The old saw about doing the same thing and expecting a different result is less simple than it seems. Sometimes you need a few attempts to get it right.

Nevertheless, when you see a long succession of smart people doing the same thing and getting the same bad result, it’s fair to wonder what they were thinking. Such is the case with government debt. National leaders who let too much debt accumulate always think their situation is different. It’s probably not.

This came to mind as I was thinking about the magisterial 2009 book This Time Is Different by Carmen Reinhart and Ken Rogoff. They systematically reviewed hundreds of debt-driven crises over eight centuries, finding (surprise!) all unfolded in roughly the same way. “This time” is rarely different.

I reviewed This Time Is Different back when it was first published in a letter you can read here. With the US (and many other developed economies) now set to join the long list of countries whose debt habits ended badly, it’s even more timely now.

Lest anyone think the problem is improving, this week the Congressional Budget Office released the latest bad news. The CBO now projects federal debt will reach $50.7 trillion in 2034 which will, if their other economic assumptions are correct, equal 122% of GDP. This is $2.4T more than the CBO said just four months ago because that projection included automatic budget cuts which Congress subsequently removed.

Looking only at FY 2024, the new CBO deficit projection is more than $400 billion larger than what the CBO said in February! If you want to get into the weeds, this Bloomberg article summarizes what happened. The part that caught my eye was an FDIC shortfall of (gasp!) $70 billion.

The FDIC is supposed to be self-funding. Banks pay an insurance premium to cover any gaps. A few billion here or there can be made up with increases in insurance costs or whatever. $70 billion? That's not just a shortfall. I will look into what happened for a possible future letter.

As I’ve discussed before, these CBO projections are error-prone from the start. The agency has to assume current law will remain unchanged for another decade, when of course, it won’t. Future congresses and future presidents will change tax and spending policies. Experience suggests their changes will make the problem worse, not better.

I have been writing about the CBO debt projections for decades. My memory may be failing, but I can't recall ever seeing the 10-year projection go down. I said a few years ago that we would theoretically see a total debt of $60 trillion in the early 2030s. I may be an optimist.

I would view their $50.7 trillion number more like a lower bound for the debt by 2034. Deficits of $2 trillion a year and rising add up quickly… unless we reach the crisis stage first. Which is quite possible, if not likely.

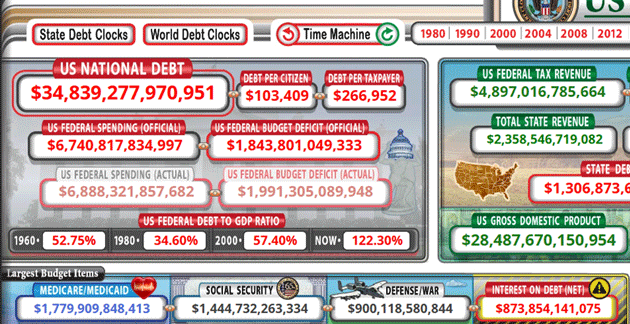

Let’s drill into the actual numbers not from the CBO but from the helpful US National Debt Clock. They do a real-time debt estimate, so while they show less than the $2 trillion deficit the CBO projects for this year, it is rising fast and will be more than $2 trillion by the end of fiscal 2024. The CBO does not include off-budget spending, which averages $269 billion a year (with large annual variances). Note that interest is close to surpassing defense spending. The CBO projects it will exceed the defense budget by the end of the year.

Source: US National Debt Clock

They also have a helpful new feature which allows you to go back and forward in time. You can see that total debt was almost $6 trillion in 2000. By 2016 it was ~$21 trillion. It is now almost $35 trillion and will easily be there by the end of the year.

But the shocker is what they project for 2028—$46 trillion in total debt plus another $4.4 trillion in state and local debt! And interest payments will be more than the total combined amount of Medicare and defense spending combined!

What kind of yield will investors demand to buy US debt with a $3 trillion deficit? No one knows. More to the point, what will inflation be with that kind of deficit and debt? Will the Fed be able to cut interest rates in the face of that kind of inflation?

It is somewhat amusing, in a macabre sort of way, that people believe a 50 or 100 basis point cut will make some kind of difference in 2025 when deficits are going to increase. If you don't think that deficit spending has an effect on inflation, you are not paying attention.

This time next year we will realize that the deficit was more than $2 trillion. Probably significantly. While it doesn't seem to be in anybody's campaign rhetoric this year, care to make a bet that it will not be the most significant topic in 2028?

People keep asking me, “When is the crisis you’re predicting going to happen?” I think the answer is December 19, 2029. (Please note, sarcastic humor and not a forecast.)

Follow me here. We have a national election that will be focused on debt and inflation. All sorts of political promises will be made and there will be serious differences. Whomever is elected will be promising they will fix the problem. Except they will not be able to get Congress to go along with whatever their proposed solution is. It will take serious compromise, which won’t happen.

Whoever the new president is will be sworn in in January of 2029. The markets will give him or her some grace for a period of time to fix the problem. When it is clear that it won't happen by the end of the year, and Congress gets ready to go into its Christmas recess, the bond market will go nuts at the most inconvenient time, which will be on or around December 19. I hope that doesn't happen, but I keep pointing out that it will take a crisis of biblical proportions in order to create the environment for a compromise that none of us will like.

In theory, there’s a lot we could do to prevent or at least delay a debt crisis. In reality, we aren’t going to do it. The numbers have grown too large. Cutting foreign aid or welfare or whatever isn’t nearly enough. Taxing the rich or raising tariffs also isn’t enough. I’m sorry for everyone who thinks it’s easy. I assure you, it’s not. I have been through the numbers. The only way to bend this curve is with spending cuts and/or tax increases so giant they would spark a societal conflagration.

Instead, I expect our political heroes to keep kicking the can down the road until the road gets too steep, as it will at some point. The limits are real. Private investors can’t and won’t buy government debt whose repayment is doubtful in real inflation-adjusted terms—or will demand such high rates the debt will explode even higher.

|

Having eliminated all other options, crisis is the only remaining possibility. This time isn’t different. |

Confidence is a top theme running through This Time Is Different. Consistently through hundreds of crises Reinhart and Rogoff examined, highly indebted economies can remain more or less stable as long as people are confident in their future. Things fall apart quickly when that confidence wanes.

A few quotes from the book:

"Highly leveraged economies, particularly those in which continual rollover of short-term debt is sustained only by confidence in relatively illiquid underlying assets, seldom survive forever, particularly if leverage continues to grow unchecked.

"If there is one common theme to the vast range of crises we consider in this book, it is that excessive debt accumulation, whether it be by the government, banks, corporations, or consumers, often poses greater systemic risks than it seems during a boom. Infusions of cash can make a government look like it is providing greater growth to its economy than it really is. Private sector borrowing binges can inflate housing and stock prices far beyond their long-run sustainable levels, and make banks seem more stable and profitable than they really are.

“Such large-scale debt buildups pose risks because they make an economy vulnerable to crises of confidence, particularly when debt is short term and needs to be constantly refinanced. Debt-fueled booms all too often provide false affirmation of a government's policies, a financial institution's ability to make outsized profits, or a country's standard of living. Most of these booms end badly.

“Of course, debt instruments are crucial to all economies, ancient and modern, but balancing the risk and opportunities of debt is always a challenge, a challenge policy makers, investors, and ordinary citizens must never forget.”

This next part is critical. Read it carefully, then read it again.

“Perhaps more than anything else, failure to recognize the precariousness and fickleness of confidence—especially in cases in which large short-term debts need to be rolled over continuously—is the key factor that gives rise to the this-time-is-different syndrome. Highly indebted governments, banks, or corporations can seem to be merrily rolling along for an extended period, when bang!, confidence collapses, lenders disappear, and a crisis hits.

“Economic theory tells us that it is precisely the fickle nature of confidence, including its dependence on the public's expectation of future events, that makes it so difficult to predict the timing of debt crises. High debt levels lead, in many mathematical economics models, to ‘multiple equilibria’ in which the debt level might be sustained—or might not be.

“Economists do not have a terribly good idea of what kinds of events shift confidence and of how to concretely assess confidence vulnerability. What one does see, again and again, in the history of financial crises is that when an accident is waiting to happen, it eventually does. When countries become too deeply indebted, they are headed for trouble. When debt-fueled asset price explosions seem too good to be true, they probably are. But the exact timing can be very difficult to guess, and a crisis that seems imminent can sometimes take years to ignite.”

Did you read it again? If not, then do so. Burn it into your memory. It is the crux of the issue.

Here's how I reacted to that quote in my 2010 letter. Remember, this was just a couple of years after the US subprime crisis. A similar crisis was unfolding in Europe, especially Greece.

“How confident was the world in October of 2006? I was writing that there would be a recession, a subprime crisis, and a credit crisis in our future. I was on Larry Kudlow's show with Nouriel Roubini, and Larry and John Rutledge were giving us a hard time about our so-called ‘doom and gloom.’ If there is going to be a recession you should get out of the stock market, was my call. I was a tad early, as the market proceeded to go up another 20% over the next 8 months.

“As Reinhart and Rogoff wrote: ‘Highly indebted governments, banks, or corporations can seem to be merrily rolling along for an extended period, when bang!, confidence collapses, lenders disappear, and a crisis hits.’

“Bang is the right word. It is the nature of human beings to assume that the current trend will work out, that things can't really be that bad. Look at the bond markets only a year and then just a few months before World War I. There was no sign of an impending war. Everyone ‘knew’ that cooler heads would prevail.

“We can look back now and see where we made mistakes in the current crisis. We actually believed that this time was different, that we had better financial instruments, smarter regulators, and were so, well, modern. Times were different. We knew how to deal with leverage. Borrowing against your home was a good thing. Housing values would always go up. Etc.

“Now, there are bullish voices telling us that things are headed back to normal. Mainstream forecasts for GDP growth this year are quite robust, north of 4% for the year, based on evidence from past recoveries. However, the underlying fundamentals of a banking crisis are far different from those of a typical business cycle recession, as Reinhart and Rogoff's work so clearly reveals. It typically takes years to work off excess leverage in a banking crisis, with unemployment often rising for 4 years running.

“The point is that complacency almost always ends suddenly. You just don't slide gradually into a crisis over years. It happens! All of a sudden there is a trigger event, and it is August of 2008. And the evidence in the book is that things go along fine until there is that crisis of confidence. There is no way to know when it will happen. There is no magic debt level, no magic drop in currencies, no percentage level of fiscal deficits, no single point where we can say ‘This is it.’ It is different in different crises.

“One point I found fascinating… when it comes to the various types of crises which the authors identify, there is very little difference between developed and emerging-market countries, especially as to the fallout. It seems that the developed world has no corner on special wisdom that would allow crises to be avoided or allow them to be recovered from more quickly. In fact, because of their overconfidence—because they actually feel they have superior systems—developed countries can dig deeper holes for themselves than emerging markets.”

John of 2024 here again. Reading that now, I see I was describing what I’ve elsewhere called a collapsing sandpile, or a “Minsky Moment.” Debt is sustainable until it suddenly isn’t. Some event, some last grain of sand, triggers the hidden fingers of instability and it all collapses. And anything can be that trigger.

This is why debt crises are so destructive. By their nature, no one is prepared because no one sees them coming. A few expect them, yes, but they never know the timing. History shows over and over that in a debt crisis, everything is fine and then it’s not. The transitions happen fast.

Right now, investors are highly focused on monetary policy, specifically when and how much the Fed will cut interest rates. This has many market implications but is also fiscally critical. The US Treasury is, by far, the economy’s largest borrower. “Higher for longer” interest rates contribute to “higher for longer” budget deficits.

My own outlook is that inflation will remain high enough to keep the Fed from cutting much, even if GDP growth softens. This means the federal government’s interest burden will increase. Remember, it’s not just the new spending. That’s bad enough but as time passes, more ZIRP-era bonds mature and have to be refinanced at today’s higher rates. Interest expense thus rises even more.

None of this is really part of the 2024 election campaigns, either presidential or congressional. There’s a reason for that, too: very few voters care. People like you and me care, yes. We are unusual. Most Americans look at other things they think more important, or at least more relevant to their lives.

When fiscal policy enters the conversation at all, it’s usually as pandering. Candidates promise whatever their audience wants to hear: tax cuts and higher spending for you, tax increases and spending cuts for whatever groups you dislike, debt forgiveness for this group, etc. Whether these things can or will actually happen is rarely even discussed.

In one sense, that’s just as well. Crisis is now inevitable. The election results may have some effect on its timing and contours, but they aren’t going to stop it. The main unanswered question is what will trigger the crisis.

Social Security is a prime candidate. Current projections show trust fund assets will be depleted in 2033, at which point recipients would get automatic benefits cuts of around 20%. That won’t play well, obviously, but how would Congress fill the gap? Raise taxes, cut other spending, borrow more? No good choices. But doing nothing would no longer be an option.

We may not have that long, though. Something else could happen first: wars, terrorism, cyberattacks, another pandemic, natural disaster—many unpredictable events could suddenly necessitate sharply higher spending and borrowing. Even a garden-variety recession would be bad, reducing tax revenue while raising demand for safety net spending. Which, by the way, the CBO assumes no recession for the next 10 years. They can’t, of course, but is it realistic?

We are right to fear what is coming, but this is a particular kind of fear. The right word is “dread.” That’s when you know something is coming, but not how bad it will be. The feeling you get right before they prick your finger for a blood sample? That’s dread.

A debt crisis is coming. This time won’t be different.

I have my own personal limits I deal with. The main one that affects you and me is that through much trial and error, we have determined the large majority of readers want me to keep this weekly letter to 3,000 words or less. My very longtime friend and editor Patrick Watson diligently edits my prose, excising excess verbiage to impose those limits. So this one time, to help him, I will simply hit the send button and wish you a great week! And for those old enough, think about the passing of Willie Mays. RIP. And Say Hey, Kid!

Your really not wanting a crisis analyst,

|

|

John Mauldin |

P.S. If you like my letters, you’ll love reading Over My Shoulder with serious economic analysis from my global network, at a surprisingly affordable price. Click here to learn more.