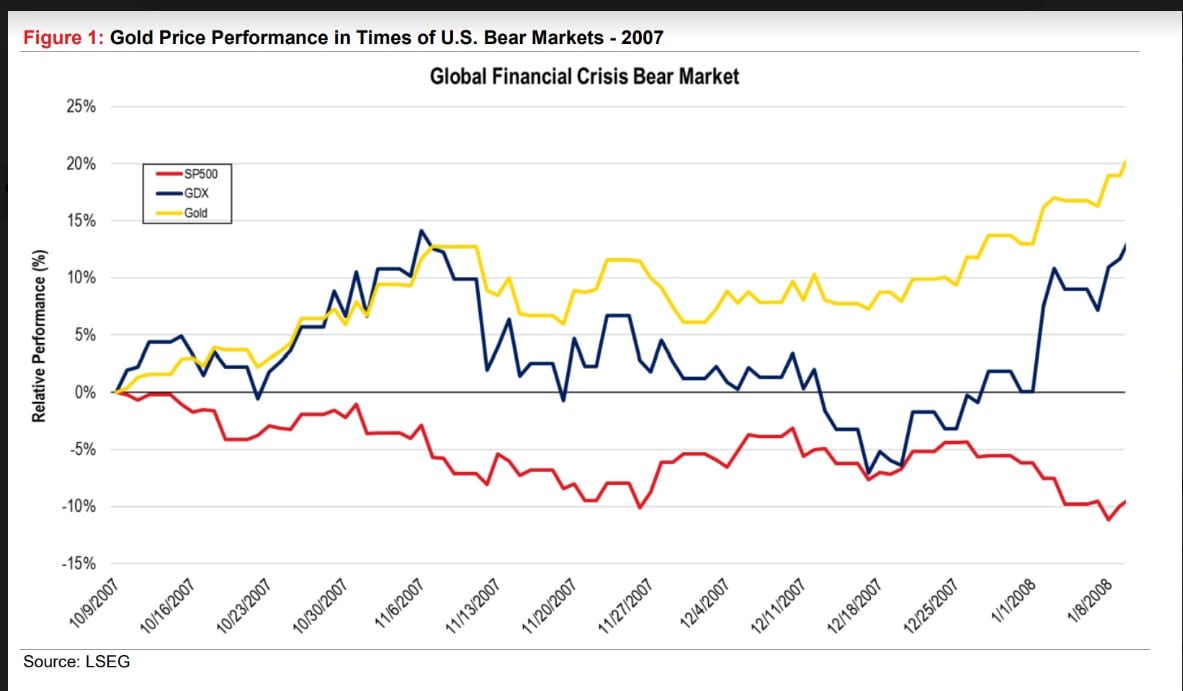

- Gold vs SPX in 2007 bear market.

During the 2007-2009 bear market, the S&P 500 lost approximately 10% of its value, while gold prices surged.

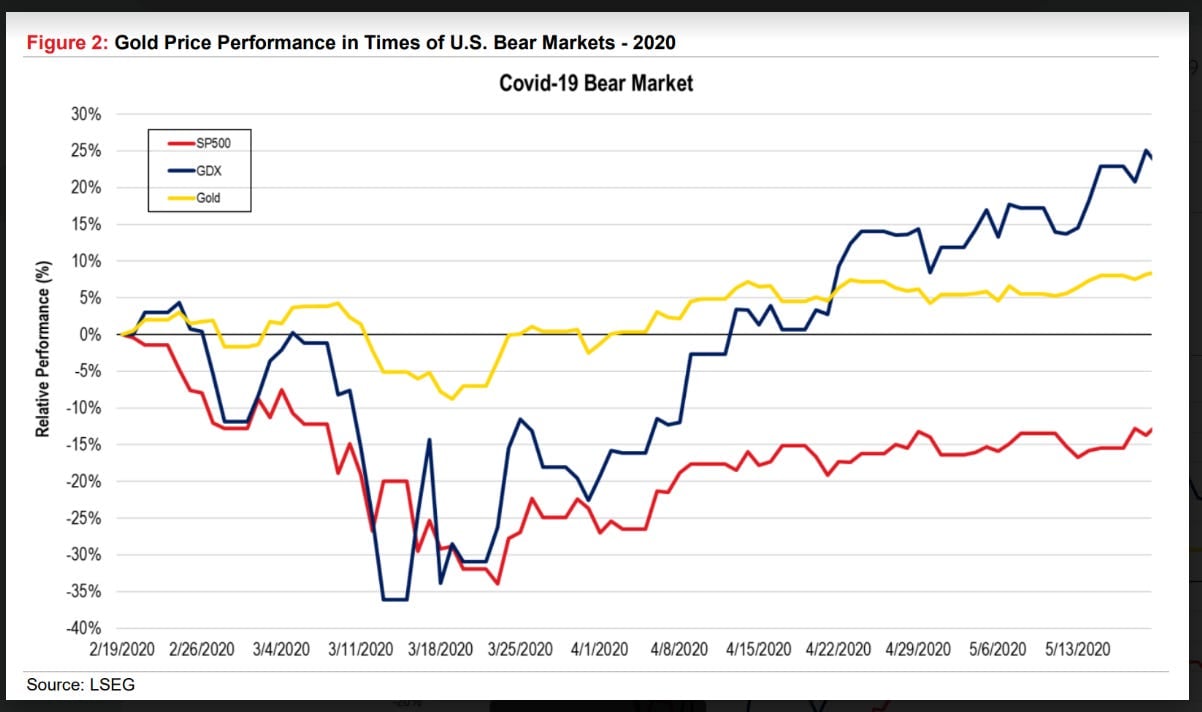

- Gold vs SPX in 2020 COVID

In 2020, during the COVID-19 pandemic, the S&P 500 initially plummeted down 35% before a slight dead cat bounce. Gold, however, reached new highs, peaking at over $2,000 per ounce as investors sought safe havens amid economic uncertainty.

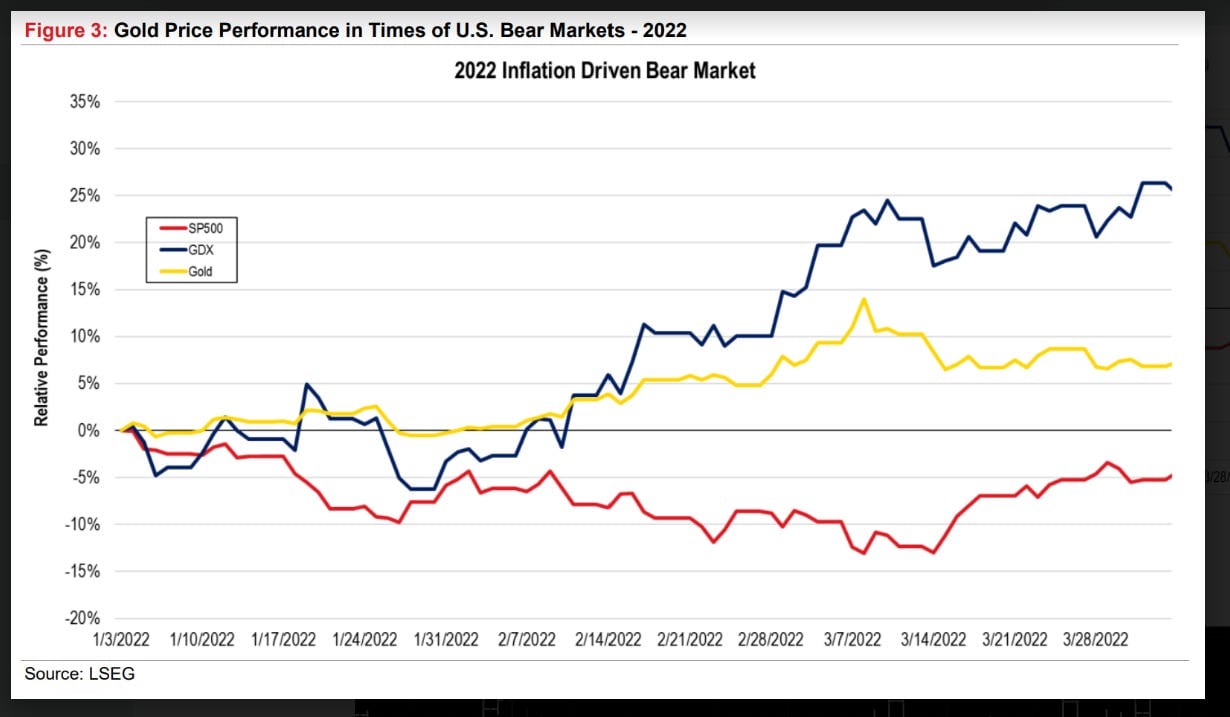

- Gold vs SPX in 2022

In 2022, the S&P 500 experienced significant volatility and declines, while gold prices remained relatively stable, with slow and steady growth as the year progressed. Gold did its job maintaining its status as a safe haven during market turbulence

Originally Published on The Silver Academy.

Originally Published on The Silver Academy.