Ticker: ABRA.V (Venture), ABBRF (OTC)

52-week high-low: 0.63-$0.26/share

Shares Outstanding: 445m (Basic), 617m (F/D)

AbraSilver Resources is a silver, gold, and copper exploration company with projects in Argentina and Chile. Its principal asset is the Diablillos Ag-Au project in Argentina. It has a relatively large resource base (which has gotten a lot larger, but we will have to wait until the update MRE is published) and has an initial open-pit PEA published in 2018. There remains exploration upside as minimal deep drilling has been undertaken, and the deposit remains open along strike. Since the 2018 PEA, the company has had excellent exploration success, which has increased the value of the project well above that outlined in the PEA. However, we will have to wait another quarter to see precisely how much more valuable Diablillos is worth.

Ownership of the company is strong, having major shareholders such as SSR Mining (+9% interest), Eric Sprott (+15% interest), insiders owning 3% with 20% owned by institutional investors, and retail investors holding 50%. The company does have a relatively sloppy share structure, but this isn't uncommon for juniors, given the length and severity of the last bear market. The company currently has 445m shares on issue but 617m shares on a fully diluted basis.

While advancing and building projects in Argentina, it has become increasingly uncertain over the past several years. Its flagship, Diablillos, is in the Salta province and ranked #1 overall for investment attractiveness in Latin American. This ranks ahead of Mexico (6th) and Brazil (9th) per the 2019 Fraser Institute Mining Survey.

AbraSilver's assets are located in 3 of the top 4 most attractive jurisdictions in Latin America, again according to the Fraser Institute (2020). This includes its Arcas project in Chile (3rd), its La Coipita project in San Juan Argentina (10th), and Diablillos (1st).

Diablillos: Per the 2018 PEA, the project would be a 6ktpd operation producing 9.8m AgEq oz. p.a., generating an after-tax NPV7.50% and IRR of $212m and 30.20% using a silver and gold price deck of $20/oz. and $1,300/oz. But at today's metal prices, the NPV would be significantly higher as gold and silver prices have risen substantially.

The project was acquired from SSR Mining, which holds a minority interest in the company. The company deferred the property payment of $5m to 2023 and $7m to 2025 to SSR in exchange for 24m shares. The capital investment required to bring this project into production is $293m, which is too large for AbraSilver to do independently. Initial development capital will likely end being higher given the rise in inflation and if AbraSilver wants to maximize the NPV and go with a large plant beyond 6ktpd. It will probably either have to enter into a JV agreement or sell it outright, though things could change depending on how high precious metal prices rise. Selling a gold or silver stream could provide a significant portion of the required capital if the company decides to go that route.

The project is highly leveraged to changes in the silver price (and gold price) as the NPV increases $47m for every 10% increase in the silver price (subject to change). There have also been numerous high-grade gold intercepts post the 2018 PEA, likely making the project more sensitive to changes in the gold price in the updated PEA. For example, the NPV7.0% at $18/oz. Ag and $1,300/oz. Au is $178m vs. an NPV7.0% of $328m at $24/oz. Ag and $1,300/oz. Au. Many things are likely to change in the updated PEA, scheduled for release in Q3, 2021. There are several ways in which AbraSilver could and likely will increase the value of the project, such as higher throughput/tonnage) and/or a longer-mine life than that envisioned in the 2018 PEA, as well as higher gold or silver grades, improved metallurgical recoveries, and reduced stripping.

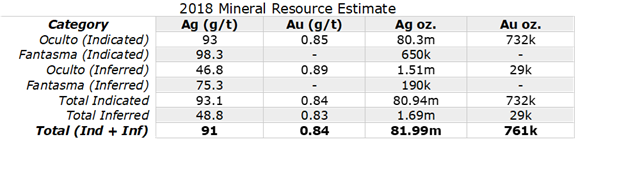

The project is an epithermal Ag-Au deposit with Cu-Au Porphyry Intrusive. The Diablillos property has multiple epithermal and porphyry targets. The Oculto Zone currently contains most of the resource [and where most of the work has been focused]. 90k meters of drilling having been completed. But all the drilling to date has not tested below a depth of 400m. The open-pit mineral resource contains 82.63m oz. Ag and 761k oz. Au. In addition to being open along strike, the deposit is open at depth. Diablillos is the highest-grade oxide project in the America’s with an M&I AuEq grade of 2.08 g/t (marginally higher as this is based on a 75:1 GSR).

A lot has changed since the 2018 PEA as AbraSilver has had success delineating additional mineralization.

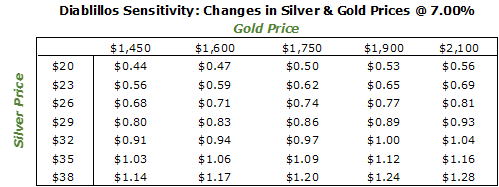

While most of the value in the company is derived from Diablillos, its other two assets could unlock value with additional exploration and rising gold and silver prices or, at the minimum, provide investors with some optionality. Below is a sensitivity table based on the Diablillos PEA (2018) using various gold and silver prices. This is preliminary, and many things will likely change as the company advanced the project towards a feasibility study. The sensitivity table values the Diablillos project on a per-share basis at various gold and silver prices.

Note: This is a base case scenario and outdated. It does provide a rough estimate of the value of the project. Instead of using a F/D share count, 575m shares are used, which is lower than the 617m F/D to account for the company's net cash position and cash inflow that will occur when the warrants and options are exercised. We will provide an updated valuation when the updated PEA is published, expected in Q3, 2021.

The following are some drill highlights from the 2020 drill campaign and some drill results published this year, 2021: (Note: There have been far more high-grade intercepts, but these are some of the best)

- 17.5m @ 603.9 g/t Ag + 0.10 g/t Au

- 7m @ 202 g/t Ag + 20.64 g/t Au

- 9m @ 49 g/t Ag + 7.31 g/t Au

- 15m @ 658 g/t Ag + 2.35 g/t Au

- 2m @ 56 g/t Ag + 9.45 g/t Au

- 28m @ 383 g/t Ag + 0.34 g/t Au

- 83m @ 289 g/t Ag + 1.45 g/t Au

- 15m @ 296 g/t Ag + 2.16 g/t Au

- 2.5m @ 30 g/t Ag + 8.26 g/t Au

- 6m @ 232 g/t Ag + 2.90 g/t Au

- 13.5m @ 179 g/t Ag + 4.47 g/t Au

- 11.2m @ 222 g/t Ag

- 2m @ 70 g/t Ag + 5.12 g/t Au

- 81m @ 382 g/t Ag + 2.12 g/t Au

- 17m @ 1,466 g/t Ag + 0.55 g/t Au

- 2m @ 5,796 g/t Ag + 0.94 g/t Au

- 7m @ 132 g/t Ag + 5.35 g/t Au

- 27m @ 207 g/t Ag + 4.29 g/t Au

- 103m @ 388 g/t Ag + 1.70 g/t Au (Best Ever Intercepts: Grade x Width)

- 22m @ 413 g/t Ag

- 15m @ 701 g/t Ag

- 10m @ 1,004 g/t Ag + 0.17 g/t Au

- 36m @ 370 g/t Ag + 0.39 g/t Au

- 5m @ 1,555 g/t Ag + 1.19 g/t Au

- 8m @ 81 g/t Ag + 7.97 g/t Au

- 13m @ 34 g/t Ag + 6.43 g/t Au

- 75m @ 166 g/t Ag + 2.24 g/t Au

- 38m @ 183 g/t Ag + 2.60 g/t Au

- 104m @ 216 g/t Ag + 2.21 g/t Au

- 7m @ 969 g/t Ag + 2.63 g/t Au

- 24m @ 327 g/t Ag + 2.22 g/t Au

Non-Core Assets:

Arcas Copper/Gold Project: AbraSilver entered into a JV agreement with Rio Tinto whereby Rio can earn up to a 75% interest in the project by incurring up to US$25m in exploration spending. The property hasn’t been drilled in a while, with a subsidiary of Teck Resources having last drilled there in 2010. A summary of the key term of the agreement are as follows:

- 1st option: If Rio Tinto incurs total project expenditures of US$4 million within three years and makes aggregate cash payments to Aethon of US$300,000 during the first two years, it will have the right to acquire a 51% interest in the Arcas project through the acquisition of 51% stock of a new company that will be incorporated;

- To exercise the option, Rio Tinto shall make the cash payments before the following dates:

- US$100,000 on or before the first-anniversary date;

- US$200,000 on or before the second-anniversary date;

- 2nd Option: If Rio Tinto incurs additional project expenditures of US$5 million over the subsequent 2-year period, it will have a right to acquire a 14% interest in Opco (holder of the Arcas project), resulting in its total interest being 65%; and

- 3rd Option: If Rio Tinto incurs additional project expenditures of US$16 million over the subsequent 3-year period, it will have a right to acquire a 10% interest in Opco (holder of the Arcas project), resulting in its total interest being 75%;

- Rio Tinto has agreed to incur minimum project expenditures of US$1 million within one year of securing all necessary approvals to conduct drilling activities which are to be part of the Stage 1 earn-in project expenditure.

- If Rio Tinto withdraws from the project, it will pay Aethon an amount equaling the cost to maintain the Project concessions for the 12 months commencing on the date of termination that has not already been paid.

- Under the terms of the Agreement, Rio Tinto shall have the right to form a Joint Venture (“JV”) with the following key terms:

- The JV (Opco) may be formed with 51% to Rio Tinto and 49% to Aethon upon satisfaction of the 1st option; 65% to Rio Tinto and 35% to Aethon upon fulfillment of the 2nd option; or 75% to Rio Tinto and 25% to Aethon upon satisfaction of the 3rd option.

- The JV will be managed by Rio Tinto and funded by each participant in accordance with their interest.

- Aethon may elect not to fund its interest and be diluted down to a 10% interest. If Aethon is diluted below a 10% interest, its interest will convert to a 1% net smelter royalty capped at US$50 million.

- Each party will have a right of first refusal should the other party wish to divest its shareholder interest.

- The project is unlikely to be advanced toward a production decision in this cycle; however, it does provide potential optionality value dependent on how successful Rio Tinto is in exploration efforts and those undertaken by AbraSilver

La Coipita: The company entered into an option agreement to acquire 100% interest in the project, located in the San Juan province, Argentina. AbraSilver believes the project will be of interest to larger mining companies and intends to look for a strategic partner to advance the project.

AbraSilver and the Diablillos project is one of the more exciting open-pit Ag-Au deposits given its high-grade nature, low-cost structure (shallow oxide resource, especially one of this grade generally falls into the lowest quartile on the industry cost curve, if not the bottom half), and potential scale, making AbraSilver, a company to watch. Near-term catalysts include an updated resource estimated and an updated PEA.

Click Here Visit AbraSilver Resource's Website or go to Abrasilver.com.

Disclosure: Goldseek Employees Hold A Position in AbraSilver