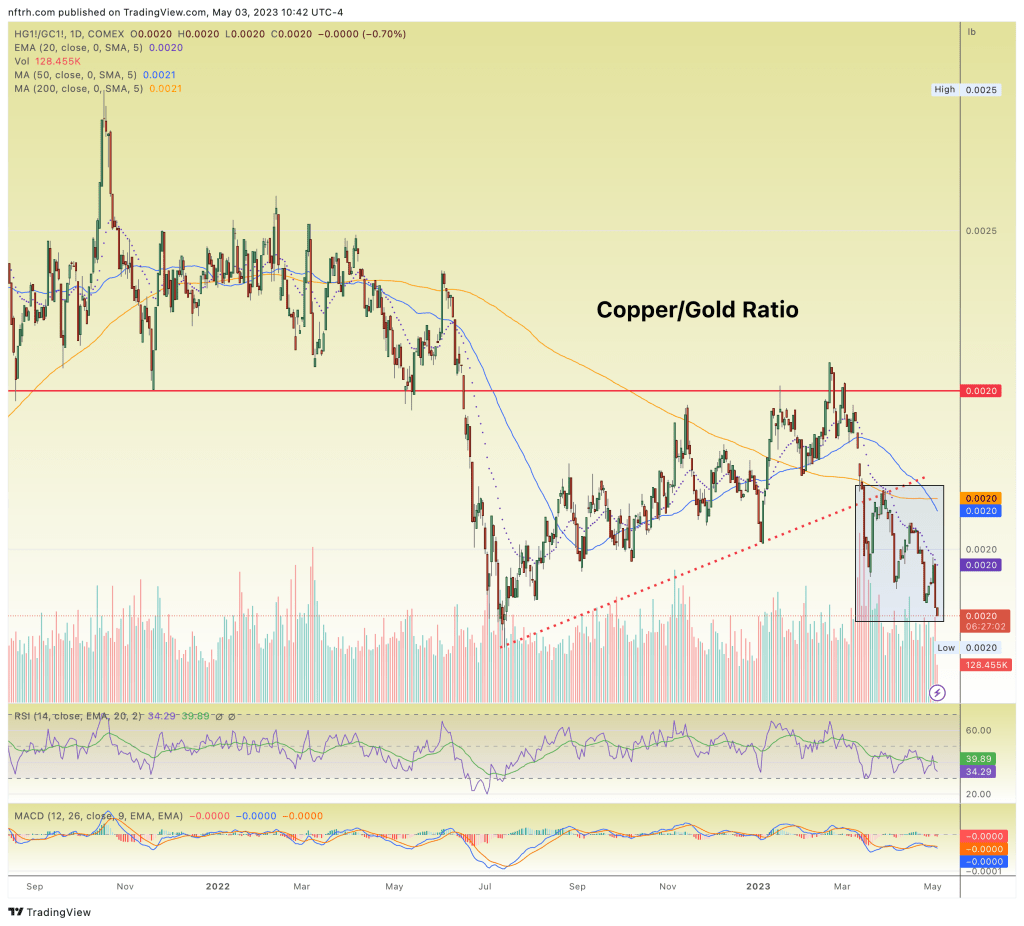

“The metals” is not a thing says the Copper/Gold ratio; and a simplified macro view is not either as this Greed/Fear ratio breaks down

To preface, I have no right to be right about the markets. All I have are indications that the herds either don’t know about or don’t care about (I know this by relative Twitter follows and, I assume, website popularity compared to promotional interests tending the herds and instigating their greed). *

So, any post like this can turn out to be wrong if, in this example, the Copper/Gold ratio somehow reverses, turns and burns, painting me as wrong headed. But it has not done that. What it has done is continue with the favored NFTRH macro theme that has been in place for most of the last year. That theme is that while the herds focus on backward looking indicators (and promotions), the forward looking ones have pointed to a continuum of inflation>disinflation>deflation scare in the interim to any new inflation cycle out on the distant horizon.

It is irksome when gold bug or commodity writers/analysts talk about gold and “the metals” as a thing. As if gold is silver (Au’s little commodity/inflation tinged bro), is copper, is tin, is steel, all subject to similar supply/demand/macro fundamentals. To be fair, I’ve noticed over the years that these “the metals” touts have died down. I guess that is what an extended commodity bear market will do. But post-2020 there have been a lot of people bullish on copper and gold concurrently, which is somewhat of a straddle between one metal with unfavorable fundamentals (e.g. gold from mid-2020 through most of last year) vs. one with positive fundamentals (e.g. copper into mid-late 2021 or so).

Today the roles are reversed, but the wrongheadedness continues in the form of those bullish on both metals. Promotional touts include China reopening for copper and the “China/India love trade” for gold, the ‘buy resources!’ auto-piloted robots and the Fed, which will stop raising interest rates and go more dovish. But the cyclical stuff, like copper, along with most commodities and stock markets, should get hammered for the very reasons that the Fed will remove its hawk costume. Gold can get dinged, but it will retain value in relation to the cyclical stuff.

Copper is an industrial metal. Gold is gold. An anchor, a lump of heavy value that gets marked up or down over decades and centuries depending on the mood of humans toward that which humans have constructed; namely, financial systems and associated economies that require economic building materials, including most “metals” and none with more star power than Doctor Copper. Most metals are supply/demand driven in correlation with economies. Gold is far from that. It is more greed/fear driven. Indeed, you could call the Copper/Gold ratio a Greed/Fear ratio.

Checking in on our Copper/Gold ratio macro indicator we find that on the implied day of the Fed’s last rate hike this indicator of economic deceleration and the deceleration of that which manufactured the economic cycle, inflation, continue to break down. “The metals”, my ass. Copper and commodity bulls want you to invest in jingles like a new “commodity super-cycle” and of course on the shorter-term the “China reopening” story. But the indicator is the indicator and it says ‘ah, no, not yet dear super-cyclers’.

Our position is something completely different in the interim while planning to buy at a later date from commodity super-cycle herds thundering over a cliff. Herds… that’s the reason they exist. The current herd got on the inflation/commodities/copper tout well after central banks created the most recent inflation cycle and they are getting out well after they should have on the dis-inflation cycle (a year ago with a second chance back in February).

The daily chart of the Copper/Gold ratio continues to break down on the implied day of the Fed’s last rate hike. Cu/Au could reverse and rally tomorrow. It also could tank further, taking the herds with it. I, and the people I write for, are currently prepared for the second thing as the predominant trend for perhaps many months forward.

* Think about it. If the herds are most often wrong (they are) are not the entities that they follow also more often wrong than right, by definition? The herds follow easy analysis because it is easy.

For “best of breed” top down analysis of all major markets, subscribe to NFTRH Premium, which includes an in-depth weekly market report, detailed market updates and NFTRH+ dynamic updates and chart/trade setup ideas. Subscribe by Credit Card or PayPal using a link on the right sidebar (if using a mobile device you may need to scroll down) or see all options and more info. Keep up to date with actionable public content at NFTRH.com by using the email form on the right sidebar. Follow via Twitter@NFTRHgt.