The precious metals market has been hit with solid selling pressure. This week, gold slipped below the $1,900/oz mark for the first time since March. Silver fared no better, also hovering around a 3-month low.

This is a sharp contrast to what we saw in early May, when gold prices came within cents of a record high of $2,074/oz set in August 2020, and silver also climbed above $26/oz for the first time in a year.

This can be explained in many ways: a stronger US dollar, robust economic data, markets pricing in Federal Reserve rate cuts, etc. Yet these are only just “short-term” factors, and the tailwinds for safe-haven assets remain in place moving forward.

Analysts at JPMorgan noted that investors following the “long duration theme” would still favor gold (and by extension silver), and that seems to have become a consensus in recent months.

Since the start of the year, bullion has risen by 10% despite its recent dropoff, outperforming global equities by a wide margin (see below).

“The overall bullish trend is here to stay, and gold will pick up steam in 2024, with the Fed, the European Central Bank and the Bank of England starting to loosen their monetary policies,” Georgette Boele, senior economist at ABN AMRO, said in a Kitco interview last week.

It appears a bullish outlook for precious metals remains intact over a longer horizon. Below are five reasons we have highlighted:

- Central Bank Behaviour

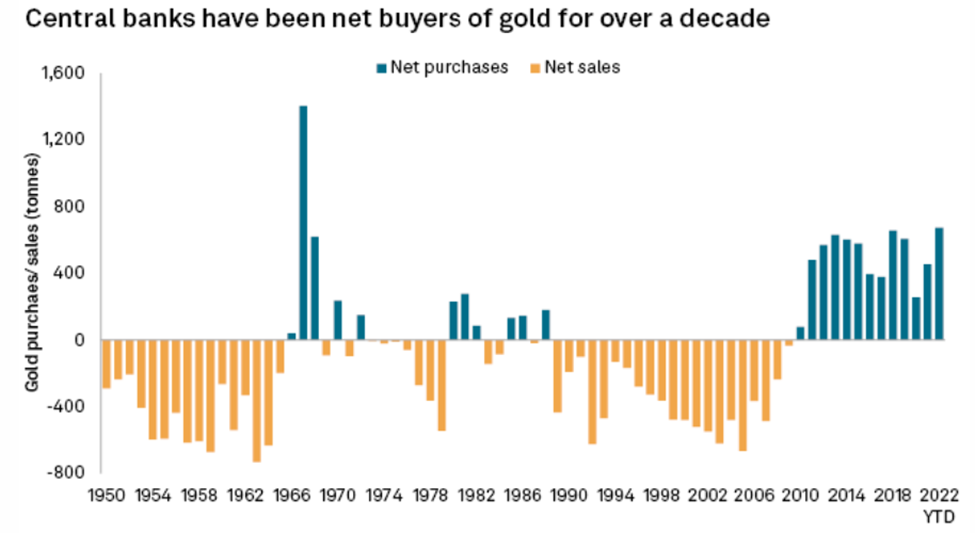

What’s keeping gold in a bull market is a robust demand for the metal, led by an unprecedented level of buying from central banks.

As the lender of last resort for their respective countries, these banks have been stacking up on gold to meet their financial obligations since the 2007-08 financial crisis. Bloomberg previously reported that banks have been buying the most gold since the United States abandoned the gold standard in 1971.

As of today, central banks are enjoying their longest period of gold buying, which represents a dramatic shift in attitude from the 1990s and early 2000s.

Source: S&P Global

Source: S&P Global

Latest data from the World Gold Council further solidifies the trend of relentless gold buying by central banks observed in recent times.

During the first quarter of the year, the banks collectively added 228 tonnes to global reserves, representing the highest rate of purchases seen in a first quarter since WGC began recording the data in 2000.

This follows what was already an impressive year of buying in 2022, during which central banks’ added 1,136 tonnes valued at some $70 billion, their most amount of purchases in 11 years. Most of these were made during the second half, which saw 862 tonnes purchased.

Commenting on this recent trend, the WGC said it expects net central bank gold buying to remain robust through 2023 given the better-than-expected Q1 data, especially as emerging market banks remain relatively under-allocated to gold.

The increased level of central bank buying, according to Wall Street research firm Goehring & Rozencwajg, brings gold towards a “new phase” of the bull market.

“It probably started in the third and fourth quarter of last year, and it really revolves around central banks’ behavior as much as anything else. I think it’s going to propel gold much much higher in this leg of the bull market,” founding partner Adam Rozencwajg said in a recent interview with Investing News Network.

- Geopolitical Dynamics

Behind the central banks’ gold buying are likely the escalating geopolitical factors that prompted them to add gold bullion to their reserves.

The most obvious one is Russia’s invasion of Ukraine and its recent political turmoil, which are lowering the overall risk appetite and igniting the safe-haven gold trade. In addition, the sanctions imposed on Russia could have a wider impact on international trade, in particular what it means for the status of the US dollar.

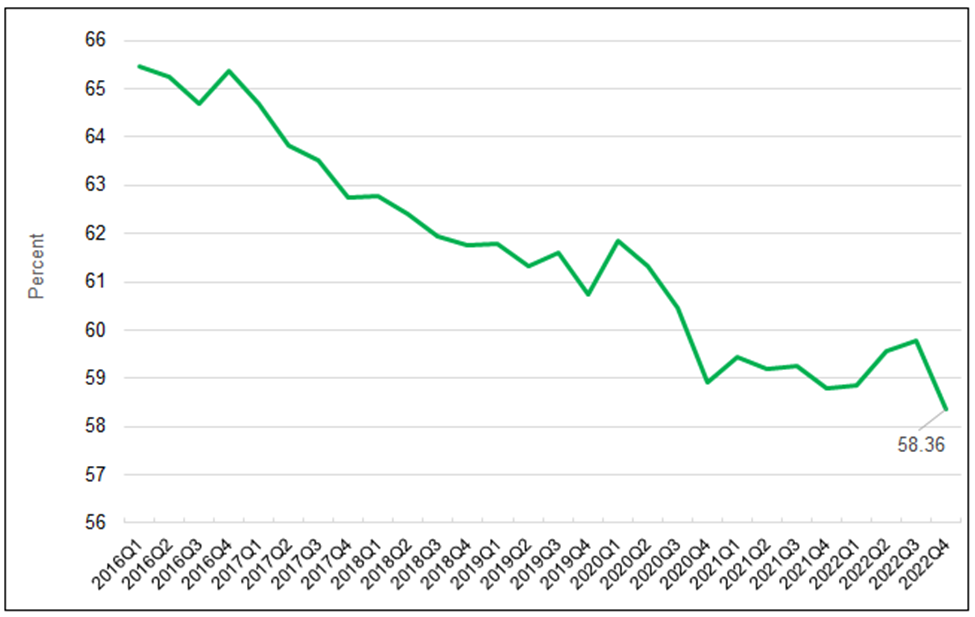

Paul Wong, market strategist at Sprott, recently stated in a report that central banks have ramped up purchases in preparation for a “de-dollarization”, considering gold’s emerging role as a neutral reserve asset.

“Deglobalization is accelerating the transition to a more multipolar world, making the question of global reserve currency allocations more relevant,” Wong wrote. Since its peak in the late 1990s, the USD has slowly lost market share as a reserve currency (see figure below).

Source: Sprott

Source: Sprott

History has shown that currency predominance in international trade and reserves follows economic, cultural and military dominance. According to the Sprott strategist, “currency reallocations could move more quickly and significantly than anticipated if reserve managers increase allocations to other currencies or reserve-neutral assets.”

Currently, the risk is minor and gradual, says Wong, but China has the potential to gain share as its reserve share. What’s interesting is that China has been one of the most prominent buyers of gold in recent times.

Counterparty risk — the potential for one party in a financial transaction to default on its contractual obligations — is also a major influence on central bank behaviour. As gold becomes increasingly involved in settling multicurrency energy and commodity trades — particularly in China-related trade with oil producers — the links between gold, other commodities and counterparty risks may intensify, Wong said.

Whilst on the topic of currencies, the greenback, an alternative safe-haven asset to bullion, is said to be entering a bear market. “Though there have been periods whereby both the dollar and gold appreciated or depreciated in tandem, generally, the latter’s performance is superior during periods of a weak US dollar,” Christopher Yates, equity analyst at Sunbird Portfolios, recently wrote.

Previously, we’ve theorized that central banks are stockpiling gold for this purpose, and more. One possibility is a “gold revaluation” to cover the massive amount of debt they have accrued over the years. Another, albeit more specific to the Eurozone region, is the idea of a new Gold Standard.

- Tight Physical Market

There’s no denying that central bank action could help elevate gold demand, and prices, for at least the short term. Also contributing to the gold bull market is the tightness in the physical market.

Yates’ analysis of the shape (i.e. structure) of the gold futures curve reveals that there remains a small level of backwardation at the front end of the curve, which is not a common occurrence within the gold or silver markets. So long as this remains, one would suspect there is likely a solid price floor for precious metals, he added.

We also need to consider whether an increased number of physical gold buyers (i.e. central banks) would cause market-wide supply shortages, and hence drive up prices.

The WGC estimates that global gold supply grew by 1% year-on-year to 1,174 tonnes in the first quarter of 2023, driven by a marginal 2% growth in mine production and a 5% uptick in recycling. However, demand is also likely to trend up through the rest of the year, and so it remains to be seen whether the supply growth would be sufficient to avoid a market deficit

For silver, its sister metal, the market has already sunk into a prolonged supply shortage that could take years to recover from.

Latest data from the Silver Institute reveals that annual silver demand also surged by 18% to a record high 1.24 billion ounces against a stagnant supply in 2022. This resulted in a second straight year of undersupply at 237.7 million ounces, which the Institute says is “possibly the most significant deficit on record.”

“We are moving into a different paradigm for the market, one of ongoing deficits,” said Philip Newman at Metals Focus, the research firm that prepared the Silver Institute’s data.

In 2023, we are most likely going to see a repeat of last year, according to the Institute, which expects the market deficit to remain high at 142.1 million ounces on the back of solid demand.

A sustained supply shortage would keep the precious metals market in bull territory for much longer, and so long as demand doesn’t wane, that’s where gold and silver will end up.

- Market Risks

Also playing into gold bulls’ hands is a confluence of market factors that are causing further stress on the global economy, cementing the appeal of safe havens.

First there is the well-documented high inflation, which is often hedged against by buying gold. While price level increases have begun to slow in some places, including the United States, the underlying inflation figures remain sticky.

For a year and a half, the US Federal Reserve has been implementing a series of interest rate hikes to combat a skyrocketing inflation that reached a 40-year high last October, and yet results so far have been mixed at best. Core inflation — which excludes volatile food and gas prices — remains high at a year-over-year rate of 5.3%, despite as many as 10 Fed rate hikes.

Despite the general expectation of a rate pause in July, Fed Chair Jerome Powell this week pretty much alluded that more hikes are on the way.

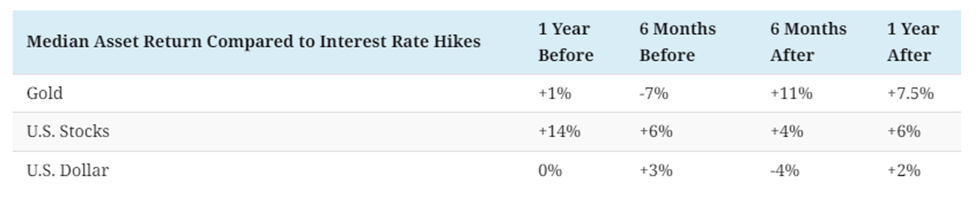

This brings us to interest rates, which are already peaking, offering more incentives to turn to gold. This is because as rates rise during tightening cycles, holding onto and lending out cash becomes more profitable, often resulting in investors de-risking by selling assets like stocks. During these times, investors also seek out uncorrelated assets that are uniquely connected to these macroeconomic factors, often turning to gold.

While gold underperforms compared to stocks and the US dollar leading up to rate hikes, past tightening cycles saw gold hit new all-time highs in the 2000s (see graphic below).

Source: Visual Capitalist

Source: Visual Capitalist

What rising interest rates also can do is exacerbate the already problematic US fiscal deficit, which is expected to reach approximately $1.1 trillion in the second half of 2023.

An additional $400-$500 billion will be needed to rebuild the Treasury General Account (used to pay the country’s obligations), and $540 billion will be required for the Fed’s quantitative tightening program. This would result in a significant net US Treasury issuance of approximately $2 trillion during the second half of 2023, according to Sprott.

However, the US could be hard-pressed in finding sufficient global demand to absorb this level of issuance, given its already high debt level and budget deficits alongside insufficient foreign central bank buying. This could lead to a dysfunctional Treasury market, characterized by asset price declines, rising yields and, possibly, a credit/capital crunch. Significant liquidity tightening would increase yields and pressure on the US banking system and financial assets, and thus, higher credit risks.

These risk elements listed above (liquidity risk, credit stress, credit crunch, US Treasury market dysfunction, bond volatility, inflation and regional banking stress) have been historically bullish for gold prices, Sprott says.

- Recession Signs

Speaking of banking stress, so far this year, we’ve already witnessed three of the four biggest banking failures in US history. The failure of Silicon Valley Bank on March 10 ended a run of 868 days with no bank failures, the second-longest streak since 1933. The SVB collapse was soon followed by Signature Bank, and then First Republic Bank seven weeks later.

Although the three bank failures in total may not seem like a lot — still well below the average of 25 per year since we entered the new millennium — the economic repercussions cannot be overlooked.

Together, the three banks — First Republic, SVB, and Signature Bank — held assets totalling $532 billion, surpassing the $526 billion (adjusted for inflation) owned by the 25 banks that failed in 2008.

While many thought the sale of First Republic “would stop the ‘who’s next?’ conversations, investors are clearly continuing to focus on remaining players that are deemed the weakest” analysts at UBS wrote in a note to clients.

The bigger worry, though, is that the bank failures might lead to doubts about relatively healthy banks, creating a financial contagion that could impact the wider economy.

“The US banking crisis has increased the demand for gold as a proxy for lower real rates as well as a hedge against a ‘catastrophic scenario,’” JPMorgan Chase strategists Nikolaos Panigirtzoglou and Mika Inkinen wrote in a Bloomberg note.

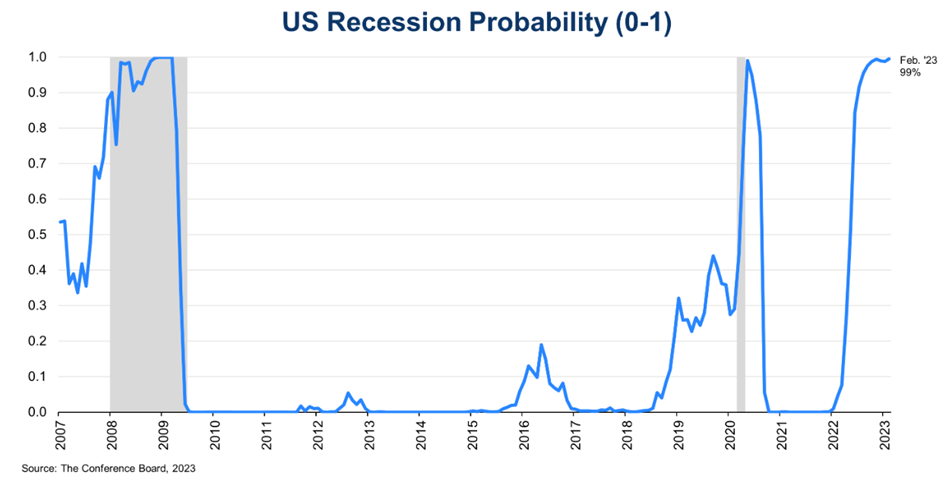

Recent downside surprises in US economic data have lifted the chances of a recession over the next 12 months, with safe-haven flows providing somewhat of a cushion for gold, Yeap Jun Rong, a market analyst at IG, said in a recent CNBC interview.

According to business think tank The Conference Board, there’s a 99% chance of a recession within the next 12 months (see graph above). The Federal Reserve has also predicted a recession later this year, albeit a “mild one.”

This places gold, which is as heralded the best safeguard against economic turmoil, in the spotlight for at least this year and in 2024.