The battered gold miners’ stocks are clawing back from their recent unusual breakdown. That was fueled by heavy gold-futures short selling slamming gold in the wake of the latest FOMC meeting. Speculators’ resulting excessive shorts had to soon be covered, and that tragic terrorist invasion in Israel proved the igniting catalyst. Both gold and GDX are rebounding sharply, poised to soon regain their interrupted uptrends.

My essay last week analyzed gold’s violent breakdown in depth. In a nutshell, top Fed officials slashed their forecast for 2024 rate cuts in half from 100 basis points to 50bp. Despite these dot-plot projections being notoriously inaccurate, traders viewed that shift as very hawkish. So afterwards they flooded into the US dollar as Treasury yields soared, which unleashed withering gold-futures shorting hammering gold lower.

Gold was looking solid technically before that late-September FOMC meeting, still in its strong upleg’s uptrend and still above its 200-day moving average. But over the next nine trading days following those shifting year-end-2024 dots, gold plunged 5.5% on a parallel 1.5% US Dollar Index surge! Both of gold’s key support zones were shattered, and its festering pullback was stretched into a formal correction exceeding 10%.

With gold’s powerful 26.3% upleg that nearly carried it to new nominal record highs slain, the gold stocks weren’t going to take that well. Gold miners’ profits are highly leveraged to prevailing gold prices, so gold-stock prices amplify whatever their underlying metal is doing. During that nine-trading-day post-FOMC span, the leading GDX gold-stock ETF collapsed 12.3%. That made for 2.2x downside leverage to gold.

GDX is dominated by the largest major gold miners, and their stocks tend to amplify material gold moves by 2x to 3x. So this small contrarian sector’s latest plunge was actually on the light side relative to gold. But that recent drop sure had an outsized psychological impact, with bearishness soaring as a months-old selloff deepened. Gold’s pullback had started from $2,050 in early May, and GDX’s from $35.85 in mid-April.

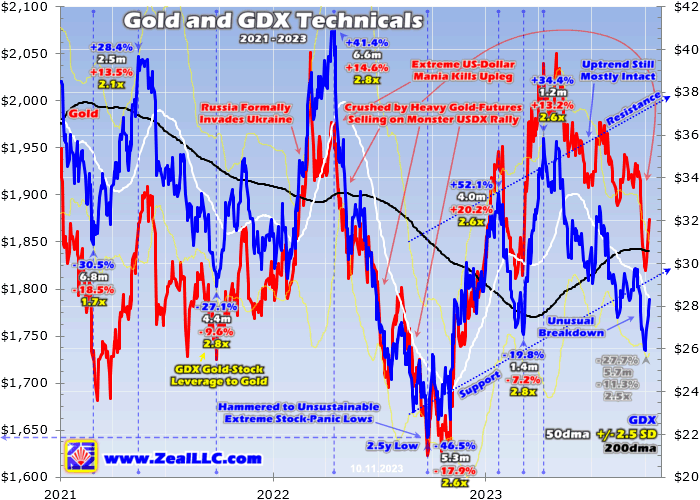

With gold stocks seriously of favor today, traders have forgotten their last upleg. That powered up a nice 63.9% over 6.5 months, leveraging gold’s underlying one by 2.4x. Before the last several weeks and that hawkish-2024-dots scare, GDX remained in this upleg’s uptrend despite selling off with gold since early May. This chart superimposes GDX and some of its key technicals over gold during the last several years.

Gold stocks’ unusual breakdown in recent weeks is striking, knifing well below uptrend support. That extended GDX’s total selloff since its latest upleg peak to 27.7% over 5.7 months. While steep, that was normal leveraging gold’s roughly-parallel pullback-then-correction by 2.5x. But gold’s sharp drop wasn’t sustainable, as I explained in last week’s essay written right at gold’s lows. My contrarian conclusion then was...

“The bottom line is gold just suffered a violent technical breakdown, trashing sentiment. But gold’s latest plunge was driven by massive gold-futures selling, leaving speculators’ positioning exceedingly-bearish. These super-leveraged traders have probably about exhausted their capital firepower available for selling. Their shorts in particular are likely challenging major secular highs, which are never sustainable for long.”

“That guarantees huge mean-reversion short-covering buying is imminent, which will catapult gold sharply higher. As specs rush to cover or face financial ruin, the much-larger long-side specs will pile on to chase gold’s upside momentum. The sparking catalyst for all this will be some Fed-dovish data shifting traders’ federal-funds-rate expectations, which could come any day. Battered gold stocks will soar as gold recovers.”

That has all started unfolding in the week since, except the surprise ignition source for that inevitable gold-futures short covering. It wasn’t Fed-dovish data, but Islamic jihadis invading Israel out of the blue! The whole world was shocked over the weekend watching their horrific massacre. Gold exited trading last Friday at $1,829, then gapped up to $1,850 late Sunday New York time as the Asian markets opened.

There’s nothing more bullish for gold than excessive spec gold-futures shorts, which guarantee imminent strong gold rallies. Shorting effectively requires traders to borrow contracts to sell, which legally soon have to be repaid necessitating symmetrical offsetting buying. Specs run extreme leverage too, so they can’t afford to be wrong for long or risk total ruin. This week gold-futures margins are only $7,800 per contract.

Yet each one controls 100 ounces of gold worth $187,400 at mid-week prices. That enables maximum leverage up to 24.0x, which is insane. At 24x, a mere 4.2% gold move against speculators’ bets would wipe out 100% of their capital risked! So when these guys saw gold instantly surge 1.2% from Friday’s US close late Sunday, their pucker factor had to soar. How would Israel avenge its butchered peaceful citizens?

Iran has long funded the terrorist Hamas organization, and there were already questions about what role Iran played in that Israel invasion. There’s serious risk a wider regional war could erupt, unlike anything seen in the past half-century. Israel could retaliate against Iran directly, or Iran and potentially Syria could escalate against Israel with their Islamic-militant proxies. All that makes it a heck of a lot riskier to short gold!

Speculators’ collective gold-futures positioning is only reported weekly in the famous Commitments of Traders reports. While current to Tuesday closes, they aren’t released until late Friday afternoons. The latest one when this essay was published had October 3rd data, a day gold slumped to a new correction low of $1,824. GDX would hit its own selloff-to-date nadir of $25.91 the next day as gold continued to slip.

That day specs’ total gold-futures longs fell to just 273.7k contracts. That was on the lower end of their tight ten-CoT-week trading range of 271.7k to 282.4k. As gold entered that span way up near $1,974 before dropping relentlessly within it to $1,820 last Thursday, spec long selling had to be exhausted. That violent gold breakdown would’ve shaken loose any more selling if specs had remaining capital firepower for it.

Gold-futures trading is so extraordinarily risky that only a small group of traders attempt it. While their market impact is amplified by their extreme leverage, they only command very-limited capital. Apparently nearly all of these guys with the will and capacity to sell longs had already done it. That alone was very bullish for gold, as spec longs outnumbered their shorts by 2.5x on average over the past 52 CoT weeks.

That means spec longs are 2.5x more important than shorts for driving gold price trends. Big gold uplegs generally aren’t at risk of failing until speculators buy enough gold-futures long contracts to drive them way up to recent years’ upper resistance around 413k. Last Tuesday specs’ bearish long positioning left them with vast room to buy a massive 139.3k contracts before returning to those gold-upleg-slaying levels!

For reference, anything over 20k in any single CoT week is huge and really moves gold prices. Over ten CoT weeks specs had only sold 21.9k longs total, a tiny 2.2k weekly run rate. All the action driving gold’s violent breakdown came on the smaller short side. In that same ten-CoT-week span, total spec shorts soared 64.4k contracts to 161.7k as of last Tuesday! Such levels are exceedingly-high and unsustainable.

My essay last week included an important spec-gold-futures-positioning chart if you haven’t seen one recently. Total spec shorts at 161.7k were the highest seen by far since early November 2022. That was when gold was finishing bottoming after being crushed last year, by the US Dollar Index’s parabolic moonshot to multi-decade secular highs on monster Fed rate hikes. That unleashed massive gold-futures selling.

At worst between late September 2022 when gold bottomed at deep stock-panic-grade lows and early November, total spec shorts hit 185.3k. That was an extreme 3.8-year secular high happening right as gold bottomed at just $1,623! In that drawn-out bottoming process, total spec shorts exceeded last week’s 161.7k in just five CoT weeks. Speculators’ quite-finite gold-futures-shorting firepower was expended.

They legally soon had to buy offsetting contracts to cover and close their shorts, and they did as gold bounced and started rebounding. The resulting symmetrical fierce short-covering buying helped catapult gold 20.2% higher over the next 4.2 months! The major gold stocks per GDX blasted up 52.1% in that span, amplifying gold’s mean-reversion rebound by 2.6x. A similar scenario has just started unfolding now.

Very tellingly, gold started recovering Friday despite a shocking upside surprise in the critical US monthly jobs report. The +336k headline jobs growth in September doubled Wall Street’s +170k consensus estimate! That was incredibly Fed-hawkish, greatly bolstering top Fed officials’ incessant higher-rates-for-longer jawboning. Such a crazy beat should’ve unleashed withering gold-futures selling, pummeling gold lower.

Yet gold bounced 0.5% that day, while the USDX fell 0.2%! That was strong evidence the gold-futures selling and US-dollar buying had exhausted themselves. All this came the day before Muslim militants started slaughtering Jewish kids and families. While Hamas’ Israel invasion was the main gold-futures-short-covering catalyst, one was inevitable soon given specs’ excessively-bearish gold-futures positioning.

In the first few trading days of this week into this essay’s Wednesday data cutoff, gold surged a big 2.4% to $1,874. That quicky erased nearly half of gold’s violent breakdown since late September’s FOMC-2024-dots hawkish surprise! GDX blasted 5.3% higher in those several trading days hitting $28.32. That amplified gold’s sharp reversal by 2.2x, and restored almost 7/10ths of major gold stocks’ unusual breakdown.

The newest CoT report current to this Tuesday won’t be released until late Friday afternoon, so traders don’t know how many shorts specs have covered. But odds are this gold-futures short-covering buying is only starting. From late March to early August, total spec shorts averaged a tight 94.1k contracts which was right at their lower support line of recent years. Mean reverting back there would require 67.6k of buying!

Such a massive slug of short covering should take at least a few weeks. And that’s exactly what births major gold uplegs. They all start with stage-one gold-futures short-covering buying, which is inherently self-feeding. The more specs buy to cover, the faster gold surges forcing still more specs to close out their shorts. That soon propels gold high enough for long enough to start enticing back long-side specs.

Unlike legally-required short covering, long buying is totally voluntary. But the much-larger long guys love piling on to chase gold upside, amplifying it with their leveraged capital inflows. That stage-two long buying greatly grows gold uplegs. Short covering is the trigger reversing gold then firing up the way-bigger long-buying engine. Eventually that drives gold high enough to attract back investors’ vast capital in stage three.

With the very-low spec longs and very-high spec shorts last week, gold could easily blast another 20%+ off its latest correction low in a strong new upleg. That’s nothing special by gold-upleg standards either. Again the last one peaked up 26.3% in early May, and there were a pair of +42.7% and +40.0% monsters both cresting in 2020! But even at mere 20% gains in coming months, gold will cross a magical threshold.

There’s nothing that excites speculators and investors more than new all-time highs, which the financial media extensively covers stoking extreme greed and bullishness. Gold’s nominal all-time-record close was $2,062 in early August 2020. Another middling 20% gold upleg off last week’s low would leave the yellow metal way up at $2,183, deep into new record territory! That will work wonders to attract in big capital.

Traders love chasing winners, and would flood back into gold and gold stocks with a vengeance as new records are achieved. Investors’ gold portfolio allocations today are virtually zero, so even shifting a percent or two into gold would launch it stratospheric. A great proxy for that divides the value of the gold bullion held by the world-dominating GLD and IAU gold ETFs by the market capitalization of the elite S&P 500 stocks.

Exiting September, American stock investors’ gold held via GLD and IAU shares was worth $77.1b. Yet the SPX stocks were worth a staggering $38,218.4b. That implies American gold portfolio allocations of just 0.2%, effectively nothing! When gold returns to favor as new records fall, investors including fund managers will really up their meager gold allocations. Even a slight change is super-bullish for gold prices.

And as goes gold, so go the gold miners’ stocks. Again GDX tends to amplify material gold moves by 2x to 3x, so a 20% gold upleg implies 40% to 60% GDX gains. That’s considerable, well worth riding. But gold stocks have exceptional upside potential way beyond normal as gold nears record-breaking territory. The bullish financial-media coverage will attract in far more traders than usual, greatly boosting gold-stock gains.

If this past week’s gold-futures short-covering buying continues as it ought to, gold could start hitting new nominal record closes within a few months. The battered gold stocks will be way higher from here when that happens. And the major gold miners’ gains will be trounced by the fundamentally-superior smaller mid-tier and junior minors we’ve long specialized in. Our trading books are full of them still at cheap prices!

Successful trading demands always staying informed on markets, to understand opportunities as they arise. We can help! For decades we’ve published popular weekly and monthly newsletters focused on contrarian speculation and investment. They draw on my vast experience, knowledge, wisdom, and ongoing research to explain what’s going on in the markets, why, and how to trade them with specific stocks.

Our holistic integrated contrarian approach has proven very successful, and you can reap the benefits for only $8 an issue (now 33% off!). We research gold and silver miners to find cheap fundamentally-superior mid-tiers and juniors with outsized upside potential. Sign up for free e-mail notifications when we publish new content. Even better, subscribe today to our acclaimed newsletters and start growing smarter and richer!

The bottom line is gold stocks are clawing back from their recent unusual breakdown. That was driven by gold’s own violent breakdown on massive gold-futures short selling following a hawkish FOMC surprise. But that left speculators’ gold-futures positioning extreme, with excessive and unsustainable shorts. That guaranteed imminent symmetrical short-covering buying on the right catalyst, reversing gold sharply higher.

Surprisingly that didn’t prove Fed-dovish economic data, but the shocking massacre in Israel. Resulting exploding geopolitical risks make it way more dangerous to short leveraged gold futures. So odds are the mean-reversion normalization buying to unwind those bets will continue. That will keep driving gold back higher, and the gold stocks will amplify its gains like usual. It sure looks like major uplegs are being born!

Adam Hamilton, CPA

October 13, 2023

Copyright 2000 - 2023 Zeal LLC (www.ZealLLC.com)