I’m going to save discussion of the CPI report for my Deeper Dive this weekend because it requires digging deep into the numbers involved in the report to show why it is not the game-changer for the new trend in inflation that the stock market made it out to be. Not even close. It could, of course, become a first blip in the direction of a new downward trend against the rising trend for inflation that has held all year, but this year’s trend, so far, remains firmly anchored.

Even Minneapolis Federal Reserve Bank President Neel Kashkari said after the CPI report came out,…

that he is unsure how restrictive monetary policy is right now, and that borrowing costs should stay where they are as U.S. central bankers take stock of inflation. "The biggest uncertainty in my mind is how much downward pressure is monetary policy putting on the economy? That's an unknown," Kashkari told the Williston Basin Petroleum Conference in Bismarck, North Dakota. "And that tells me we probably need to sit here for a while longer until we figure out where underlying inflation is headed before we jump to any conclusions."

In fact, another article out claims, as I’ve been claiming here, that Fed policy is not restrictive at all; and that’s the interesting point for the day I want to focus on as I think the article says it well:

Time and again, Jerome Powell has made it clear. Financial conditions, the Federal Reserve’s key lever for cooling the US economy, are tight.

HOWEVER …

After an $11 trillion rally in US equities since late October — and the sudden revival of meme-stock fever — many on Wall Street think he’s dead wrong. Not only are popular gauges of the investing climate famously loose — some are looser than before the Fed kicked off its historic monetary-tightening campaign more than two years ago.

Looser than before the Fed even began its battle! That is even a little strong than what I’ve said as I pointed out how Powell’s sweet and soothing tones have seriously (and now repeatedly) undone nearly all the tightening the Fed managed to achieve. According to this article, Powell has actually undone MORE than all the tightening the Fed had achieved. In which case, of course, the inflation Powell is hoping will finally prove to be transitory is rising again!

Rather than help the Fed chair on his legacy-shaping mission to vanquish the inflation threat at its core, the objection goes, the market frenzy across risky assets is working against his policy goals by encouraging Americans to consume en masse.

Another point in the article that I found particularly interesting is the writer’s explanation as to why the Fed is blind to such an extent that Kashkari is saying no one knows if the Fed’s interest rates are putting downward pressure on the economy. I’ve been using a caviar motif to express why the Fed has no clue about what most citizens are experiencing.

Yet the latest Fed data on household wealth helps explain Powell’s sanguine stance on the link between financial conditions and the broader economy — and why consumer confidence remains stubbornly detached from the S&P 500 rally.

That would be the S&P rally that just broke past 5300 on a trivial wisp of hope and put in a new record high because stock investors were so elated about the major turnaround in CPI (their irrationally exuberant view, certainly not mine, as I’ll explain this weekend).

Put simply, the fruits of the market boom remain unevenly spread among Americans given epic disparities in wealth — especially across generations and racial groups — while equity gains are still modest when adjusting for the impact of inflation.

While Powell’s soft words have lit a fire in markets once again to pile up money for those rich enough to make big plays in these casinos, the inflation he is lighting up once again as he stokes those markets chews away at the middle class and the poor.

I remember how Janet Yellen use to scratch her little round head to figure out why wealth disparity was growing at such a rapid rate, even as she continued the policies that were creating it.

So while the stock market may be cheering up rich Americans, it’s doing little to invigorate the less affluent, who are trapped by inflation and struggling to cover debts thanks to sky-high borrowing costs.

(The costs we are now paying for that massive government Covid debt binge plus the years of government debt binging that came before. You pay one way or another, even if you don’t pay down the debt. Right now it is via “inflation tax” (i.e., the inflation, itself) and inflation-fighting interest rates.)

“Inflation is a pressure cooker, and that’s largely why consumer sentiment is so negative,” said Kyla Scanlon, a social media creator and video columnist for Bloomberg Opinion, whose label “vibecession” was coined to describe glum feelings among the electorate.

This view sits awkwardly for proponents of the “wealth effect” [those proponents being the wealthy, themselves]— a behavioral-economics theory that suddenly went mainstream during the global financial crisis when central bankers in effect engineered a rise in equity prices in order to induce household spending — with some success. Today, the stock market would, at one level, also appear to offer obvious support for a spending boom rooted in stock gains. US share values have risen in all but one month since October, swelling retirement and brokerage accounts and, thereby, giving consumers an excuse to up their discretionary spending.

In other words, the caviar view I’ve presented: Inflation is not hitting the price of caviar as much as it is hitting the price of coffee and cocoa. So, it’s not hitting the rich as much as the rest. Even if inflation tripled the price of caviar, however, those who dine at Fed luncheons would have no problem footing the bill. So, they can pretend to be sympathetic with the average consumer, but the fact is that there is a considerable difference in how it feels to struggle to buy breakfast cereal for the kids because wheat has gone up so much and to have less expendable money to pour into stocks and bonds because the price of caviar is up.

The majority of Americans own very little in the way of stocks, and what they own is tied up in retirement accounts that many don’t really have access to. So, the wealth effect does not trickle down and spread out.

Nor does inflation sit the same with everyone. Low-demand, low-necessity items like caviar are not likely to experience the same price pressures as rice, wheat, and meat. However, inflation also impacts retired people on fixed incomes differently, even though Social Security supposedly adjusts for inflation.

Another article lays that out:

High inflation harms older households — and two factors determine who is most at risk, research finds…

For retirees and people approaching retirement, higher than normal inflation poses unique challenges.

Most retirees have access to one of the few inflation-adjusted sources of income — Social Security — that is adjusted every year to keep pace rising costs….

While Social Security benefits are keeping pace with price increases [I disagree because the government’s inflation rates seriously understate what people are really experiencing due to myriad adjustments that are sometimes just fakery to make the government look better … and save it money on SS benefits.], the effects may vary for individuals depending on their personal expenses and where they live, noted Laura Quinby, senior research economist at the Center for Retirement Research at Boston College.

“It’s getting ninety percent of the way there for most households every year, which is just incredibly valuable,” Quinby said.

I doubt it is even that close in keeping up, and even 90% means you are falling behind more and more every year on that part of you income.

Yet even with inflation-adjusted benefits, retirees have struggled with higher prices since inflation rose in 2021. And near-retirees have also faced challenges planning for a new life phase amid a rising cost of living.

So, while the Fed is having a hard time figuring out what everyone is complaining about, given that the caviar economy is still booming, it’s not hard to figure at all, really. The roaring twenties are pumping money into the barons who have enough expendable cash to keep pumping money into stocks, and that leaves out the larger portion of the population. The net news jobs for the rest of the population are almost all part-time jobs without benefits, which also means more time and money spent on gas getting from one job to the other, leaving scant time left for living.

For those for whom Social Security is a major part of their retirement income, SS never has kept up with real-world inflation. And inflation on some things, such as housing, hits much harder in some areas than others; so, if they don’t own their homes, the SS adjustment for inflation may come in well below the impact housing prices are having on their budget.

Retirees tend to have most of their income from either Social Security or defined benefit pensions. While Social Security is adjusted for inflation, pensions generally are not — a disadvantage for retirees who rely on them.

If you own your house, bought it several years back on low interest, and are more reliant on 401Ks than Social Security, you may be doing all right … until the next big market crash wipes out your 401Ks. If you stashed a lot of gold, clearly you’re doing all right at present. But for a huge number of people inflation is beating them up badly because, since Biden took office, the price of everything (even using the government downwardly rigged numbers) is 20% more than it was when he took office.

The article claims that 34% of near-retirees have postponed their retirement date by an average of four years in order to make up for inflation. No wonder they’re not feeling too happy about the economy.

Obviously, the wealthy who own large, prestigious homes have benefited far more from the asset value inflation in homes than the poor who own little or none if either group chooses to realize that rise in value by downsizing for retirement.

“Low income and younger segments of the population have missed out from the wealth effect,” JPMorgan strategists including Joyce Chang wrote in a note this month when explaining the persistence of the “vibecession.”

“Consumers are more upset about the prices they’re paying at the grocery store, for flights and hotels,” said Chris Zaccarelli, chief investment officer at Independent Advisor Alliance. “And that has them more angry than a hot stock market has them happy.”

So, Jerome & Co. need to stop wondering why the average consumer is so unhappy with the economy they have rigged. It’s only working for the upper crust right now. For the rest, if you think inflation is killing you, it probably is. It’s cut off 20% of your life force right now … unless your income has also grown by that much during Biden’s term.

Tempting as it is to say this is all due to Biden, remember Trump pounded the Fed into lowering interest rates every time he turned around and into running the money printers at full speed his entire term, and he used the government to dole out never-before-seen amounts of money (as always, mostly to the rich, but also this time to the poor and the average), all funded by government debt; and now you’re paying for it because raising government debt also fuels inflation as the government shoves that new money made out of nothing into the economy.

No wonder one-fifth of all credit-card users are now maxed out and delinquencies are starting to rise.

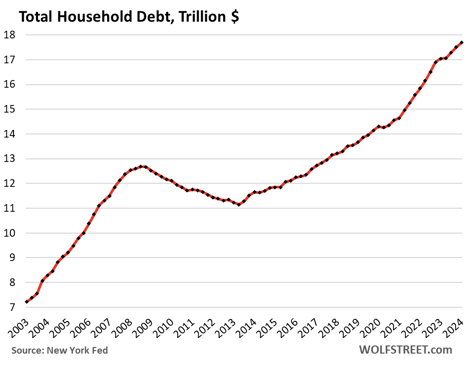

Look at how much worse household debt is now than it was back in the Great Recession:

Population didn’t grow that much! Not even under Biden’s border population explosion plan.

Notice, also, how the rate of rise almost doubled since the Covid lockdowns and during the Covid handouts. We might have received a lot of free government cash, but our rate of personal debt expansion skyrocketed anyway, due in part to rising prices, especially for homes and cars.

Take your own pick as to whether the Fed is unbelievably blundering or just outright evil, but it is clear they all deserve to lose their jobs because they are about to send us through this inflation war for a second spin to wring us out dry. In my next Deeper Dive, I’ll show why this minuscule blip down in inflation is cold comfort that does not set a new trend.