The biggest gold-stock gains during major gold uplegs accrue in the mid-tiers and juniors. These smaller gold miners in the sweet spot for upside potential are just finishing reporting their latest quarterly results. How they are faring fundamentally affects their coming trajectory as gold powers higher. The mid-tiers’ overall Q4’22 results are challenging to analyze, due to big composition changes in their leading benchmark.

That remains the GDXJ VanEck Junior Gold Miners ETF. With $3.6b in net assets as of mid-week, GDXJ is the second-largest gold-stock ETF after its big-brother GDX. That is dominated by far-larger major gold miners, although there is much overlap between these two ETFs’ holdings. GDXJ remains misleadingly named, as it is overwhelmingly a mid-tier gold-stock ETF. True juniors are just a small fraction of its weighting.

Gold-stock tiers are defined by miners’ annual production rates in ounces of gold. Small juniors have little sub-300k outputs, medium mid-tiers run 300k to 1,000k, large majors yield over 1,000k, and huge super-majors operate at vast scales exceeding 2,000k. Translated into quarterly terms, those thresholds shake out under 75k, 75k to 250k, 250k+, and 500k+. All majors and super-majors should stay exclusively in GDX.

That would leave the juniors and mid-tiers for GDXJ, making both ETFs much more differentiated and useful for investors. These smaller gold miners offer a unique mix of sizable diversified production, great output-growth potential, and smaller market capitalizations ideal for outsized gains. Mid-tiers in particular are really the sweet spot. They are much less risky than juniors, and amplify gold uplegs much more than majors.

This outperformance was gathering steam into late January, when GDXJ had blasted 57.4% higher in 4.0 months on a parallel young gold upleg surging 20.2%! But waxing short-term overbought, gold was then crushed by several unusual events I analyzed in depth in recent essays. They included a dovish surprise from the European Central Bank, a US-jobs record seasonal adjustment, and gold-futures reports going dark.

So this dominant mid-tier benchmark was bludgeoned 21.2% lower into early March. That gutted bullish sentiment, leaving gold stocks really out of favor. But they’ve just resumed surging on the extraordinary market events of this past week. With the Fed’s most-extreme tightening cycle ever now spawning full-blown crises of confidence in larger banks, traders are remembering gold’s legendary safe-haven status.

Fed-rate-hike-induced bank runs aside, gold is destined to power way higher with inflation still raging out of control. The Fed’s extreme money printing has fueled the worst inflation super-spike since the 1970s. In monthly-average-price terms from trough to peak CPI inflation months then, gold nearly tripled during that decade’s first inflation super-spike before more than quadrupling in its second! Gold stocks shot stratospheric.

With gold still far from reflecting the Fed’s still-doubled US money supply since March 2020’s pandemic-lockdown stock panic, speculators and investors should be aggressively upping their gold-stock portfolio allocations. With mid-tiers and juniors still trading at deeply-undervalued levels, traders should be paying attention to their fundamentals and looking to buy low. So the smaller gold miners’ latest results are important.

Unfortunately fourth-quarter reporting is delayed while the big complex audited annual reports required by securities regulators are prepared. American companies have 60 days after fiscal-year-ends to file their annual 10-K reports with the Securities and Exchange Commission. But in Canada which is the epicenter of global gold-stock trading, companies aren’t required to report full-year results until 90 days after Q4s end!

So while most of the larger GDXJ gold miners’ Q4’22 operational and financial results are out, there are still a handful of stragglers. For 27 quarters in a row now, I’ve painstakingly analyzed the latest reports from GDXJ’s 25-largest component stocks. They now account for 63.5% of this ETF’s total weighting, the lion’s share of its sprawling 98 different stocks. Hard fundamental data cuts through obscuring sentiment fogs.

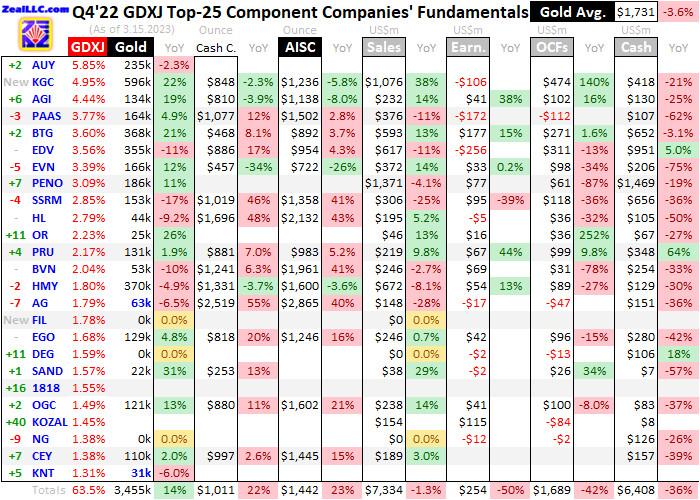

This table summarizes the operational and financial highlights from the GDXJ top 25 in Q4’22. These gold miners’ stock symbols aren’t all US listings, and are preceded by their rankings changes within GDXJ over this past year. The shuffling in their ETF weightings reflects shifting market caps, which reveal both outperformers and underperformers since Q4’21. Those symbols are followed by their current GDXJ weightings.

Next comes these gold miners’ Q4’22 production in ounces, along with their year-over-year changes from the comparable Q4’21. Output is the lifeblood of this industry, with investors generally prizing production growth above everything else. After are the costs of wresting that gold from the bowels of the earth in per-ounce terms, both cash costs and all-in sustaining costs. The latter help illuminate miners’ profitability.

That’s followed by a bunch of hard accounting data reported to securities regulators, quarterly revenues, earnings, operating cash flows, and resulting cash treasuries. Blank data fields mean companies hadn’t disclosed that particular data as of the middle of this week. The annual changes aren’t included if they would be misleading, like comparing negative numbers or data shifting from positive to negative or vice-versa.

The elite mid-tier and junior gold miners filling GDXJ’s upper ranks reported a mixed Q4’22. While their collective production surged, so did their mining costs which really cut into profitability. Raging inflation forcing up variable costs was the latter’s main driver. But big composition changes among the GDXJ top 25 components really distorted aggregate results, leaving year-over-year comparisons challenging to analyze.

As a professional gold-stock speculator and financial-newsletter guy for over two decades now, I’m a big GDXJ fan. But despite being the best gold-stock ETF out there, it still has serious shortcomings. I can live with this being a mid-tier ETF despite its name. There are only two true gold juniors among the GDXJ top 25, primary gold miners producing less than 75k ounces per quarter. Their outputs are highlighted in blue.

But it still chaps my hide how much overlap GDX’s and GDXJ’s common managers allow. These GDXJ top 25 stocks accounting for 63.5% of its weighting also represent 24.9% of GDX’s! 13 of these GDXJ-top-25 components are also GDX-top-25 ones, while fully 20 of the GDXJ top 25 are included in GDX. The GDXJ top 25 are mostly clustered between the 12th to 33rd weightings within GDX, which is fairly high.

For years I’ve argued that both GDX and GDXJ would be way more useful to speculators and investors if their holdings were mutually-exclusive. GDX should only include majors and super-majors, leaving GDXJ with all the mid-tiers and juniors producing less than 250k ounces per quarter. GDX would be a blue-chip major ETF for pension funds, while GDXJ would have way more upside potential unsaddled from majors’ inertia.

Majors’ large market capitalizations require much-bigger capital inflows to materially boost their stocks, retarding their responsiveness in gold uplegs. They also operate at large scales making it very difficult to consistently bring on enough new production to overcome relentless depletion. The majors in GDXJ are like albatrosses chained around the necks of mid-tiers and juniors. And that burden was just made worse.

During this past year, GDXJ’s managers added super-major Kinross Gold which produced a whopping 596k ounces of gold in Q4’22! While KGC is a good operator, it certainly doesn’t belong in a “Junior Gold Miners ETF”. B2Gold, Endeavour Mining, and Harmony Gold are also larger majors that mined 368k, 355k, and 370k ounces last quarter. Together these four majors accounted for 13.9% of GDXJ’s entire weighting.

Together all the GDXJ-top-25 gold miners produced 3,455k ounces in Q4’22, which soared an impressive 13.5% year-over-year! I’d rave about that big growth if it was righteous, as it trounced the GDX top 25’s 4.4% YoY growth. I analyzed the elite GDX majors’ Q4’22 results in depth in another essay last week. And the World Gold Council recently reported overall world-gold-mine output slumped 0.9% YoY last quarter.

But all that hefty GDXJ-top-25 production growth came from KGC’s head-scratching inclusion. If that super-major’s output is removed from Q4’22, these elite mid-tiers’ and juniors’ aggregate actually shrunk by a disappointing 6.1% YoY. Some smaller gold miners were forced out of the GDXJ top 25 over this past year, so had their production been included it would have mitigated some of that comparable decrease.

Another factor skewing this production comparison is explorers and non-reporters flying up GDXJ’s ranks. Filo Mining is a curious new addition, as it is advancing a large primary-copper deposit in Chile with just byproduct gold. De Grey Mining is also an explorer in Australia, which looks years away from bringing a gold mine online. China’s Zhaojin Mining is a producer, but rarely bothers reporting quarterly results in English.

The Turkish gold miner Koza Altin skyrocketed up 40 GDXJ rankings on a soaring market capitalization, yet it doesn’t look much better in timely releasing quarterlies. So between a new super-major inclusion and a bunch of non-producing explorers and non-reporting foreign gold miners flooding GDXJ’s upper weightings, aggregate results are challenging to compare with Q4’21’s. Individual gold miners’ are more relevant.

The mid-tiers’ and juniors’ average mining costs are also obscured by some reporting issues. GDXJ’s largest component is Yamana Gold. But since AUY is being purchased by Pan American Silver and Agnico Eagle Mines, it hasn’t bothered reporting full Q4’22 results yet! With this deal almost closed, odds are it never will. Yamana gave an earlier operational production update, but no cost data or financial results.

Yamana getting taken out is sad, as it is a great growing mid-tier miner. Had its Q4 costs been included, they would’ve certainly lowered the GDXJ-top-25 averages. In the preceding Q3’22, AUY reported cash costs and all-in sustaining costs of $794 and $1,148 per ounce. And Canadian gold miner K92 Mining just edged into GDXJ’s 25th slot, but it respects its shareholders so little it isn’t reporting Q4 until March 30th!

We have to wait until Q2 is dawning to see how this fast-growing junior fared in Q4. KNT would’ve really helped drag down Q4’22 averages, as in Q3 it achieved fantastic cash costs and AISCs of just $503 and $909. So Yamana’s buyout combined with composition changes and late Canadian reporting definitely skewed the GDXJ top 25’s average cost data. Again last quarter proved challenging to properly compare.

Unit gold-mining costs are generally inversely proportional to gold-production levels. That’s because gold mines’ total operating costs are largely fixed during pre-construction planning stages, when designed throughputs are determined for plants processing gold-bearing ores. Their nameplate capacities don’t change quarter to quarter, requiring similar levels of infrastructure, equipment, and employees to keep running.

So the only real variable driving quarterly gold production is the ore grades fed into these plants. Those vary widely even within individual gold deposits. Richer ores yield more ounces to spread mining’s big fixed costs across, lowering unit costs and boosting profitability. But while fixed costs are the lion’s share of gold mining, there are also sizable variable costs. That’s where this past year’s raging inflation really hit.

Energy is the biggest category, including electricity to power ore-processing plants including mills and diesel fuel to run fleets of excavators and dump trucks hauling raw ores to those facilities. Other smaller consumables range from explosives to blast ores free to chemical reagents necessary to process various ores to recover their gold. So higher variable costs continue to heavily impact the world’s gold miners.

I found plenty of examples of this while wading through the GDXJ top 25’s latest quarterlies. That new out-of-place super-major Kinross warned higher costs were “mainly due to inflationary cost pressure on key consumables such as fuel, emulsion and reagents”. Hecla Mining reported its “increase in total cash costs was due to higher labor, contractor costs, and inflation in diesel, reagents, and other key inputs”.

Cash costs are the classic measure of gold-mining costs, including all cash expenses necessary to mine each ounce of gold. But they are misleading as a true cost measure, excluding the big capital needed to explore for gold deposits and build mines. So cash costs are best viewed as survivability acid-test levels for the major gold miners. They illuminate the minimum gold prices necessary to keep the mines running.

The elite mid-tiers’ and juniors’ cash costs looked ugly in Q4’22, rocketing up 21.9% YoY to a new record high of $1,011 per ounce! There’s nothing good to say about that, but it does remain far below prevailing gold prices. Thankfully these stunning cash costs were heavily skewed by a trio of extreme outliers, on top of Yamana and K92 Mining not reporting yet. Those are Hecla, Buenaventura, and First Majestic Silver.

HL has long been a high-cost producer, but lower Q4 production catapulted its cash costs an epic 48.4% higher to $1,696! Peru’s BVN has been a hot mess for years, and its cash costs ran a lofty $1,241 last quarter. But the real jaw-dropper is AG’s mind-boggling $2,519, which rocketed up 55.1% YoY! That isn’t companywide though, those crazy costs are isolated at one troubled primary gold mine First Majestic runs.

Thankfully that accounted for just over a fourth of AG’s total gold production last quarter, with the great majority byproducts from this company’s other three silver mines. That single gold mine represented less than 0.5% of the GDXJ top 25’s total Q4’22 production, so its extreme costs shouldn’t be allowed to distort averages so much. Excluding these outliers, mid-tiers’ cash costs looked far better averaging $825.

All-in sustaining costs are far superior than cash costs, and were introduced by the World Gold Council in June 2013. They add on to cash costs everything else that is necessary to maintain and replenish gold-mining operations at current output tempos. AISCs give a much-better understanding of what it really costs to maintain gold mines as ongoing concerns, and reveal the major gold miners’ true operating profitability.

The GDXJ top 25’s AISCs in Q4’22 looked even worse than their cash costs, soaring 22.8% YoY to their own new record high of $1,442! While still plenty profitable with gold averaging $1,731 last quarter, that is still way too high for comfort. But these scary average AISCs were also heavily distorted by those same three outliers. Hecla, Buenaventura, and First Majestic had crazy $2,132, $1,961, and $2,865 AISCs!

Remove those, and the rest of these elite mid-tiers and juniors averaged way-more-reasonable Q4’22 AISCs of $1,223 per ounce. And had Yamana and K92 reported yet, those would likely be considerably lower still. So the smaller gold miners are faring fine fundamentally, navigating though these inflationary waters fairly well. And their collective AISCs are expected to improve this year, per miners’ own guidances.

With those unadjusted Q4 average AISCs again running $1,442, the GDXJ-top-25 average AISC outlook for full-year-2023 is $1,339. And that worst offender First Majestic is forecasting much-better AISCs for its floundering primary gold mine, averaging $1,788 this year. But take that with a grain of salt, as a year ago AG guided that mine to full-year-2022 AISCs near a $1,555 midpoint. Yet last year’s actual soared to $2,745!

These inflation-goosed and skewed-higher AISCs really cut into the mid-tiers’ and juniors’ profitability last quarter. Subtracting the GDXJ-top-25 average AISCs from quarterly-average gold prices yields a great proxy for sector unit earnings. That plummeted 53.6% YoY in Q4’22 to just $288 per ounce, shockingly a new low in this long research thread! But again that was heavily distorted by that trio of extreme outliers.

Using that adjusted average all-in sustaining cost of $1,223 without them, the rest of these gold miners saw average unit profits almost double to $508 per ounce! That looks a heck of a lot better. And these gold-mining earnings are likely to improve in coming quarters. Not only are these mid-tiers and juniors guiding towards lower AISCs ahead, but Q1’s quarterly-average gold price so far is way stronger than Q4’s.

With the great majority of Q1’23 behind us, gold is averaging $1,874 on close which is a full 8.3% better than Q4’22’s $1,731 average! Gold miners’ profits in this current quarter will really amplify these $143-higher gold prices. So unit earnings should surge dramatically in quarters ahead, greatly improving mid-tier and junior fundamentals. Higher output later this year will likely further erode lofty inflation-goosed costs.

With super-major Kinross Gold intruding into GDXJ’s upper ranks and being-acquired Yamana apparently not bothering with Q4’22 reporting, the elite mid-tiers’ and juniors’ hard accounting results are also difficult to compare with Q4’21’s. While we could certainly take out Kinross, estimating Yamana involves way too many assumptions. So we probably have to wait for stabilization in coming quarters to get a better read.

Nevertheless, the GDXJ top 25’s total revenues merely slipped 1.3% YoY to $7,334m. Hard accounting earnings under Generally Accepted Accounting Principles or other countries’ equivalents plummeted by 49.9% YoY to $254m. Yet they would’ve looked far better without big noncash impairment charges of $350m from KGC and $360m from Endeavour Mining. Pan American Silver also dragged down profits.

Buying out most of Yamana’s mines, PAAS flushed $157m of “Transaction and Integration” costs through its income statement last quarter. Without these unusual one-off items, the GDXJ top 25’s collective bottom-line earnings would’ve proven way higher in Q4’22. Cashflows generated from operations also plunged 41.7% YoY to $1,689m, while overall cash treasuries dwindled down a similar 36.4% YoY to $6,408m.

In general corporations can’t pass along all their inflation-fueled higher input costs to their customers via price hikes. So they are forced to absorb some of those rising costs, leading to burning cash. And gold miners are even more constrained, with essentially no ability to dictate their selling prices. Excluding the always-problematic hedging, they are forced to accept whatever prevailing gold prices markets are offering.

So the high-potential mid-tier and junior gold miners fared decently fundamentally last quarter, though big GDXJ-top-25 composition changes really distorted comparisons. But these smaller gold miners continue to produce for well under prevailing gold prices, still yielding solid unit and bottom-line earnings despite all their inflationary cost challenges. With gold powering higher, mid-tiers and juniors remain way undervalued.

If you regularly enjoy my essays, please support our hard work! For decades we’ve published popular weekly and monthly newsletters focused on contrarian speculation and investment. These essays wouldn’t exist without that revenue. Our newsletters draw on my vast experience, knowledge, wisdom, and ongoing research to explain what’s going on in the markets, why, and how to trade them with specific stocks.

That holistic integrated contrarian approach has proven very successful, yielding massive realized gains during gold uplegs like this underway next major one. We extensively research gold and silver miners to find cheap fundamentally-superior mid-tiers and juniors with outsized upside potential as gold powers higher. Our trading books are full of them already starting to soar. Subscribe today and get smarter and richer!

The bottom line is the mid-tier and junior gold miners just reported mixed quarterly results. Their overall production surged, although GDXJ throwing in a super-major drove that. Mining costs soared to record highs, but a handful of extreme outliers heavily skewed that. Still these smaller gold miners were able to earn solid profits in both per-ounce and bottom-line terms, showing fundamental strength in a challenging quarter.

And with gold stocks still really undervalued relative to gold, mining profits are likely to really improve in coming quarters. Gold’s extreme-Fed-tightening-interrupted upleg has resumed and is gathering steam. Resulting higher average gold prices will be leveraged to much-higher gold-stock earnings. That sets up the battered gold stocks for a massive upleg, making for great contrarian buying opportunities today.

Adam Hamilton, CPA

March 17, 2023

Copyright 2000 - 2023 Zeal LLC (www.ZealLLC.com)