Another week of weakness in the metals and especially the mining stocks. While there could be more weakness if Biden wins the election but that is clearly priced in to some degree. Now is the time to pounce. As discussed below we has a weak of some amazing earnings reports but also some very pathetic earnings as well such as McEwen Mining or Coeur Mining, which has ruined futures earnings to a degree because if moronic hedging of the gold price. Does anyone really want to invest in a company that obviously no understanding of the gold market whatsoever? I think not. Please excuse what is likely a plethora of grammatical errors this week. I have been dealing with a lot.

Please sign up for the free email list @ Goldseeker.com or try out our subscription service free for 30-days. In addition to a monthly newsletter, we offer an actively managed portfolio look over my shoulder service where we give you advance notice of our investments and trades, putting our money where our mouths are.

$AEM, $AGI, $BNKR, $CDE, $EGO, $MUX, $NGF.V, $OGC.TO, $PVG, $PGM.V, $SAND, $SCZ.V, $TUD.V, $AUY

Agnico-Eagle: Reported Q3 results, delivering strong operational performance and robust free cash flow generation. The company also increased it dividend by 75%. Operating cash flow was $434m vs. Q3 2019 when OCF was $275.3m. Agnico set a record for operating cash flow. In Q3, production totaled 492.7k oz. Au @ AISC of $1,016/oz. vs. $898/oz. in the year ago period.

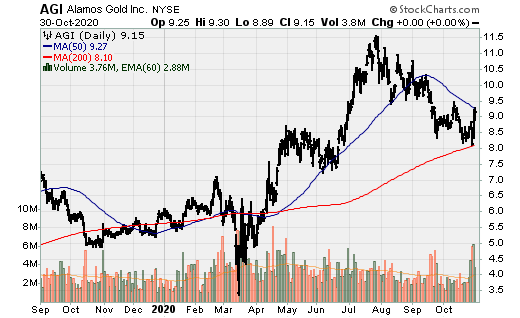

Alamos Gold: Reported an all-around fantastic quarter with several catalysts on the horizon. The company produced 117k oz. Au during the quarter and generated $76m in free cash flow and operating cash of approx. $105m. Like many other mid-tier and top-tier producers, the company hike its dividend to the tune of 33%. Alamos completed the Lower mine expansion at Young-Davidson, which will kick the asset into a free cash flow machine as production increases 30-35% in 2021 and costs drop significantly. It will take some time for the production to ramp-up at YD. Throughput reached 6.7ktpd in Q3 and it expected to reach 7.5ktpd by year end. 8ktpd (and likely higher, perhaps 8.25ktpd) will likely be achieved in Q1/Q2 2021. The company has several high-return development projects, most notably the Island Gold expansion.

That will take several years to complete but, in the meantime, the La Yaqui development project is on pace to reach production in Q2-Q3 2022. This will do two things: I) allow Mulatos to maintain production of 150-160k+ oz. Au annually and; II) significant lower costs (AISC) to sub $600/oz. or 35-40%.

Should the price of gold increase enough, it could also undertake the Lynn Lake development project, or if it gets the go ahead, develop one of its three exceptionally high-return Turkish assets. I believe Alamos could become a senior-gold producer over the next 5-years and believe the acquisition of Victoria Gold would be an ideal fit. It would immediately increase production by 210k oz. Au p.a. and likely 250-275k oz. Au over time should the Raven target continue to return wide intercepts of grades 3-8x higher than the reserve grade of 0.65 g/t Au. Alamos Gold seems to prefer underground operations (YD and Island Gold) so an open-pit might be out of the question, however, this would be a perfect fit.

Bunker Hill: Reported multiple near surface high-grade silver intercepts at its Bunker Hill Mine in Idaho. Highlights include:

- 7.6m @ 165.52 g/t Ag, including 1.5m at 648 g/t Ag

- 4.6m @ 126.56 g/t Ag, including 1.5m at 239 g/t Ag

- 2.0m @ 178.72 g/t Ag, including 0.4m at 394 g/t Ag

- 2.1m @ 163.15 g/t Ag, including 1.1m at 280 g/t Ag

- 5.8m @ 127.24 g/t Ag, including 0.9m at 295 g/t Ag

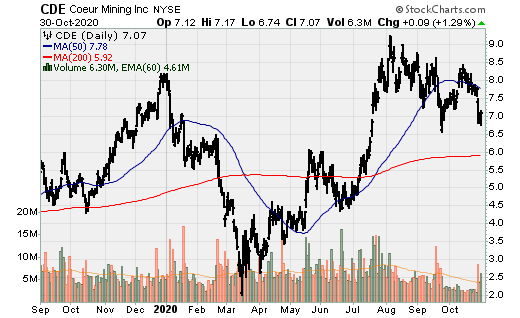

Coeur Mining: The company produced gold and silver production totaling 96k oz. Au and 2.6m oz. Ag. In Q3, the company generated $57.4m. Coeur’s management team and BOD obviously doesn’t understand the gold market as they’ve hedged 55.5k oz Au in Q4 with a maximum price of $1,823/oz., hedged 158.7k oz Au in 2021 with a maximum price of $1,875/oz. and hedged 126k oz. Au in 2020 at a maximum price of $2,030. I’m sure they will end up embarrassing themselves as it has done many times in the past. Coeur commenced construction for the Rochester expansion but if Coeur wants to see material growth, it will need to develop La Preciosa, which realistically speaking won’t happen this cycle. Given what they paid for this, it is a massive mal-investment.

Eldorado Gold: Reported Q3 2020 results: Gold production totaled 136,922 ounces in Q3 2020, an increase of 35% from production of 101,596 ounces in Q3 2019 @ AISC of $918/oz. The Company is maintaining its 2020 annual guidance of 520,000-550,000 ounces of gold at an all-in sustaining cost of $850-950 per ounce sold. The company generated operating cash flow (OCF) of $165.4m in Q3 and free cash flow (FCF) of $117.2m.

The company’s cash position increased to $504m, with $32m available under its revolver. The company sold the Vila Nova mine for $10m and is evaluating options to sell more assets such as Tocantinzinho in Brazil and the Certej Project in Romania. The company reminds me a bit of Yamana Gold in that it has destroyed shareholder value over the past 5+ years (albeit to a far lesser degree) as it has sold off quality assets. However, it has done a much better job than Yamana as it has a deep pipeline of growth assets; Lamaque expansion, Skouries, Perama Hill but it is hard to see a reason to sell the aforementioned assets as it has had trouble advancing assets in Greece. It seems very foolish to sell off quality assets when the gold price is clearly headed higher.

McEwen Mining: Reported Q3 Results. Q3 production totaled 30.4k AuEq oz. during the quarter. The company is still unable to control costs with AISC at Black Fox of $1,644/oz., $1769/oz. @ Gold Bar, $1,505/oz. @ El Gallo, and $1,538/oz. @ San Jose. This company is one hell of a mess and has been trouble nearly since its inception. There is hope, at least with the Black Fox Expansion and potential at the Fenix Project. San Jose is a decent asset and will only improve as silver price rise but Gold Bar is a very sub-par asset that McEwen would be best-off divesting. It should really consider selling its large and valuable copper asset Las Azules, this way it could acquire at least one high quality gold asset of scale.

New Found Gold: Continues to report amazing drill results at its Queensway Project, which sent the stock to multiple record highs throughput the week. These include:

- 18.35m @ 15.80 g/t Au

- 18.85m @ 31.2 g/t Au

- 41.35m @ 22.3 g/t Au

- 7.9m @ 24.1 g/t Au

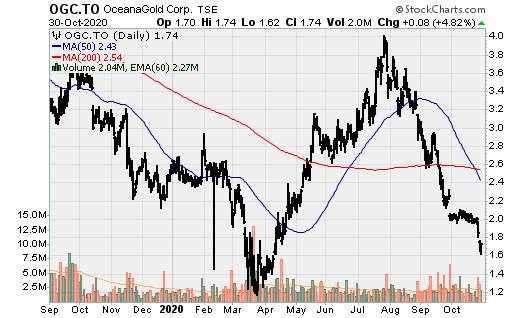

Oceana Gold: The company reported a weak quarter as it couldn’t keep costs under control. During the quarter, the company produced 63.1k oz. Au in Q3 but at AISC of $1,695/oz. Along with Pretivm, Coeur, and McEwen Mining, this is another company I wouldn’t touch with a 10-foot pole (unless the valuation was right as it does have some nice assets).

Pretivm Resources: The company continues to struggle, unable to increase output despite the expansion and more importantly the inability to reduce all-in sustaining costs. The company produced 86.14k oz. Au during the quarter @ AISC of $1,016/oz. AISC should have been much closer to $800-$825/oz. by this time or at the very minimum, sub-$900/oz. It is looking increasingly likely max out will never approach 400-440k oz. Au nor achieve sustainable AISC sub-$850/oz., let along $$900/oz. Due to strong gold prices, the company generated $66.8m in free cash flow and increased its cash position to $175m.

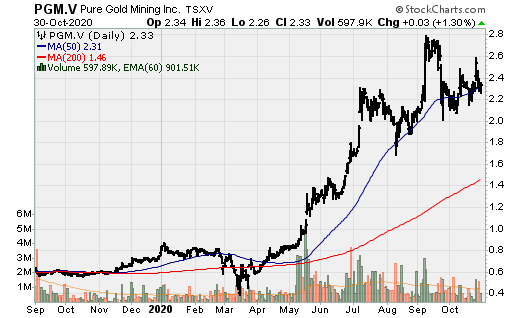

PureGold Mining: Released drill results to establish greater continuity and expansion of gold mineralization. Highlights include (underground):

- 296.1 g/t gold over 4.9m

- 40.0 g/t gold over 2.2m

- 18.7 g/t gold over 2.8m

- 11.1 g/t gold over 6.7m

Highlights of surface drilling from Wedge:

- 66.3 g/t gold over 1.0m

- 24.3 g/t gold over 1.0m

- 20.5 g/t gold over 1.0m

- 16.6 g/t gold over 1.5m

- 11.4 g/t gold over 2.0m

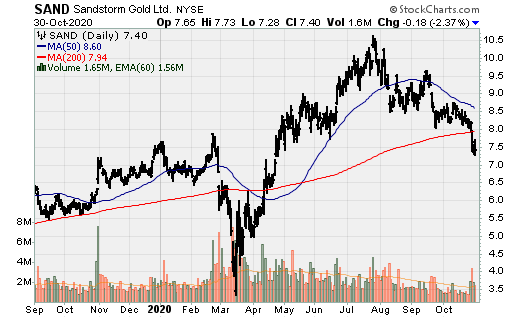

Sandstorm Gold: Reported a very disappointing quarter, with attributable production of just 12k oz. Au (vs. 17.3k oz. in Q3 2019). Despite record quarterly gold prices (by a wide margin) it generated just $18m in operating cash flow (vs. $18.2m in Q3 2019). The company should bounce back in Q4 and in 2021 as the delay of deliveries (there is a 1-2 months lag with stream deliveries if the underlying metal is from concentrate and given the fact several of its mines started ramping up production again in late Q2, taking time to reach full production). Cerro Moro is noteworthy in that it was a slower ramp-up and at the time is one of Sandstorm’s more important assets (especially at current silver prices).

Sandstorm also has some near-term growth assets namely Relief Canyon and increased output from Aurizona once gold crosses $2k/oz. as its NSR royalty increases to 5%. I do believe Sandstorm Gold will announce a new deal of size within the next 6-8 months given it has $135m in cash and investments, an undrawn revolving credit facility of $225m (with an accordion feature for $250m), on-going cash flow generation and roughly $20m of warrant money coming in. In other words, it has capacity to complete $280-$300m worth of deals.

Santacruz Silver: The company reported production of 977k AgEq oz. in Q3. This should translate into a dramatic increase and record quarterly operating and free cash flow for the company as it has been able to significantly reduce all-in sustaining (AISC), estimated at $16/oz. AgEq and expected to fall further in the near future. The company is in the process of acquiring the Zimapan Mine (which it is currently leasing now), which should close in Q1 2021. I know the Chairman quite well and he is well connected in Mexico and strongly believe he will come up with a way to pay for the $23m acquisition as equity financing is far too dilutive at this point.

Production at Zimapan increased 44% quarter over quarter and 52% relative to the comparable quarter in 2019. Once the acquisition is completed, there is room to further increase production to upwards of 5-5.2m AgEq oz. p.a. (from Zimapan and Rosario). While there is more risk involved in this company, should it achieve its objectives and gold breach $30/oz., the stock price should increase by 2-4x.

Tudor Gold: The company continues to hit very large, low-grade intercepts. This week the company reported additional monster drill holes including but not confined to: 1,152m @ 0.741 g/t AuEq, Including 1.561 g/t AuEq over 121.5m and 0.968 g/t AuEq over 414m. This continues to remain an excellent optionality play on higher gold prices. These types of companies tend to do very well as the bull market progresses. It is essentially a call option on gold.

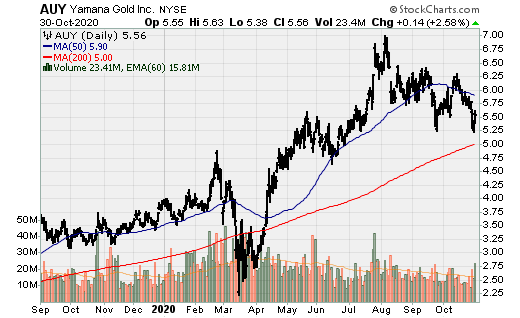

Yamana Gold: The company reported a strong Q3, however, the value the company destroyed for shareholders is very evident given the fact this quarter had the highest operating cash flow since 2015 ($199m) and free cash flow of $156m, back when gold and silver prices were 35-40% lower, the worst of the bear market. The company also reduced net debt by $149m.