As we near the end of 2023, perhaps before considering too much where we will go in 2024, we should first assess where we stand in 2023. Here is brief synopsis of the facts regarding the ongoing collapse of the Everything Bubble, which comprises a bond bubble, a real-estate bubble and a stock bubble. Our starting point before we get too far in predicting what will happen in 2024 is to ask, “Where are we in the collapse of the Everything Bubble right now?” What do we actually know?

The big bond bubble bust

We know that banks exist right now in a distressed state because we saw four collapse this year with each showing signs of heavy strains in its reserves because Fed QT and interest hikes have brought down the value of the old Treasury bonds that banks hold in their reserves. Fed interest rates have, since then, been raised higher still, and the number of new Treasuries being issued has, since then, been raised substantially higher by the US government. So, we actually have every reason to believe banks likely exist in a more distressed state, though they could have repositioned their assets and liabilities to some degree in the months since.

Regardless, we know they are distressed. In fact, it doesn’t appear they’ve done much in to reduce their exposure to this bond risk because their reported unrealized losses still remain high. They came down some as the bond market rallied in November, bringing yields down, but it also does not seem likely those lowered yields will hold.

We know that banks have been cushioning the tightness they are feeling in their reserves by backing out of reverse repo loans with the Fed by which they, in essence deposited (“loaned”) a couple trillion in cash to the Fed to bank it away with interest promised for the days when the Fed began tightening. This meant they took Treasury bonds off the Fed’s hands as collateral.

No one in financial media back then was talking about why the Fed would be pumping so much liquidity into bank reserves in the front door with QE while taking so much out the backdoor by offering reverse repo arrangements. OK, some were asking why, but not in the sense of proffering an answer to why, not even Zero Hedge, which was pointing out the huge rise in reverse repos all the time.

I speculated it was intended to become a clandestine source of liquidity when the strains of eventual QT began. Now we have seen that is exactly what it was all about because that is actually happening, and it is finally being mentioned in the news. What we also know is that this facility has drained down from over $2-trillion in cash banked at the Fed to less than half that much.

What we don’t know is whether that liquidity backup in the face of QT can even go all the way down to the near-zero level that is normal for reverse-repo loans because, for one thing, it is not all banked in the same proportion by all banks. Some have banked a greater portion of their reserves this way; some may have banked almost none. So, tightness will start showing up in some banks well before the facility is completely drained down. When, then, does the next bank bust?

We also don’t know how low this repo facility can go before banks and those they bank with start feeling nervous. Remember that the Fed thought it could drain its balance sheet down much further than it could back in 2019. So did all banks apparently, as they said nothing until very late in the game when things were about to go wrong. And wrong they went. So, there is a strong possibility for tightness to suddenly emerge in the repo market if banks start feeling the squeeze just by seeing that this cash cushion is thinning out.

If they start to see the real impacts on banks where reverse repos have already bottomed out because they didn’t have as many banked with the Fed, they could get edgy about loaning to each other. Banks are swinging high in the air and watching the safety net get rolled up beneath them. They may be less inclined to keep swinging from loan to loan as the net gets packed away. So, one thing we don’t know is when the first bank will run out of that cash cushion and what effect that will have on other banks as they start to see that happen. That is a black swan because most don’t seem to be paying much attention, at least publicly, and we have no idea where the panic point would be as this cushion disappears. Maybe there isn’t one. Maybe it just comfortably rolls back to zero, but I doubt it.

We know that corporate defaults in 2023 began to rise but not to a great extent so far. Based on the last reports I saw, they are coming in for this year at more than double what they were in 2022. However, we also know that only half as many corporate bonds matured and needed to be refinanced in 2023 as will mature and need to be refinanced in 2024. To the extent the number of bonds that were hitting maturity in 2023 rose over 2022, we saw an increase in defaults and in restructuring bankruptcies and liquidations.

We know we will be facing a huge wall of bonds that will be refinancing in 2024 at much higher rates than corporations have seen in a long time — at least, double the number that matured and had to be refinanced in 2023. So, we can reasonably expect, at least, double the increase in the default rate.

Market Insider reports,

A default cycle has started with bankruptcy filings rising, and default rates will continue to rise over the coming quarters, impacting in particular middle market companies.

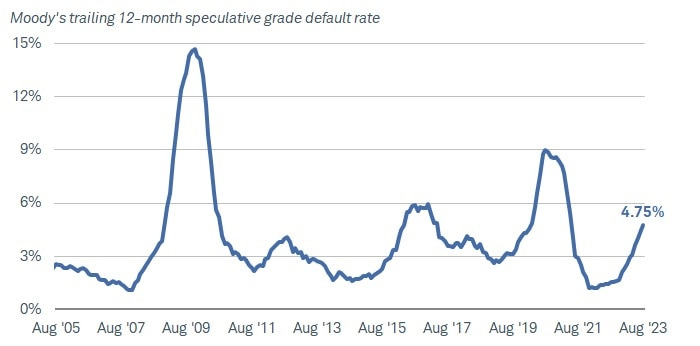

The latest data graph I have found for high-yield bond defaults looks like this:

Shwab

Shwab

But that was clear back in August! While that was for HY bonds, other kinds of loans are reportedly running a little higher for defaults. So, add to what was known in August enough more defaults to fill out this year at the same incline for this year; then, at least, double that rate of increase for 2024 as mathematically certain just based on the double the level of bonds maturing. That’ll bring us easily to, at least, the second highest level on the graph. That’s just based on what we have seen this year and what we know is coming in the amount of bonds to be rolled over under these higher interest rates and declining profits.

In July, data from Moody's showed that corporate defaults had already blown past total defaults in all of 2022 by a whopping 53%.

That, alone, would bring them to more than double by the end of the year, as there is no reason to think the default rate would have decreased.

Meanwhile, S&P Global data has shown a cumulative 516 bankruptcy filings this year through September, which is more than in all of 2021 or 2022 and hovering just below the 518 filings in the first three quarters of 2020, when the pandemic roiled the economy.

As Shwab summarizes,

Corporate defaults are now occurring at the fastest rate since the fallout from the pandemic. According to Moody's Investors Service, the trailing 12-month speculative-grade default rate rose to 4.75% at the end of August 2023…. [The last peak occurred] at 9% in August 2020. The number of corporate defaults is expected to keep rising, according to both Moody's and Standard & Poor's (S&P).

Corporate profits have been declining as interest has been rising, so that’s double trouble for those needing to refinance maturing bonds.

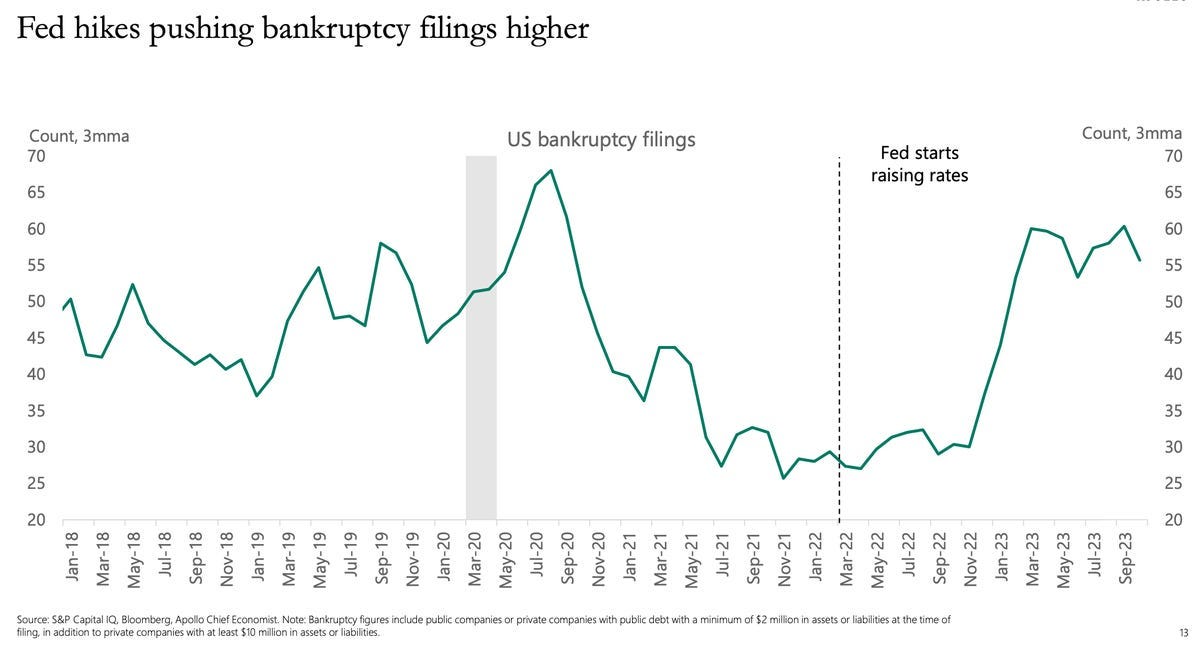

You can see here how bankruptcies also skyrocketed at the very end of 2022 and early 2023 then sustained that high level throughout the remainder of 2023:

Markets Insider

Markets Insider

We are also seeing that trouble in the credit markets, according to Market Insider, is showing that lagged effect I’ve been writing about between Fed policy decisions and economic impact:

Lagged effects of monetary policy are slowing consumer credit growth with auto and credit card delinquencies rising and bank lending conditions tightening, leading to a significant slowing of loan growth impacting consumers and firms with weak balance sheets….

Still, there is a sizeable amount of risky debt maturing in the near term, roughly 20% in the US and nearly 45% in Europe, according to Apollo.

I provided graphs that give a better sense of the scale of that wall of maturing debt in my last “Deeper Dive.”

So, that’s where one component of the Everything Bubble Bust (the bond component) is right now.

Housing bubble trouble

The housing bubble has frozen solid, but at high prices and high interest, which is really a disaster for everyone even though it means the bubble is not breaking up yet. It is bad for home builders, bad for home sellers, bad for home buyers and bad for real estate agents. Business is freezing over. At some point, the ice dam has to break, but we have no idea what that point is. Jus as with an ice dam holding back a lake on a thawing glacier, the moment of this bubble breakup will likely come as a surprise and can be cataclysmic. I have no idea at present when that will happen, but I do know it already looks as threatening as a real glacial ice dam looks to the town that lives and thrives downstream from the melting glacier.

In the meantime, you might say hometown Glacierville is being evacuated because of the risk. It’s no longer a thriving little town. Housing construction and stores like Home Depot that sell lots of housing products are being hit by the stagnant situation. Water is no longer flowing out of the glacier because of the ice dam, so the town’s river of liquidity for business and life is drying up. That is what we know about the current state of the housing bubble.

Here is a video that makes a number of interesting points about the state of this particular bubble bust:

Some highlights of things we already know from the video:

-

The FHA is already proposing a bailout program, called the Mortgage Reduction Plan, for homeowners who cannot keep up with their payments due to high interest. Yes, the bailouts are already being proposed. The program will reduce payments for up to five years, placing the discount (a credit on each payment) as an interest-free lien to be paid off at the end of the loan. (This is somewhat like the Covid forbearance and it proves once again that the lockdowns created economic damage that still has not been resolved. This program won’t resolve it completely either, as many people will eventually find their mortgages underwater and will have no way to pay off the lien upon resale.

-

The program is being proposed because currently 9% of FHA mortgages are delinquent, probably in good part as the outcome from Covid forbearance. That’s one more thing we know. So, renters through their taxes are subsidizing bailouts for home buyers. (If the economy is going to cruise in for a soft landing, why do we already have 9% delinquencies and proposed bailout programs?) This makes the FHA our present sub-prime lender, reliant on gimmicks to keep the housing economy minimally alive. It also does’t let the housing market correct through natural removal of all the dead wood because the market, itself, is too big to fail. Same rinse-and-repeat failure pattern I wrote about in my little book.

-

Housing hasn't been this unaffordable in, at least two decades, and rate buy downs on new homes by the homebuilder are on the downhill side of the curve to where many efforts to sell with buy downs as incentives are not working anymore.

-

HELOCs (home equity lines of credit) have seen their variable rates double or triple, causing an effect similar to ARMs back in 2006-2007. These were used to help finance rental homes and Air B&Bs that now no longer make sense financially. Even many of the FHA loans were used to buy rental properties, which is likely fraud.

-

Sellers are holding off, thinking the Fed will pivot and then they’ll be able to sell for the price they want when mortgage rates drop. Even IF there were a pivot and it lowered mortgages interest, there are so many sellers waiting for that pivot fantasy who will all hit the market at once that prices would crash just because of the burst in inventory. (Remember, this is a list of the KNOWN current state of the housing market. Sellers holding off and waiting for interest to fall is a known, and will hit like the ice dam breaking in bonds if interest drops enough to make a difference with buyers. However, buyers are also holding off due to prices they find highly disagreeable.)

-

People are still chasing the mania in many areas, trying to get in on the momentum (FOMO, fear of missing out, a.k.a. greed). Leverage amplifies momentum on the way up, and it amplifies crashes on the way down.

-

Many of the all-cash sales that bid up prices are also highly leveraged, but the credit used came from big bond issuances by big businesses, deployed in place of mortgages.

-

Jeff-Bezos-backed real estate company is lurking like a shark below the reef to gobble up as many failed single-family homes as it can to turn them into rentals. This is like Bill Gates snarfing up all the farms to control the food chain and solve the problem of belching, farting cows for all of us. (One more way the Fed’s housing bubble in the end actually feeds the wealth disparity the Fed claims it doesn’t want to see. Well, then, what a failure they are at their own goals.)

-

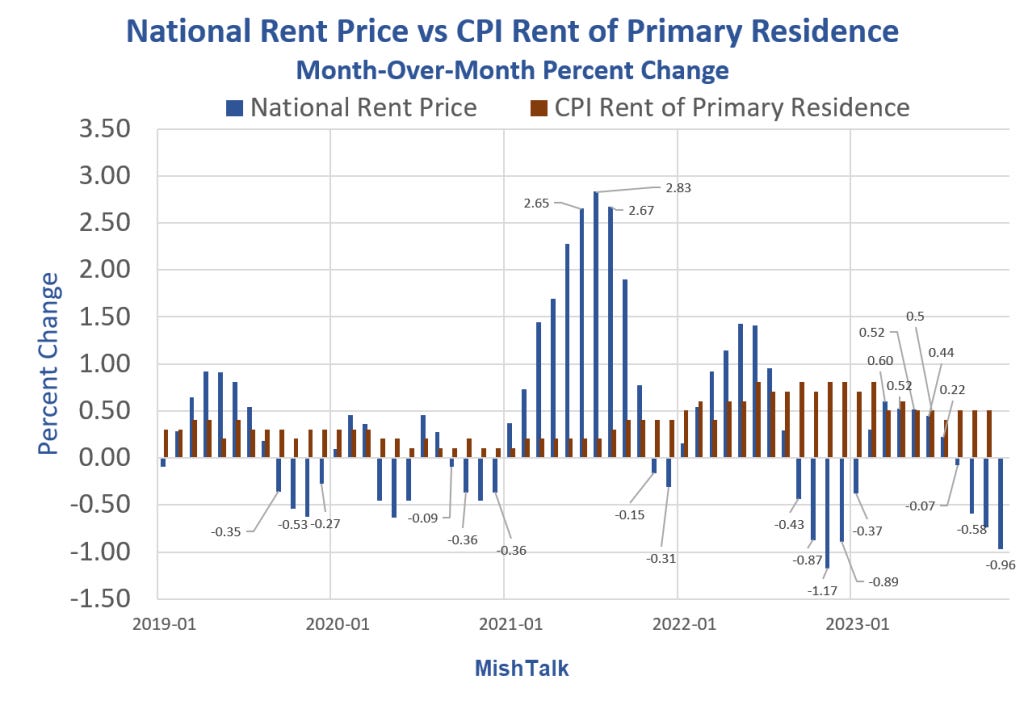

Rents are coming down. (Not really quite a known as presented in the video.) While good for renters, many landlords cannot pencil out their investment when rents fall, especially the mega landlords who raised capital with bonds. (If true, this rent reduction will likely take months more to show up in CPI, though, because of CPI’s own lag in reporting. One writer in the headlines below says he’s heard the reports on rent dropping but doubts the moves will hold.)

-

The turndown in the housing market, the video claims, is likely to happen in about six months. (Also speculation, not a known.)

MishTalk

MishTalk

This certainly isn’t a good state of affairs, even if the bubble is not yet imploding and driving home prices off a financial cliff, and these are the major failures the Fed regularly delivers with all of its interference that causes huge distortions in markets. It’s what we get when in Fed we trust. By trying to avoid the pain of normal corrections and crashes of financial situations that should never have built up in the first place, the Fed builds up bigger cataclysms to come, as is the theme of my little ebook.

I focused here on the state of the housing bubble collapse over the commercial real-estate collapse because I’ve focused in earlier “Deeper Dives” and daily editorials on the CRE collapse, so my readers already know CRE is going down hard compared to housing because its problems were made so much worse by Covid causing people to work from home more, wiping out the need for a lot of office space at a time when retail space was already collapsing due to e-commerce. While Covid crazily drove up housing prices, it drove down commercial real-estate prices.

There has been no rebound in CRE prices. So, time is simply the enemy as we wait for those loans, which tend to be more through big corporate bonds than mortgages, to mature and face refinancing when they don’t have enough paying renters to qualify for a loan or to issue a bond without a serious credit-rating downgrade to their bond due to insufficient revenue making it a very high-risk issuance — the junk of junk.

The third part of this “Deeper Dive” — available to paying subscribers only — takes stock of the truly perilous state of the stock market right now in terms of what can be known: (And I want to especially say thank you to the few people who pay more than they have to as Founding Subscribers just because they want to keep The Daily Doom going.)

(Headlines, available to everyone today, related to today’s “Deeper Dive” editorial and analysis appear in boldface below:)