BEFORE ASSET PRICE DEFLATION

Before we talk about asset price deflation, let’s review what happened before 2022.

Most financial assets benefited enormously from the Fed’s hugely gratuitous efforts to support, sustain and reinflate prices after the 2020 collapse and the ensuing forced economic shutdown.

From the article Gold Market Manipulation And The Federal Reserve…

“Long-side investors in all assets, including precious metals, ‘benefited’ from the manipulative efforts of the Federal Reserve twelve years ago and again just recently.

The recent recovery in prices for stocks, bonds, oil, gold, and silver has been almost unbelievable. It is literally jaw-dropping…” June 28, 2020

It’s kind of hard to believe that I wrote those words two years ago. A lot has happened since then. It isn’t an understatement to say that whatever superlatives were used to describe the situation at that time probably should have been saved for what came afterward.

For example, gold surged to more than $2000 oz in August 2020, and came close to breaching that level again earlier this year.

Stocks increased more than fifty-five percent by the end of the following year and the widely-followed popular cryptocurrency, Bitcoin increased nine-fold from 9000 to 64,000.

Housing prices seemed to have no upside limits and commodity prices increased by one hundred sixty-six percent.

IT’S ALL OVER NOW

That was then and this is now. Here are some charts to look at…

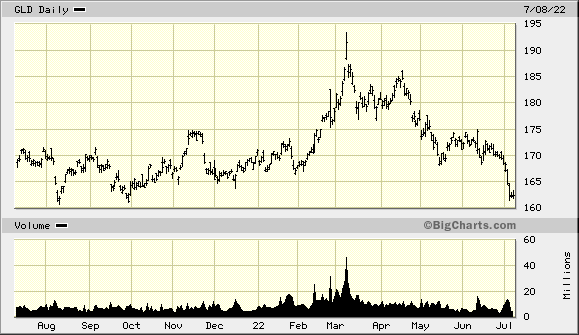

GLD (Gold ETF) 1-YEAR

|

|

In less than four months, the gold price has dropped more than sixteen percent.

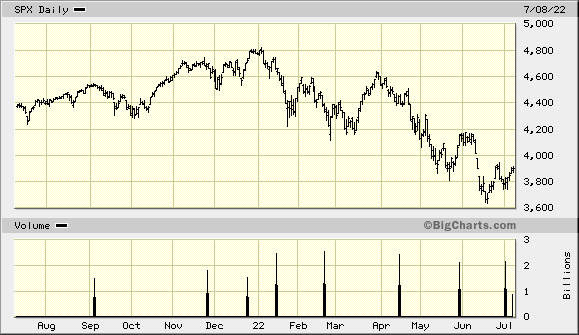

SPX (S&P 500) 1-Year

After reaching all-time highs at the end of last year, stock prices have fallen twenty-five percent.

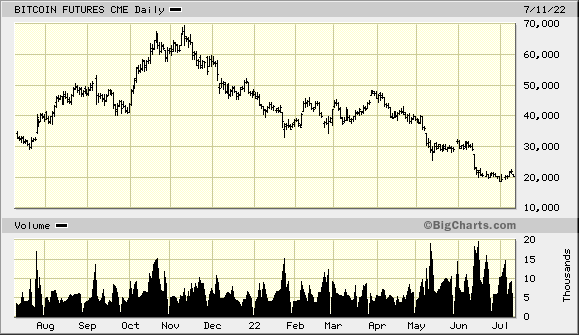

BITCOIN (CME Futures) 1-Year

|

|

The award for most breath-taking price drop so far goes to Bitcoin. That shouldn’t be a surprise to anyone. The most widely-watched cryptocurrency has fallen from 69,355 last November to a recent low of 18,525, a drop of seventy-three percent.

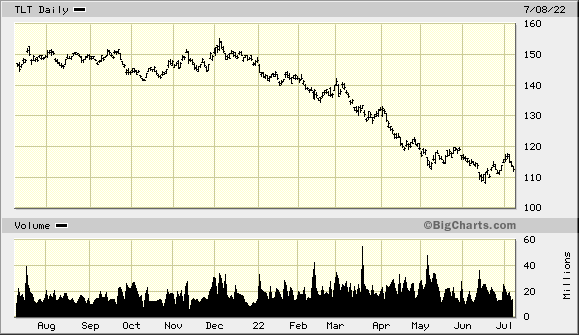

TLT (Long-Term US Treasury) 1-Year

|

|

Long-term US Treasury bonds have dropped by thirty percent since December.

THE MOST SIGNIFICANT CHART

Any one of the above charts might be considered as important, or significant, but I believe that a variation of the Long-term US Treasury Bond chart is deserving of further consideration…

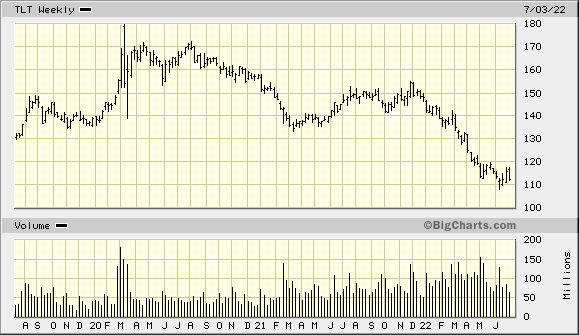

TLT (Long-Term US Treasury) 3-Year

|

|

The big push to keep interest rates down and reinflate asset prices didn’t do much for bonds.

The reversal point in a multi-decade decline in interest rates came in the summer of 2020 and bond prices have been declining since.

The decline grows in significance because it is larger and longer than in our previous example. From peak prices in August 2020, long-term bond prices have declined by forty percent.

There is additional significance in the fact that the rise in interest rates and corresponding decline in bond prices began while other assets were still in streak mode to the upside.

Investors were looking for the next big thing and the rocket fuel provided by the Fed for everyone’s favorite moonshot seemed to be working.

RUSH FOR THE EXITS – CONCLUSION

Then the Fed said that while it would still continue to provide rocket fuel (expanded credit), it was going to raise the price for the fuel by pushing interest rates higher.

Push turned to shove and the bond market fell down the “stairway to heaven”.

The reverberations were felt in surrounding crowded theaters and participants headed for the exits.

That rush for the exits brings us to where we are now. Expect another wave of selling to occur. It will include forced liquidations of leveraged positions in all markets as well as mass selling out of discouragement and despair.

Things are going to get a lot worse. The ultimate fire sale is underway. (also see A Depression For The 21st Century)

Kelsey Williams is the author of two books: INFLATION, WHAT IT IS, WHAT IT ISN’T, AND WHO’S RESPONSIBLE FOR IT and ALL HAIL THE FED!