I’m making Part Three of my “Epocalypse Revisited” series available to all because it introduces where the series will go in examining the world’s transition to a global, digital cashless society, countering the notion that globalism just fell off a cliff and dispelling rumors about gold-backed rubles and the mighty yuan trouncing the dollar.

The new New World Order and its currency

It’s true that the globalist paradigm has to adapt to the new “New World Order” that US President Biden has proclaimed now that the West is battling Putin with sanctions just as the Everything Bubble is blowing up all over the world. Many are saying this forebodes a decline in globalism because nations will be pressed to depend on themselves and grab for all they can to save themselves from the shortages all of this will create.

Opposite of the many, I believe present events actually accelerate the path toward a global, digital currency. Many of the people I am reading seem to be jumping all-too-rapidly to the conclusion that the old globalism they hated is ending and being replaced by some form of multi-fractured nationalism and gold-backed or “commodity-backed” (read “oil-backed”) currencies … as if all the powerful globalists, including all the central bankers, would so easily walk away from their dream. I think that is wishful thinking with no evidence to support it.

I see Biden’s new New World Order as being the same old thing, except that it is now splitting into a bipolar version. The globalists are far from giving up what they have sought to create throughout the decades of my life. Nothing that hard-fought ever ends as easily as many in the alternative press are now saying, yet I’m reading their declarations that globalism is dead everywhere. Even BlackRock’s globalist CEO, Larry Fink, says it’s over; so who am I to argue to argue with the Fink? However, when Larry Fink, the central bankers’ key operative agent in all things dark and mirky, pronounces the death of globalism, maybe that is just what the globalists want you think (wink). Fink is, after all, the one who runs some of the central banksters’ largest programs.

A huge crack has formed in the world for sure, and globalism must adapt around that fissure; but that only changes the character of the thing. The Davos crowd will not only find it easy to adapt around the new East-West divide, but the whole war-and-sanction situation makes globalism more assured than ever. In fact, I think that will become so apparent it will tempt any good conspiracist to wonder if the war and sanctions were secretly planned to take globalism beyond its recent stalling point where it seemed to have bogged down when the Trump Trade Wars followed by global Covid lockdowns hammered years of smooth cooperation.

Many in the anti-dollar or anti-Fed or even anti-US crowds see the present sanctions as being the end of US hegemony in global politics (as they’ve hoped for) and particularly the end of the US dollar as the global reserve currency. That leaves me, as usual, a man without a club or a camp to be a part of. Such is the cost of independent thinking: sometimes everyone disagrees with you, and you just have to accept that.

Regardless of what feels like my solitary status, I think the obituaries now being written all over the economic blogosphere for both US hegemony and the dollar are as premature as they were when I read people saying the same thing forty years ago. While the dollar’s days in its present form are numbered, it is not going to come about as some financial defeat in which Russia and China team up to crush the petrodollar and replace it with their own currencies or some hybrid built from those currencies. That, in my view, is not even remotely likely, though many fear it is already happening, so I’ll explain why below.

Rather, the dollar will be replaced along the evolutionary path toward digital currencies and ultimately a single global digital currency, just as I’ve been writing about for the past few years, particularly in my Patron Posts. I’ve said all along that the collapse of the Everything Bubble will provide the necessity for the transformation to a digital global currency, and I’ve been tracking how central bankers have been working toward that for years. Present events accelerate the global financial collapse, which I started describing as having begun with central-bank tapering before this war even began. The war and its attending sanctions haven’t brought on some new and different collapse than the one I was describing, but the whole package of chaos is certainly making the bursting of all bubbles more abrupt.

For several years, when talking about our slow creep toward a digital currency, I’ve said that gaining acceptance for a global digital currency will likely require a large global problem that finally presses the masses to accept a global solution. A global problem will almost seem to mandate a global solution, and we now have such a situation forming just as the US financial system started to fail with the bond market imploding as central banks neared the end of their taper — a problem that was already destined to become severe.

I think the majority of people in the world will be ready as soon as next year to start thinking about a global solution as ongoing inflation burns even more quickly through everyone’s finances, and interest rates soar, especially now that sanctions amplify that inflation by increasing shortages. For the past two years, I’ve written about how inflation was going to force us into a crash of the Everything Bubble, making it impossible for the Fed to avoid tightening into a stagflationary recession because inflation would burn even brighter if they didn’t tighten bringing its own economic destruction.

The housing bubble, as I laid out recently, has already begun to turn, as I said it would, having nothing to do with this war. The bond bubble was collapsing into its core and getting ready to supernova, as I laid out in a Patron Post before the war began. Stocks have been crumbling away ever since the bond vigilantes took over the bond market and in fear of Fed tightening, as I said they would in another Patron Post, with two indices entering bear markets. So, all of that was in play even without war, and all of it was already about to get worse as central banks actually attempt (as the Fed did in 2018 and failed miserably at) to rewind their QE, with the Fed starting in May.

And now we have the war and sanctions, crushing down on top of it all.

In fact, inflation had already become so hot prior to the sanctions that I just read even people who are pretty well off were already changing their spending habits:

As inflation bites and America’s mood darkens, higher-income consumers are cutting back, too

Americans [are] saying not only have [they] started buying less but [they] will be buying less across more categories if inflation persists. But these financial stress points are not limited to lower-income consumers. The survey finds American[s] with incomes of at least $100,000 saying they’ve cut back on spending … in numbers that are not far off the decisions being made by lower-income groups.

So, the effect of inflation has already become pervasive, and cutting back described in the survey is what puts the recession in a “stagflationary recession” like the one we experienced in the late seventies and early eighties. As shortages grow worse all over the world than they already have been due to the war and the sanctions, I believe the nations imposing the sanctions will have to band to gather to help each other because they clearly do not want their sanctions to fall apart. Those who oppose the sanctions against Russia will also band together out of necessity. The need to cooperate financially between nations, both in trade and currency, has been amplified by all these sanctions but in a way that cleaves the world into two groups that are doing their best to polarize the undecided nations into joining one group or the other.

The ties that bind

Nations already started looking at how to make their supply chains more robust internally so they are not as dangerously dependent on other nations as they discovered they were when their own Covid lockdowns busted their supply chains — a transformation that damaged globalism so significantly that the “supply-chain problem” is now constantly talked about all over mainstream news, even by people who don’t usually talk about economics. “Supply chain” has become a part of ordinary vocabulary.

However, no nation has all the resources or the climate necessary to produce everything it needs or wants; and developing less interdependence will take a few years. In the meantime, the present sanctions will likely take the supply-chain problem to extremes to where they will actually help get that global cooperation between nations in the West going again. Western nations will have to band together tighter than ever, even as they seek to become more robust in handling their own needs, in order to keep from being unduly injured by their own sanctions … if they want their sanctions to survive long enough to succeed because effective sanctions require full cooperation, and we were already in a world of shortages.

Look at the sovereign-debt defaults and the corporate defaults that I covered at fair length earlier in this series, if you are a Patron, and you will see that Western nations had already set themselves on a path to financial ruin.

If they don’t now work to help each other survive the chaos that massive global sanctions inevitably add to those problems, then the sanctions they’ve imposed will fall apart as nations become desperate to save themselves from what they’ve done. They have created a dire situation that will require extraordinary international teamwork to keep everyone in full sanctions combat readiness. At the same time, those nations mandating the sanctions are seeing some pretty dramatic results inside of Russia, which will energize them with a sense of new empowerment, making them believe all the more that globalism can work to help end things like warfare.

While the goal of the sanctions is to crush Russia, and that appears to be working to some extent, the West is swinging a sword without a handle: it cuts the hand that holds it. So, what I foresee is the opposite of the anti-globalist victory many are being quick to proclaim. I see a situation that binds the West together under the sense of a common enemy and that forces them to work together to help each other survive their own sanctions in order to hold them together long enough to accomplish their intended objective against Russia. I explained in my last Patron Post how that is shaping up politically around the world.

As usual, I’m not talking about what I think should be; I’m talking about what I believe will be and is. If the West is to succeed in its desire to punish Russia severely, under the West’s revitalized sense of unity and power, then the new New World Order of global sanctions forces Western nations and those who want to align with them to cooperate in offsetting the undesired and unintended side effects.

The globalists are not going to fade like wall flowers

I wrote about the death of the dollar in a previous Patron Post when I last revisited the Epocalypse, showing I have long believed the dollar, as we know it, will pass on. So, I’m not saying the change to the new New World Order has turned all of that on its head, but the fiat dollar has always proven stronger than its detractors, which include me. Right now, it’s stronger than it has been in a couple of years. My focus, however, has always been on what will replace the dollar, regardless of whether the dollar goes down due to collapse or just because a more desired invention replaces it, and that is what the globalists and bankers have long been working on.

Agustín Carstens, head of the Bank for International Settlements, and others I’ve written about, such as those at the International Monetary Fund, are not going away. The United States and the Federal Reserve are not going away. The European Central Bank is not going to fold up its maps to global dominance and walk away. The Davos crowd is not going to pack it in and never host another party. All of these globalist entities will be highly involved in the ultimate currency replacement that they see as essential for getting us out of this mess, and you can be certain, despite the dreams of many who dislike central banks as much as I do, that they are NOT going to a gold standard!

That is absolutely anathema to their thinking. To do that would be to deliberately strip themselves of the great power they have aggregated around themselves for many decades, and that they will never do! Unless all those entrenched people throughout the world of global finance suddenly catch some bankster version of Covid and die, the world is not about to move to a “commodity-backed” version of the gold standard that anchors the quantity of a currency to some finite resource.

It makes no difference whether that commodity is a resource like gold or oil because the abilities to free-float a currency without such limitations — to make executive decisions about how much should be in circulation and what the paths of circulation should be — are where all the power lies. Those in control of their nation’s currency will never strip themselves of such power. Nor do their governments show the least inclination to strip them of that power. I don’t know where such fantasy thinking is coming from because that has never been how the world works, but it is popping up everywhere right now.

Perhaps the thought is that the globalists have finally defeated themselves with their own sanctions, but that is wishful thinking on the part of those who want to see them fail and go away. In fact, I think the perception of how much global desire there is to kill the dollar largely comes from the hearts of people who don’t like fiat currencies projecting their own hatred for the dollar on the others around them.

Yes, there are some nations that want to detonate the dollar, but there are a lot more who are not going to want to add one more massive chaos into the already cracked-up world. There are many nations in which people prefer dollars to their own currency. Many and powerful are those who are creating the sanctions who also see the dollar as their safest refuge right now. They’re not going to want to bust that up at the same time they are busting up commerce to cripple Russia.

Putin’s War is the uniter for the West

There are some tough realities to deal with here. This article is not about who is right or wrong in terms of how we got here or whether the sanctions will be effective or not. It’s about what is. And what is, is that the West sees this as Putin’s War, and they are, in fact, intensely unified in seeing it that way. It is one of the rare things that has crossed the political divide that has become so polarized in American government and has reunified Europe.

That means the US will still certainly play a significant role in the further development of any new currency that emerges down the road from the Great Bust, which had begun to unfold before the war, because the US has a major role in Europe’s defense right now. The US and Europe will cooperate in their financial roles because all nations creating the sanctions seek to shore up as much economic and financial stability and cooperation as they can muster during this sanctions regime. The globalists, including Fed banksters, were all rolling toward new central bank digital currencies long before any of this anyway as I’ve laid many times in my Patron Posts by quoting central bankers; but a new global currency is not ready to roll out yet; so, the dollar’s role is safe for the time being.

Europe feels much more imperiled by Putin than the US does. It is their border he is running up against. Europe feels the need of strong US support in this fight to such an extent that additional European nations are finally giving serious consideration to joining NATO because of the threat they now perceive from Putin. Thus, Putin will, ironically, end up with more NATO than he has ever had surrounding him. No one has done more to make those nations want to join NATO than Putin. Many members of the governments of those nations are now practically begging to join on their own volition.

I am not engaging an argument here about whether they should want to join or whether NATO is good or terrible or whether joining is what they need to do. I am just stating the facts that they DO want to join or are, at least, more strongly considering it than ever before. If these nations do feel there is a gun to their head, pressing them to join NATO, they certainly believe Putin is the one holding it. After decades of wanting less US presence in Europe, they are now asking for more US presence, and Putin’s invasion of Ukraine brought that about. All of this increases US hegemony.

People can argue all they want about how NATO provoked Putin to take on that role; but, at the end of the day, Ukraine does not have to ask Putin for permission to do anything, any more than Canada has to ask the US if it can be part of the British Commonwealth or someday join the European Union if it should decide it wants to go all euro on the US. The US may not like that, but Canada does not need US permission, and the US does not under International law have any right to go to war with Canada if it hates a closer union between Canada and Europe. It may fight it politically, using the treaties it has, or financially in every way it can, but blowing up swaths of Canada with missiles would transform the world and irrevocably damage US relations around the world. So, at the end of the day, the US might have to simply accept losing that battle if Canada decided to join the eurozone, just as it lost the original euro battle decades ago when Europe decided to form a bloc of nations called the eurozone. The same applies to Russia with respect to Ukraine.

Moreover, NATO always rejected Ukraine’s bid to join NATO. It is not as if NATO was trying to persuade Ukraine to join, and Ukraine was reluctant. It was the other way around. Ukraine applied, and NATO said, “No.” People can argue, “But NATO intended eventually to give that permission.” Maybe. Maybe not. It hasn’t even given that permission under present circumstances, and Ukraine has now overtly given up asking … but the war continues anyway. People can argue, “The US has invaded nations just like Putin is doing,” I will agree, but I’ll add, “So has Russia … many, many times for decades.”

The emotional content of such arguments clouds people’s perspectives to think in terms of how they think things should be regarded, not how Putin’s invasion has changed the world. Putin has, for a fact, made the ruble one of the world’s most-hated currencies. Any chance it might have had of broad global adoption has been reduced to rubble.

People can also argue — and I would agree — that the US staged a coup in Ukraine, and we can agree that was a terrible thing to do, but we would still argue about whether or not Russia had already interfered in Ukrainian elections prior to all of that. None of this “how we got here” stuff makes any difference in understanding where we are and what is going to take place because of that. No one made Putin invade Crimea or Donbas. His decision to step things up that dramatically, whether provoked or not, was his decision alone, and it completely changed the world. As far as Europe is concerned, Putin has driven a knife into Europe’s flank, and is twisting it all he can, and all of Europe is writhing. So, the determination to make sanctions work is visceral.

Here’s what I’m getting at: No one with a knife in their side is going to sit in an armchair and debate what provoked their attacker so long as the knife remains in their side and is still being twisted. Europe sees Ukraine as being part of Europe. Eastern Europe, which has muscle memories that run decades deep as to what it was like to suffer under Russian-dominated Soviet rule, has particularly strong feelings about that. The majority of the US congress on both sides of the aisle also sees Ukraine as being part of Europe and feels very strongly about that. Russia does not.

As far as Europe is concerned, Russia is attacking their flank. As far as they are concerned, NATO is not in any way making them feel that way. Europe feels that way all on its own. Its long-embedded memories make it intensely sensitive about invasions by Russia in nations along the Eastern European border. Whether that was a czarist Russia, a Soviet Russia or Putin’s Russia, those memories are bone-deep and chilling to most Eastern European nations. Understanding the depth of that passion is essential to realizing the unifying determination to make this iron curtain of sanctions succeed.

Because Europe’s natural resolve to work with all NATO nations is so intense — as is their sense of solidarity with Ukraine — do not think the present conflict makes globalism weaker as some are claiming. Instead, it means Europe will do all it can to circle the wagons and strengthen cooperation between NATO nations, reaching to the US, Canada, Australia, New Zealand and all the nations that it can include. That may be a bit like herding cats, and there will certainly be disagreements in how to go about things to keep them from backfiring, but the broad international desire to work together to make these sanctions work is resolute.

Europe is going to deal with the knife and fight the one who put it there. It’s not going to care about discussions of who provoked what. However, alliances forged only because of a common enemy are also fragile as soon as the enemy is defeated, as we saw between the West and Russia when Germany was defeated as the common enemy in WWII. So, holding the Western alliance together is going to take constant work, and it may well be destined to crumble once the common enemy is no longer the binding glue, just as we saw when the Cold War formed after WWII when the alliance between the West and Russia cleaved in two. But, for now, this is the new New World Order. That is what Biden is talking about — a world cleaved in two at the heart of Ukraine but united more than ever between Europe and the rest of the West against Russia.

In that atmosphere, killing the dollar is not part of any Western nation’s plan. Adding to their financial chaos is not part of the plan. That means dividing themselves in a competition between dollar and euro at a time like this is not part of the plan. So, when I wrote in my last Patron Post (for those reading this who are Patrons) about the new-world bi-polar disorder now becoming more Eurocentric for the West, I was not using the word “Eurocentric” in the sense of focusing around the “euro.” I capitalized it because I mean it in the sense of having a “European” defense focus. Putin has electrified the West, magnetizing it to stick together.

I think the euro is likely to prove a weaker contender for the new currency that I believe will come out of a now accelerated collapse of the global Everything Bubble because it already is weaker, and Europe is in a situation where it will not want to make the US its financial enemy. That relationship of greater need on Europe’s part means anything that evolves out of the developing collapse in terms of a global currency will be something Europe and the rest of the West, whom Europe needs in this battle, will mutually agree upon if it is to happen.

With war being the energy that drives the new escalation of bi-polar globalization, the security concerns of Europe make Europe much more willing to work with the US and other NATO nations because security always comes first in almost everyone’s mind. On the other side of the pond from Europe, the US position has already been staked out by President Biden when he said “the US must lead this “New World Order” that is going to replace the old New World Order that globalist George Bush the First liked to talk up, which emerged when the former Russian imperium, known as the USSR, collapsed shortly before the start of his watch. That means US hegemony remains in play. US interests will, at least, get major regard at the table when the collapse that was coming anyway is evident to all.

This new New World Order re-aligns along an East-West axis

The new New World Order will evolve into a much more tightly integrated Western economy out of necessity as the West faces off with what it sees as an Eastern enemy. Russia will, of course, include as many remainder nations as it can rally around itself. Those engaging the battle on each side are doing their utmost to coerce as many nations to join their side as they can.

It certainly won’t be any kind of Chinese yuan-ruble hybrid that provides the new answer for the large number of highly developed economies in the West. They will all avoid that like the plague, so I don’t know why so many are even talking about it as a possibility, other than wishful thinking. The old globalism that built around the West in the first place with Europe always playing a key role in the Davos crowd, will now just cleave off the few who do not choose to play with the West. All of this actually plays into their hands just like Covid played into the hands of people who wanted to get the unwieldily masses to learn how to act as a herd and move where they’re told.

Thus, as Michael Every of Rabobank writes, present events…

won’t scramble the US dollar, contrary to popular misconception: the only way that is going to occur is if we see a true revolution in thinking in China, or everyone defaults on Eurodollar debt at once, blowing up the global system entirely. Yet a Western attempt at a martial and Marshall Plan for key EM would put pressure on those economies on the other side of a new, global ‘Berlin Wall’.

And it is a very popular misconception right now because the West is uniting more strongly to say, “It’s our way or the highway.”

I write in the alternative press exclusively, but the herd has missed the turn as Every takes note. I don’t see so much of a dollar collapse, as a dollar emergence or a better term might be transcendence into another kind of currency the West agrees on in time. The West has zero interest in adding problems for the petrodollar. They have far more than enough petroproblems without using the present as the prime time to destroy the global oil-trade currency, too. They are more likely to rally round the dollar than to ditch the dollar. It will become a digital dollar, as Biden has already put in play by decree, giving all agencies of the government less than a year to respond with how a digital currency will effect them, but I will go into that in my next Patron Post.

While there may be a currency change in play because of all this, as part of Biden’s new New World Order, it centers around a digital dollar as far as the US is concerned at this point. Europe’s existential needs and its coincident need of strong help from the US will drive those fighting the sanctions war to strive together financially. The US government and Federal Reserve will continue to support their interests.

China and Russia do not even begin to have all that it takes to crush the dollar. Any effort by China and Russia to crush the dollar out of existence with their own replacement will be fiercely battled by all nations in the West. China is limited in taking on such a fight by the fact that its economy has been built on Western trade. Alienating the the entire West does not suit the pragmatic Chinese. Western trade is what made them, for a time, a powerhouse; but their power has been decreased by their own zero-Covid policy causing great financial ruin. They are in no shape to make a financial power-play and succeed.

Their attempt at a global currency replacement, as many have speculated they intend, if they were to make that move now, is likely to be the great also-ran of history. I’m not making that as an assertion but will lay out below the reasons China and Russia simply do not have that capability for replacing the dollar with their own currencies. In fact, they have far less of that capability now than they did before this war.

The yuan doesn’t have what it takes to replace the dollar

And neither does anything else right now.

If you were to build a job description of all the traits needed or desired for a currency capable of doing the heavy lifting of being the world’s reserve currency, it would look something like this (abridged and adapted from a list of requisite traits published by Charles Hugh Smith):

- Must have sufficient quantities in circulation to cover all the financial transactions in the world necessary for daily commerce, current debt service and future credit expansion plus sufficient surplus to supply massive quantities held in national reserves all over the world. Must have experience daily managing such vast quantities for stable value. (The dollar may not be perfectly stable, but name a national competitor that has been more stable over the past fifty years.)

- Must be capable of floating freely on global financial markets, without capital controls, allowing local price discovery in each national market, as opposed to having values set by a single national government. (Unlike the yuan where the Chinese government tightly controls the free conversion of the yuan into other currencies, requiring government permission, unlike the dollar that has only imposed government sanctions on a very small number of nations and, otherwise, needs no government permission for international transactions. China is always afraid its “money” will flee the country for safer havens. While there is the potential for sanctions with US currency; history says there is the certainty of many restrictions with the yuan. China is not going to be trusted with other nation’s sovereign wealth or by major investors to give up such entrenched centrally-controlled behavior anytime soon. Marxist and formerly Marxist nations also have a storied reputation for socializing things like the West is doing with the Russian oligarchs, so they engender no more trust than the West on that front.)

- Must be backed by sufficient supply of interest-bearing government bond issuances that also float freely to be priced by a global marketplace. (Means China need not apply as it issues relatively little in government bonds, which are the primary instruments used to convey the global currency between central banks and major banks. The US massive debt actually fills the bill for this kind of player.)

- Must have nearly bottomless liquidity and be flexible so that large buyers are confident they can buy and sell in enormous daily quantities without significantly impacting the market and the overall value of their holdings.

- No candidate that has ever been hyperinflated need apply. You will be drug-tested for previous hyperinflation.

- No currency pegged on the dollar need apply, as that is just an inferior derivative dollar. (The yuan is still somewhat pegged to the dollar because it’s fixed to a currency basket dominated by the dollar.)

- Must maintain sufficient supply of gold for large-scale convertibility for special transactions between central banks and other major international players, yet must maintain more trust with banks than gold so they prefer your ease of use over using gold.

- Must be backed by national wealth in an economy of sufficient scale to produce all of the above qualities. The socio-economic position of your family will be highly considered in your evaluation by others. We don’t want any ne’er-do-wells or riff-raff where your own family troubles might adversely affect your performance on the job as we need to know you’ll be able to show up for work every morning 24/7 without exception without being beleaguered by your own financial problems. For this reason, your family’s financial position must also be openly transparent.

- Must be a member of a dependable, more or less highly regarded legal system.

As Charles Hugh Smith concludes in his own version of this list,

The requirements of a replacement for the USD are high and no other currency is close to meeting these requirements: vast scale, free float, backed by interest bearing bonds whose price is discovered by markets, extremely liquid markets for the currency and bonds, the processes that affect valuation are transparent to all holders, and the currency is issued by a transparent system reliant on markets discovering the price of the currency, bonds and risk.

I know, I know, the dollar will die–but not just yet.

Sure the dollar is not perfect in those respects. Nothing is perfect. However, the only viable contender that holds those qualities right now is the euro, but it has just proven to be every bit as prone to weaponization for sanctions as the dollar. It provides no benefits versus the dollar for nations seeking to avoid weaponization of a currency or on any other basis. It is tied to the Swift system like the dollar, and many government bonds issued in euros provide negative interest that is worse than the negative real interest of dollar-based US bonds. And those who run the world are not going to want to make the US angry right now when they need its help.

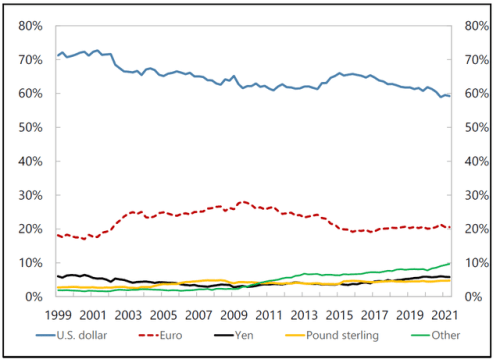

As you can see in the following graph, contenders for the dollar’s job run far behind the dollar in popularity (as a percentage of global transactions), and the distant but leading contender (the euro) will suffer the same dent to its reputation from sanctions that the dollar does because it’s carrying out the same kinds of sanctions all over the world:

All currencies, other than the euro, are barely even “also rans,” even if they were grouped together, for popularity and performance.

This does not mean the dollar is not being hurt by its weaponization with regard to the qualities in the “job description” above, but the world is far from having any other currency that is given the same regard by as many nations as the dollar. Keep doing more of this kind of sanctions stuff, and the US will keep whittling down its popularity, but it has a long way to go.

The dollar’s extensively installed base makes it hard to supplant. Moreover, the QE provided by the Federal Reserve increased that base substantially as the Fed showed it will truly do whatever it takes in quantities larger than any nation has ever seen to make sure the world has all the global/reserve currency it needs for all of its global transactions. It’s a big job to carry out while also managing the currency for the interests of your own nation, which has to be your primary goal, or you’ll be stripped of your role entirely by your nation’s government.

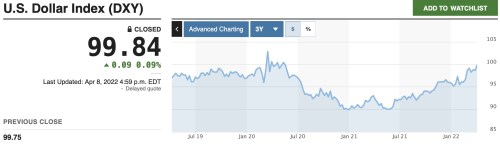

While many view QE as undermining the dollar, the value of the dollar in the dollar index (it’s value in relation to other currencies) remained relatively stable during the massive QE of the past two years and even rallied to end the race today right on par with where it was prior to the Covidcrisis and all that monetary expansion:

All readers here know I am far from being a fan of the Fed, but that is some pretty impressive performance really — to make it through that massive money printing and end today right back where we started. I dare say the yuan or the ruble could never have come close. All that QE ended far from having become the dollar bust that some anticipated. (Though serious problems will emerge as the Fed now attempts to remove that QE.) That’s why they say, “Don’t fight the Fed.” It did all the heavy lifting and came out right on par with its collective rivals. (The dollar index shows the dollar’s value relative to a basket of rival currencies, not its purchasing power where all currencies have suffered similar inflation or worse because of their own money printing.)

China was not by any stretch of the imagination the nation all other nations turned to during these times of economic damage from Covid lockdowns. It was so busy with its own lockdowns that it looked far from being a safe haven, and it is well known for practicing all kinds of capital controls with investors that keep it from having anything like the safe-haven status of US bonds/dollars in the eyes of most investors. The yuan is more likely in times of stress to be the currency investors run from.

The reserve issuer must accept that large amounts of its currency circulate the world and, therefore, that foreign investors have some weight in determining domestic long-term interest rates and the exchange rate. By all indications, Chinese financial authorities do not appear to be considering relinquishing controls as a priority on the immediate horizon.

China is too afraid of massive outflows to let investors buy and sell so freely. It has many times restrained large movements of its currency to maintain the renminbi’s value. Every time Chinese markets experience significant trouble, even the Chinese try to flee the country with their money and invest it in real estate or something elsewhere.

The ruble is not golden

Meanwhile, the ruble as a contender is a risible joke. It has experienced massive devaluations in the past and recently to where no nation is even remotely likely to see it as a safe haven for their reserves. The very idea makes one wince at the extraordinary risks involved.

Oh, but the ruble is now a gold-backed currency, many are now claiming. That is far from accurate.

There have been a number of misleading articles about Russia creating a gold-backing or gold-fix for the Ruble in the last week....

About a week ago, the Russian central bank resumed gold purchases. They set a standing order at 5,000 rubles a gram for three months, roughly $1,617 per ounce (when enacted).

That’s it….

After … sanctions were imposed, Russia’s large gold mining sector was in need of new outlets for the $20 billion-a-year industry, 90.5% of which is exported – with only 10% going to China….

Many people have falsely compared this to the US Gold Standard prior to 1914.

It’s nothing like that….

Russia has not made Rubles convertible for gold. You cannot go to the Russian central bank (or any other Russian bank) and redeem your Rubles for gold at a fixed price. You don’t know what price that would even be at because they have not pegged the Ruble to gold, or conversely established a fixed gold price in Rubles. The gold price is still fluctuating in rubles. Russian banks and Russian people are still buying and selling gold at market prices…

The Russian central bank has simply offered to buy gold at 5,000 rubles a gram for three months.

Why did it do that? Well, Russia is the second-largest gold-mining nation in the world, and its industry sells 90% of its gold, as noted, outside of Russia with only 10% of that going to China. That means its gold miners would have gone broke because they were sanctioned out of the trade. So, Russia stepped in by agreeing to buy gold at a set minimum price in rubles in order to provide a floor for the price of their gold and a guaranteed market. Now, the degree to which those companies want rubles and how many rubles that gold will have to price at down the road remains much in question, but the price floor is a lot better than living in Russia and getting nothing for your gold because you’re locked out of most of the world’s gold trade.

It’s not a bad idea, but it’s not a gold standard, a gold-backing, or anything other than a standing order to buy gold for three months.

It’s merely a security blanket for Russian miners. So, dispense with the fantasy that Russia has put the ruble on a new gold standard. Far from it. It’s nothing more than a standing order for gold to put a floor on the price of gold in rubles … in Russia. It guarantees no miner will sell for less than that because Russia will buy all they want to sell at that price. Russia is not promising to give out gold on demand in exchange for rubles at a set price, which would be a true gold standard. It’s using rubles to buy gold — the exact opposite.

Nor will this move likely to do much for the price of gold elsewhere because Russia has been largely isolated from the gold market by all these sanctions. It has become the chief buyer of its own gold to provide a market for its own industry, knowing it can, as a nation, find plenty of back-channels with other nations not adhering to the sanctions by trading secret shipments of gold for things it needs. That is all. Russia will use gold to circumvent sanctions wherever it can, so it is willing to buy all the gold it can when the price in rubles in Russia is good.

The announcement may have helped stabilize the ruble, but the ruble is Russia’s problem. No one else cares about the ruble. The ruble had largely stabilized before this announcement, in small part due to Russia’s demand that “unfriendly nations” pay for natural gas in rubles but, even more, due to the stringent capital controls placed by Russia’s central bank, particularly banning all manner of foreign exchanges and large bank withdrawals even within Russia, all of which run diametrically opposite of what is needed for a currency to become the global reserve/trade currency. It all means the ruble is far less likely to become a global trade currency than it ever was.

We may, regardless, see a small section of the remaining Russia-friendly world carve itself off to try using another currency, such as the yuan or ruble, but I doubt that experiment will will perform well on the job for the reasons listed in the job description above. In fact, it’ll likely be fun to watch the experiment so long as you are only watching from the sidelines, unless you are an arbitrage genius.

The reports of the dollar’s death are greatly exaggerated

I think a few writers are a bit enthusiastic due to their love of gold, love of crypto or hatred toward the US or the Fed to see the dollar get destroyed, but it ain’t done yet. And, neither is globalism. The needs of globalism and of a modernized will give rise to a digital replacement of the dollar, albeit under Western rule (like it or hate it), not under Chinese or Russian rule. The latter two are not even remotely close to being desired enough or able enough to fill that role. King Dollar is not immortal, but neither is he at risk of being deposed by any of the current contenders for the throne.

Others are basing the ruble’s supposed new reign on a claim that the ruble is replacing the petrodollar because Russia is requiring countries that are on its new “unfriendly” list to buy their oil in rubles. However, that only applies to Russian oil, which those nations are attempting to ween themselves off of anyway. Arab countries, for example, are still pricing their oil in dollars to the US or anyone else willing to trade in dollars. The same is true for natural gas.

For the last couple weeks, there has been a lot of discussion of Russia’s demand that ‘unfriendly’ countries pay for natural gas in Russian Rubles. A lot of people are declaring it to be a major blow to the US Dollar reserve system or even the start of Brenton Woods III. Striping away the hyperbole, the demand really doesn’t change much….

Anticipating the sorts of sanctions that it currently faces, Russia liquidated its US Treasury holdings and remaining US Dollar reserves in 2018. In other words, Russia had already stopped holding US dollars prior to the Ukraine invasion….

A transaction to buy Russian gas post 2018 might have looked like this: A Western company sends US Dollars to a Russian company with an account at a German bank in exchange for gas. The Russian company then sells/lends those US Dollars for Rubles, Euros, Yen, etc… in the FX markets.

At the end of the day, the Western company gets Russian gas, the US Dollars wind up back in Western markets

The dollar, in other words, remained an essential part of the trade.

Fast forward to today and here is what changes based on Russia’s Ruble demand. Instead of the US dollars being converted to Rubles (or Euro, Yen, etc…) after the gas transaction, they will be converted before the transaction. Instead of the transaction happening in Germany, Japan, South Korea, etc… it will happen in Russia.

Here is how it might work: The Western company exchanges its US Dollars for Rubles at a bank in Russia and then uses them to buy Russian gas. The Russian gas company gets Rubles and the Russian bank gets US Dollars. The Russian bank will presumably then try to sell/lend the US Dollars in the FX market.

The dollar still remains, in most cases, a part of the trade, though presumably other countries could use their own currency; but many hold dollars they want to put to use, and this trade only affects fossil fuels coming out of Russia, which many are trying to wean themselves off of anyway. For as long as Russia continues to occupy parts of Ukraine, Russian oil will likely see a diminishing market over time as the sanctioning nations find their way to other energy alternatives.

At the end of the day, the Western company gets Russian gas, the US Dollars wind up back in Western markets, and Russia gets whatever currency they wanted (assuming it can access FX markets).

All that essentially changes is the order of the exchange process. It does help Russia skirt the sanctions, but it does not threaten the dollar throughout the rest of the world’s markets as no other nation is requiring rubles for oil. In fact, if Russia does not get allowed into foreign-exchange markets, it will just pile up a lot of US bonds or dollar-based assets that it cannot exchange for anything, forcing it to hold those instruments off the market, thus maintaining more room for the US to make new issuances of its debt.

The author concludes,

The various petrodollar theories have done great damage to the understanding of how reserve currencies actually work and why the US has one. In 2022, India doesn’t use US Dollars to import TVs from China because Henry Kissinger struck a deal with the Saudis to sell oil in 1974. The US Dollar is the predominant reserve currency because of numerous factors that we have discussed in more detail elsewhere…. Suffice it to say that one gets a reserve currency by having the currency that other countries want to hold in reserve.

Those factors that make a desirable global reserve currency are the ones I presented above. Being the petrodollar is just one leg the US dollar rests on, but the dollar is a bit of a centipede and right now a bit venomous like a centipede. No one wants its bite, so some will run away; but only the worst actors have anything to fear. These sanctions are one more wound to the dollar, but large centipedes don’t die easily. You can cut them in half, and the half with the head continues to live and bite. Nations with “most-hated” status may fear US sanctions, but they fear euro sanctions just as much, and all other currencies have a long way to go to get to where they are able to handle the role of global trade currency or to where they will be trusted to handle the role.

I’ll lay out where I believe all of this is going to go in terms of the evolution of global currency in my next Patron Post, “Epocalypse Revisited Part Four: The Cashless Society and the New Digital Dollar Divide” in a few days, which is my thank you to those who try to support all of my writing on economics at a level of $5 a month or more. They are doing much more than buying a subscription. They are supporting all the writing I try to do on economics so I can stay focused on this topic in every place where I publish.

Liked it? Take a second to support David Haggith on Patreon!