The United States Federal Reserve surprised markets Wednesday by cutting the benchmark interest rate by half a percentage point instead of the 0.25% reduction many were expecting.

It’s the first time interest rates have fallen since the COVID-19 pandemic.

The super-sized cut brings the central bank’s target range to between 4.75% and 5.0%. The decision was not unanimous, with Fed Governor Michelle Bowman, the lone dissenter, favoring a 25-bp cut instead.

At a press conference, Fed Chairman Jerome Powell said he does not see an elevated risk of an economic downturn due to the 50-basis-points cut. Investors have been wondering whether the Fed can cut rates in time to avoid a recession.

“You see growth at a solid rate. You see inflation coming down. You see a labor market that’s still at very solid levels. So, I don’t really see that now,” Powell said.

Bloomberg reported that more than half of the Fed policymakers favor at least another 50 bp of easing over the next two meetings.

US stock markets initially reacted favorably to the news, with the S&P 500 and the Dow Jones hitting record highs. But the major indexes erased strong gains to close modestly lower, even as Powell signaled more easing along with an economic soft landing, said Investor’s Business Daily.

To us at AOTH, the takeaway is not so much the amount of the rate cut, but what it means for markets going forward.

No recession

I was right in my prediction that the Fed would pause its rate hikes in June 2023.

I’ve also voiced my opinion that we will get a soft landing with no or an extremely shallow and short recession. Remarkably, the Federal Reserve has raised interest rates fast enough to reverse the inflation rate, without causing a severe downturn. And it’s done in an extremely short amount of time.

While I wasn’t expecting the 0.5% reduction, I feel confident forecasting that the rate easing cycle will continue well into the new year. If a recession occurs at all, I do not see it until late in 2025.

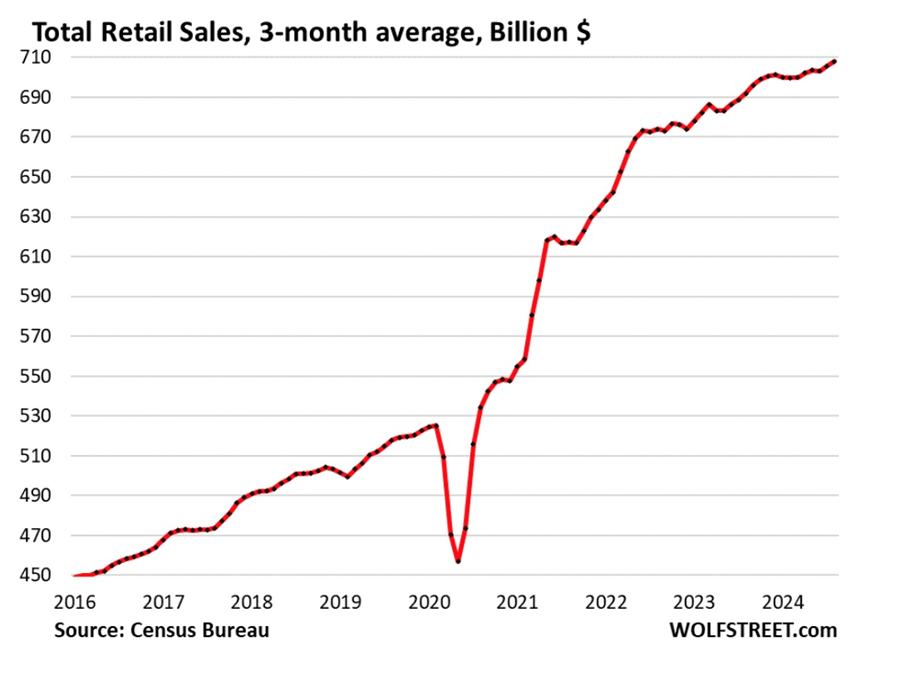

Wolf Street points to the rise in retail sales as evidence of a recession not occurring yet. A three-month average shown in the chart below indicates retail sales increased 0.3% month to month and 2.3% year over year. E-commerce gained the most, with auto dealers second. Internet sales rose 1.4% month to month and 7.7% year over year.

Wolf Richter says it’s remarkable that retail sales continue to rise even as the prices of many goods have been dropping all year. When prices fall and consumers buy the same amount of stuff, retail sales should decline. If sales are increasing but the prices of goods are falling, it means consumers are buying more stuff, particularly durable goods.

For example, vehicles. Used-car sales jumped 8% in August compared to July, and 14% year over year. New vehicle sales were up by 11% and 7.6%, respectively, to 1.4 million units.

“Real” (after inflation) consumer spending in July jumped by 0.4% in June, the biggest month-to-month increase since February 2023. Wolf Street points out this showed up in the Atlanta Fed’s GDP, which grew 3% in the third quarter compared to the 10-year average of 2%.

What about the theory that an inverted yield curve means that a recession will arrive 6 months to a year later?

In a typical healthy market, the yield curve (typically the spread between the US 10-year Treasury note and the 3-month or the 2-year note) shows lower returns on short-term investments and higher yields on long-term investments. This makes sense, as investors earn more interest for tying up their money for longer. The yield curve is said to “invert” when short-term yields are higher than long-term yields.

The yield curve has inverted 28 times since 1900, and in 22 of those times, a recession followed. For the last six recessions, a recession began six to 36 months after the curve inverted. Typically a recession follows six to 12 months after the yield curve inverts.

After a little over two years of inverting, the yield curve in early August “uninverted”, i.e., it snapped back to normal. Interest rates on long-term bonds were higher than the rates on shorter-term bonds like 3-month and 2-year Treasuries.

After US job openings fell to the lowest since the start of 2021, the yield on the 2-year Treasury note on Sept. 4 fell briefly below the 10-year note. It’s only the second time this has happened since 2022.

Prima facie, this seems like a good thing. Investors now have more confidence that the economic future is brighter and that locking in their money at higher rates for longer terms is safe.

On the other hand, since the 1970s, every US recession has been preceded by an inverted yield curve. Could it happen again? An expert says this time will be different, and we agree.

“Fixed-income investors are increasingly aligning with our view that the U.S. economy won’t slip into a recession, especially now that the Fed seems committed to easing its policy to avert one,” said Ed Yardeni, a veteran Wall Street strategist and founder of Yardeni Research, via Bezinga.

According to Yardeni, the yield curve could steepen significantly without a recession materializing, especially as the Fed transitions to an easing cycle. In past cycles, the spread between the 2-year and 10-year peaked at an average of 220 bps, with a range between 161 bps and 290 bps. If the 2-year yield bottoms around 3.00% during this easing cycle, the 10-year yield could rise to 5.20%, significantly above its current level of 3.72%.

Yardeni believes the neutral 2-year yield is around 3% and the neutral 10-year yield is closer to 4%.

The yield curve’s disinversion might not completely eliminate recession risks. But, for now, markets appear to be betting on a more favorable outcome—a cooling economy without a hard crash.

Stocks

As mentioned at the top, stocks initially took off following the Fed’s rate-cut announcement, then declined, due to traders and investors pricing in the possibility of a recession.

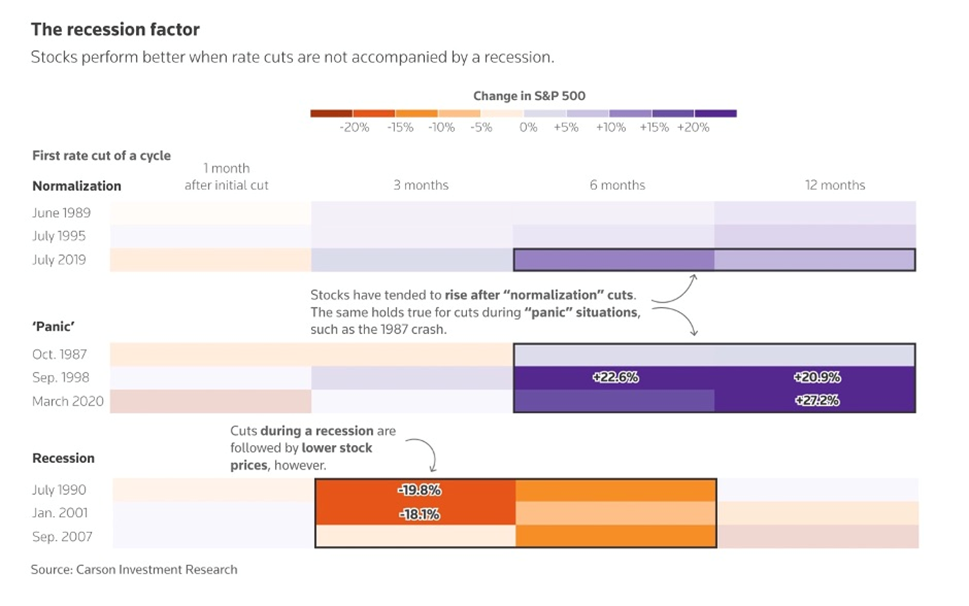

Naturally, how the stock market does depends on whether or not the economy falls into a recession following the rate cut.

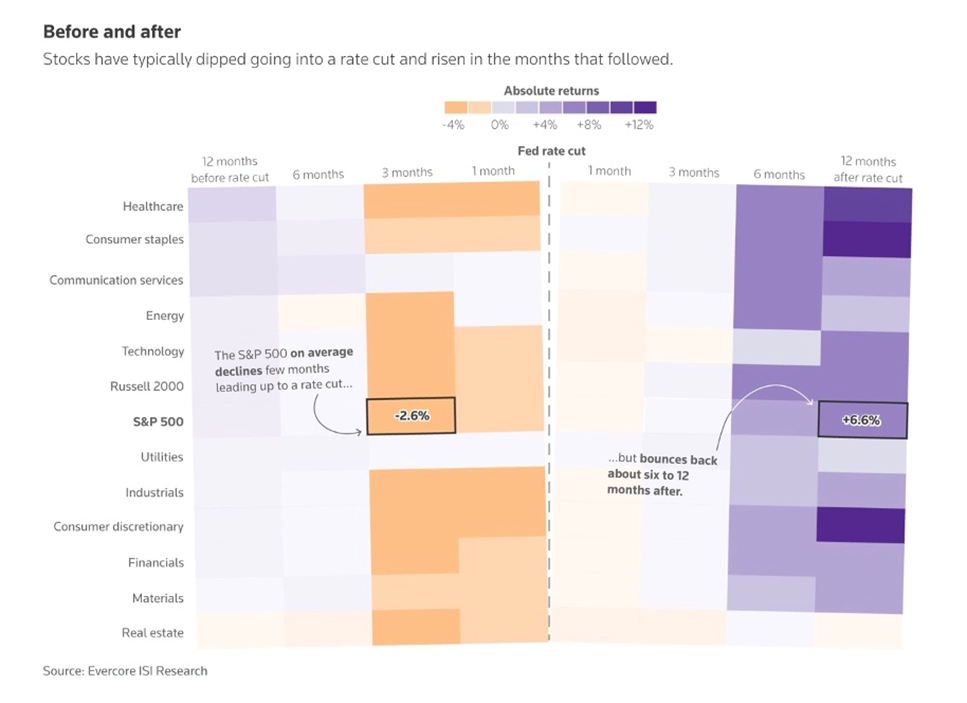

The S&P 500 slumped an average of 4% in the six months following the first reduction of a rate-cutting cycle if the economy was in recession, said a Reuters analysis published on Tuesday, citing data from Evercore ISI going back to 1970.

During non-recessionary periods, the S&P 500 gains 14% in the six months following the first rate cut. The index is up 18% so far this year.

“Based on previous easing cycles, our expectation for aggressive rate cuts and no recession would be consistent with strong returns from U.S. equities,” Reuters quoted James Reilly, senior market analyst at Capital Economics, in a report.

Overall, the S&P 500 has been 6.6% higher a year after the first rate cut of a cycle — about a percentage point less than its annual average since 1970, Evercore’s data found.

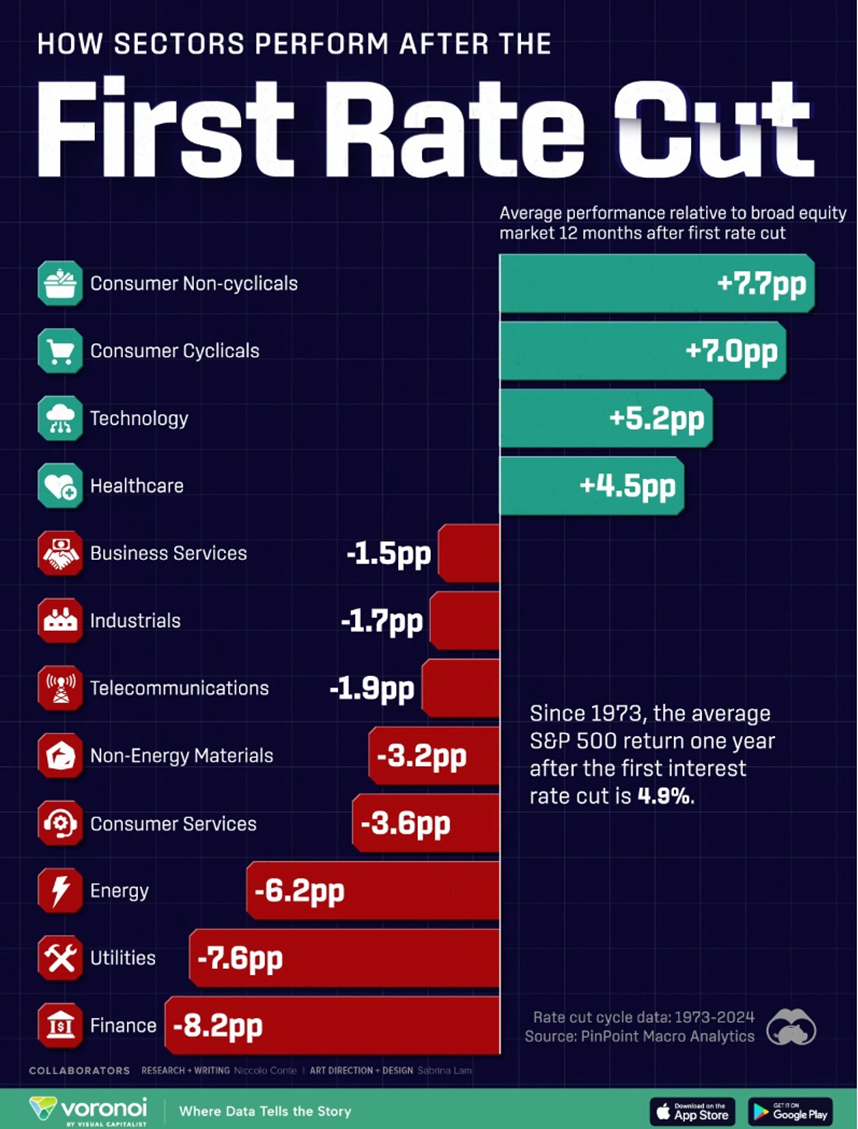

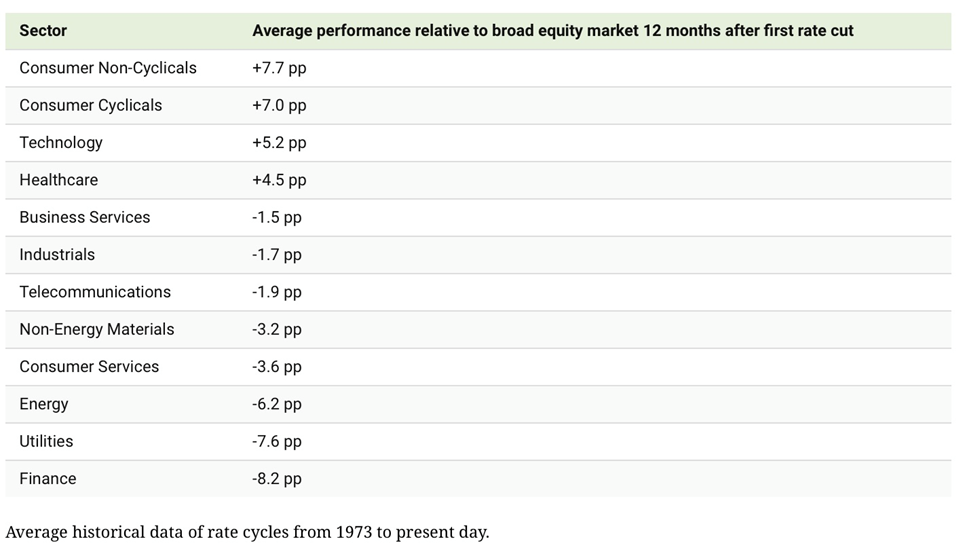

Among S&P 500 sectors, consumer staples and consumer discretionary had the best average performance, both rising around 14% a year after the cut, while healthcare rose roughly 12% and technology gained nearly 8%, according to Evercore.

Small caps, seen as highly sensitive to signs of an economic turnaround, also outperformed, with the Russell 2000 rising 7.4% over the next year.

Evercore’s data gels with an infographic published by Visual Capitalist a week ago. It found that consumer non-cyclicals see the strongest returns after the first rate cut, especially during recessions, due to the demand for staple goods.

By contrast, tech stocks underperform the market six months after the first rate cut, but they bounce back within a year because reduced borrowing costs generally benefit growth stocks.

The financial sector is historically the weakest performer because interest rate cuts often signal that the economy is slowing, putting pressure on loan growth, credit losses, and default risk, wrote Visual Capitalist’s Dorothy Neufeld.

Treasuries

Treasury yields tend to fall alongside rates when the Fed eases monetary policy, states the above-mentioned Reuters analysis. Again it depends on whether the economy’s in recession or not.

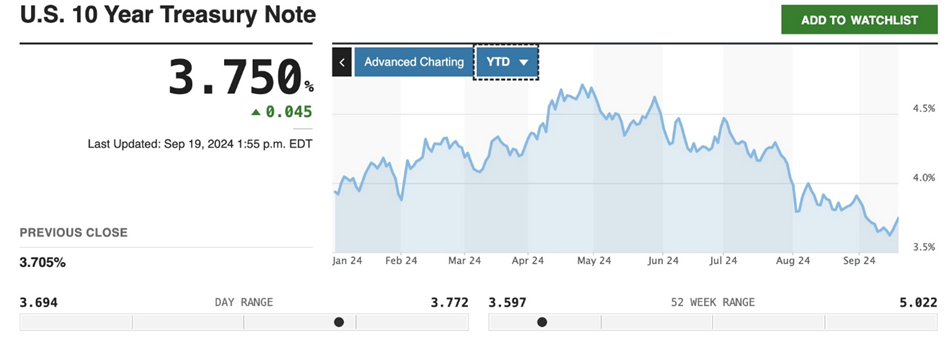

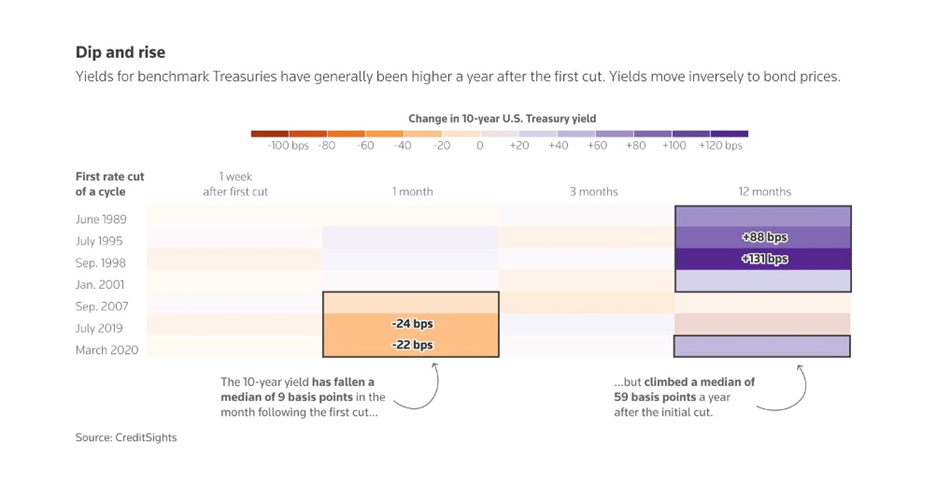

Reuters notes the 10-year yield has fallen a median nine basis points in the month following the first cut in the last 10 rate-cutting cycles and climbed a median 59 basis points a year after the initial cut as investors begin to price an economic recovery, data from CreditSights showed.

Treasury yields have been falling this year, with the 10-year Treasury having dropped about 20 basis points this year to the lowest level since mid-2023.

Curiously, however, Treasury yields rose following the rate cut Wednesday. The yields on longer-dated notes like the 20-year and the 30-year bounced off lows touched earlier in the week.

The higher yields suggest that Wall Street was disappointed by what the central bank telegraphed in the months to come, explained MarketWatch, quoting Cindy Beaulieu, chief investment officer, North America, at Conning, which has about $160 billion in assets under management. “We believe rates across the curve had come down too far, too fast,” she said.

Treasury yields can be thought of as a signpost for whether the market thinks the economy is in recession or not.

Beaulieu said she thinks the 10-year yield could end the year north of 4%, and even at 4.25%. “The market talks about pricing in a soft landing, but when driving rates so low, that sounds a lot more like a recession,” she told MarketWatch.

The dollar

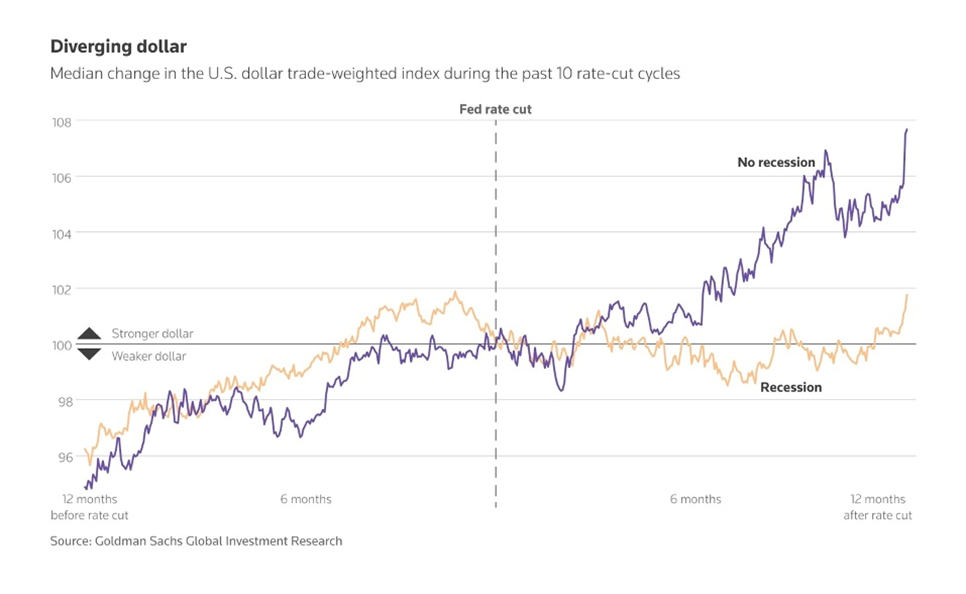

Conventional wisdom would seem to indicate that falling interest rates results in a weaker dollar. Getting back to the Reuters analysis, the dollar’s performance again depends on the state of the US economy.

An analysis by Goldman Sachs quoted by Reuters found that the greenback strengthened a median 7.7% against a basket of currencies after the first rate cut when the economy was not in recession. The data is based on 10 prior cutting cycles. In fact the dollar even gained when the economy was in recession, by 1.8%.

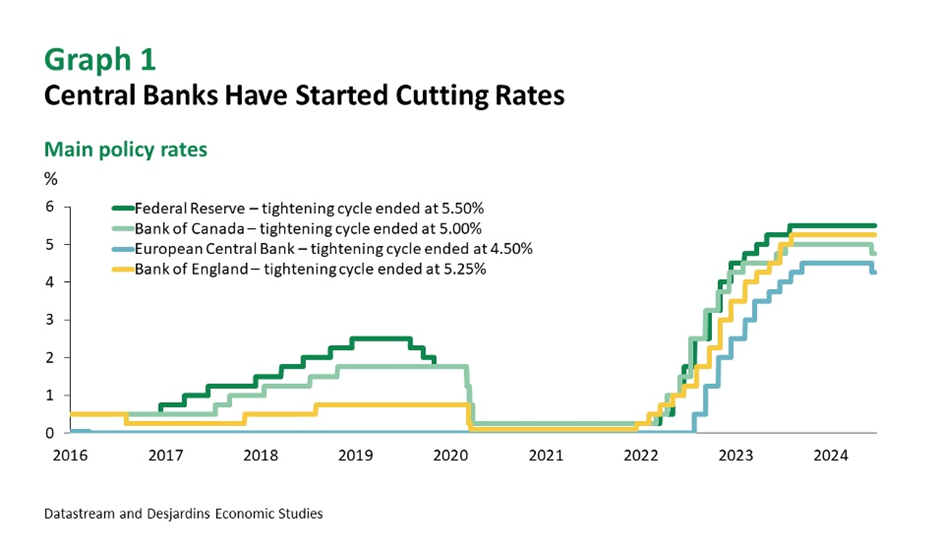

The dollar also tends to outperform other currencies when the US cuts alongside a number of central banks. So far the European Central Bank, the Bank of England, the Swiss National Bank, and the Bank of Canada have all slashed rates.

By contrast, when the rate-cut cycle sees relatively few major banks cut rates, the dollar’s performance weakens.

The US dollar index, which measures the greenback’s strength against a basket of currencies, has fallen off a cliff since late June, barely holding above 100.

Again in depends on what happens to the economy as far as which direction the dollar goes.

Analysts at BNP Paribas quoted by Reuters said, “We think the Fed would be likely to cut by more than other central banks in a potential recession scenario this time around, further eroding the (dollar’s) yield advantage and leaving the currency vulnerable.”

Commodities

In June Desjardins published a report concluding that “the start of the rate cut cycle will lift commodities.”

The first two graphs show that central banks had already started cutting rates in June, with their tightening cycles ending at about 5.0%.

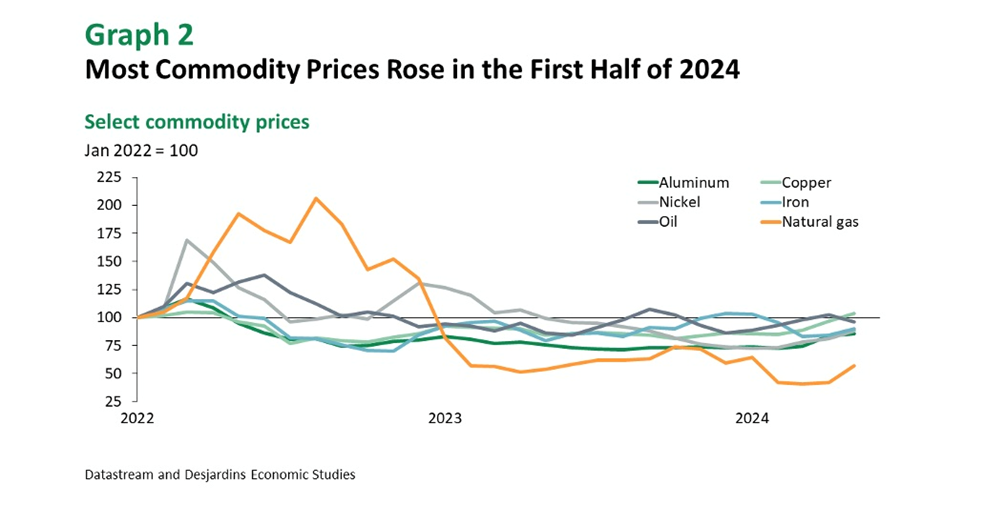

The second graph shows a selection of commodities all gained in the first half of 2024.

The report’s authors believe that base metal prices are rising “just a little too fast.” Of course the report was written six months into the year and since then some commodity prices have slipped. Copper for example peaked at $5.10 a pound on May 21, fell as low as $3.89 on Aug. 7, and is now trading at $4.23.

Desjardins forecasts the rate cut cycle and renewed growth in Europe suggests demand for aluminum will heat up. Copper shortage fears in light of the energy transition elevated copper to a high not seen since its 2021 peak of US$10,800 a ton. But Desjardins says the price of copper is expected to slip back from this May 21 peak, and it did. “The outlook for copper prices nevertheless remains rosy for the next few quarters, yet gains are likely to be more modest than in the first half of the year,” the report says.

The trend of rising nickel prices in reaction to protests in New Caledonia, a major nickel producer, along with stronger manufacturing activity, reversed as oversupply weighed on prices, as the chart below shows. However, social unrest in the French territory could keep the risk premium on nickel prices in place for some time, states Desjardins.

On June 24, Aljazeera reported protesters set several buildings in fire including a police station and a town hall, after pro-independence activists were arrested and taken to France.

China, which buys about 75% of all seaborne iron ore, is expected to trim its main policy and benchmark lending rates on Friday, Reuters said, after the Fed’s outsized rate cut removed some risk around sharp yuan declines.

Prices of the steelmaking ingredient rose on Thursday, “as prospects of fresh Chinese monetary stimulus and lower inventories overshadowed concerns of the top consumer’s weakening domestic demand.”

Desjardins said it’s only expecting a modest uptick in global demand because, even though some central banks have already started cutting interest rates, it will be some time before rates go down far enough to make a difference.

After iron ore hit a one-week high on Sept. 12, Reuters reported that Chinese steelmakers have built up their inventory of imported iron ore recently to prepare for the upcoming Mid-Autumn Festival holiday over Sept. 15-17, as replenishment is expected to become less convenient during holidays, Chinese consultancy Mysteel said.

The restocking of inventories may lead to a rebound in iron ore demand in the short term, Chinese financial information site Hexun Futures said.

The gold price hit a fresh record-high $2,590.47 in mid-day trading Thursday, with investors reacting to the 50-bp cut the day before. Gold has an inverse relationship to interest rates. As rates go lower, gold typically gains in price. The precious metal is up 25% so far this year.

Gold also moves higher on a weaker dollar. Fed policymakers projected the benchmark interest rate would fall by another half of a percentage point by the end of this year, a full percentage point next year, and half of a percentage point in 2026, Reuters said Thursday, quoting Alex Ebkarian, chief operating officer at Allegiance Gold, saying:

“The market is factoring in bigger and more rate cuts because we have both fiscal and trade deficits, and that’s going to further weaken the overall value of the dollar. If you combine geopolitical risks with the current deficit that we have, along with the low yielding environment and weaker dollar, the combination of all these is what’s leading to gold’s rally.”

Because gold thrives in a low-rate environment, UBS and Goldman Sachs are targeting $2,700 by early to mid-2025.

Silver is also benefiting from the rate cut, with the spot price rising 3.5% to $31.11 an ounce, Thursday. “We maintain our view that silver is set to benefit from a rising gold price environment,” UBS added.

In the shorter term, there is a good chance that the rate cut is already baked into the gold price, limiting the opportunity for gains, CBC News said in an article titled, ‘What will happen to gold prices after the Fed cuts rates?’

Other experts expect bigger price increases in the coming months. Citi analysts, for example, predict $3,000 in the next six to 18 months.

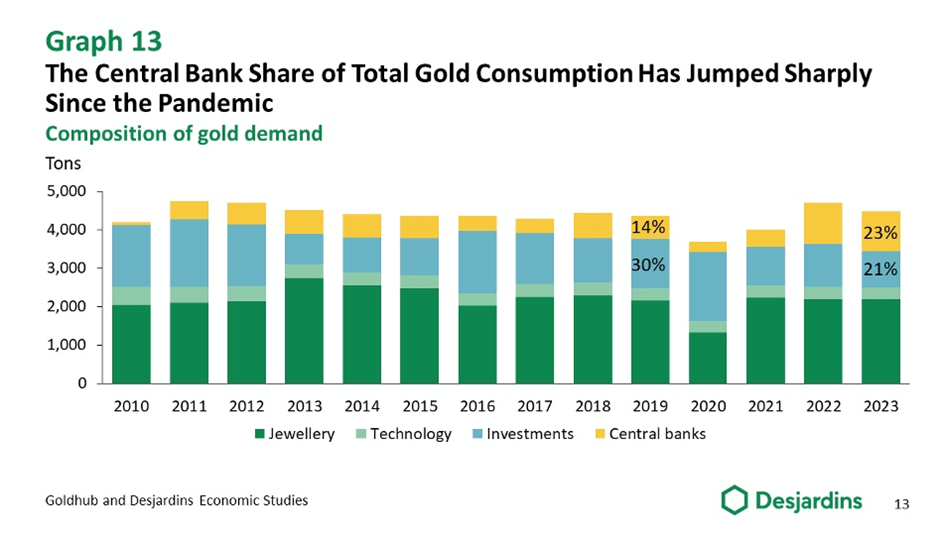

Beyond rate cuts, other demand drivers for gold include continued bullion purchases by central banks, sustained physical demand from Asian investors, greater gold ETF demand in coming months (says UBS), and safe-haven demand due to ongoing geopolitical conflicts.

Recently we commented on gold supply.

According to a recent analysis by S&P Global, gold discoveries around the world have become more scarce and smaller, dampening the outlook for future supply of the metal.

The report via Mining.com found there have only been five major gold discoveries since 2020 adding about 17 million ounces. A major gold discovery was defined as containing 2 million ounces in reserves, resources and past production.

What S&P is really saying in its report is that there is no money for the juniors!

The report ballyhoos the fact that, despite there being a lack of new discoveries in the past decade, increasing gold budgets “brings a tad of optimism for the future of gold supply, as the number of initial resource announcements continues to grow in size and number.”

Optimism for whom? Certainly not junior resource companies.

S&P research analyst Paul Manalo said, “Based on the latest monthly Gold Commodity Briefing Service, we expect gold supply to peak in 2026 at 110 million ounces, driven by increased production Australia, Canada and the US — countries that also account for the most discovered gold.”

He added that gold supply is expected to fall to 103 million ounces in 2028, resulting from a decline in supply from these countries.

As for peak gold, it’s already here.

In 2023, 4,448 tonnes of gold demand minus 3,644t of gold mine production left a deficit of 804t. Only by recycling 1,237t of gold jewelry could the demand be met. (The World Gold Council: ‘Gold Demand Trends Full Year 2023’)

In the second quarter of 2024, gold demand reached its highest second quarter on record, but supply still failed to keep pace. Mine production of 929.1 tonnes fell short of total gold demand of 1,258.2 tonnes. Only by recycling 335.4 tonnes could Q2 gold supply meet Q2 demand.

Metals security of supply depends on junior resource companies — Richard Mills

World markets

The Fed’s first rate cut in four years is sure to resonate around the world, well beyond US borders.

Reuters summarized what’s in focus for world markets, lightly edited below:

- Confidence in Fed cuts starting is a boon for bond markets globally that often move in lock step with Treasuries. US, German and British government bond yields are all set for their first quarterly fall since end-2023, when a Fed pivot was anticipated.

- Lower U.S. rates could give emerging market central banks more room for maneuver to ease themselves and support domestic growth. Around half of the sample of 18 emerging markets tracked by Reuters have already started cutting rates in this cycle, front-running the Fed, with easing efforts concentrated in Latin America and emerging Europe.

- Those economies hoping US rate cuts will weaken the robust dollar further, lifting their currencies, may be disappointed. JPMorgan notes the dollar has strengthened after a first Fed cut in three out of the last four cycles.

- A global equity rally, which faltered recently on growth fears, could resume if lower US rates boost economic activity and means recession is avoided.

- In commodities, precious and base metals such as copper should benefit from Fed rate cuts, and for the latter the demand outlook and a soft landing are key.

Conclusion

We started out this article asking what a rate cut means for the market.

The answer to a large extent depends on whether we get a soft landing or a hard landing. I’ve been right all along in predicting the Fed would pause its rate-hiking cycle in 2023, wait to see what happens, then slash rates at its September meeting.

While I wasn’t expecting the 0.5% reduction, I feel confident forecasting that the rate easing cycle will continue well into the new year. If a recession occurs at all, I do not see it until late in 2025.

While the inverted yield curve is a reliable recession indicator, we agree with the economist who believes this time is different. “The yield curve could steepen significantly without a recession materializing, especially as the Fed transitions to an easing cycle,”saysEd Yardeni.

During non-recessionary periods, the S&P 500 gains 14% in the six months following the first rate cut. The index is up 18% so far this year.

If rate cuts continue, Treasury yields will likely continue falling. The 10-year yield has fallen a median nine basis points in the month following the first cut in the last 10 rate-cutting cycles.

On the other hand, if the markets perceive a recession, bond yields could climb. An expert quoted by MarketWatch said she thinks the 10-year yield could end the year north of 4%, and even at 4.25%.

Conventional wisdom would seem to indicate that falling interest rates result in a weaker dollar.

However, an analysis by Goldman Sachs quoted by Reuters found that the greenback strengthened a median 7.7% against a basket of currencies after the first rate cut when the economy was not in recession. The data is based on 10 prior cutting cycles. In fact the dollar even gained when the economy was in recession, by 1.8%.

The dollar also tends to outperform other currencies when the US cuts alongside a number of central banks. So far the European Central Bank, the Bank of England, the Swiss National Bank, and the Bank of Canada have all slashed rates.

A strong dollar isn’t good for commodities, but in June, Desjardins published a report concluding that “the start of the rate cut cycle will lift commodities.”

Desjardins is bullish on base metals, including copper, nickel and aluminum, and precious metals gold and silver.

Demand drivers for gold include rate cuts, continued bullion purchases by central banks, sustained physical demand from Asian investors, greater gold ETF demand in coming months, and safe-haven demand due to ongoing geopolitical conflicts.

When peak gold and a dearth of new discoveries are introduced to the mix, gold, and silver, which often follows gold’s trajectory, look like great investments in this new macro environment of monetary easing.