We now have solid confirmation that the bear market did not go away and that the rally that began in October was just another typical bear-market rally. Look at the three graphs below to see how perfectly it fits the pattern of all the other bear-market rallies this year, which means we are heading down to a new lower low. The bear is back, and he looks hangry!

The charts all look bad … REAL BAD!

First, let’s look at the Dow, which I noted earlier was the only major index that had pulled out of its bear channel, but it had topped out at the same level as its previous peak. It tried to bust through that ceiling, but failed. The question, I asked when it hit that ceiling was “Will the index now continue to grind upward above that peak or will it bump its head and fall back into its bear-market range?” We now have our answer. The Dow bear gave up its breakout, and is returning to trend:

The Dow bull market peaked at the start of the year as one of the shortest bull markets in history (beginning after the flash-crash of 2020). 2020 was the shortest crash in history, and I believe the shortest bull market followed. Now, throughout 2022, we have been in a major crash event. The last market crash was stopped short by absolutely massive Fed interference coupled with federal-government interference with the biggest cash injections in history.

Neither the Fed nor the federal government are at liberty to do that this time with inflation burning up their backsides. If they do, they will fuel hyperinflation. So, they’d best stay with the tightening they’ve done, but it would seem to be time to stop tightening further, as we’ll finish the fall from the last bear rally even if they hold at their next meeting. That’s already in play; and, if the fall merely repeats at the rate (angle) it has happened after each of the last bear rallies, you can see how far it is likely to go before it finds major support at the bottom of the bear’s range. And, if it takes longer to fall, that only puts the bottom of this bear’s range down further down.

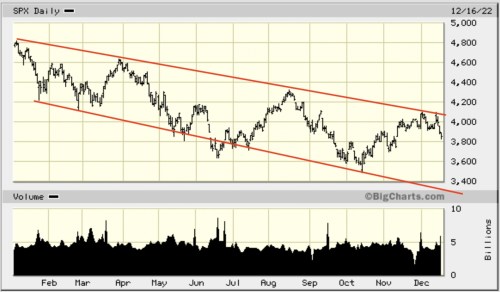

The S&P has been completely consistent at the top of its range, and you can easily see it merely pinged the top of the bear’s range twice this month then caved in and fell again. It is now well on its way back toward the descending bottom of that range:

The S&P, too, peaked out at the very start of the year and has been a bear market ever since, never breaking out its range along the upper trend. The NASDAQ, too, has been totally consistent in the trend line for its bear-rally peaks, although it hit its peak last November and has been a bear market ever since. However, the trend for its bottom has not been as clear:

Clearly, however, the NASDAQ is well on its way back down to find a bottom somewhere, and my goal is not to provide charts to say where the landings are but to show that this economy is still ravaging the stock market severely and has plenty of meanness easily left in store, especially with the Fed continuing to tighten, as Papa Powell has consistently promised he will do until his fight with inflation is done and inflation has turned a corner, or he’s damaged the economy enough to cause a meaningful rise in unemployment.

We also just saw the S&P break below the support of its 100DMA, while the Russell 2000 and Nasdaq break below their 50DMA. There is not much support below here and plenty of room to fall before the market plumbs major support at the bottom of this bear’s trend channel.

Negative forces clawing at the market’s soft underbelly

I had one guy calling every day to tell me what an idiot I was to think the bear was going to continue to prowl, as the rise in the Dow, particularly, proved a new bull market was forming. Well, this week provided vindication that the bear is fully back on the prowl. So read the charts and howl. The bear is large and in charge.

There is no hope expressed in any of the charts, except maybe a faint breath still left in the Dow. It’s settled down exactly to its top-range trend line. Will it bounce or hammer on through in the week ahead? The question I had asked earlier was would it have the strength to keep climbing long enough to start pulling the other indices up with the hope it was stirring, and the answer to that was that it clearly did not.

The next few days should show if that last tiny ember of hope (from a Dow chart standpoint of it settling to rest yesterday on its upper trend line) holds or goes out. Regardless of charts, which are never the foundations for my predictions, but mere confirmations of what is happening, this receding economy, with Father Fed’s help, is going to continue to stomp the market down, and the market clearly has room left to fall for, at least, this one leg. After that, we’ll have to see how bad the wreckage to the economy is and whether it’s devastating enough to cause Papa Powell to stop sucking money out of the economy.

This present leg down is going to be our most damaging so far.

As Zero Hedge reported yesterday, Hawkish Fed & Horrible Data Hammer Stocks

Another day, another set of ugly US macro data as PMIs plunged to post-COVID-lockdown lows (worse than expected), all of which sent the US Macro Surprise Index back into the red (this was the biggest weekly drop since May)…

As for those PMI reports, they looked like this:

Any reading in the two Purchase Manager’s Indices below “50” is considered recessionary. As Zero Hedge reported, “US PMIs Scream Recession In December Flash Report,” and “the last time PMIs fell to this level, things got ugly fast.” In the article quoted above, they also wrote,

That was then piled on by some FedSpeak, reinforcing the hawkish message…

DALY: “INFLATION IS TOXIC”, FED “IS FAR AWAY” FROM ITS PRICE-STABILITY GOAL, MAY NEED MID-4% OR MORE JOBLESS RATE FOR LABOR-MKT BALANCE

MESTER: HAVEN’T SEEN IMPROVEMENT ON SERVICE-PRICE INFLATION

And as if that wasn’t enough, she explicitly called out ‘the markets’:

DALY: DON’T KNOW WHY MARKETS ARE SO OPTIMISTIC ON INFLATION, PREPARED TO HOLD PEAK RATE MORE THAN 11 MONTHS IF NEEDED

MESTER: NEED TO KEEP FUNDS RATE ABOVE 5% IN ’23 TO CURB PRICES, FED HAS `MORE WORK TO DO ON INFLATION,’ IT’S TOO HIGH

All unmistakable language, but the drunken bulls want to keep coming back for a fight — a fight they keep losing as they interminably smash their heads on the market’s ceiling with endless glee.

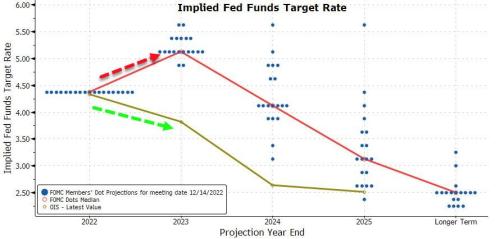

The Fed, as I pointed out before, keeps pushing its expected terminal rates higher up and further out from the Fed’s own last projections, relentlessly smacking the bulls back down each time they do because they refuse to face the reality of inflation in a way that even the Fed heads said they cannot understand, and failing bulls are still refusing to face the targets the Fed has promised:

Yet, the Fed only revises higher each time to knock them down again.

Reality is a bitch. It’s going to keep hammering the bulls no matter how dumb they are because, as I’ve said all along, the Fed WILL fight inflation until it believes it has won the war. So, down we are going again.

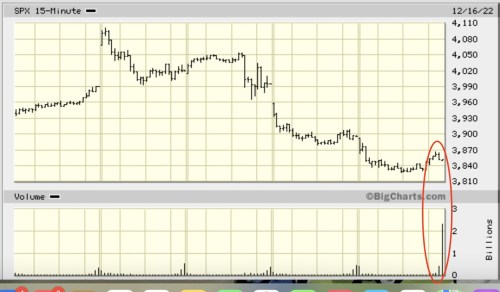

This week was especially ugly as the Fed’s persistent bull fighting achieved its goal with only a breath of hope left at the end of Friday’s trading, but that was because of extreme trading volume due to a the largest number of options expiring all year (called “quad witching”) which still barely managed a bounce:

The “witching” petered out, and the market went back down to end below its open, completing a second week of decline. Not much hope there, because there is no more of that happen until 60/40, equity/bond balanced portfolio’s get rebalanced at the end of the year, which, with bonds in turmoil, could go either way.

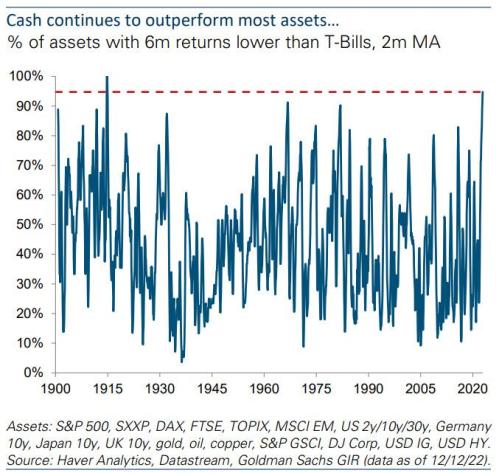

The old market drivers, the FAANG stocks are down 50% for the year, so 2022 has provided quite the bear ride while cash has been king all year, which is where I told everyone in January I was parking my money to sit out this terrible year:

Even the basic math looks bad

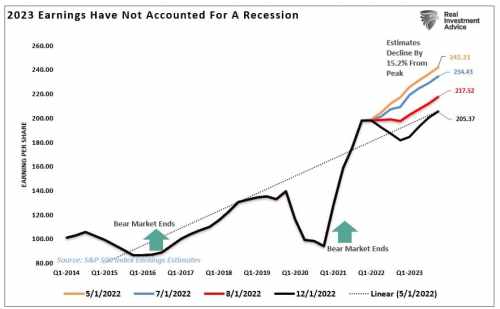

Valuations math also suggests a difficult road remains ahead. With every month that goes by, forward estimates have been moved lower:

No one is seeing any short-term upward trajectory anymore and that is while every writer but me, it seems, still believes we are not in a recession yet because “jobs are strong,” though that mantra just got solidly stomped on, but we’ll have to see if anyone listens or if they all keep following the pied piper. (See my last article based on the latest revelations of absolutely massive job lies: “Snow Job: Fed Admits Gov’t Job Estimates too High by Over 1-Million, which Means Serious Peril!” You can’t call it anything else when the Fed says it knows this but keeps reporting labor is strong and when the BLS, which makes the reports, has another survey that has shown vastly different job numbers; yet, it apparently couldn’t be troubled to figure out which data set was correct and why the discrepancy had become greater than at any time in the past. All too convenient for an election year, giving cause for them to ignore the gross error.)

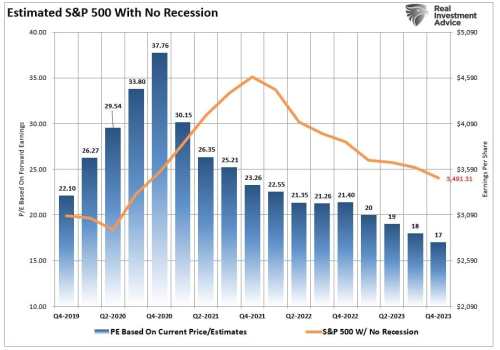

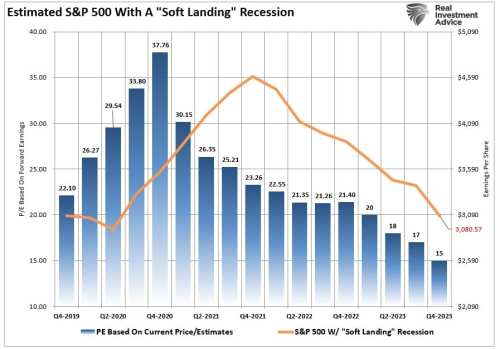

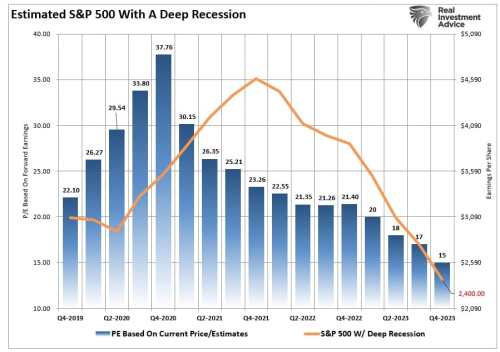

Consider the following three projections for the S&P from Lance Roberts to see where the market may go if we are not already in a recession and do not enter one, if we do enter one, but it is a soft landing, and if we go into a deep recession because (as I would put it, the Fed is tightening when we are already in recession and will KEEP tightening until it sees unemployment go up because it completely misunderstands the current broken labor market and thinks it means the economy is still resilient, though Lance may have different reasons):

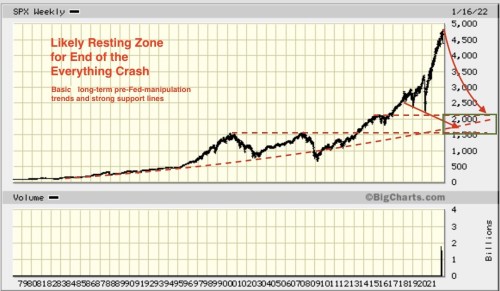

The last graph is where I have said from early this year I believe this bear market is headed. In fact that is the top of the range I gave, and that is based on my belief that the Fed (and everyone else) completely misunderstands our labor market in thinking it is strong when it is broken and thinking its strength means those negative GDP numbers for half the year were just wrong. Here is where I targeted the bears likely trajectory to a landing many months ago:

Looks like Lance Roberts thinks we may well make that box. If the Fed keeps misreading the job market in such a gross manner and so over-tightens when we are already in a recession it doesn’t see due to the prevalent blindness about the dead-and-dying labor market, I’m sure we will!

Says Roberts,

While such seems like an unduly large correction from current levels, there are previous precedents in history to suggest the possibility. Such would also align with the Federal Reserve “breaking something” in the credit markets, which impairs market functioning.…

While the “no recession” case is possible, we struggle with that view.

With the Federal Reserve committed to continued rate hikes in 2023, reducing market liquidity through Quantitative Tightening, and the consumer struggling to make ends meet, the risk of a recession seems quite elevated….

A recession seems highly probable if the Fed’s end game is higher unemployment and lower inflation through higher interest rates

Well, that is exactly what the Fed repeatedly says it is committed to, and exactly zero members of the FOMC projected lower rates anytime in 2023 at their last meeting, so why would we doubt that is where they are headed, especially since Powell just pounded those points home several times after the last FOMC meeting? They have only moved tighter at ever meeting they’ve had, the exact opposite of the market’s delusional hope for a Fed pivot.

There is no soft landing on this glide path

We’re on a crash course, Folks, because Pilot Powell is flying blind. He’s told us he’s going to raise rates further and that all FOMC members agree with that course and that the Fed will keep rates up all of next year for certain and will keep draining money out of the system via quantitative tightening until the Fed sees the “strong labor market” or inflation break.

He doesn’t realize the labor market is already badly broken or that the broken labor market is one reason GDP fell through the first half of the year. It was only spared in the third quarter by a massive fake reduction in applied inflation that we all should know could not possibly be legitimate. (In case you missed that article, the BEA cut its applied inflation rate almost in half from the rate it applied in the previous two quarters. Even Powell said the Fed saw no evidence of any meaningful inflation drop during the third quarter. So, ask yourself, does your own experience say the inflation rate dropped by nearly half over the full third quarter?)

So, with a blind pilot taking us down during an inverted yield curve, we’re going to land like this:

Powell’s Plane

Powell’s Plane

Good luck with that feeling soft!

Liked it? Take a second to support David Haggith on Patreon!