Record earnings continue to roll in, though they are having no impact on the stock price of mining companies as gold got absolutely hammered on Friday, with silver falling as well. Nominal 10yr rates marched higher, though they are still exceptionally low, and real rates remain negative. The $1.9T stimulus bill could pass as early as this weekend, if not in the near future.

$AGI, $AR.TO, $BTG, $CXB.TO, $CG.TO, $EGO, $EDV.TO, $KL, $OR, $TXG.TO

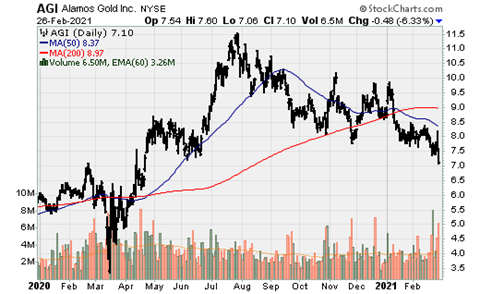

Alamos Gold: The company generated $58m and $126.5m in free and operating cash flow in Q4 and $122.3m and $382.9m for the full year 2020. The company reported record-high quarterly production in Q4 at 120.4k oz. Au and 426.8k oz. for the full-year 2020. In Q4, Alamos announced a 25% increase in the quarterly dividend to US$0.025/share. Cash costs and AISC came in below guidance in Q4 at $733/oz. and $1,030/oz. Year-end mineral reserves increased 200k oz. Au (net of depletion) to 9.9m oz. Reserves and Inferred resources at Island Gold increased 8% and 40%, for a combined increase of 1.0m oz.

Alamos started construction at the la Yaqui Grande project at Mulatos in Mexico, which will allow the company to maintain production but at lower-costs. During Q4, Alamos acquired Trillium Mining for $19.5m, increasing the land package adjacent to and along strike from Island Gold by 60%. Alamos remains well-financed with cash and equivalents of $220.5m and equity investments of $43m. The repaid the $100m drawn on its credit facility earlier in the year in Q4. Production is expected to increase approx. 155 to 470-510k oz. Au in 2021 @ AISC of $1,025-$1,075/oz. Moving forward, AISC will fall at La Yaqui Grande cones-online and a few years later following the Island Gold Phase III expansion. Argonaut's flagship asset is the Magino development project (construction has commenced), near Island Gold, and has many similarities. Alamos Gold acquiring Argonaut would make a lot of sense, but we will have to wait and see.

Argonaut Gold: For the fourth quarter of 2020, the company reported record quarterly revenue of $100.8m from the sale of 53.48k AuEq oz., which generated record quarterly operating cash flow cash of $39.5 million. For the full year 2020, the company reported record annual revenue of $319.7m from the sale of 179k AuEq oz. generating record operating cash flow of $95m. Argonaut will be transitioning from a high-cost junior producer into an emerging mid-tier producer with much lower costs beginning in 2023. Because of the Magino Project, this makes for a likely takeover target (at some point). Whether this will occur before the completion of the mine build at Magino remains to be seen.

B2Gold: The company produced 270.47k oz. Au ounces (including 14,150 ounces of attributable production from Calibre Mining) and consolidated gold production of 256,319 ounces from the company's three operating mines. For the full-year, the company produced a record 1.04m oz. Au. In 2021, the company is forecasting production of 970-1.03m oz. Au. In Q4, AISC totaled $926/oz. and $788/oz. for the full-year 2020. These costs include the attributable production from Calibre, which was higher in Q4 relative to the previous two quarters. The company is a cash cow, generating $197m In Q4 and $951m for the full-year 2020.

B2Gold has a strong balance sheet with $480m in cash and equivalents and no debt. In Q3 2020, the company repaid the $425m balance outstanding in the revolving credit facility. The full $600m is undrawn and available. B2Gold continues to advance the Gramolite project, proceed with underground development at Otjikoto, and determining the optimum throughput rate at Fekola (which looks to be higher than the current 7.5mtpa nameplate). It would make a lot of sense to use some cash, debt, and equity to make an acquisition or refill its development pipeline.

Centerra Gold: Produced 172k oz. Au in Q4 and 824k oz. Au for the full year-2020 as well as 20.4m and 82.8m lbs. Cu. With the copper prices surging so-far in 2021, this should put downward costs pressures at Mt. Milligan. Q1 could very well surprise on the upside. Centerra generated operating cash flow of $182m and $76.8m in free cash flow in Q4 and $930m and $603.8m for the full-year. AISC was $974/oz. in Q4 and $729/oz. for the full-year.

The company increased gold reserves at Kumtor by 107% to 6.3. oz. (July 2020) and published a new technical report outlining a new 11yr mine life with average annual production of 590k oz. for five years beginning in 2022 @ AISC of $828/oz. Progress was made at Mt. Milligan as it achieved record throughput. 2021 guidance is for 740-820k oz. Au, 70-80m lbs. Cu @ AISC of $850-$950/oz. Costs will be elevated due to processing lower-grade ore at Kumtor, and higher capitalized stripping at both Kumtor and Mt. Milligan. Centerra is well capitalized with $545m in cash and no debt. Given the lack of any substantive development project in its pipeline (Kemess is relatively small), an acquisition could be coming later in 2021.

El-Dorado Gold: Gold production totaled 528.9k oz in 2020, an increase of 34% from production of 395.33k oz. in 2019. 2020 AISC totaled $921/oz., generating operating cash flow of $425.6m and free cash flow of $236.2m. The company has $540m of cash and term deposits and $100m available under its credit facility.

There have been several positive developments for the longer-term future of the company thus far in 2021. In February 2021, Eldorado entered into an Amended Investment Agreement with the Hellenic Republic, providing a mutually beneficial and modernized legal and financial framework to allow for investment in the Skouries project and the Olympias and Stratoni mines. There remains significant value to be unlocked through its Greek assets. The focus in 2021 will be on advancing Skouries.

In January, the company announced the acquisition of QMX Gold for $104m. This significantly expands the land position adjacent to its Lamaque operations, which have been a pleasant surprise and is an important asset for the foreseeable future. El-Dorado also announced a maiden MRE at Ormaque, which highlights the exploration success and future growth at Lamaque. The MRE contains 803k oz. Au (Inferred) @ 9.50 g/t. Ormaque could become a second underground mine to feed the Sigma mill. The Sigma mill is expandable, and, in a few years, Lamaque could produce an average upwards of 250-300k oz. Au or higher at low-costs. Development at Ormaque could be fast-tracked as more than 60% of the resource is in the upper part of the deposit (<400m from surface). El-Dorado brought Lamque into production very quickly, and there remains ample excess capacity at the Sigma mill. Exploration in 2021 is focused on infill and expansion drilling as the deposit is open in multiple directions.

Before the developments mentioned above, $EGO provided 2021 and five-year guidance. Medium-term guidance is obviously subject to change and highly likely. 2021 production is forecast at 430-460k oz. Au @ AISC of $920-$1,150/oz. 2022 production guidance will remain in line with 2021, marginally increasing in 2023, 2024, and 2025. 2025 production is projected to be flat relative to 2020, but again, we believe it will be higher, perhaps significantly, as Skouries isn't included nor Ormaque. If we want to ballpark the potential upside, Ormaque could increase production at Lamque by 70-110k oz. Au and 140k oz. Au at Skouries, for companywide production of 660-780k oz. Au @ AISC of $7750-$875/oz. (Skouries AISC <$250/oz).

Endeavour is set to have a very exciting year through significant production growth and likely market re-rates. Ideally, the company will look to offload Karma, which has a short-mine life based on reserves with high AISC, so average AISC/oz. would fall. Endeavour recently reported the results of a PFS at Fetekro and FS at Kalana. Fetekro is very exciting as the company took this from discovery to PFS very quickly, and it already has a robust production profile.

. These assets will far more than replace lost production at Agbaou and Karma at much lower costs. Highlights from the Fetekro PFS:

- Average annual production of 209k+ oz. Au

- Long initial mine life: 10yrs

- Average AISC: $838/oz. ~ Should Endeavour have additional exploration success, production could be higher and costs lower.

- Potential to be the company’s 4th cornerstone asset (Sabodala-Massawa, Ity & Hounde).

- Using a $1,500/oz. gold price, IRR and NPV5%: 33% and $479m. 50%+ IRR and >$800m+ NPV5% @ $1,820/oz.

Highlights from the Kalana PFS:

- Average annual production of 150k oz. Au (+50k oz. vs. previous FS)

- AISC of $901/oz.

- Using $1,500/oz. gold price, IRR and NPV5%: 49% and $331m. 70% IRR and $580m NPV5% @ $1,820/oz.

- Initial 10yr mine life.

Kirkland Lake Gold: Produced 369k oz. Au in Q4 and 1.37m oz. Au for the full-year @ AISC of $800/oz. The company generated 1.315m of operating cash flow and $733m in free cash flow. During the year, the company had exploration success at all three of its cornerstone assets. 2021 production is forecast at 1.3-1.4m oz., which will be more heavily weighted in the back of the year. Costs will also be higher in the first half of that at AISC of $900/oz. and AISC of $700/oz. in the 2H.

2020 was an exciting year for the company. It laid the groundwork for significant near, medium, and long-term growth. Most notably, Agnico and Yamana gold made a positive construction decision on the Canadian Malartic underground, which increased the life of the asset through at least 2039. In all likelihood, it will be considerably longer when all is said and done. Osisko Gold Royalties also completed the spin-off of Osisko Development, which provides near, medium, and longer-term production through a 5% NSR on Bonanza Ledge (2021_, a 15% precious metal stream on San Antonio (2021/2022), and a 5% on the large Cariboo mine (2023/24). The spin-off also gives Osisko a significant equity position in Osisko Development. There were also positive developments at several projects, such as an increased resource with high-grades at Windfall (2-3% NSR + 14.50% equity interest), Increased reserves at Island Gold, much of which is on the 3% NSR ground. El-Dorado delivered a relatively large maiden MRE at Ormaque (800k oz. @ 9.5 g/t), which should significantly increase mill feed to the Sigma mill (2.8ktpd excess capacity) in the medium-term.

Torex Gold: Reported record 2020 financial results. Torex sold 437k oz. Au in 2020 @ AISC of $924/oz., generating operating cash flow of $342m. The company has a net cash position of $162m, a $183m increase over year-end 2019. Torex continues to advance Media Luna, with production slated for early 2024. This should create a nice transition as the ELG pits are expected to be depleted by 2025. Torex plans further development at the ELG underground and will invest in exploration to find its next mine within the prospective Morelos land package in the Guerrero Gold Belt (GGB).