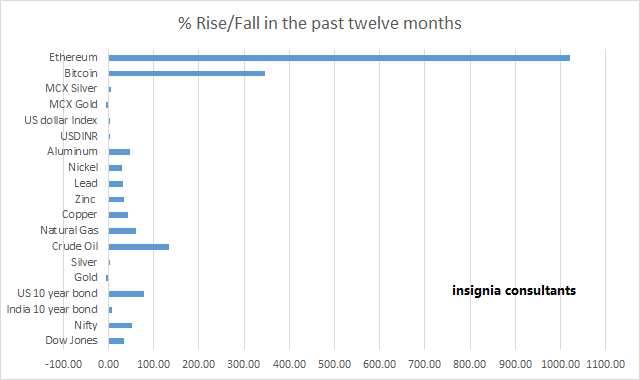

Let’s start with the performance of various asset classes in the past twelve months. Gold has been the laggard among all asset classes.

|

Comparative Performance of various asset class |

|||

|

|

31-10-2021 |

31-10-2020 |

% gain/loss |

|

Dow Jones |

35,819.59 |

26,501.60 |

35.16 |

|

Nifty (India) |

17,671.65 |

11,642.40 |

51.79 |

|

India 10 year bond |

6.367 |

5.881 |

8.26 |

|

US 10 year bond |

1.561 |

0.874 |

78.60 |

|

Gold |

$1,783.90 |

$1,879.90 |

-5.11 |

|

Silver |

$2,394.90 |

$2,364.60 |

1.28 |

|

Crude Oil |

$83.57 |

$35.79 |

133.50 |

|

Natural Gas |

$5.43 |

$3.35 |

61.78 |

|

Copper |

$9,539.25 |

$6,712.00 |

42.12 |

|

Zinc |

$3,393.50 |

$2,519.75 |

34.68 |

|

Lead |

$2,384.25 |

$1,810.25 |

31.71 |

|

Nickel |

$19,617.50 |

$15,210.00 |

28.98 |

|

Aluminium |

$2,735.25 |

$1,853.50 |

47.57 |

|

USDINR |

₹ 74.9150 |

₹ 74.5540 |

0.48 |

|

US dollar Index |

94.121 |

94.042 |

0.08 |

|

MCX Gold |

₹ 47,635.00 |

₹ 50,699.00 |

-6.04 |

|

MCX Silver |

₹ 64,534.00 |

₹ 60,865.00 |

6.03 |

|

Bitcoin |

$61,698.80 |

$13,797.30 |

347.18 |

|

Ethereum |

$4,334.38 |

$386.42 |

1,021.68 |

The key reason for underperformance of gold and silver in the past twelve months are below

- Sharp rise in Bitcoin, Ethereum and other crypto currencies.

- Very Sharp rise in US Ten Year Bond Yields.

I have given both value wise and graph for better understanding. So what really caused people to shun gold and silver.

- Coronavirus vaccine news and actual implementation started between November 2020 and March 2021.

- Taper Talks by the Federal Reserve and nation reopening (from lockdown) affected global financial markets between April 2021 and Now.

- Inflation and Hyper-inflation and Stagflation was also affecting global financial markets between July and now.

- In between, the US changed its president from Trump to Biden.

- Crypto Mania has been catching up everyone in the past twelve months. Crypto Mania is there in every nook and corner of Earth.

Key news/factors which will affect global financial markets and bullion in the next twelve months are.

- Crypto Mania will continue till the end of next year as well. Introduction of digital currencies by various central banks from the end of 2022 will reduce the pace of rise of crypto currencies and not the actual rise.

- Inflation, deflation and stagflation. They should interchange every quarter in the next one year.

- Energy price trends will dictate the global inflation scenario. Energy price trend can be the oomph factor for central bank policies on liquidity management.

- Global liquidity scenario. A lot of central banks have started raising interest rates. Many more will do so till June 2021.

- Central banks will continue to increase gold reserves.

- Asian physical demand for gold will rise for the next twelve months as the income outlook looks rosier.

- The pace of rise of US ten year bond yields will fall. Overall US ten year bond yield will rise.

The US dollar Index and Asian currencies will be dictated by the bond yield gap between their respective nations. Local currency price versus the US dollar will play a big role in determining gold and silver demand in a nation. Asian currencies (other than yuan and yen) will be very volatile after Christmas. The only threat for Asian currencies is energy price. Asian nations with low forex reserves can see a prolonged slump and vice-versa.

Deglobalization will zoom in the next twelve months. This year’s historical disruption in the global supply chain and fears of repeat in future years will result in more and more corporations to increase localization. Most Apparel manufacturers in Europe intend to relocate production from Asia to low cost European nations. Land border will be a key factor to relocation decision. Other sectors will also follow the same. Relocation from Asia to Europe and North America will not happen overnight. But the same will be started in the next one year. Gold price will get supported by higher local content.

Deglobalization is one of the reasons why raw material cost is rising. Every manufacturer of every sector is buying more of it for local use. Nations are now reluctant to sell raw material in raw form. For example Indonesia will sell less raw nickel and less raw palm oil from next year. They intend to sell processed nickel and palm oil from next year. This will increase value addition. The rush for raw material for local manufacturing should be bullish for gold and silver.

Digital currencies. China is slated to launch a digital currency next year. Other central banks will launch digital currencies over the coming years (if not next year). Cryptocurrencies will fall if and when central banks start launching digital currency. Gold investment demand (ETF physical and other forms) will rise on introduction of digital currencies.

Bond yields will be dependent on interest rate trends. Interest rate trend or money supply policy by central banks will in turn be dependent on a combination of inflation outlook and growth outlook. Central banks generally prefer hyperinflation to continue till it does not hurt growth significantly. Gold price generally falls at the beginning of higher rate cycle and rises in the latter half of higher interest rate cycle. Beginning of higher interest rate cycle next year will be bearish for bullion unless accompanied by a falling US dollar Index.

Headline inflation may not rise due to statistical impact. Real inflation will be at a historical high. A sustained sharp increase in real cost of living will be very bullish for gold.

TECHNICAL OUTLOOK

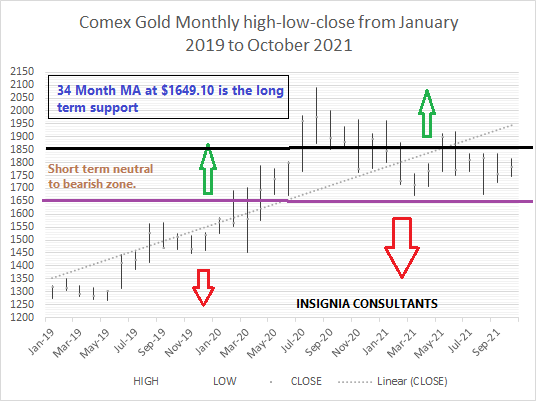

COMEX GOLD (near term future) (closing price on 29th October $1783.90)

- Weekly Moving Average: 100 week: $1789, 200 week: $1591.70

- Daily Moving average: 200 day: $1794.60 400 day: $1818.40

- Past Twelve Month High Price: $1966.10

- Past Twelve Month Low Price: $1673.30

- Gold has been trading in $1673.30-$1966.10 wider range for the past twelve months. This range will be broken soon and form a new range.

- Bearish case scenario for short term: Failure to break $1854.00 by end November will result in a fall to $1662.20 and $1619.90 and $1527.30.

- Bullish case scenario for short term: Gold will keep on trying to rise to $1864.40, $1905.50 and $1944.90 as long as it trades over $1713.80 (on daily closing basis).

- Bullish case scenario for long term: Gold can rise to $2073.10, $2297.10 and $2422.20 as long as it trades over $1649.10 on daily closing basis.

- Bearish case scenario for short term: Failure to break $1944.90 by end March 2022 will result in a crash to $1619.90 and $1431.60.

- Gold View for Diwali of 2022: Gold price should fall first and then rise. We are expecting a fall to $1619.90-$1639.30 zone first followed by a rise to $2073 and $2422.20.

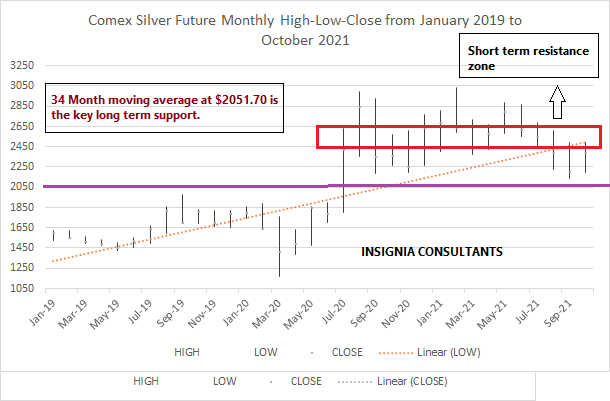

COMEX SILVER (near term future) (Closing Price on 29th October 2021 $2394.90)

- Weekly Moving Average: 100 week: $2280.80, 200 week: $1974.60

- Daily Moving average: 200 day: $2530.50 400 day: $2382.40

- Past Twelve Month High Price: $3035.00

- Past Twelve Month Low Price: $2141.00

- Silver is now caught between long term bulls and short term bears.

- Short term bearish trend is there as long as silver does not break two hundred day moving average of $2530.50.

- Long term bullish trend is intact as long as silver trades over two hundred week moving average of $1974.60.

- Silver Short term: Silver will keep on trying to break past $2530.50 for $2769.40 as long as it trades over $2248.40. However failure to break $2530.50 by end of November 2021 will result in a crash to $2051.70 and $1947.90 first.

- Silver Long Term: Silver can rise to $2944.90, $3143.90 and $3728.40 in the long term as long as it trades over $1974.70.

- Silver Price Target for Diwali of 2022: We remain bullish on silver for Diwali of 2022 with $3143.90 and $3728.40 and more as price target.

The pace of rise of silver will vary each month. There can be short term bearish phase in silver followed by an equally big rise. Long term demand use in equipment’s which reduce carbon footprints and other uses will ensure bullish fundamentals for silver. However short term investors should remain on the side-lines for now. Long term investors need not worry an iota.

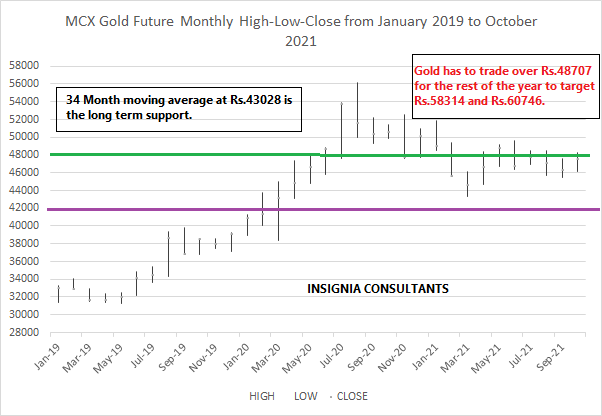

MCX GOLD (near term future) (closing price on 29th October Rs.47635)

- Weekly Moving Average: 100 week: Rs.46877, 200 week: Rs.39730

- Daily Moving average: 200 day: Rs.48110 400 day: Rs.48313

- Past Twelve Month High Price: Rs.52520.00

- Past Twelve Month Low Price: Rs.43320.00

- MCX Gold short term: MCX gold futures has to trade over Rs.48110-Rs.48313 zone to be in a short term bullish zone and rise to Rs.49779, Rs.52520 and Rs.55858. However failure to break immediate resistance of Rs.48707 by end November will result in a crash to Rs.46150 and Rs.44664 and Rs.43035.

- MCX Gold long term: MCX gold futures are bullish in the long term as long as it trades over Rs.43320. However failure to break Rs.52520 by end March will result in a plunge to Rs.39730 and more.

- MCX Gold View till Diwali of 2022: I remain bullish on gold till 2022 Diwali. However I am against investing aggressively at current prices. One can start investing in small amounts at current price and increase on every three percent and more fall till Rs.42000. MCX gold future will rise to Rs.60746 and Rs.65426 by Diwali of 2022 as long as it trades over Rs.43035.

Gold prices have to show clear signals of breaking past $2000 to attract short term investment flows. There will be chance of a short term deep fall in case gold does not break $1900 till end January.

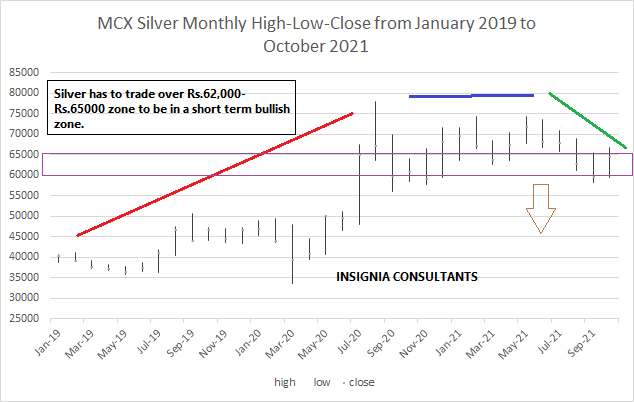

MCX SILVER (near term future) (closing price on 29th October Rs.64534)

- Weekly Moving Average: 100 week: Rs.59187, 200 week: Rs.49417

- Daily Moving average: 200 day: Rs.66834 400 day: Rs.62746

- Past Twelve Month High Price: Rs.74426.00

- Past Twelve Month Low Price: Rs.57800.00

- MCX Silver Short Term View: Silver can rise to Rs.72847 as long as it trades over Rs.59173. MCX Silver Future will crash if immediate resistance of Rs.68250 is not broken by end November to Rs.57102 and Rs.55331.

- MCX Silver Long Term View: Silver has to trade over Rs.53812 to rise to Rs.75499 and Rs.82139.

- MCX Silver View till 2022 Diwali: I am cautiously optimistic on silver as apart from 2020 silver failed to rise in a big way. Silver has to trade over Rs.68250 till next Diwali to continue its bullish trend and rise to Rs.81160 and Rs.89749. MCX silver future will trade in Rs.51927-Rs.53570-Rs.56498-Rs.60818-Rs.68250 range in case Rs.68250 is not convincingly broken.

I am a hardcore silver bull. My silver view always has a slightly bullish bias. I would like to predict that MCX silver will rise to Rs.101883 by 2022 Diwali. But I am holding it back as past experience suggests that silver has crashed whenever the world became bullish on it.

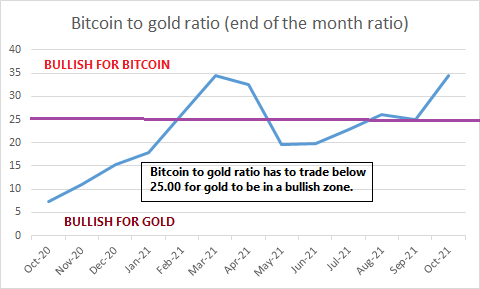

Bitcoin to gold ratio

I am just taking end of the month rates for calculation of ratio. Bitcoin to Spot Gold Ratio will dictate gold price till end of next year. The current norm is that this ratio has to trade below 25.00 for a few months for any chance for gold to break past $2100. The US dollar Index to gold ratio now has less impact on gold price as compared to Bitcoin to gold ratio. Keep a close watch on the Bitcoin to gold ratio.

Should I invest in physical gold at the current price for 2022 Diwali?

Those who celebrate Diwali are asking me this. Small amounts of physical gold and physical silver will be brought all over India this Diwali. This buying will be based on religious sentiment. But should an investor invest in gold and silver for Diwali of 2022? I do not expect the gold price to rise by more than fifteen percent till Diwali of 2022. There has to be a compelling reason if gold has to generate a return of more than fifteen percent in the next one year. If you are satisfied with a fifteen percent return then invest at the current price. If you want a return over fifteen percent in gold then wait for a correction of eight percent or more and then invest.

Should I invest in physical silver at the current price for 2022 Diwali?

Fundamentals suggest that silver should blast off to $50.00 over the next twelve months. To me silver is an investment at current price for 2022 Diwali. Silver future, silver ETF or physical silver should be five percent of one's long term investment portfolio.

Will central banks add crypto currencies to their reserves?

My niece is eleven years old. She just asked me whether central banks will add bitcoins and crypto currencies as a part of their reserve diversification. She has a very valid point. Kids these days know more about crypto currencies than any other asset class. I was stumped by this question. As I ponder over this, my view is that central banks will add selected crypto currencies to their reserve basket over the coming years. Crypto currencies will replace the forex basket in central bank reserves but not gold. Physical gold will be a very critical investment for central banks for decades to come. (I have made it compulsory for my niece to read our daily report since the pandemic began. I have been explaining to her all the details.)

How to trade in gold and silver till 2022 Diwali

Use a buy on crashes strategy in silver as long as it trades over $19.00. Keep on booking profit till $27.00 is not broken convincingly. One can also go short in silver in case $27.00 is not broken by March 2022. Remember silver has to trade over $27.00 for at least two continuous months for any chance to target $50.00

In the short term I will prefer to invest in gold if and only if there are clear signals that gold price will trade over $1850-$1860 zone. In the long term I will prefer a buy on crashes strategy with a stop loss below $1500. If a long term investor is not prepared for an MTM loss of $1500 then he should look for other asset classes.

TO END

Young traders or reditt traders invest for a short term return of minimum five percent per month. They are very aggressive traders. They have a much higher risk taking ability than traders like me who were born in the 70's. Gold price has to indicate an annualized rise of twenty percent or more to attract these young traders.

Gold price would have broken past $3000 but the crypto mania craze is pulling everyone away from gold investment. Real inflation or felt inflation is way over twenty percent. Real Cost of living is rising over twenty percent per year. Higher returns in crypto currencies is being used as a way to target real inflation. Crypto currencies are the inflation hedge as on date. Gold is an inflation hedge but for traditional traders like me.

In 2022 the world will move to normalization away from coronavirus. It is very difficult to predict consumer taste, preference, spending habits and investment habits. Everything has changed for the long term since the covid pandemic began. Gold jewellery demand pattern in India is uneven and seeing a big change.

Global stock markets are a big bubble. It will move into a short term bearish phase in the next eight months. Gold and silver will shine on a stock plunge. Keep a close watch on stock market trends.