The mantra? Our fossil-fueled based transportation system needs to be 100% electrified, and the switch must be made from oil, gas, and coal-powered power plants to those which run on solar, wind and nuclear energy. If we have any hope of cleaning up the planet, before the point of no return, a massive decarbonization needs to take place.

This has to involve a colossal boost in the production of mined metals, including lithium, graphite, cobalt and nickel for lithium-ion batteries used in EVs, renewable energy grid storage and consumer electronics; copper for electric vehicle motors, charging stations and renewable energy plants; silver for solar panels and EVs.

By attempting to break free of fossil fuels though, are we setting ourselves up for a new dependence on critical metals, including lithium, graphite, cobalt, nickel, even copper? A dependence that brings with it the threat of environmental devastation?

Renewable energy proponents are reluctant to discuss the harsh labor conditions or non-existent environmental regulations associated with mining many of the battery and energy metals.

Done improperly, mineral extraction has the potential to damage local communities and ecosystems, destroying cultures and biodiversity in the process.

The most obvious example is the DRC, where the majority of the world’s cobalt, a key ingredient in lithium-ion batteries, is mined, often by children in dangerous working conditions.

In a previous article, we wrote that life expectancy in the Democratic Republic of Congo is less than 48 years, one of five children will die before age five, and almost 60% of the country’s 71 million people live on less than $1.25 per day.

The DRC is also racked by political violence in eastern Congo, where clashes between the DRC’s army and Rwanda’s Tutsi-led rebels have killed scores of people and displaced hundreds of thousands.

IRA blowback: restricting imports slowing electric vehicle adoption

Unfortunately, nickel mining appears to be following the same example of the Congo, not “blood cobalt” extracted from mines run by warlords, but nickel mined from equatorial laterite deposits and processed using the environmentally damaging HPAL technique.

And China has been a very willing player having invested heavily in Indonesia, building smelters and using their technology to produce battery-grade nickel cheaply, though at a horrendous cost to the environment.

Cheap Indonesian nickel, controlled by China and dumped on the market, has collapsed nickel prices and forced global mine closures.

Battery- and auto-makers seem unaware, or don’t care, where the nickel for their batteries comes from, or about the destructive and horribly polluting way its processed. All they care about is bringing down the cost of battery raw materials and electric-vehicle sticker prices – to make EV’s as price competitive to ICE vehicles as possible – by receiving the full credit available under President Biden’s IRA (Inflation Reduction Act).

Leading to the question: What’s the point of making supposedly “clean & green” battery components when the refining process is so dirty and environmentally damaging? Why switch from fossil fuels to electrification if mining the metals required for renewables and EVs uses coal-fired power and damages, wrecks, the environment the energy transition is trying to save?

Nickel sulfides vs laterites

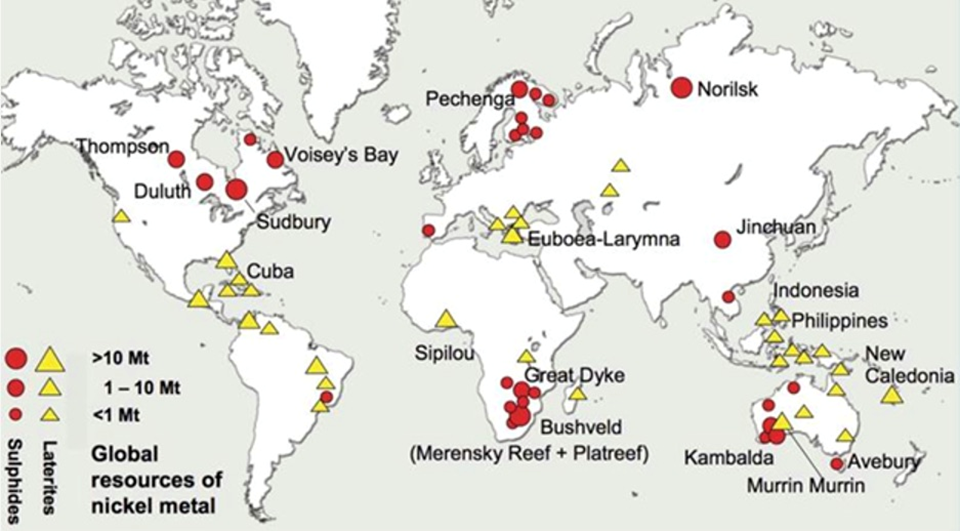

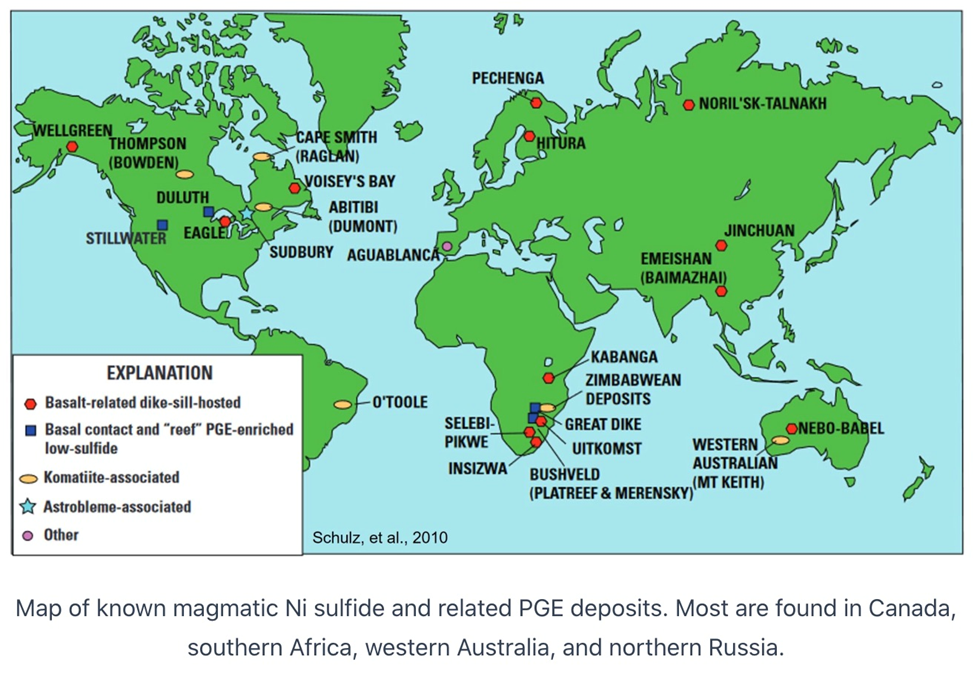

Nickel deposits come in two forms: sulfide or laterite. About 60% of the world’s known nickel resources are laterites, which tend to be in the southern hemisphere. The remaining 40% are sulfide deposits.

Source: Geology for Investors

Source: Geology for Investors

Nickel sulfide deposits, the principal ore mineral being pentlandite (Fe,Ni)9S8, are formed from the precipitation of nickel minerals by hydrothermal fluids. They are also called magmatic sulfide deposits. The main benefit of sulfide ores is that they can be concentrated using a simple separation technique called flotation.

Nickel laterite deposits — the principal ore minerals are nickeliferous limonite (Fe,Ni)O(OH) and garnierite (a hydrous nickel silicate) — are formed from the weathering of ultramafic rocks and are usually operated as open pit mines. There is no simple separation technique for nickel laterites. The rock must be completely molten or dissolved to enable nickel extraction.

Historically, most nickel was produced from sulfide ores, including the giant (>10 million tonnes) Sudbury deposits in Ontario, Canada, Norilsk in Russia and the Bushveld Complex in South Africa.

It used to be that there were two markets for nickel: the higher-grade, or Class 1 nickel went into batteries, and the lower-grade, Class 2 material was used to make stainless steel.

The higher-grade nickel was derived from sulfide nickel deposits in the northern hemisphere, whereas the lower-grade stuff came from nickel laterite deposits found along the equator, for example Indonesia, the Philippines and New Caledonia.

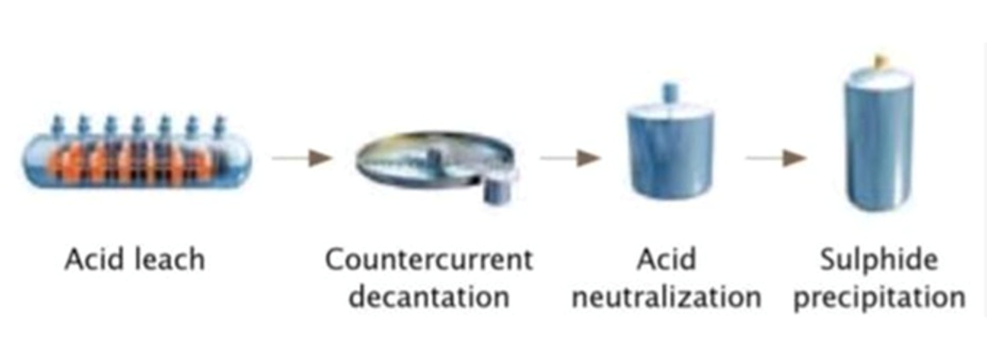

Up to now, the main method for processing laterites ores has been High Pressure Acid Leaching.

HPAL involves processing ore in a sulfuric acid leach at temperatures up to 270 degrees C and pressures up to 600 psi to extract the nickel and cobalt from the iron-rich ore; the pressure leaching is done in titanium-lined autoclaves.

Counter-current decantation is used to separate the solids and liquids. Separating and purifying the nickel/cobalt solution is done by solvent extraction and electrowinning.

The advantage of HPAL is its ability to process low-grade nickel laterite ores, to recover nickel and cobalt. However, HPAL is unable to process high-magnesium or saprolite ores, it has high maintenance costs due to the sulfuric acid (average 260-400 kg/t at existing operations), and it comes with the cost, environmental impact and hassle of disposing of the magnesium sulfate effluent waste.

Submarine Tailings Disposal (STD) / Deep Sea Tailings

HPAL breakthrough

China saw an opportunity to exploit lower-grade nickel deposits in Indonesia, and have used their capital to build smelters in the country, and their technology to process the nickel into battery-grade material.

Traditionally, processing nickel laterite deposits was more expensive than sulfides, but China has changed the game. As Bloomberg reported recently,

Many of the world’s biggest nickel mines are facing an increasingly bleak future as they wake up to an existential threat: a near limitless supply of low-cost metal from Indonesia…

A huge Indonesian expansion of low-grade production led to a surplus, and, crucially, processing innovations have allowed that glut to be refined into a high-quality product.

The world’s largest nickel producer, China’s Tsingshan Holding Group, shocked the nickel world in 2018 by announcing a $700 million plan to produce battery-grade nickel.

Now, a new generation of HPAL is being used to turn Indonesia’s lower-grade nickel ore into metal suitable for powering electric vehicles. Working with Ningbo Lygend Mining Co., Harita Nickel became the first in Indonesia to process the ore into mixed hydroxide precipitate or MHP, Bloomberg reported last year.

Its Obi Island operation is one of three producing HPAL operations, with nearly $20 billion of further projects announced.

A venture combining Zhejiang Huayou Cobalt Co., CMOC Group and Tsingshan Holding Group Co. — Huayue Nickel Cobalt — has built a $1.6 billion plant on the island of Sulawesi. GEM Co. has backed a separate $1.6 billion facility nearby.

Until this new generation, HPAL was known mostly for cost over-runs and delays.

“China has done with HPAL in Indonesia what they did with nickel pig iron in China 20 years ago,” Angela Durrant, principal nickel analyst at Wood Mackenzie, was quoted saying. “It’s like teaching a child something new again and again — and suddenly they get it. Then they run with it, they catapult onward. This is what Indonesia is doing with China’s technology.”

According to AME Research, HPAL uses ore grades as low as 0.9% Ni, and it costs Harita Nickel just $5,225 a ton, 48% less than with electric-furnace smelters. The process also yields cobalt, a bonus for batteries.

Yet the dark side of HPAL remains.

While making MHP is less carbon-intensive than producing battery-grade nickel through coal-powered smelting, the latter forms the bulk of Indonesia’s capacity.

HPAL produces nearly double the amount of tailings that need to be treated and stored, raising the risk of severe contamination.

Bloomberg says Harita presses the water out of its waste slurry then stacks the dry soil in former mine sites (dry stack tailings), but there’s not enough space. The company proposes building a tailings dam but that comes with its own set of problems, including leakage.

While Indonesia banned the controversial practice of “deep sea tailings” — dumping waste into the ocean via a submerged pipeline — in 2021, imo, this is still happening. For example Ramu, the plant in Papua New Guinea that inspired Harita, still does it, Bloomberg said.

In 2022, China’s CNGR Advanced Material Co said it will invest in three new projects in Indonesia to produce nickel matte — adding to the two nickel matte projects the company is already funding on the island of Sulawesi with Singapore-based Rigqueza International.

The process however is highly energy-intensive and polluting, more so than HPAL and about four times dirtier than traditional nickel sulfide processing.

“The technology is definitely real, but does not meet ESG standards,” Bloomberg quoted Jon Lamb, portfolio manager at metals and mining investment firm Orion Resource Partners.

China’s gain

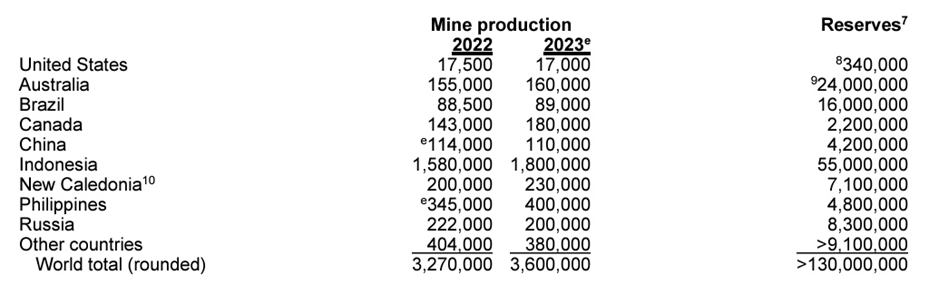

Despite the environmental costs, Indonesia’s HPAL and matte projects have pushed the nickel market into surplus. The archipelago nation now accounts for more than half of world supply, with the potential to reach three-quarters of all production toward the end of the decade.

The problem is that much of this nickel is locked up in offtake agreements and will never reach Western end users. In a recent article, Reuters notes that Indonesian nickel, in the form of nickel pig iron (NPI) has been used to feed China’s stainless steel industry, and continues to do so; NPI remains the largest-volume category of trade between the two countries, growing 47% in 2023.

More recently, however, Chinese nickel imports have including rising amounts of matte and MHP.

After Indonesia banned exports of nickel in 2020, to build its domestic nickel refining sector, China’s NPI producers started building processing capacity in Indonesia itself.

China’s nickel matte imports have exploded from 10,8000 tons in 2020 to 300,500 tons in 2023, with Indonesia accounting for 93% of the total. Imports of MHP grew from 336,000 tons in 2020 to 1.32Mt last year, 63% of which came from Indonesia.

“The exponential growth in this Sino-Indonesian trade reflects the continuing boom in Indonesian production that followed the country’s ban on exports of unprocessed ore,” writes Reuters metals columnist Andy Home.

By 2023, there were 43 nickel smelting facilities in operation, 28 under construction and 24 more being planned, according to The Oregon Group. Indonesia is now the world’s largest nickel producer, mining 37% of global supply and forecast to increase to two-fifths by 2030, states Benchmark Mineral Intelligence in an article.

Source: USGS

Source: USGS

Nickel price collapse

Chinese companies refining battery-grade nickel from Indonesia have flooded the market, pushing prices down about 45% last year and making about half of all nickel operations unprofitable.

Source: Trading Economics

Source: Trading Economics

Last week Anglo American took a $500 million writedown on its nickel business. This week, BHP’s CEO Mike Henry said the company will have to decide whether to shutter its flagship nickel business in Australia; $2.5 billion of its Western Australia Nickel operations has already been written down.

Glencore, one of the world’s biggest producers, is closing its nickel operations on the islands of New Caledonia. The company’s Murrin Murrin nickel-cobalt mine in Western Australia will keep producing for now, despite Glencore’s call for “persistent oversupply”.

According to Macquarie Group, about 250,000 tons of annual production has been taken out of the market by closures, with another 190,000 tons of planned output delayed. The Australian bank says at $18,000 a ton, 35% of production is unprofitable; at $15,000 that number jumps to 75%. LME nickel is currently trading at $17,665.

A Bloomberg chart using Macquarie data shows 150-175,000 tons of annual nickel oversupply lasting until 2027.

Indonesia recently warned struggling producers not to expect any meaningful price revival. The government official overseeing the nickel boom reportedly said prices are unlikely to rise above $18,000 a tonne, and that the country will ensure the market remains well supplied to keep costs lower for electric-vehicle manufacturers.

The official also said prices shouldn’t drop below $15,000, lest Indonesian smelters be forced to cut production below that level.

US-Indonesia FTA?

Additionally, he noted that several European automakers have been aggressively approaching Indonesian miners to lock up supply deals.

Companies like Volkwagen and Stellantis are competing with American firms like GM, Ford, Tesla and Rivian, that are concerned about China dominating the global battery supply chain.

But, rather than taking steps to mine/ process critical minerals domestically, the US government instead is pursuing a trade deal with Indonesia. Incredibly, such a deal would allow the island chain’s China-controlled nickel mining and processing industry to take advantage of provisions in the Inflation Reduction Act aimed at reducing US dependence on China.

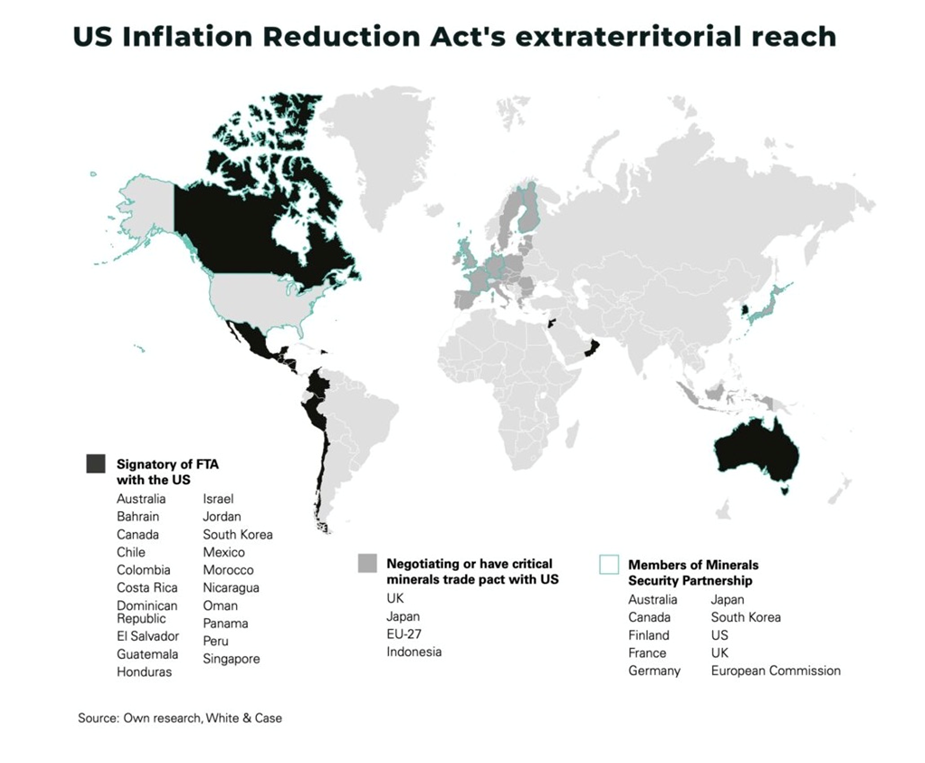

The Inflation Reduction Act aims to grant incentives to companies that source their battery materials within the US and outside of China.

Passed by the Biden administration in 2022, the IRA provides US consumers tax credits of up to $7,500 per electric vehicle, if the parts or materials are sourced from the United States, or from countries with which the US has a free trade agreement. This includes lithium, graphite, cobalt and other critical minerals.

As well as offering consumer incentives, the IRA subsidizes up to 30% of manufacturing costs related to battery cell assembly and battery pack production, helping to encourage carmakers and battery suppliers to invest in US-based supply chains.

(Remember, the Biden administration prefers to leave “dirty” mining and mineral processing to foreign countries, and instead invest in cleaner, more upstream activities like battery EV manufacturing.)

IRA blowback: restricting imports slowing electric vehicle adoption

One of the first things the Biden administration did upon passing the IRA was to send officials to the DRC to try and secure a steady supply of cobalt, an important EV battery ingredient. They did this despite major miners and big tech companies fleeing the country because they don’t want to be associated with child labor and environmental destruction from illegal mining.

The next thing they did was to start negotiating a free trade agreement with Indonesia. At the end of November, The Oregon Group reported that The US and Indonesia are in talks on a potential critical minerals trade partnership to secure supply chains between the two countries, with Indonesia requesting a limited free trade deal.

Not content with being the almost sole supplier of NPI and battery-grade nickel to China, Indonesia has set its sight on the US market. The Inflation Reduction Act announced investments of more than USD$365 billion in clean energy programs and is expected to stimulate about $3.5 billion in private capital spending on the energy transition.

“Indonesia is a producer and holder of the world’s biggest nickel reserves amounting to 21 million metric tons, so Indonesia can become a supplier for … batteries and EVs in the US,” said Indonesian President Joko Widodo.

The first problem with the United States partnering up with Indonesia is the country has employed what some have considered unfair trade practices in banning the export of raw nickel ores. This is also a form of resource nationalism. The European Union has contested the export ban at the World Trade Organization.

The second problem is a trade agreement goes against the spirit of the Inflation Reduction Act, which is to reduce US dependence on China. To qualify for IRA tax credits, a company processing and/or extracting critical minerals must get the minerals from the US or a country with a free trade agreement, not a “foreign entity of concern”. China is among the four nations currently deemed a FEOC; the others are Russia, North Korea and Iran.

Source: The Oregon Group

Source: The Oregon Group

Yet according to The Oregon Group,

A free trade deal between Indonesia and the US would allow Indonesia access to domestic US tax credits and give US electric automakers access to 37% of the world’s supply nickel and the second largest cobalt supplier.

Let’s remember that Indonesia’s nickel industry was set up, bought and paid for by China.

“Indonesia now has three plants capable of producing 164,000 metric tons/year of Mixed Hydroxide Precipitate (MHP), a nickel intermediate suitable for battery production, and over 25 more such plants have been proposed. All but three involve PRC companies,” states United States Trade Representative Katherine Tai, in Concerns Regarding a Potential Critical Minerals Trade Agreement.

A 2022 report by New York-based China Labor Watch said Chinese companies have invested more than $30 billion in Indonesia’s nickel supply chain. (ABC News, Nov. 4, 2023)

It should be noted that US-Indonesian rapprochement has not gone un-noticed in Washington. The Oregon Group states:

In October, a bipartisan group of nine US senators, sent a letter “to express concern regarding media reports of a potential critical minerals “limited free trade” agreement between the United States and Indonesia.”

The senators highlight concerns over domestic sourcing opportunities, as well as trade, labor and environmental concerns.

And there has already been calls by US senators for an investigation into Ford’s plan to invest and partner in Indonesia.

The third problem regarding an FTA with Indonesia is the way Indonesia processes nickel, i.e., using the highly polluting HPAL process and the even dirtier means used to produce nickel matte utilizing deep-sea tailings. If the goal of the IRA is to provide financial incentives for clean energy, why should Indonesian nickel producers, most of which are Chinese, be allowed to benefit from it when what they are doing is anything but green?

While Indonesia’s president has promised to clean up the industry and monitor mining standards, alleviating carbon dioxide emissions and tailings from HPAL plants will arguably be difficult if not impossible.

The Oregon Group concludes, and we agree, that the United States will not sign a free trade agreement with Indonesia because of concern over China’s influence there — especially in an election year.

However, note that several automakers hold no such grudges against China, and have been more than willing to invest in Indonesia. This includes Ford, which signed an agreement with an Indonesian unit of nickel miner Vale and China’s Zhejiang Huayou Cobalt to partner in a $4.5 billion HPAL plant; Hyundai, which in 2023 opened a new plant with a $1.55 billion investment to produce Indonesia’s first locally assembled electric car; and Mitsubishi’s plan to invest $372.25 million in the country this year to expand its EV production capacity.

Toyota and Volkswagen are also looking at agreements worth a respective $1.8 billion and $4.7 billion.

We also agree with The Oregon Group’s statement,

A deal with Indonesia would significantly undermine US efforts to produce a domestic, secure supply of nickel — with a significant knock-on effect across the global critical minerals and mining industry.

Note that the United States only has one operating nickel mine, Eagle in Michigan, but it plans to close by 2026. There are no nickel smelters.

It’s estimated that countries with a free trade agreement with the US only account for 9.3% of global nickel production. This presents a liability, in terms of security of supply, but also an opportunity, in that some FTA countries, like Canada, have sulfide nickel reserves that could be tapped, and government-supported, to make battery-grade nickel that is a lot cleaner than the kind being produced in Indonesia.

We are pleased to see some overtures in this direction. As The Oregon Group mentions, a proposed nickel mine in Minnesota has received $20.6 million from the Department of Defense and $115 million from the Department of Energy to help build Talon Metals’ (TSX:TLO) ore processing plant in North Dakota.

Large scale low grade ultramafic nickel deposits

The supply of industrial metals that will power the global energy transition has increasingly become a concern.

“Large scale low-grade ultramafic nickel deposits are the only potential multicycle scalable sources of large quantities of nickel required to meet massive new nickel demand from electric vehicles and continued strong growth from stainless steel. The original example of this type of deposit is [Australia’s] Mt. Keith — successfully built and operated by BHP’s nickel business for more than 25 years as one of the largest nickel sulphide mines in the world.

BHP has now developed a similar scale sister deposit — Yakabindie, and [last] year, acquired the Honeymoon Well deposit. While many investors are familiar with high-grade nickel discoveries in Western Australia, and Sudbury – it is important to note that [low-grade] Mt. Keith has remained open through many nickel cycles while the high grade deposits at Kambalda [Western Australia] have been shut for many years — highlighting some insights into the underlying economics.

large, low-grade deposits can be very profitable even at their low grades and recovery levels, as the revenue generated from each tonne of material is a multiple of the operating costs. The copper industry moved to large low-grade deposits several decades ago and a generation of companies generated hundreds of millions/billion of dollars for shareholders by advancing these projects during the prior past 2 decades. These nickel deposits represent a whole new generation of investment opportunities which could be even more lucrative for those investors prepared to do the work and trapped in investment paradigms that stopped being meaningful 20 years ago. If these type of deposits are good enough for BHP Billiton, they should be good enough for the rest of us.”

Can Low-Grade Bulk Nickel Ever Be Profitable?

Capital intensity for new nickel mining has gone through the roof. The discrepancy between the initial per-pound capital cost of nickel projects and the ultimate construction cost is over 50%. Larger-scale projects have not demonstrated lower per-unit capital costs. Sometimes large projects have even higher capital intensity. Thats all because global nickel supply is increasingly coming from laterite nickel deposits, which require high-pressure acid leach (HPAL) plants.

We are now looking at north of $35 per pound capital intensity as we move into these multibillion-dollar ferronickel and HPAL projects.

Other companies exploring for sulfide nickel in Canada and the US include FPX Nickel (TSXV:FPX), Renforth Resources (CSE:RFR), Canada Nickel (TSXV:CNC), and Flying Nickel Mining (TSXV:FLYN).

Dark side of green

Something nobody in the clean-tech, green-energy space likes to talk about is the “dark side of green”. This can be seen as a hidden cost of electrification/decarbonization.

Batteries for electric vehicles and grid-scale energy storage are great ideas, but we must remember, these are only devices to store energy. The electricity that goes into them has to come from somewhere. If it’s from coal, natural gas or oil, it cannot be considered green.

Moreover, the extraction of minerals for battery components may be extremely polluting, depending on where the mining/processing takes place and how.

What’s the point of making “green” battery components when the refining process is so dirty?

In China’s Inner Mongolian city of Baotou, dozens of pipes churn out a torrent of thick black chemical waste that flows into an artificial lake filled with toxic sludge. A constant smell of sulfur pervades the apocalyptic scene. Most people in the West haven’t heard of Baotou but its mines and factories are one of the biggest suppliers of rare earth minerals used in a plethora of so-called green applications, everything from wind turbines to electric vehicles to nuclear reactors.

The ecological risks of rare earth mining aren’t confined to China, which mines and processes most of the materials.

This includes air pollution, biodiversity loss, desertification/drought, food insecurity (crop damage), loss of landscape/aesthetic degradation, soil contamination, soil erosion, waste overflow, deforestation and loss of vegetation cover, surface water pollution, decreasing water quality, groundwater pollution or depletion, mine tailings spills, and large-scale disturbance of hydro and geological systems.

In 2019 Malaysian environmental groups demonstrated over concerns about radioactive waste from Australian rare earths miner Lynas Corp’s processing plant located there.

In Indonesia, nickel is produced from laterite ores using the environmentally damaging HPAL technique. The advantage of HPAL is its ability to process low-grade nickel laterite ores, to recover nickel and cobalt. However, HPAL employs sulfuric acid, and it comes with the cost, environmental impact and hassle of disposing the magnesium sulfate effluent waste.

Most of four HPAL plants currently under construction, led by Chinese stainless-steel producers and battery makers, plan to continue the environmentally egregious practice of Deep Sea Tailings (DST), due to the much higher cost of managing the tailings on land.

Chinese nickel pig iron producers in Indonesia now are looking to make nickel matte, from which to turn laterite nickel into battery-grade nickel for EVs. The process however is highly energy-intensive and polluting, as well as far more costly than a nickel sulfide operation (up to $5,000 per tonne more).

According to consultancy Wood Mackenzie, the extra pyrometallurgical step required to make battery-grade nickel from matte will add to the energy intensity of nickel pig iron (NPI) production, which is already the highest in the nickel industry. We are talking 40 to 90 tonnes of CO2 equivalent per tonne of nickel for NPI, versus under 40 CO2e/t for HPAL and less than 10 CO2e/t for traditional nickel sulfide processing.

Mining practices in the Democratic Republic of Congo (DRC) have elevated the issue of “conflict minerals” to the public consciousness, with stories of armed groups operating cobalt mines dependent on child labor. Environmental standards are non-existent.

Rare earths mining and processing in China, the extraction and refining of laterite nickel in Indonesia, and cobalt mining in the Congo, are three good examples of the disconnect between the rhetoric being delivered lately regarding the so-called new green economy, and reality.

In many respects the widely touted transition from fossil fuels to renewable energies, and the global electrification of the transportation system, are not clean, green, renewable or sustainable.

Conclusion

China and Indonesia are killing the nickel market, flooding it with cheap laterite production they make into nickel chemicals suitable for batteries. The nickel price fell 45% last year and there hasn’t been much improvement so far in 2024.

Some of the largest nickel producers are closing mines. Indonesia is promising to keep ramping up production keeping supplies adequate and prices low.

Indonesia is by far the largest nickel producer, with a mined output in 2023 of 1.8 million tonnes. Traditionally, Indonesia sent nickel pig iron to China for processing into stainless steel. They still do that, but now, the refined nickel exports to China include the battery chemicals nickel matte and mixed hydroxide participate (MHP).

China has invested tens of billion into Indonesia, building smelters and using their technology to dominate the nickel market. In this way, it’s no different from the choke hold China has put on cobalt — mined in the DRC then sent to China for processing — rare earths, steel, copper etc.

Beijing is now the world’s critical minerals processing hub, but the West is doing very little to stop it. For nickel, the response is to close nickel mines until prices go back up. That’s not going to happen, they might think it’s the right thing to do for shareholders, but it doesn’t do anything to improve security of nickel supply for the West or help the environment. Remember too, that Indonesia has built its nickel industry through resource nationalism — mandating that no raw nickel be exported and that it be beneficiated, refined and smelted locally — a mercantilist policy that goes against the spirit of free trade and the US’s “Friend Shoring” policy.

The worst part of this is what Indonesia’s nickel industry is doing to the environment. We’re supposed to be putting clean power into batteries to electrify the world and save ourselves from fossil fuels, yet China and Indonesia are using coal-fired smelters to produce battery-grade nickel using HPAL, which creates far more carbon emissions than sulfide nickel operations do, and ends up with tailings that are dumped into the sea.

Though Deep-Sea Tailings (DST) was suppose to be banned in 2021 it’s still happening.

It all leads to an existential question: If the processes for refining nickel aren’t clean and green, why are we using them in the energy transition?

We’d be better off sticking to fossil fuels.

At least some of the responsibility for countering cheap Indonesian nickel built, bought and paid for by China, lies on the demand side. While at least one US company, Ford, has inked a supply deal with Indonesia, the US government could use the Inflation Reduction Act to prohibit the use of Indonesian nickel by battery-makers.

Instead of trying to negotiate a free trade agreement with Indonesia that allows nickel buyers to access tax credits and subsidies contained within the IRA, US officials should, imo, recognize the influence that China has on Indonesian nickel and simply ban it from the IRA. Treat it the same as any other mineral not produced by the United States or a country the US has a free trade agreement with. Ban it not only because it isn’t green, but because it’s produced by Chinese-owned smelters and sold back to China.

In my opinion there also needs to be an attitude change, about how North American governments feel about mining and refining. One solution to ending the China/Indonesia nexus for nickel, or the China/DRC nexus for cobalt, is to explore for and develop mineral deposits here. Currently we have kind of a “plantation mentality” — we want the dirty mining to happen somewhere else, and we want the value-added upstream part of the supply chain to happen here.

We’ve written about this before.

‘Not hard to dig a hole’, anti-mining Democrats say

Paraphrasing ‘It’s not that hard to dig a hole and process the stuff, anybody can do that, we’ll leave the dirty part for others. We’re focused on creating jobs that take the ore and battery chemicals mined and refined elsewhere and transforming them here into electric vehicles.’

Such a plan would cut US reliance on industry leader China for EV materials while also enticing unions with manufacturing work.

The current administration wants to go the easy route and get its battery raw materials from places like Indonesia and the DRC, but the problem is that these jurisdictions are controlled by China — the very country the US is trying to take out of its supply chain. Not only that, the mineral processing methods China uses are not green, which casts doubt on the entire electrification enterprise, the end goal of which is to clean up the environment and save the planet from global warming/ climate change.

There must be a better way, and there is. I believe we should be doing more to find and develop nickel sulfide deposits in North America. Above we named five companies doing that.

Where will mining companies look for new nickel sulfide deposits, from which the extraction of high-grade nickel needed for battery chemistries is economically and technically feasible? I’d suggest Canada.

Decades of under-investment means few new large-scale greenfield nickel sulfide discoveries. The result of such limited nickel exploration is a low pipeline of new projects, especially sulfides in geopolitically safe mining jurisdictions. Any junior resource company with a sulfide nickel project will, if we prioritize Security of Supply and consider where our ‘clean & green’ isn’t coming from, therefore be attractive to potential acquirers