Gold has been hammered lower in recent weeks by what looks like heavy gold-futures selling. Normally these hyper-leveraged speculators’ positioning data crucial for gaming gold trends is reported weekly. But unprecedentedly as far as I know, that has gone dark since late January! The gold-futures trading bullying around gold prices is now stealthed, which is troubling and likely contributed to gold’s sharp selloff.

Just a couple weeks ago, gold was thriving in a strengthening young upleg. It had powered 20.2% higher in 4.2 months, hitting an impressive $1,951 as February dawned! Gold’s January surge had left it short-term overbought, so a healthy mid-upleg pullback was in order to bleed off some of the mounting greed. That soon erupted, but proved way more violent than usual. Gold plunged 4.4% in just two trading days!

After weathering the last Fed rate hike just fine, early on February 2nd gold fell sharply. The European Central Bank’s latest monetary-policy decision was more dovish than expected, hitting the euro which boosted the US dollar igniting a 2.0% gold down day. As the majority of those big losses cascaded in about a half-hour after the ECB signaled a coming rate-hike pause, that looked like big gold-futures selling.

Because of the extreme leverage inherent in gold futures, their traders punch way above their weights in moving gold. Midweek specs were only required to keep $7,400 cash margins in their accounts for every 100-ounce contract traded, which controlled $183,870 worth of gold. That enables maximum leverage of 24.8x! A week earlier with margins lower and gold higher, 27.2x was the limit. This ought to be criminal.

In the stock markets, leverage has been legally capped at 2.0x since 1974 for good reason. The risks to both traders and efficient markets are serious running extreme leverage. At 25x, a mere 4% gold move against traders’ positions will wipe out 100% of their capital risked! And at 25x, every dollar traded in gold futures has 25x the gold-price impact of a dollar invested outright! This really distorts global gold markets.

Because gold-futures speculators run crazy leverage, their trading time horizons are crazy-myopic. They can only care about what gold is likely to do in coming minutes or hours. They frantically trade on market developments that affect the US dollar’s fortunes, which are their primary trading cue. Sharp gold drops on anything that gooses the dollar nearly always result from big gold-futures selling, usually on the short side.

Gold started rallying back overnight into the 3rd, but suffered another precipitous plunge in the wake of that Job Friday’s latest US monthly jobs report. The US government claimed 517k jobs were created in January, shattering the +187k expected with a statistically-impossible eight-standard-deviation beat! That left traders convinced the Fed would have to hike rates faster and farther, so the US Dollar Index soared.

Gold plunged another 2.4% to $1,866 that day, with the lion’s share of those losses snowballing within a half-hour after that jobs data. Ironically that upside surprise was literally made up. The Bureau of Labor Statistics’ own raw data in that very report actually showed a staggering 2,505k US jobs lost in January! An epic 3m+ jobs seasonal adjustment was fabricated to conjure up that massive politically-expedient beat.

As I explained in an essay last week on sharp gold pullbacks being healthy, 4%+ two-day plunges aren’t that unusual. They actually tend to happen a couple times a year or so, driven by hyper-leveraged gold-futures selling. With their lack of leverage and far-longer time horizons, investors don’t care about short-term dollar volatility. During that latest gold plunge, identifiable investment demand actually rose slightly!

The best high-resolution daily proxy for global investment demand is the combined gold-bullion holdings of the mighty American GLD and IAU gold ETFs. They dominate that space, acting as conduits for the vast pools of US stock-market capital to slosh into and out of gold. During those two days where gold fell 4.4%, GLD+IAU holdings actually enjoyed a small 0.2% build! Investors weren’t responsible for gold’s plunge.

While annoying since it really distorts gold prices, normally speculators’ collective gold-futures trading is soon disclosed. Every Friday afternoon, the US Commodity Futures Trading Commission publishes Commitments of Traders reports current to preceding Tuesday closes. They reveal what specs as a herd are doing in gold futures. Gold price action is highly correlated to their super-leveraged buying and selling.

As a professional gold-stock speculator and financial-newsletter guy for decades now, there’s no data that I anticipate more than those weekly CoTs. I devour specs’ latest positioning within minutes after its late-Friday releases. But for the critical CoT week leading up to early February’s violent gold plunge, that data wasn’t published. That was really odd, since the CFTC has released CoTs like clockwork since June 1962!

I soon learned the CFTC had issued a notice the day before. A major futures-clearing and data firm called ION Markets was hit by a ransomware cyberattack. This Irish company is apparently essential to the plumbing underlying global futures trading. With a sizable chunk of ION’s servers inaccessible due to that event, many automated futures-reporting functions were forced to go manual. So the CoT data went dark.

The CFTC warned “The ongoing issue is impacting some clearing members’ ability to provide the CFTC with timely and accurate data. As this incident unfolded, it became clear that the submission of data that is required by registrants will be delayed until the trading issues are resolved. As a result, the weekly Commitments of Traders report that is produced by CFTC staff will be delayed until all trades can be reported.”

That seemed reasonable, but no timeline was given for when “A report will be published upon receipt and validation of data from those firms.” Since this CoT data is so critical for so many major global markets, I figured it would be a day late. But over a week later, neither that data nor the following CoT week’s that encompassed gold’s 4.4% plunge were reported! We need to see how much gold-futures selling drove that.

Last Friday the 10th, the CFTC issued another press release saying the same thing. That was fully ten days after that January 31st attack on ION! You’d think firms as important as it and its customers would pull out all the stops, getting all hands on deck to manually gather all that futures data if necessary. It was amazing US futures regulators were tolerating companies still not reporting that critical positioning data.

“Although the impact of the cyber-related incident at ION has been mitigated, firms that are responsible for reporting are continuing to experience some issues with respect to the submission of timely and accurate data to the CFTC. As a result, the weekly Commitments of Traders report, that is produced by CFTC staff, will continue to be delayed until all trades can be reported.” Again no ETA on those CoTs was given.

This mess wasn’t just a gold-futures thing, it affected many futures markets. According to the Financial Times, the day after that ION cyberattack the US Treasury held meetings to assess whether that posed a systemic risk to broader financial markets! And speculators’ collective gold-futures trading going stealthed likely exacerbated gold’s selloff. It cloaked how much gold-futures selling they had done to hammer gold.

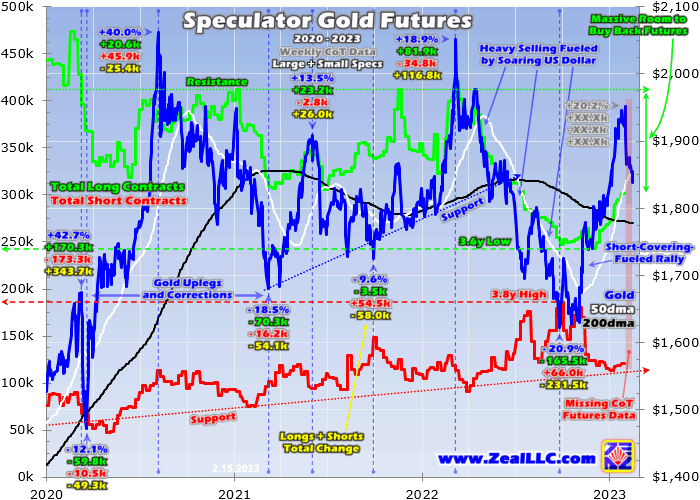

This chart looks at gold prices superimposed over that weekly CoT data during the last several years or so. Total spec longs and shorts are rendered in greed and red respectively. Gold uplegs and corrections are highly correlated with spec gold-futures buying and selling. Material gold selloffs give up their ghosts as soon as these hyper-leveraged traders have exhausted their very-finite gold-futures selling firepower.

Unbelievably the last-available spec gold-futures-positioning data is only current to Tuesday January 24th! ION’s servers were taken offline due to its own negligence in hardening them the following Tuesday the 31st. So there was no data to fill that next CoT. Thus neither those speculators nor other traders know how specs were positioned leading into gold’s February 1st interim high of $1,951 before that selling hit.

Just over a week earlier, specs collectively had 301.2k long contracts and 120.6k short ones outstanding. Those numbers are meaningless unless you are deeply immersed in ongoing CoT analysis. So to help our newsletter subscribers quickly digest CoT trends, I recast specs’ total gold-futures longs and shorts as percentages up into their past-year trading ranges. Those constructs are super-useful for trading gold stocks.

When total spec longs near 0% up into their past-year range and total spec shorts near 100% up into their own, spec selling is likely exhausted. That means a gold trend reversal is highly probable, a bounce to a big new rally. Once speculators have done all the long dumping and all the short selling they are likely to do, all they can do is buy. And that leveraged buying quickly catapults gold sharply higher, like in recent months.

On January 24th when gold closed at $1,937, total spec longs were 33% up into their past-year range and total spec shorts were 32% up into their own. That implied speculators still had room left to do about one-third of their short-covering buying and two-thirds of their long buying. Those are respectively the first- and second-stage drivers of big gold uplegs, fueling enough momentum to ignite stage-three investment buying.

Interestingly during the following CoT week into the 31st, gold actually slumped 0.5% to $1,928. It didn’t surge to that $1,951 high until after the next day’s Fed decision. So specs likely sold some contracts in that week, which would’ve left their positioning more bullish for gold with less selling firepower left. Those GLD+IAU holdings only slipped 0.1% lower during that CoT week, so identifiable investment selling was trivial.

During the subsequent CoT week into the 7th, gold first surged 1.2% to that upleg high before plunging 4.4% over the next couple trading days on that dovish ECB and epic US-jobs seasonal adjustment. Gold exited that CoT week with a serious 3.0% loss, implying big gold-futures selling. Investors didn’t freak out, as GLD+IAU holdings edged up 0.1% during that gold-slamming week. Those leveraged specs were to blame.

After decades of watching gold action all day everyday and analyzing all following CoT reports, again that sharp selling on those couple days looked like shorting. Triggered by those market events, gold’s drops were sharper and more violent than those usually associated with long selling. There’s no doubt that speculators had to expend a significant fraction of their remaining selling firepower to so hammer gold.

The crucial question is how much? Where are specs positioned in gold futures now relative to their past-year trading ranges? The answers to these questions are essential to gaming when this gold pullback, or possibly a larger correction, will end. But as long as the CFTC is coddling ION and its customers and not demanding legally-required CoT data, no one knows. That includes the gold-futures speculators themselves!

With that extreme leverage they run, they live and die by the sword. They can’t afford to be wrong for long or risk getting wiped out. These guys watch the weekly CoT reports like hawks, well aware of what they mean for gold price trends and reversals. I suspect they’ve dumped more longs and added more shorts since February 1st than they would’ve had they known how their peers were collectively positioned.

The more gold-futures contracts they sell, the less they have left to sell going forward! That ups odds for a sharp gold reversal as buying resumes. This chart shows the growing black hole in that key CoT data since it was last reported current to January 24th. The green spec-longs line likely fell in recent weeks as gold plunged, while the red spec-shorts line likely surged sharply higher. I’m dying to see the size of those moves.

Unfortunately we have no idea when the CFTC will resume publishing the CoTs, including that back data. Later on Friday the 17th after this essay was published, another CoT report current to Tuesday the 14th is due to be reported. If not, that will mark a scandalous three CoT weeks in a row with no positioning data! Its festering absence will cause gold prices to become even more distorted, impairing market functioning.

Since speculators’ hyper-leveraged gold-futures trading is usually the dominant driver of gold price action, I analyze every CoT in our weekly and monthly subscription newsletters. I’m waiting with bated breath to see the CFTC resume publishing that essential data. As soon as it comes out, I’ll share its likely big gold implications with our subscribers who pay the bills. It might even spook specs into resuming their buying!

Again the more gold-futures selling they have done in recent weeks, the less they have left to do. Their finite capital firepower available for selling is exhausting! Unstealthing their collective trading may prove a shock, as these guys realize their likely selling has run its course so they rush to buy. That could catapult both gold and its miners’ stocks sharply higher, ending this anomalous selloff exacerbated by stealthed data.

Like usual the biggest beneficiaries of a sharp gold reversal higher will be the gold stocks. They were hit far harder than they should’ve been in recent weeks as gold’s anomalous plunge gutted bullish sector sentiment. Thus they are poised to roar back up in a V-bounce mean reversion as gold’s selloff ends. So this outsized gold plunge is a great mid-upleg opportunity to buy into gold stocks at relatively-low prices!

If you regularly enjoy my essays, please support our hard work! For decades we’ve published popular weekly and monthly newsletters focused on contrarian speculation and investment. These essays wouldn’t exist without that revenue. Our newsletters draw on my vast experience, knowledge, wisdom, and ongoing research to explain what’s going on in the markets, why, and how to trade them with specific stocks.

That holistic integrated contrarian approach has proven very successful, yielding massive realized gains during gold uplegs like this underway next major one. We extensively research gold and silver miners to find cheap fundamentally-superior mid-tiers and juniors with outsized upside potential as gold powers higher. Our trading books are full of them already starting to soar. Subscribe today and get smarter and richer!

The bottom line is speculators’ gold-futures trading that dominates gold price action has been stealthed in recent weeks. A major futures clearing firm suffered a ransomware cyberattack, taking down automated data systems. Though resolved, US regulators responsible for ensuring compliance have dawdled in demanding legally-required CoT data essential for markets. That missing is increasingly distorting gold prices.

Unaware of how much gold-futures selling they’ve done, specs don’t know how much selling firepower is left. So they’ve been flying blind, piling on to gold’s downside momentum with extreme leverage which is super-risky. When the CoTs come back online and this becomes apparent, it may spark a buying panic for these guys to normalize their gold-futures bets. That would catapult gold and gold stocks sharply higher.

Adam Hamilton, CPA

February 17, 2023

Copyright 2000 - 2023 Zeal LLC (www.ZealLLC.com)