps the economy grow and raises living standards for everyone. But debt is also easily misused, and that’s where it causes trouble. In fact, we have seen throughout history where debt has been used far more than was prudent, especially by governments, and you get a debt crisis for an individual company or country.

Professors Ken Rogoff and Carmen Reinhart described this process for governments in their magisterial book, This Time Is Different: Eight Centuries of Financial Folly. I think it is one of the most important books of the last 20 years. I have reviewed it extensively in the past and did a published interview with both Rogoff and Reinhart.

What I wrote in my 2011 letter The Beginning of the Endgame is the perfect set-up for dealing with the debt and deficits of the US (and then a possible survey of other debt-burdened economies).

“The lesson of history, then, is that even as institutions and policy makers improve, there will always be a temptation to stretch the limits. Just as an individual can go bankrupt no matter how rich she starts out, a financial system can collapse under the pressure of greed, politics, and profits no matter how well regulated it seems to be. Technology has changed, the height of humans has changed, and fashions have changed.

“Yet the ability of governments and investors to delude themselves, giving rise to periodic bouts of euphoria that usually end in tears, seems to have remained a constant. No careful reader of Friedman and Schwartz will be surprised by this lesson about the ability of governments to mismanage financial markets, a key theme of their analysis.

“As for financial markets, we have come full circle to the concept of financial fragility in economies with massive indebtedness. All too often, periods of heavy borrowing can take place in a bubble and last for a surprisingly long time. But highly leveraged economies, particularly those in which continual rollover of short-term debt is sustained only by confidence in relatively illiquid underlying assets, seldom survive forever, particularly if leverage continues to grow unchecked.

“This time may seem different, but all too often a deeper look shows it is not. Encouragingly, history does point to warning signs that policy makers can look at to assess risk—if only they do not become too drunk with their credit bubble-fueled success and say, as their predecessors have for centuries, ‘This time is different.’

“[Back to my voice] Sadly, the lesson is not a happy one. There are no good endings once you start down a deleveraging path. …much of the entire developed world is now faced with choosing from among several bad choices, some being worse than others.

“And this is key. Read it twice (at least!):

“Perhaps more than anything else, failure to recognize the precariousness and fickleness of confidence—especially in cases in which large short-term debts need to be rolled over continuously—is the key factor that gives rise to the this-time-is-different syndrome. Highly indebted governments, banks, or corporations can seem to be merrily rolling along for an extended period, when bang! — confidence collapses, lenders disappear, and a crisis hits.

“Economic theory tells us that it is precisely the fickle nature of confidence, including its dependence on the public’s expectation of future events, which makes it so difficult to predict the timing of debt crises. High debt levels lead, in many mathematical economics models, to ‘multiple equilibria’ in which the debt level might be sustained—or might not be. Economists do not have a terribly good idea of what kinds of events shift confidence and of how to concretely assess confidence vulnerability.

“What one does see, again and again, in the history of financial crises is that when an accident is waiting to happen, it eventually does. When countries become too deeply indebted, they are headed for trouble. When debt-fueled asset price explosions seem too good to be true, they probably are. But the exact timing can be very difficult to guess, and a crisis that seems imminent can sometimes take years to ignite.”

The term Debt Supercycle was first used by Tony Boeckh of The Bank Credit Analyst (in the late ’60s) and further explored by my good friend Martin Barnes when he was editor. The concept has been refined over time, but the term still fits. There seems to be a cycle of debt followed by countries where they leverage their debt too much and we see the (all too frequently) ugly end of a Debt Supercycle. Rogoff and Reinhart offered data on those cycles.

I have been writing about US debt for decades. And the crisis has always remained in the future. And yet, we are now at almost $34 trillion of US government debt on our way to $60 trillion. Interest costs are beginning to significantly eat into the total revenues.

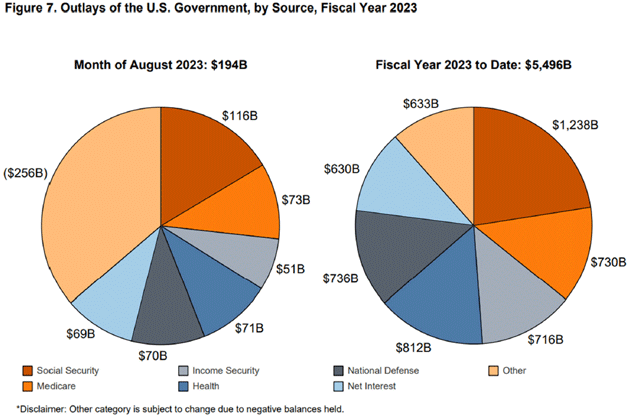

The most recent budget analysis from the US Treasury shows the net interest rate payments are getting close to total military expenses and will likely surpass that within the next few years. We will look at this more in depth over the next few weeks but let me just offer up a few charts from the Treasury website.

Note that for the month of August net interest expenses were essentially equal to National Defense and larger than welfare (Income Security). Note that the average duration of federal debt is roughly 7 years. As longer-term paper with much lower rates rolls off, it is replaced with much higher-cost debt.

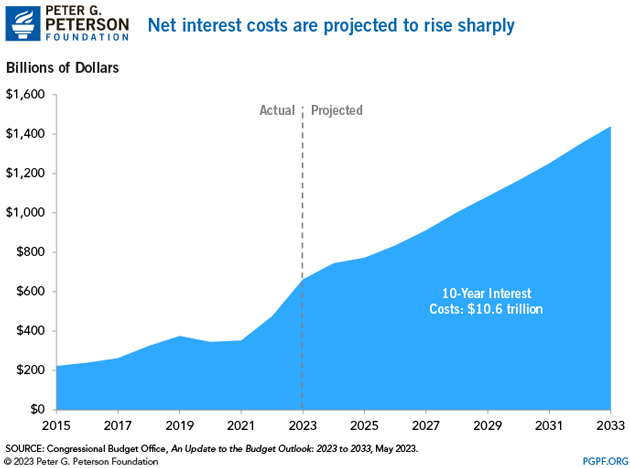

The next chart from the Peterson Foundation (well worth perusing—but remove sharp objects as you do, though!) illustrates that point. The chart shows that just a few years ago, total interest expense was in the $300 billion range. Today it is double that and projected to triple within four to six years. If interest rates continue rising it will be even worse.

Source: Peterson Foundation

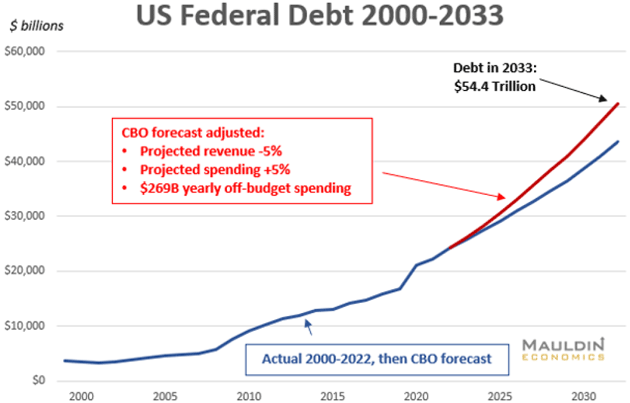

We are on an unsustainable path. While CBO projections are obviously based on assumptions, what happens when we are at $50 trillion total debt (highly likely!) and interest rates are 4% (certainly possible if the Bond Vigilantes wake up from their long slumber, which might happen soon.)

I will be looking at this problem in depth over the next few weeks because we are in for a rough ride if an economic crisis erupts at the same time the other cycles reach their own conclusions. I think it is critical investors get a handle on what we are facing and also on how to adjust our own lives in order to make sure that we, our families, friends, and communities get through it.

Debt Be Not Proud

Debt represents future consumption brought forward in time. When you buy a house, for example, your future spending on other goods and services will fall because you have monthly mortgage payments. Ditto for cars or any other debt-financed purchase. Even if you go bankrupt, somebody absorbs that debt, and whoever it is will have less to spend on other things.

Again, debt isn’t bad in itself. Debt is useful if you can repay it and you spend the borrowed money productively. Often one or both is lacking. When this happens on a large scale, it has macro effects that contribute to the “debt supercycle.”

I explained this more fully in my 2011 book (with Jonathan Tepper), Endgame: The End of the Debt Supercycle and How It Changes Everything. It is still available and, while I would change a few things (like the timing), it still describes the debt problem well.

Briefly, the problem isn’t simply lenders and borrowers making poor decisions. Powerful people and institutions, mainly in central banks, actively encourage these poor decisions by manipulating interest rates and credit conditions. They may have good intentions, but they are focused on the short term. Their goal is to avoid (or at least mitigate) recessions and financial crises. And indeed, they’ve had some success in forestalling the periodic asset bubbles and banking panics common in the 19th century and earlier. But this relative stability has a cost.

Here's what happens: Central banks stimulate growth via loose credit conditions, which eventually spark inflation, forcing them to tighten. Some of the debt is liquidated but not all, so it’s still there for the next expansion. More debt gets added on top of it, then more in the next phase, and so on. As the debt load increases across the economy, its ability to stimulate GDP growth falls. More debt is required to produce the same amount of growth.

Needless to say, this can’t continue indefinitely but it can take several iterations of the business cycle to reach what I called the Endgame. This is evident mostly, but not exclusively, in government debt. Let’s take a closer look there.

Not an Accident

Last week the Congressional Budget Office estimated the FY 2023 federal budget deficit was $1.7 trillion, about $300 billion more than the prior year. Spending actually fell slightly but tax revenue fell even more. This brought the gross national debt to $33+ trillion, of which debt held by the public was $26 trillion (a distinction without a real difference!). I have been saying for a long time we would have a $50 trillion debt by 2030. That now looks laughably naïve.

By the way, last year’s $26T debt almost exactly matches the “Alternate Scenario” I described last February (see Deficits Forever). I arrived at that by assuming CBO’s revenue projection would be 5% too high and its spending projection 5% too low, plus an allowance for off-budget spending. I still think those are reasonable guesses and, if they are correct again, the debt will widen a lot more in the coming years. Here’s that chart again.

The debt is rising, first, because the government spends so much more than it collects in taxes, and it spends so much because serious spending cuts are politically impossible. Even the fiscal hawks would only nibble around the edges, with any actual cuts projected far out in the future. Trillions in COVID relief spending—some of which was necessary, to be sure—aggravated the problem.

The House passed a budget which would theoretically balance the budget in 10 years, but one needs to make some very positive assumptions. But it had no, as in zero, chance of getting through the Senate. And now, that won’t even get through the House. 20 GOP members oppose Jim Jordan for speaker because he wants to cut spending too much (at least that is what my sources say).

A particularly annoying part of this is that three different administrations—Obama, Trump, and now Biden—missed a chance to lock in historically low rates by issuing more long-term bonds. I feel sure they would have found buyers. Again, an insider sitting at the table told me that Mnuchin opposed offering 50-year bonds. Now? Fat chance. And it appears the opportunity won’t be back anytime soon.

As of right now, the Treasury’s average interest rate is around 3%. That has almost doubled since the Fed began raising rates in early 2022. It will go higher still as older bonds roll off. This St. Louis Fed analysis calculates higher rates will add $98 billion to the interest expense in 2023 alone. Again, this will grow even if rates stabilize at current levels.

There’s a lot of variables to this but it’s entirely plausible, if not probable, the government will soon be spending $1 trillion annually just for interest payments. In GDP terms, CBO estimates interest expense will grow from 1.9% to 3.6% of the economy in the next 10 years.

None of this is accidental. The Fed kept rates artificially low for years, which eventually helped kindle inflation, to which the Fed responded with higher rates. Raising rates to combat inflation was appropriate but it leaves us in a really uncomfortable fiscal situation… and brings the end of the Supercycle closer.

Highly Leveraged Future

Imagine for a moment your mortgage was structured like the federal debt. You keep adding principal every year, you can’t control the interest rate, but you do get to choose the maturity and payment schedule. What would that look like? Unless you are a pretty good bond trader, it would probably look like a mess.

Now, these are not fully comparable situations. Your lender can foreclose if you default on the mortgage. Treasury bond holders don’t have that choice. They can, however, stop lending or demand higher rates. And that’s very likely going to happen, in my opinion.

This would be a huge problem just by itself but there’s more.

Large parts of the private economy are over their heads in debt, too. Think of the many highly leveraged businesses living on borrowed money that will run out at some point, possibly before revenue rises to their optimistic targets. Much like the Treasury, they will have to refinance at much higher rates. How will that go?

This isn’t just a US problem. Everything I just described is, to varying degrees, applicable around the globe. China? Japan? Germany?

And finally, remember all this debt will come to a head just as the other cycles we’ve been talking about – the Fourth Turning, for example – are reaching their peaks. Can you say “instability?” And maybe much worse?

Now, in one sense this is very simple. Debt which can’t be repaid, won’t be. But remember, debt is future consumption brought forward. The scales will balance. The future has holes in it that somebody will have to fill. And whoever that is probably won’t be happy about it.

I’ve talked about a Great Reset grand bargain in which all this debt is somehow rationalized. But it won’t be so simple as flipping a switch. It will be a long, ugly, emotional, and potentially violent process. No one should assume they will escape intact.

But even if we muddle through, the debt will weigh on us. As it grows into a larger portion of the economy, less will be left for other things. This will depress GDP growth when the economy will already be struggling with demographic challenges. The math is clear, and we will go into it in future weeks.

I’ll close with a little quote from my last debt letter in February. This still fits and I can’t say it any better.

“As noted above, the CBO cannot assume, because they don't know, any negative economic problems in the future. None of us know what’s coming, but experience says we shouldn’t expect a smooth ride over the next 10 years.

“Sometimes I wonder what it must feel like not to care about all this. I really don’t enjoy being a budget scold, partly because we are a dying breed. It is getting lonely in my worry closet. Very few people truly care about government debt anymore, and even the number who pretend to care about it is shrinking, especially in Washington, DC, and Congress. And almost no one even talks about the drastic changes it would take to actually balance the budget—much less begin paying down the debt.

“I titled this letter ‘Deficits Forever’ because, unfortunately, I think that’s probably what will happen. And that might be okay if we could at least keep the deficits somewhat smaller and more stable. That doesn’t seem to be in the cards, though. We are going to reckon with this debt for a long time.”

Lower GDP and even a recession (there is always another recession!) will reduce potential revenue (taxes) and increase spending. Deficits are likely to soar from already nosebleed levels. But that is fodder for the next few weeks.

Dallas and Eavesdropping on Millionaires

New York was fun, if somewhat exhausting. It seems the world in which I live is constantly changing way too fast, so that means I and my business partners are also having to constantly change. But it does allow us to creatively think about how we can better serve you and then compel us to actually make those changes even if they are difficult.

I am looking forward to Thanksgiving when I will cook for my family in Dallas. My prime rib plus a few different ways to cook mushrooms are guaranteed crowd pleasers, at least if the crowd is my family.

My new book (written with my daughter Tiffani!), Eavesdropping on Millionaires, will be in stores in early November. (You can pre-order your copy now!) The stories and data are fascinating. In this book we choose dozens of millionaires who have significantly different ways of becoming a millionaire (or more!) and what happened to them in the last two economic crises!

How often do you have the chance to sit down with a millionaire and ask, “How did you do it?” But that is exactly what we did and now you can read their stories.

I am proud of the book. It is a quick read and will make a wonderful gift for friends and family (especially your kids beginning their journey). The pre-orders make a difference in the bestseller rankings, so thanks if you can!

We hope you find it as fascinating as we did not only writing it, but doing all those wonderful interviews. We made many new friends from whom we learned a lot.

And with that, it is time to hit the send button. I trust you will have a great week. I'm looking forward to spending time with family and friends, more gym and pickleball (though I am terrible at it). And don’t forget to follow me on X!

Your seeing cycles in my dreams analyst,

John Mauldin

P.S. If you like my letters, you'll love reading Over My Shoulder with serious economic analysis from my global network, at a surprisingly affordable price. Click here to learn more.