Gold has lost $170 since hitting a peak of $2,050 per ounce in early May.

But let's be fair to gold; it is up over 13% in the last year, 54% in the past five years, and 407% over the past 20 years.

It’s natural for investors to view the value of gold through the lens of its price in fiat money, especially the Federal Reserve note. Perhaps a more useful way is to examine how commodities are priced in gold. Oil has not risen for over 50 years when priced in gold.

GOP Rep. Matt Gaetz recently joked about the gold bar bribery allegations against Democratic Sen. Bob Menendez to make a serious point about inflation. Speaking on the House floor, Gaetz quipped,

"We are devaluing American money so rapidly that in America today, you can't even bribe Democrat senators with cash alone. You need to bring gold bars to get the job done just so the bribes hold value."

American Investors Are Missing the Gold Story

Of course, gold has risen in U.S. dollar terms over the past decade, but gold’s performance is more profound globally:

- Up 68% vs. the Chinese yuan

- Up 73% vs. the pound in the UK

- Up 80% against Canada's Loonie

- Up 100% in Japanese Yen

- Up 133% in Swedish krona,

- Up 200% in Brazilian real

China's recent gold buying frenzy has extended to 11 consecutive months.

Data from the People's Bank of China shows it bought gold again in September. Gold reserves rose by 26 tonnes, boosting reported net buying to 181 tonnes so far this year. China's "self reported" gold reserves now total 2,192 tonnes. but analysts believe the actual number is exponentially higher. The communist nation is unlikely to disclose its full gold holdings until it has secured a #1 position in the ongoing East vs. West financial war, if ever.

Gold has been proclaiming its message to the world in many languages. Investors need to listen.

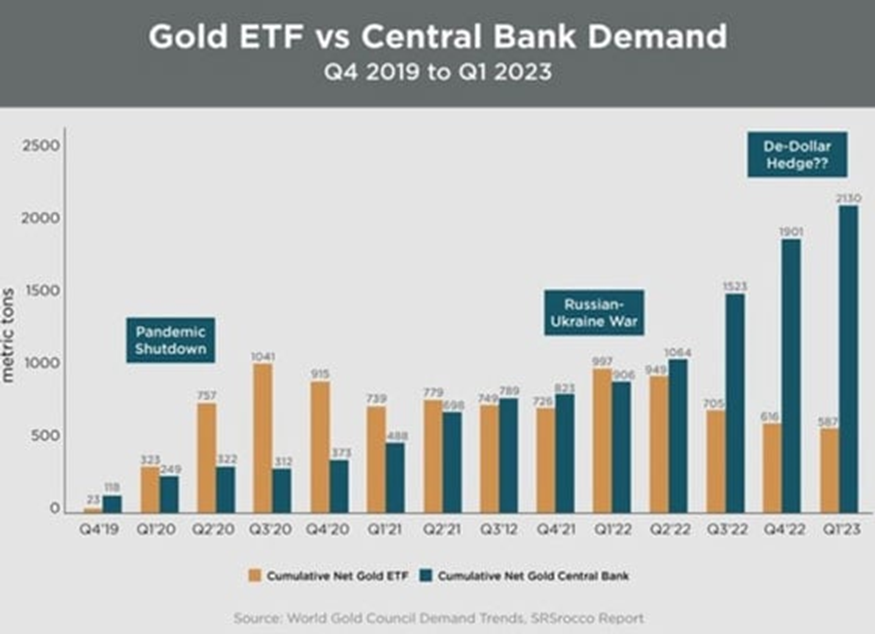

Central bankers have tuned in recently, that’s for sure. They have been buying gold in increasing amounts for years now even as investors sell their holdings in gold exchange traded funds (ETFs). Look at this chart:

A global faceoff for the control over gold pricing is starting to intensify. Asian nations have been amassing physical gold for numerous years, while the majority of Western nations continue only to add to their debt pile.

In recent weeks, we’ve seen a surge in gold prices in China, leading to a record premium over international prices, at times exceeding $100 an ounce. This contrasts significantly with the past decade's average premium of less than $7.

The East has been driving up the gold price, threatening to break the West's long-standing pricing power.

The world's largest gold/silver distribution center is located in Shenzhen Shuibei, China, and is closely connected to Hong Kong.

Much of the gold comes from Hong Kong... there are more than 7,000 stores with a daily turnover of nearly 300M RMB (nearly $40M USD).

This region contributes to 50% of China's sales.

Folks in areas like Hong Kong, China, and India observe gold and silver as culturally significant symbols of wealth.

Here is a far-fetched scenario, but it helps illustrate a point…

Suppose every one of Hong Kong's seven million population bought one ounce of gold in Hong Kong and then made a quick trip over China’s border to sell it. They could each make a risk-free $100 profit and theoretically trigger the draining of something like 200 tons of gold from Western vaults.

China’s Insatiable Appetite for Gold

China produced 372 tonnes of gold in 2022. Russia's gold production is No.2 globally, with most of it getting supplied to China traded in RMB.

These two countries have adopted a local currency swap agreement for their gold trade. Therefore, the proportion of gold purchased in U.S. dollars is low.

Last year, China imported 1,343 tonnes of gold. This year, the imports are continuing to increase significantly during the same period.

The direct reason for China's spike in gold imports is consumer demand.

It is difficult for the West to understand the Chinese cultural value of gold as a wealth preserver, but this quote from Vince Lanci sums it up well:

"Not only is China ravenously buying up all the physical gold it can get its hands on…. more importantly, it is letting the world know it is buying up all the physical gold it can get its hands on [this time]."