Gold and copper have both been on a tear lately for different reasons. Here we discuss why, and offer our predictions of where the gold and copper markets are heading.

Gold

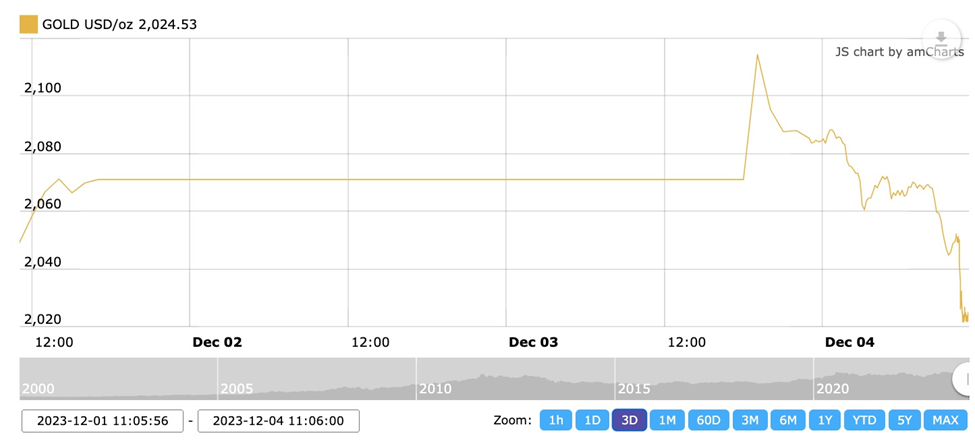

Gold on December 1st hit $2,075 for the first time, breaking the previous record high set in August 2020, of $2,072. The precious metal continued to climb over the weekend, with spot gold marking a new record in Asia trading of $2,135.99 an ounce.

Kitco News reported the move was driven by a combination of rate cut expectations and technical levels.

Indeed, the possibility of the US Federal Reserve reversing course and lowering interest rates after 18 months of raising them, is moving the gold market.

The messaging started last Tuesday with a speech by Christopher Waller, a member of the Fed’s board of governors, to the American Enterprise Institute. His talk raised the possibility that the Fed could decide to cut its benchmark interest rate as early as spring if inflation keeps declining steadily.

ABC News reported Waller sounded the most optimistic notes of any Fed official since the central bank launched its aggressive streak of rate hikes in March 2022. His comments were significant because Waller is among the most hawkish of Fed officials, meaning he typically favors higher rates to fight inflation, rather than low rates to boost job growth. The transcript from Waller’s speech can be found here.

The gold price reacted positively to the news, climbing 3.4% higher over the next three days to reach its $2,075 pinnacle on Friday. US gold futures also rose 1.6% higher, hitting a record $2,089.70.

Some analysts, like Gareth Soloway, chief market strategist at InTheMoneyStocks.com, have raised their gold price targets based on this latest price action. He is quoted by Kitco saying:

“Gold surged through its all-time highs on the back of hopes for lower rates sooner (vs higher for longer), future money printing expectations and stops being triggered on the break of $2,100,” he said. “The inverse head and shoulder pattern has triggered (assuming a daily close above $2,080).”

Soloway said a “calculated target for 2024 sits at $2,534,” which would represent a completion of the inverse head and shoulders pattern breakout.

For the gold price to have a sustained upleg, three stars need to align: the Fed has to lower interest rates, the US dollar must weaken, and most importantly, there needs to be negative real interest rates.

Gold typically gains when the real rate of interest (interest rate minus inflation) turns negative. Until rates start dropping, if inflation stays around 3.5%, real rates will stay positive.

Gold prices tend to increase significantly only during the periods of negative real interest rates. This is because negative interest rates, i.e. the situation when the inflation rate is higher than the nominal interest rate (the rate which is actually paid), means that creditors are losing money, therefore they are more prone to buy gold, even though it does not bear interest or dividends. In other words, gold reclaims then its traditional role as money and a store of wealth, which will at least keep pace with inflation to preserve the purchasing power of the capital, while bonds guarantee a real loss at negative real interest rates. — GoldPriceForecast.com

Gold’s three-day rally already appears to be over-done. As of this writing, Monday afternoon, the metal was trading at $2,029, $106 lower than the $2,135 pinnacle set in Asia.

Source: Kitco

Source: Kitco

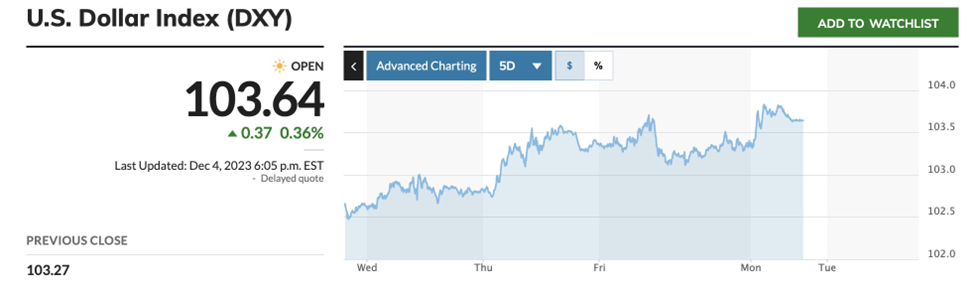

Source: MarketWatch

Source: MarketWatch

Arguably, gold is not going much higher until the dollar starts weakening (the US dollar index DXY is still above 100), and we have negative real rates. With inflation currently at 3.2% and the yield on the US 10-year Treasury at 4.2%, real rates are currently +1%.

The direction of a weakening dollar is clear, with the Federal pausing its tightening cycle after a series of interest rate hikes. But we’re not there yet. When the Fed cuts rates in 2024, it will weigh on both US Treasury yields and the greenback — both positives for gold.

The beneficiaries of dollar weakness

Right now, the Fed is taking a wait and see approach.

Have they done enough to cool inflationary pressure (seems like), or do they need to raise, potentially twice more, to get inflation into their preferred Goldilocks zone of 2%?

If, as so many believe, we are in a recession, or will be shortly, it’ll be so shallow and brief it will be over long over before it’s even recognized as a recession in the middle of 2024.

Hard landings, recession predictions wrong

The Federal Reserve has a plan: combat inflation with a series of rate hikes over a short period of time, pause, analyze. So far, their medication is working, the Fed dosed the economy with Buckley’s – tastes awful, but it works.

My view is that gold prices continue to track lower, soon crossing the $2,000 level to settle back around $1,950.

In the longer term we do expect a major lift in gold prices but now isn’t the time. We’ll have to wait until the Fed talks pivoting (to lowering interest rates). Until then, we must be realistic. As long as interest rates and the dollar remain high and inflation is coming down (gold typically acts as a hedge against rising prices), how much can we expect from gold?

Copper

The copper market narrative has been one of shrinking supply in the face of surging demand, not only due to electrification and decarbonization — EVs use four times as much copper as regular cars and trucks for example — but all the other applications for copper including in construction, power generation and communications.

In February, CNBC reported that “a copper deficit is set to inundate global markets throughout 2023, fueled by increasingly challenged South American supply streams and higher demand pressures.”

Wood Mackenzie is forecasting major deficits in copper to 2030, attributed largely to unrest in Peru and higher demand for copper in the energy transition industry.

The South American country, which accounts for 10% of world copper supply, has been racked by protests since its former president, Pedro Castillo, was ousted last December.

A strike is currently underway at the Las Bambas mine owned by China’s MMG Ltd.

On Nov. 28 Reuters reported that reduced supply from Panama and Peru, both major copper producers, could flip the copper market from surplus to deficit in 2024, or at least tighten oversupply if disruptions are not resolved soon.

Exposing the copper surplus myth

Last week, Panama’s top court ruled that First Quantum’ contract to operate the Cobre Panama mine is unconstitutional.

Between those two mines the copper industry has lost 570,000 tonnes of production.

In a recent BMO Metals Brief, head of global commodities research Colin Hamilton wrote that copper prices continue to trend higher due to supply issues following the Panamanian government’s announcement that Cobre Panama would be closed.

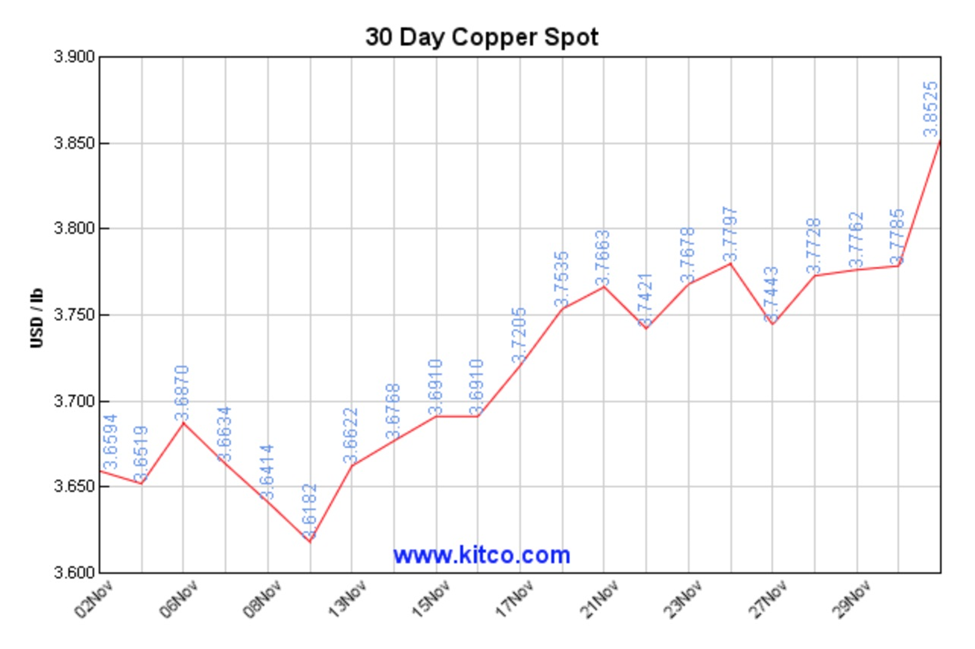

On Dec. 1, copper advanced to the highest level since August, as bets on a pivot by the Federal Reserve (lower interest rates are bullish for copper and other commodities) and the looming shutdown at Cobre Panama emboldened bulls, Bloomberg said.

It climbed up to 1.2% Friday and increased 4.4% in November, the first monthly increase since July, as a slew of stimulus in China and the potential end of the Fed’s tightening cycle boosted the demand outlook.

Source: Kitco

Source: Kitco

In my view, copper will continue to trend higher due to three factors:

- Supply failures at existing copper mines due to resource depletion and lower grades, and mine closures owing mainly to weather and strikes. Remember, 80% of the foreseeable copper supply is coming from just five mines, but four out of five have offtake agreements with non-Western buyers. That supply is locked up.

- The Fed orchestrating a soft landing for the US economy, meaning no recession or an extremely shallow, short-lasting one.

- Demand pressures. Global copper demand remains robust in both OECD and non-OECD countries. For the first four months of 2023, OECD copper demand increased by a robust 3.7%. Despite countless bearish articles in the financial press, Chinese copper demand continues to surge, with refined demand rising by 8% year-on-year.

In fact, we can now add a fourth factor: Chinese copper refining. As we reported earlier, to ensure self-sufficiency, China has expanded its network of copper smelters, meaning it will start to import much more copper ore for processing domestically. According to CRU, the country is expected to account for about 45% of global refined copper output this year.

China’s new copper smelting capacity is expected to turn China into a net copper exporter by 2025 or ‘26. With so many smelters requiring copper concentrate, the market for concentrate is tightening.

Miners pay smelters a fee to process copper concentrate into refined metal, to offset the cost of the ore. TC/RCs fall when tight concentrate supplies squeeze smelters’ profit margins.

On Friday it was reported that global miners reached agreements with Chinese smelters for lower TC/RCs, the first drop in three years. Reuters said the deals reached, including by Antofagasta and Freeport McMoRan, effectively made $80/8 cents the 2024 benchmark.

Conclusion

China is going to continue taking a lot of refined copper and wants to switch to importing a lot more unrefined ore. China is building out its network of copper smelters, just like it did for iron ore, cobalt, rare earths, lithium, etc. There is no doubt in my mind that China is aiming to become the swing copper producer, and the world’s largest copper exporter, giving it the strongest influence on the copper market. It would effectively become a price maker, not a price taker.

This is yet another example of the global copper market tightening and supporting higher prices.

The gold price is falling after a three-day run that quickened the pulses of gold bugs. But we refuse to get caught up in the mania. Gold isn’t going to $2,500 in the current macro environment — high rates, a high dollar, lower inflation, and positive real rates are all bearish for gold.

Remarkably, the Federal Reserve has raised interest rates high enough to reverse the growth of inflation, without causing a severe downturn. And it’s done it in an extremely short amount of time.

The Fed could still raise rates once or twice before it believes it has truly slain the inflation dragon. Or it could keep its finger on pause for several more months. A hawkish member of the Fed’s board of governors has raised the possibility that the Fed could decide to cut its benchmark interest rate as early as spring if inflation keeps declining steadily. Obviously, that would put downward pressure on the US dollar and upward pressure on the commodities that are priced in USD.