Not for the first time, the US Treasury has just gone and frozen the US held assets of Afghanistan’s central bank, the Da Afghanistan Bank (DAB).

Chief among these assets are 1731 old gold bars (just less than 22 tonnes) supposedly stored in the gold vault of the Federal Reserve Bank of New York in Manhattan under 33 Liberty Street.

These 1,731 gold bars (if they even still exist) were deposited with the Fed by the Afghan central bank in 1939, and are old US Assay Office gold bars that have cracks, fissures, holes and other imperfections. See details below.

While the US Treasury has not yet released an official statement on blocking the Afghan central bank assets, the Washington Post on Tuesday 17 August broke the story that a few days previously on Sunday 15 August, the Office of Foreign Assets Control of the Treasury department under the direction of Janet Yellen had made the decision to execute the freeze.

Among central banks of the world, the DAB has always been one of the more transparent when it comes to divulging information about it’s gold reserve holdings, and looking at the DAB’s annual financial statements, you can see why.

Back in the past when the Fed’s New York vault was overflowing with gold bars

Back in the past when the Fed’s New York vault was overflowing with gold bars

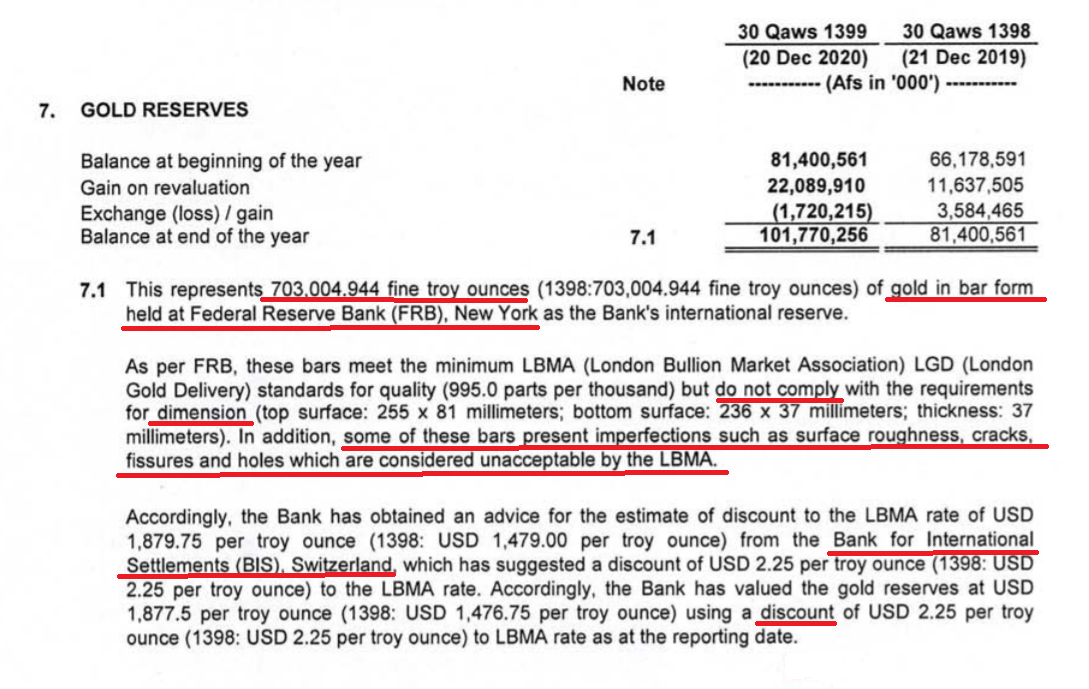

In the latest annual financial statements of the DAB for the year ended 30 Qaws of solar year 1399 (which is 20 December 2020), note 7.1 to the financial statements states that the DAB holds:

“703,004.944 fine troy ounces of gold in bar from held at the Federal Reserve Bank (FRB), New York as the Bank’s international reserve.”

This 703,004.944 ozs is approximately 21.87 tonnes of gold.

Cracks, Fissures and Holes

However, note 7.1 of the 2020 accounts goes on to say that even though the Afghan central bank’s gold bars have a minimum gold purity of at least 99.5%, they are not London Good Delivery bars because the dimensions of the bars do not comply with Good Delivery gold bar dimensions, and critically, some of the bars contain cracks, fissures, holds and other imperfections.

In short, the Afghan central bank’s gold at the New York Fed looks to be a pile of old US Assay Office gold bars. Specifically, note 7.1 says that:

“As per FRB, these bars met the minimum London Bullion market Association(LBMA) London Good Delivery (LGD) standards for quality but no not comply with the requirements for dimension.

In addition, some of these bars present imperfections such as surface roughness, cracks, fissures and holes which are considered unacceptable by the LBMA.”

Per the LBMA Good Delivery Rules for gold, bars cannot have:

“Irregularities such as surface cavities, cracks, holes or blisters (debris and water can accumulate in such irregularities which can affect the weight of the Bar and accumulated water can cause an explosion when the Bars are melted)"

Its pretty obvious that the gold bars held in the FRB New York for the Afghan’s are old brick shape US Assay Office gold bars. For a full description of these type of old gold bars, see the “Gold Bars Worldwide" document about US Mint gold bars (in archive here).

Old US Assay Office ‘brick’ gold bars, part of a ‘Melt’. Source

Old US Assay Office ‘brick’ gold bars, part of a ‘Melt’. Source

Note 7.1 then informs us that since the Afghani gold bars in the New York Fed vault are not acceptable in international markets (or anywhere else) as Good Delivery gold bars, then the market valuation of these bars has to be discounted.

When in Doubt, Call the BIS

Having already cited the New York Fed and the LBMA, Note 7.1, then takes on the appearance of a crime scene caper finale where all the usual suspects turn up at the same time, as it wheels out the boss of them all, the Bank for International Settlements (BIS).

This is because the DAB has asked the BIS in Switzerland (an authority on gold bar trading?) what type of discount to apply to the DAB’s gold bars given their undesired dimensions, cracks fissures and holes. The BIS thinks a US$ 2.25 discount per bar will do the trick.

Specifically, note 7.1 says that:

“Accordingly, the Bank [DAB] has obtained an advice for the estimate of discount to the LBMA rate of 1,879.75 per troy ounce from the Bank for International Settlements (BIS), Switzerland, which has suggested a discount of USD 2.25 per troy ounce t the LBMA rate.”

Afghan central bank annual financial statements, year-end 20 Dec 2020. Source

Afghan central bank annual financial statements, year-end 20 Dec 2020. Source

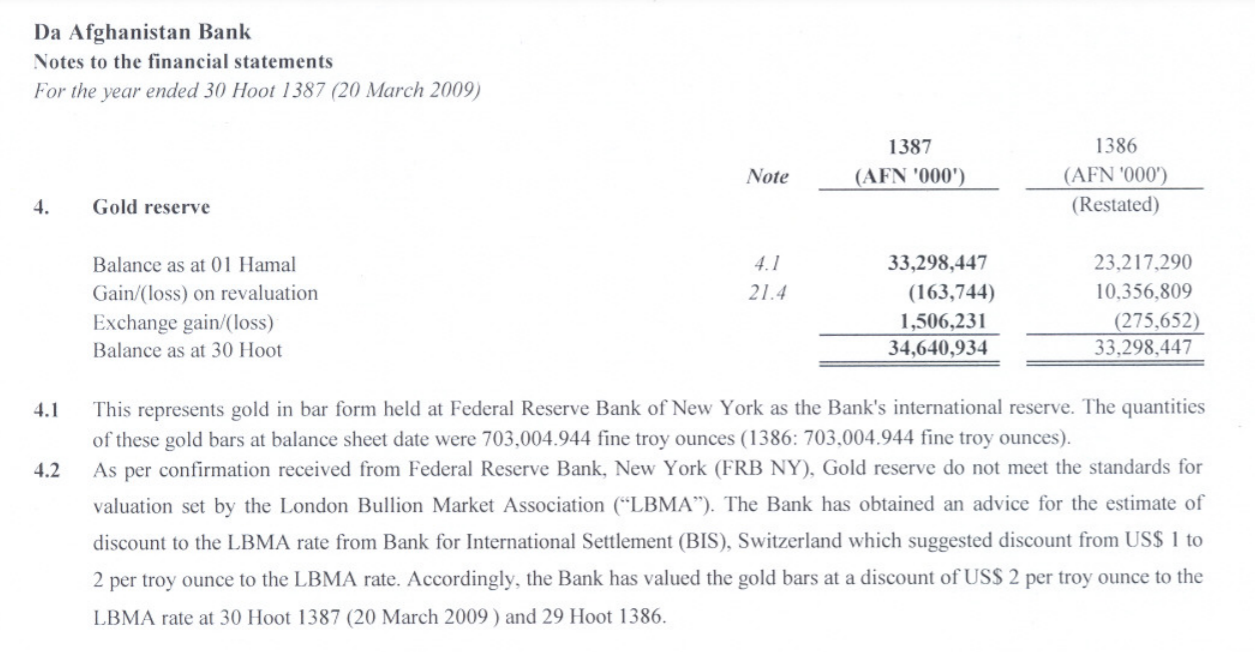

This valuation adjustment to the Afghan gold at the New York Fed is not a new adjustment and was first mentioned in the Afghan central bank’s annual financial statements for the year to 20 March 2009 (year end to 30 Hoot 1387 in the Afghani calendar). i.e. the discount adjustment was first applied to the Afghan gold from 2008 onwards.

The DAB annual financial statements for year to 20 March 2009 are in an archive of the old DAB website here.

Afghan central bank annual financial statements, year-end 20 March 2009. Source

Afghan central bank annual financial statements, year-end 20 March 2009. Source

Back then in 2008, the DAB still held 703,004.944 troy ounces of gold at the New York Fed vault in Manhattan, i.e. the exact same gold bars as no gold was bought or sold by DAB between 2008 and 2021.

Exactly 1,731 old gold bars

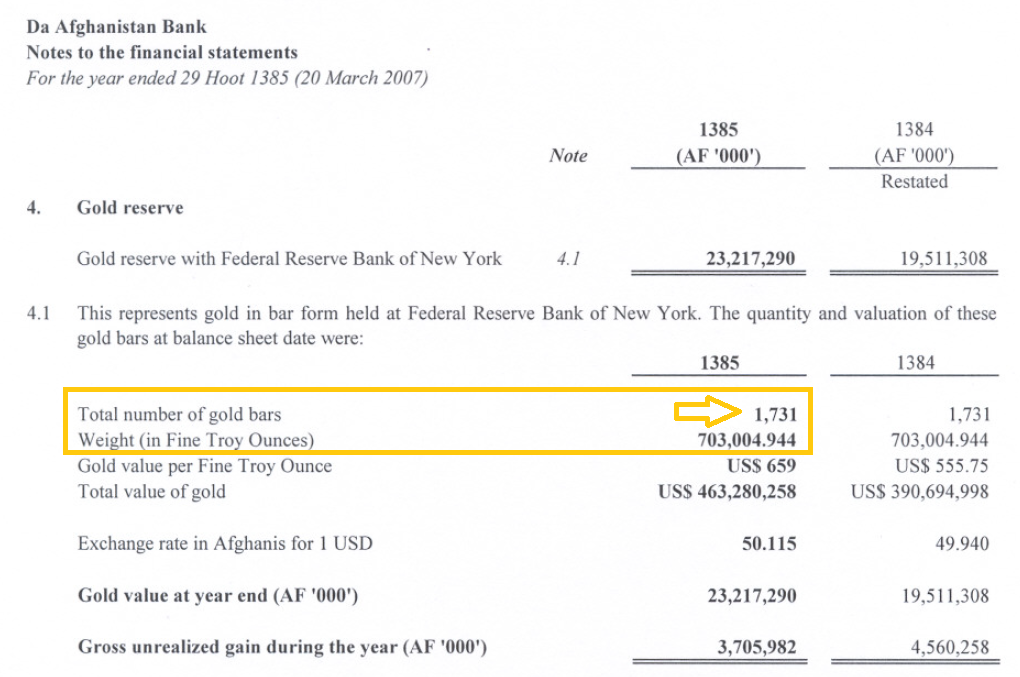

Going back one year previously to 2007, and the Afghan central bank was even more transparent, with Note 4 of the DAB’s annual financial statements for the year to 20 March 2007 (29 hoot 1385 in the Afghan calendar) showing that the Afghan central bank holds 1,731 gold bars at the Federal Reserve Bank of New York.

This was exactly, as per every other year, equal to 703,004.944 fine troy ounces. So now we know that the 703,004.944 ozs of gold that the DAB holds in the New York fed vault is in the form of 1,731 gold bars.

See screenshot below for the 1,731 gold bars reference:

Afghan central bank annual financial statements, year-end 20 March 2007. Source

Afghan central bank annual financial statements, year-end 20 March 2007. Source

It is these 1,731 gold bars belonging to the Afghan central bank that have (in August 2021) now been ‘frozen’ by the US Treasury through the FRB New York.

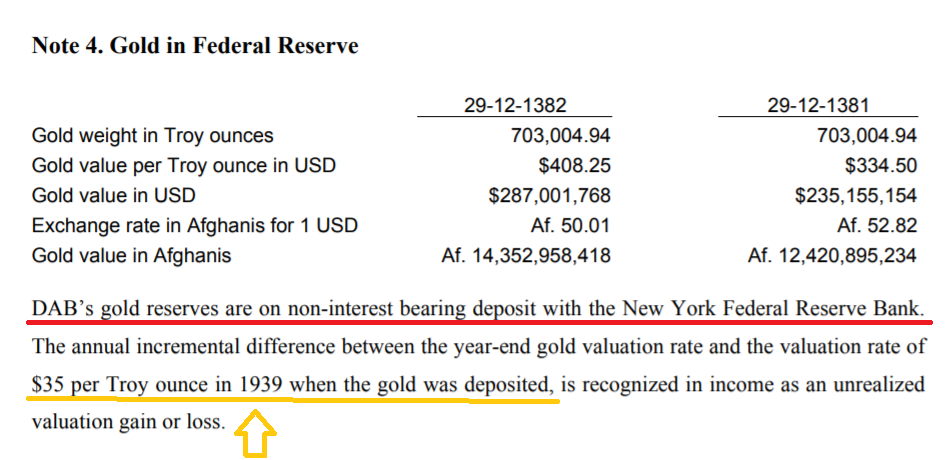

Going back to the 2004 annual financial statements of the DAB (year end 19 March 2004 / 29 Hoot 1382), we find that the 703,004.944 ozs of Afghan central bank gold (in the form of 1,731 gold bars) are held with the Federal Reserve Bank of New York as a non-interest bearing deposit.

Note 4 of the 2004 accounts, titled “Gold in Federal Reserve”, states that:

“DAB’s gold reserves are on non-interest bearing deposit with New York Federal Reserve Bank”.

See screenshot below:

Afghan central bank annual financial accounts to year-end 19 March 2004. Source

Afghan central bank annual financial accounts to year-end 19 March 2004. Source

This ‘non-interest bearing deposit’ is a troubling phrase as it suggests that the Afghan central bank gold is not held under bailment via a custodian agreement where the DAB would be bailor and the FRB New York bailee, but rather as a deposit where the depositor does not retain full title and ownership.

FRBNY staff inspecting the “Wall of Gold" in the Auxiliary vault of the NY Fed, 1970s

FRBNY staff inspecting the “Wall of Gold" in the Auxiliary vault of the NY Fed, 1970s

At the current time, this is the least of the problems of the Afghan central bank, but the question must be asked, does the gold storage agreement between the DAB and the Federal Reserve Bank of New York provide full legal title and unencumbered ownership of the 1,731 gold bars to the DAB, or is the gold merely a deposit which the FRB can do whatever it wants with, such as lend, lease swap it with a commercial bank such as JP Morgan. located across the road from 33 Liberty street in the 1 Chase Plaza vault, where a tunnel connects the two vaults.

Pre-WWII: As Old as the Hills

How long has the Afghan central bank held an unchanging amount of 703,004.944 ozs of gold at the NY Fed in the form of 1,731 old US Assay Office gold bars?

Startlingly, this question is also answered by looking at the DAB’s 2004 financial statements, also in Note 4, which reveals that the Afghan central bank gold was deposited with the Federal Reserve Bank of New York in 1939, which is 82 year ago!

Specifically, Note 4 of the 2004 DAB accounts states that:

“The annual incremental difference between the year-end gold valuation rate and the valuation rate of $35 per Troy ounce in 1939 when the gold was deposited, is recognized in income as an unrealized valuation gain or loss.”

This is not a typo. You have read this correctly. The Afghan central bank gold at the NY Fed was deposited there in 1939, which coincides with the start of World War II.

The unrealized valuation adjustment for the DAB gold above the $35 per oz acquisition price is also confirmed in the accounting policies of the DAB financial statements which states that:

“(c) Gold reserves: Monetary gold held, as part of DAB’s foreign exchange reserves, in the vaults of the Federal Reserve Bank in New York is regarded as a monetary instrument.

It is measured at quoted market prices as of the balance sheet date. The difference between the quoted market price at the balance sheet date and the original market rate of USD 35 per ounce at the date of acquisition is recognized in income as an unrealized revaluation gain or loss.”

Also in the 2004 accounts, under “Capital and Reserves”, you can see the massive adjustment attributed to “Accumulated net unrealized revaluation gains on gold reserves” which is the difference between market price and the acquisition price of $35 per oz in 1939.

These very old US Assay Office gold bars were always produced in Melts. Melts are batches of gold bars, usually between 18 and 22 bars, that when produced, were stamped with a melt number and a fineness, but were weight-listed as one unit. The US Assay Office produced both 0.995 fine gold bars and coin bars as Melts. The gold bars in a Melt are usually stored together unless that melt has been ‘broken’.

Here’s the Federal Reserve Board says about 0.995 fine Melts:

“US Assay Office bars, like bars in other countries, are produced in melts or a series of bars, numbered in succession. For instance, melt No. I contains 20 bars. Hence, the bars are stamped 1-1, 1-2, etc… , 1-20."

“US Assay Office bars are gold bars that are originally issued by the US Assay Office and that have not been mutilated and which, if originally issued in the form of a melt, are re-deposited as a complete melt. These bars are not melted and assayed. They weigh approximately 400 troy ounces, the fineness of their gold content is .995 (99.5% purity or better), and they come in complete melts.

“When an US Assay Office bar is removed from a melt, it is referred to as a mutilated US Assay Office bar."

Source: “Final report of the gold team", draft June 30th, 2000. Page 13: (https://web.archive.org/web/20150216091251/https://www.clintonlibrary.gov/assets/storage/Research-Digital-Library/holocaust/Holocaust-Theft/Box-227/6997222-final-report-of-gold-team.pdf)

Tag Team USA: Freeze – Unblock – Freeze

At the start of this article, it was mentioned that this is not the first time that the Afghan central bank gold holdings in the vault of the Federal Reserve Bank of New York have been frozen by the US Treasury.

This is because the same DAB gold holdings were also frozen by the US Treasury back in July 1991 and then unfrozen in January 2001. The fact that it’s the same 703,004.944 ozs of DAB gold which was frozen in 1999 can be seen from the US Treasury statement of 24 January 2001, when the US Treasury decided to unfreeze the gold and referred to ‘unblocking approximately $193 million in gold”.

Old US Assay Office gold bar, 999.5 fine, with ‘brick’ shape

Old US Assay Office gold bar, 999.5 fine, with ‘brick’ shape

At a gold price of $274.5 on 23 January 2001, this $193 million represented 703,000 ozs of gold. The US Treasury press release of 24 January 2001, titled “Treasury signs license unblocking frozen Afghan assets”, can be seen below:

“Late yesterday the Treasury Department signed a license authorizing the Federal Reserve to unblock Afghan government assets frozen in 1999 under Executive Order 13129.

The license, signed by Richard Newcomb, Director of Treasury’s Office of Foreign Assets Control, gives control of the assets to the new Afghan Interim Authority (AIA).

The license will unblock approximately $193 million in gold and $24 million in other assets of the Afghan Central Bank held at the Federal Reserve Bank of New York.

The assets had been blocked under the 1999 Executive Order that froze all assets associated with the Taliban regime."

It was under Executive Order 13129 of 4 July 1999 signed by then US president Bill Clinton that the DAB gold at the FRB in New York was frozen/blocked by the US Treasury in 1999. The US Treasury Secretary at that time was Larry Summers, who was sworn in on 2 July 1999. The Afghan gold was unblocked on 24 January 2001, just a few days after George W. Bush took office.

These old Afghan gold bars (if they even still exist at all down the back of the Fed vault cages) have therefore seen a lot of US tag team action over the years, being blocked and frozen by Clinton and Summers in 1999, unblocked again by George Bush Jnr in 2001, and now blocked again by Biden and Yellen in 2021. History is repeating itself.

And nobody much outside of the NY Fed’s “Central Bank & International Account Services" team has, until now, known that the Afghan central bank:

- holds 1,731 very old gold bars at the FRB New York vault

- that this gold was deposited by the Afghan central bank in 1939

- that the Afghan gold bars at the NY Fed are not Good Delivery gold bars

- that the dimensions of the bars imply they are old US Assay office gold bars

- that the bars have imperfections such as cracks, fissures and holes

Well, now you know!