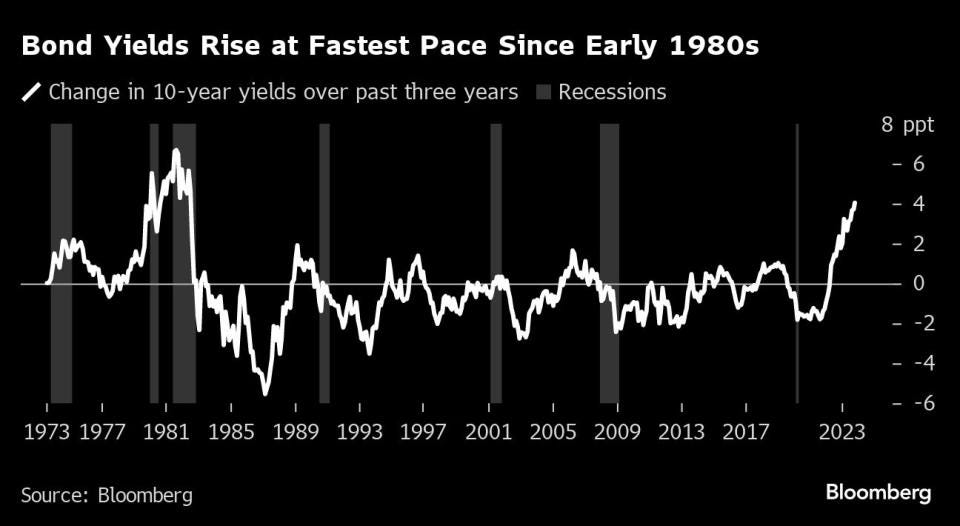

There’s a good reason why investors are amazed that something hasn’t broken in the economy yet: The last time US government bond yields climbed so far, so fast, the nation plunged into back-to-back recessions.

So says an article by Bloomberg, published on Yahoo! today.

The article presents the following graph as verification:

That is what happened the last time the Federal Reserve had to push interest rates up to fight inflation at levels that we are now approaching — the “double dip recession.” That is what I’m saying we are going to see this time — the dip into a “technical recession” that we saw through the first half of 2022 when the inflation fight was in its infancy, followed the protracted and much deeper recession we are going to see now that the Fed is left with fighting the really tough stuff that is actually starting to raise its head again. This is when the fighting gets tough.

Paul Volcker is famous for the fierce fight he put up back then because it was a rough one. Inflation did not go down easily, and the Fed had not been even remotely close to as loose and easy with money as it has been over the past fifteen years, but especially in 2020 and 2021 when it foolishly believed inflation wouldn’t happen and then, when it did happen, believed it was “transitory.” The economy is drenched in a lot more monetary fuel now than then.

Today the nation’s largest corporate banker took the Fed by the horns over its “transitory” error, saying the bank should not be trusted on its forecasts. In fact, the one thing that is not transitory is Fed errors. They happen all the time, especially when it comes to failing to see inflation coming and failing to see a recession coming.

JPMorgan Chase CEO Jamie Dimon on Tuesday warned about the dangers of locking in an outlook about the economy, particularly considering the poor recent track record of central banks like the Federal Reserve.

The only place where I’d quibble with Dimon here was where he narrows their poor track record down to “particularly recent.” Hogwash. Their track record of predicting recessions is practically perfect in its consistency; they’ve missed nearly ever one!

Aside from that quibble, let’s let Dimon finish his biting criticism:

In the latest of multiple warnings about what lies ahead from the head of the largest U.S. bank by assets, he cautioned that myriad factors playing out now make things even more difficult…..

“I want to point out the central banks 18 months ago were 100% dead wrong,” he added. “I would be quite cautious about what might happen next year….”

The comments reference back to the Fed outlook in early 2022 and for much of the previous year, when central bank officials insisted that the inflation surge would be “transitory….”

And they are still 100% dead wrong. Based on historic record, we can truthfully say that no one knows less about the outcomes of central bank policies than the central banksters who impose them on everyone.

Along with the misdiagnosis on prices, Fed officials, according to projections released in March 2022, collectively saw their key interest rate rising to just 2.8% by the end of 2023 — it is now north of 5.25% — and core inflation at 2.8%, 1.1 percentage points below its current level as measured by the central bank’s preferred gauge.

In other words, they were wrong on every projection they made, even though it is the results of their own policies that they are projecting. And they certainly cannot be forgiven for that when others have been quite accurate about what was coming down the road.

Dimon criticized “this omnipotent feeling that central banks and governments can manage through all this stuff. I’m cautious.”

I’m more than cautious. I have consistently been absolutely confident they were wrong, and they have not disappointed me in that respect. Central bank forecasts may be the best contrarian indicators you could hope for.

In other recent warnings, Dimon warned of a potential scenario in which the fed funds rate could eclipse 7%. When the bank released its earnings report earlier this month, he cautioned that, “This may be the most dangerous time the world has seen in decades.”

They could actually wind up eclipsing 7% simply because they have lost control of interest rates now that the bond vigilantes have taken over by selling bonds until they get to yields they want to see. And the vigilantes are getting a lot of help on that from the federal government of all places:

Another factor has been the sharp increase in the federal deficit, which is flooding the market with new Treasuries at a time when traditional big buyers, including the Fed and other major central banks, have pulled back on bond buying. That’s seen as one reason why yields have marched higher in recent weeks even as the futures market shows traders think the Fed’s rate hikes are likely done….

The Fed may have to raise its Fed Funds Rate to 7% just to keep up with the market so that it can look like it continues to be in control. It wouldn’t be the first time we’ve watched the Fed Funds rate go up in lockstep with market-set moves shortly after those moves took place. You can debate chicken-and-egg on this because a good part of what the market does is also in anticipation of what the market thinks the Fed will do based on Fed talk ahead of its meetings. Still, I believe a case for the Fed just running to play catch-up and appear to be in control can be made. They cannot look like interest has run away from them. Either way, if the market is taking rates up higher on its own, what the Fed does becomes a moot point anyway. That is why Dimon now says,

“I don’t think it makes a piece of difference whether the rates go up 25 basis points or more, like zero, none, nada.”

I agree. At this point the market is going to take rates up, regardless, especially as the government keeps auctioning off huge amounts of new debt to finance Bidenomics on top of all the old bonds it has to refinance as the Fed walks away.

"A hard landing is sort of our base case scenario — but I can’t point to any data and say, ‘This is a clear leading indicator of a recession and look right here,’ said Priya Misra, a portfolio manager at JPMorgan Asset Management

“Conviction levels are low,” she said. Investors who had been buying bonds “have all been hurt,” she said.

True. Even the world’s largest sovereign wealth fund has been hurt.

Norway’s $1.4 trillion sovereign wealth fund, the world’s largest, on Tuesday reported losses of 2.1% in the third quarter, as all asset classes fell in value.

That’s because bond markets all over the world are crashing as central banks all over the world attempt to take down the inflation they created with all their excess money printing during a time of global shortages, made much worse by mandatory layoffs during the Covidcrisis. People stopped producing but kept consuming as the government enable their consumption with various forms of welfare checks (morally necessary because it was the government forcing them to not work!)

A hard landing should be everyone’s base-case scenario. Why would you trust the Fed when it has failed to see every major recession coming even when it is the one creating each recession by overstimulating and then tightening to reign in all of its excesses? They have never engineered a soft landing yet. I’m not even sure Pilot Powell knows where the runway is!