We have come to terms that a global transition to clean energy is the way forward in our fight against climate change. But such “green transition” would not come cheap.

BloombergNEF estimates that governments and companies will need to invest at least $92 trillion by 2050 in order to cut emissions fast enough to prevent the nightmare scenario of climate change.

All hopes of a drastic reduction in emissions lie in our ability to scale up the role of electric power.

Overall, electricity generation will need to at least double by 2050 to almost 62,200 terawatt-hours, making up almost 50% of final energy consumption, compared with about 19% now, BNEF said.

More than three-quarters of the potential decline in emissions this decade will likely need to come from electricity supply and the increasing use of renewables like wind and solar power, according to BNEF.

Another 14% of the drop in emissions in that period can be achieved from vehicles, homes and industries switching to electric power from burning fossil fuels.

This “switch” requires much more spending on infrastructure to accommodate clean energy sources, amounting to $3.1 trillion and $5.8 trillion annually on average until 2050, BNEF model shows. That means the final “clean energy” bill could reach as high as $173 trillion, about eight times US gross domestic product in 2019.

The European Central Bank recently claimed that the potential impact of global warming would far outweigh whatever we’ll spend on clean energy. The ECB’s worst-case scenario, where no climate action is taken, could knock 10% off Europe’s GDP. Is that really a lot?

Setting aside the scale of spending, a closer look into the pathway we take towards a greener future and everything involved may blur the lines between what is and isn’t clean energy.

What is clean energy and how do we get it?

The materials required for a modern economy are those needed for electrification and decarbonization — metals like lithium, graphite, nickel and cobalt for EV batteries; copper for wiring, motors and charging stations, as well as renewable energy systems; silver for solar cells, and rare earths like neodymium for wind turbines.

The problem is, getting to 100% renewables, if that is even possible (I’d say more like 40%, if we’re lucky) will require more metals than are currently available in the world’s mines.

In fact, the amount of raw materials we’ll need to extract from the Earth to feed this “green” energy transition is staggering.

BloombergNEF estimates that it takes 10,252 tons of aluminum, 3,380 tons of polysilicon and 18.5 tons of silver to manufacture solar panels with 1GW [gigawatt] capacity.

Wind turbines need steel, copper, aluminum, nickel and other materials. To construct wind turbines and infrastructure with the power capacity of one gigawatt, BNEF found that 154,352 tons of steel, 2,866 tons of copper and 387 tons of aluminum would be needed.

For lithium-ion batteries, the key metals are copper, aluminum, lithium, nickel, cobalt, and manganese. BNEF estimates that it would take 1,731 tons of copper, 1,202 tons of aluminum, and 729 tons of lithium to manufacture 1GWh Li-ion batteries.

A single, fast EV charging station typically needs 25 kilograms of copper. BNEF anticipates that by 2027, 30.8 million charging stations will be in use.

Already, shortages are being forecasted by 2030 for cobalt, copper, lithium, natural graphite, nickel and rare earths.

With oil the West has been wholly dependent on the Middle East. Only recently (2019), has the US become energy independent but the only reason for that is fracking, a process that uses billions of liters of fresh water while often polluting groundwater supplies, and emits methane, a greenhouse gas 86 times more powerful than carbon dioxide.

The irony is, the rush to “go green” carries with it the simple fact that the mining of this stuff is anything but. Getting those minerals in the amounts demanded means going to some environmentally unfriendly places, such as Indonesia for sulfide nickel, the DRC for cobalt, and China for rare earths.

Because Western countries like Canada and the US haven’t bothered to develop their own mine to electric vehicle, or mine to renewable energy plant supply chains, they are dependent on imports, meaning they have no security of supply.

The United States is 100% import-reliant on 13 of the 35 critical minerals that the Department of Interior has classified. China maintains a firm grip on the processing of several critical minerals. The country processes around 90% of the world’s rare earth elements, along with 50% to 70% of lithium and cobalt, according to the International Energy Agency, via S&P Global.

Indeed as we move to clean energy, it seems as though we are simply replacing one energy master, Saudi Arabia/OPEC, with another, China, which “owns” the EV supply chain. To reduce our dependence, we need to think about exploring for, mining and refining minerals “at home” in North America.

EVs and solar/wind sound green, but how green are they when the materials are being imported from places like Indonesia, which allows tailings to be dumped into the sea, and the extremely polluting HPAL method of separating laterite nickel into the end-product used in batteries?

And despite eco-dreams of killing off fossil fuels, they remain very much in the picture, with Russia lording power over European gas imports, for example, and Japan and Canada continuing to rely heavily on Middle Eastern oil.

Even if we wanted to reduce our dependence on these countries, the mining industry faces significant local opposition to mineral exploration, mining, processing and smelting.

In this article we are asking how green are the sources we take for granted as non-polluting, and suggest one path to clean and green we might take going forward.

Renewables reality check

We’ve all heard the hype about renewables, but how green are they? Especially considering all the metals that need to be dug up and processed before wind turbines, solar farms and hydroelectric dams can produce carbon-free electricity?

You may be surprised by the answer. Let’s start with the grand-daddy of them all: solar.

End of “cheap” solar era?

The sun is an enormous ball of helium and hydrogen, without which life on Earth would not exist. The possibility of harnessing the sun’s rays to produce electricity is a concept that has occupied scientists for decades.

Early development of solar technology dates back to the 1800s, driven by expectations that traditional energy sources (i.e. coal) were going to become scarce (“pollution” was not a thing back then).

In 1954, Bell Labs invented the first useful silicon solar panel, which at that time was about 6% efficient. Since then, solar photovoltaic (PV) technology has evolved at a rapid pace. Today, most solar panels are between 15% and 20% efficient, though some manufacturers can create prototype solar panels that are over 30% efficiency.

The increased efficiency of solar power has also been accompanied by declining costs. For a long time, solar power was considered too expensive to implement, but its cost has come down dramatically over the years.

Since 2009, the price of utility-scale generation has dropped by a whopping 86%. Today, solar power is competitive with even the cheapest energy sources including coal.

An October 2020 study by the IEA found that solar is now the “cheapest electricity in history”, and the capital cost of solar is some 20-50% cheaper than it had previously forecast.

The IEA also estimates that new utility-scale solar projects can cost $30-60/MWh in Europe and the US, and just $20-40/MWh in China and India, due to policies designed to reduce the risk of renewable investments.

In the best locations, and with access to the most favourable policy support and finance, IEA claimed solar power can even generate electricity “at or below” $20/MWh.

But as the saying goes: “There are spots even in the sun.”

To build a utility-scale solar power requires a large amount of land. This can interfere with other uses, such as food production.

Clearing the land and moving the earth with machinery run on diesel fuel pollutes the air and causes soil compaction, erosion, and the alteration of natural drainage channels. Covering the area with PV modules involves the removal of plants, and the displacement of animal/ loss of habitat. These modules also require frequent washing with detergents that may pollute local water sources. Solar thermal power plants have similar impacts to PV systems but use more water, for cooling and as a working fluid.

Desertification is human-caused degradation of land, including unsustainable farming, overgrazing, clear-cutting, misuse of water and industrial activities.

Climate change accelerates desertification because warmer temperatures dry out once-fertile land, which then makes the area even hotter. Removing plants from the ground also increases greenhouse gas emissions, since they can no longer serve as carbon sinks.

More solar plants also mean that we need to expand our power grids in order to handle an increased capacity; in the US, it takes at least three years, and sometimes even ten, to build transmission lines, whereas a power generation project usually takes about a year. This implies more land needs to be set aside early for “clean energy” purposes.

As we strip away the amount of available land for food production, we are literally depriving ourselves of the means to survive.

According to the Solar Energy Industries Association (SEIA), a conservative estimate for the footprint of solar development is that it takes 5-10 acres of land to produce one megawatt of electricity. The world’s largest solar farm, the Bhadla Solar Park in India which has a 2245MW capacity, covers a massive 14,000 acres of land.

Applying the 10:1 acre/MW ratio, the National Renewable Energy Laboratory showed that 0.6% of the United States land mass needs (roughly 14.6 million acres) to be occupied by utility-scale solar operations to power the whole nation; this is at least 10 times as much land per unit of power produced than coal or natural gas power plants.

More importantly, it represents an opportunity cost of $17 billion in GDP had it been used for agriculture etc. (based on the sector’s contribution to US GDP last year).

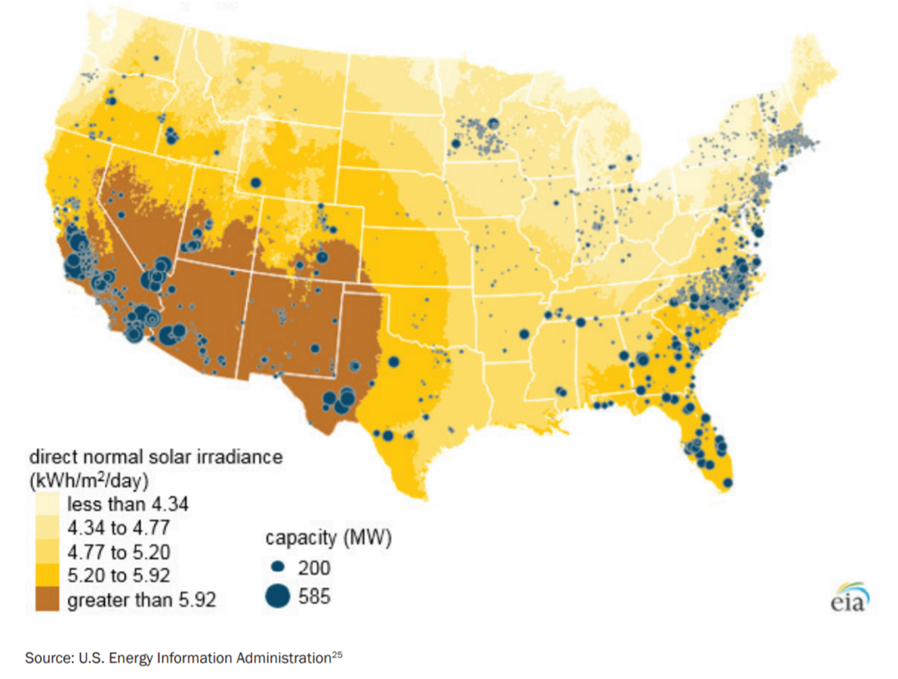

Another problem with solar (and other renewables) is how widely distributed they are geographically, meaning they leave a larger footprint and have a lower energy density.

Meanwhile, coal and oil (see below) have a very high energy density as they pack a great deal of energy into a small space; the overall land area disturbed per unit of energy produced can be quite low for very high-quality fossil resources.

Source: Brookings Institution

Source: Brookings Institution

Clearing out land for the solar farms is only the first step; the next part may require even more land usage and resource depletion.

The 17 components needed to build solar panels must all be mined. These include arsenic for semiconductor chips; phosphorous, selenium, silica, tellurium, gallium and indium for solar cells; bauxite, boron and cadmium for thin film solar cells; titanium dioxide for solar panels; coal and iron ore needed to make steel; copper for the wiring and solar cells; molybdenum for photovoltaic cells; and lead for batteries.

But prices of raw materials don’t ever stay constant, and as we’ve seen over the last 12 months, many of these have been trending up, some even to record highs.

Consequently, the cost of some modules has gone up by 25% over the past year. Analysis by research firm Rystad Energy suggests that higher prices could threaten 50GW, or 56%, of total solar developments planned for 2022.

Some believe that we’re currently witnessing what could be considered the next commodities supercycle amid the clean energy transition. But will this “green revolution” be worth it if the costs keep rising?

According to S&P Platts, while the cost of solar fell 80% between 2010-2020, supply chain pressures have now put a halt to this dramatic decrease. Soon, the notion that renewables are the cheapest sources of electricity in much of the world may no longer hold true.

Prices for building solar panels have surged more than 50% over the past year. Wind turbines are also up 13%, and battery prices are rising for the first time ever.

Raw materials now account for 70% of the cost of finished modules, leaving suppliers with almost no room to trim expenses, David Dixon, senior analyst at Rystad Energy, recently told Bloomberg.

US project developers like Invenergy have already delayed some projects as they cannot buy enough panels, while panel makers are also reluctant to manufacture more if the industry constantly slashes prices.

The Solar Energy Industries Association and Wood Mackenzie Ltd. are predicting US installations to drop 15% in 2022, about 25% below their last forecast.

So, solar power is an expensive business for everybody involved from the ground up; Tax incentives or improved technology could only do so much, but turning to renewables would almost be a moot point if we cannot build enough solar panels and other components.

Even so, after trampling over all the land and assembling enough raw materials, “clean energy” could just be an antithesis of itself from the alternative forms of environmental damage that it entails.

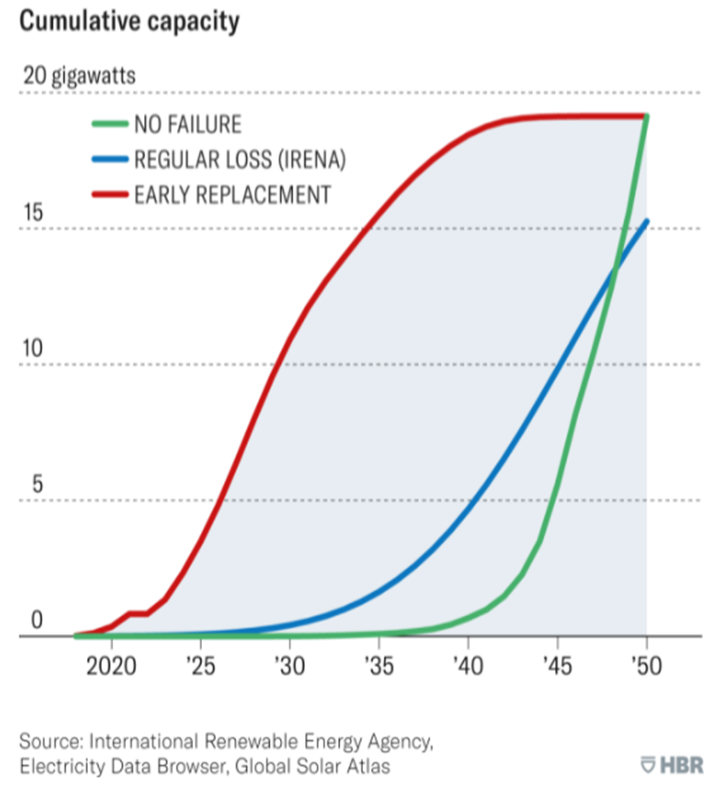

The International Renewable Energy Agency (IRENA) projects that “large amounts of annual waste are anticipated by the early 2030s” and could total 78 million tonnes by the year 2050.

Applying these figures and the 30-year lifecycle of a typical solar panel in US households, the Harvard Business Review calculated that discarded panels and equipment can produce 50 times more waste in just four years than IRENA anticipates. That figure translates to around 315,000 metric tonnes of waste, based on an estimate of 90 tonnes per MW weight-to-power ratio, the HBR model suggests.

HBR research suggests that cumulative waste projections will rise sooner and more sharply than analysts expect

HBR research suggests that cumulative waste projections will rise sooner and more sharply than analysts expect

Importantly, the US recycling infrastructure is ill-equipped to deal with the deluge of waste coming from renewables. At current capacity, it costs an estimated $20-30 to recycle one panel, but to send that same panel to a landfill would cost a mere $1-2. So of course, it’s far “cheaper” to let waste build up.

By 2035, discarded panels would outweigh new units sold by 2.56 times, the HBR estimates.

Over time, the biggest creation of the solar industry could just be a toxic cocktail of gallium arsenide, tellurium, silver, crystalline silicon, lead, cadmium and heavy earth material.

Against the wind

The same problems exist for all other renewable technologies. For example, barring a major increase in processing capability, experts estimate that more than 720,000 tons worth of gargantuan wind turbine blades will wound up in US landfills over the next 20 years.

Wind is right up there with solar as a clean alternative to natural gas, coal and oil, and like solar energy, it has obvious environmental downsides.

Foremost is the negative impact on bird life. Bird and bat populations can be injured or killed when they fly through spinning turbine blades.

Offshore wind turbines can also harm marine birds. The noise that wind turbines produce may be a problem for people living near them. Some have even claimed they cause health effects such as migraines, dizziness and poor sleep quality.

Like solar power, wind requires large tracts of land that may be put to more appropriate use such as farming or conservation.

Researchers at Harvard University found the transition to wind or solar power in the US would require 5 to 20 times more land than previously thought, and, if such large-scale wind farms were built, they would actually warm average surface temperatures over the continental US by 0.24 degrees Celsius.

A few extra windmills might not seem like a big deal, but they’re a bit like prisons and garbage dumps: NIMBY.

A wind turbine has about the same number of mined components as a solar cell. They include aggregates, crushed stone, bauxite, clay, shale, gypsum, sand and gravel for cement and concrete; coal and cobalt for magnets; iron ore, limestone and molybdenum for steel and steel alloys; zinc for galvanizing; and rare earths for permanent magnets.

Keep in mind, though, this isn’t baseload power, it’s intermittent power. Releasing energy all at once, in a controlled way, to thousands of households, is not currently possible without lithium-based storage batteries, the materials for which, like EV batteries, must all be extracted from minerals.

The materials for wind and solar are mined in more than 60 countries. Some, like Peru, Chile, Mexico, South Africa, the United States and Australia, have laws and up-to-date mining codes that protect the environment and local labor forces from exploitation. Others, such as Indonesia, Venezuela, the Congo, Zambia and Papua New Guinea… not so much.

It isn’t just the mining of materials to make batteries and renewable energy, but transporting them. The Heartland Institute calculated that a single electric-car battery weighs about 1,000 pounds. Fabricating one requires digging up, moving and processing more than 500,000 pounds of raw materials.

The materials then need to be put into containers and shipped, on container vessels powered by highly-polluting bunker fuel, to their destination ports, where they are further moved to end-users on trucks run on diesel.

It’s no different for wind. All the mining and processing required to get the metals into wind turbines, then transporting them via custom-made heavy equipment to the site, and then decommissioning them, are energy-intensive activities that rely on fossil fuels and products made from crude oil.

Danger of hydro

Where I live in British Columbia, we get most of our electricity from hydroelectric power. For the most part (not talking about the Site C dam), it’s reliable and clean. But the benefits all come after a dam has been built; the construction process is anything but green.

The biggest and most obvious impact is on the people living in the area about to be flooded. The Three Gorges Dam in China displaced between 1.3 and 1.9 million people (figures in China are notoriously unreliable) in more than 1,500 villages, town and cities along the Yangtze River.

During the 1960s dozens of families living in the Arrow Lakes Valley, in southeastern BC, lost their homes and farmland when BC Hydro decided to block the Columbia River through creation of the Hugh Keenleyside Dam. Old-timers still hold a grudge against the power utility for forcing them out and burning structures that got in the way of the damming.

Large hydropower plants have a significant impact on animal habitats and the flow of natural watercourses, including preventing fish from swimming back to their spawning grounds.

Turbines used in hydropower plants also kill some of the fish that pass through them. The Energy Information Administration estimates that fish death by turbines is between 5% to 10% even for the best turbines existing.

There is always the potential for a dam to break causing monumental devastation. In 1975, the failure of the Banquiao Reservoir Dam and others in Henan province, China, caused the most deaths of any dam failure in history — an estimated 171,000 were killed and 11 million people lost their homes.

In the United States, there were 173 dam failures and 587 incidents reported between 2005 and 2013, according to the Association of State Dam Safety.

Perhaps hydroelectric power dams just aren’t as safe as originally touted, considering they’re awfully vulnerable to major weather or tectonic events. This is also the concern with the aforementioned Site C dam, whose costs just keep skyrocketing over the years because the engineering challenges just get harder and harder.

So here in BC, some have proposed cheaper alternatives to the hydroelectric project, including one which uses a combination of natural gas and wind power.

But the problem, first of all, is that places like BC are now forbidding new NG-powered energy sources; one of the “dirty” fossil fuels, natural gas emits about half as much carbon dioxide as coal and 30% less than oil.

Another proposition would be to use liquefied natural gas (LNG) instead, but that is not “clean energy” either. The natural gas for LNG Canada would be fracked gas, which has its own environmental drawbacks.

Extracting natural gas through hydraulic fracturing, transporting it to a terminal, and then super-cooling it for transport in tankers, is far from clean; in fact, it may even be dirtier than coal.

To turn it into liquid form, the gas must be cooled to 163 degrees below zero. To do that requires a great deal of power, with massive compression units running 24/7. Where does that power come from? In most cases, the same fracked natural gas is used to run the compression units, which pretty much defeats the purpose of LNG as “clean”.

Forgetting all that, the use of fracking technology itself has raised big concerns over the safety of our freshwater supply.

Fracking just one well can use 2 to 8 million gallons of water with the major components being water (90%), sand or proppants (8-9.5%), and chemicals (0.5-2%). One 4-million-gallon fracturing operation would use from 80 to 330 tons of chemicals, and each well will be fracked numerous times. Many of these chemicals have been linked to cancer, developmental defects, hormone disruption, and other conditions.

It’s also been proven that fracking causes earthquakes. A study published in 2016 found that both fracking wells and wastewater disposal wells increase seismicity. A major research project testing seismicity in northeastern BC found a 13-fold increase in the number of earthquakes under 2.5 between August 2013 and August 2014.

Then with wind, you don’t have the benefit of capacity offered by hydro dams. Replacing a quarter of the energy produced from Site C would require 122 extra wind turbines, which is nearly half of the province’s total. Also, as you know, wind projects require even more land and are industrial garbage dumps waiting to happen.

So perhaps nuclear power is the way forward? Some time ago, I investigated the possibility of replacing Site C with small modular nuclear reactors, labelled by Natural Resources Canada as the “future of its nuclear industry.” (Of course, BC has prohibited nuclear plants and uranium mining, but not provinces like Saskatchewan and New Brunswick.)

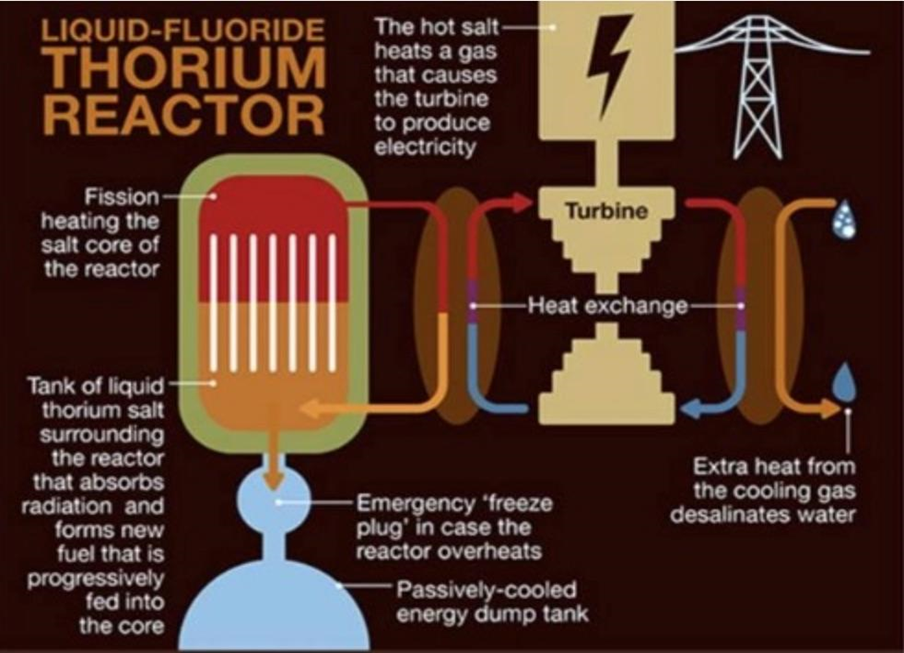

Like all technologies, nuclear power is evolving too, and one day it may no longer revolve around uranium. For years scientists have been excited by the prospects of nuclear reactors based on thorium as our primary energy source.

Studies suggest that thorium is three to four times more abundant than uranium. There is estimated to be enough thorium on the planet to last 10,000 years. Also, the element itself is less radioactive and is more easily extracted than uranium.

More importantly, liquid fluoride thorium reactors (LFTR) – a type of molten salt reactor – have very little waste compared with reactors powered by uranium. It is more efficient. One tonne of thorium delivers the same amount of energy as 250 tonnes of uranium.

Molten salt reactors (MSRs) are well suited to thorium fuel. SMRs are nuclear reactors that produce 300 megawatts (MW) of electricity or less. They can support large established grids, small grids, remote off-grid communities and resource projects.

One of the main advantages of MSRs is the reactor cannot melt down, as we saw in Fukushima when electric pumps were inundated by the 2011 tsunami, failing to cool the fuel rods, which overheated and caused radiation emissions.

The Site C dam is slated to provide 1,100 megawatts of capacity – enough to power half a million homes. The same goal could be reached by using a similar thorium reactor to that being developed by Indonesia – a molten salt reactor capable of delivering 1,000MW – at less then a 10th of the cost.

Another plus of thorium reactors is that nuclear waste (ie. plutonium) from uranium fueled reactors can be recycled to recover the fissile materials needed to create the nuclear reaction. In this way, thorium reactors not only generate less waste than conventional reactors, but also help to rectify the nuclear waste disposal problem.

The point is, getting “clean” energy is not as straightforward as it seems, and more often than not it is flooded with controversy.

Rushing headlong into electrification

Let’s face it. Ridding the planet of fossil fuels — coal, oil, and natural gas — and replacing them with renewable energy, is untenable. Not only are solar and wind inappropriate for base-load power, because their energy is intermittent, and must be stored in massive quantities, using battery technology that is still in development, they don’t have anywhere near the energy intensity provided by fossil fuels, or nuclear.

However, driven by the need to decarbonize due to increasingly apparent climate change, governments around the world right now are choosing to de-invest from oil and gas, and instead are plowing funds into renewable energies even though they aren’t yet ready to take the place of standard fossil-fueled baseload power, i.e., coal and natural gas.

We have seen this foolish endeavor playing out in Europe, where natural gas prices topped records due to coal plants being shut down as well as nuclear plants shelved, such as in Germany and France. The skyrocketing cost of electricity is being borne by ordinary citizens who had no vote in this dumb policy of “premature decarbonization”.

“Energiewiende” (energy transition) refers to Germany’s policy of increasing its share of renewables, and phasing out nuclear power, which before Fukushima amounted to about 25% of the country’s total electricity load.

However Germany’s production of solar and wind power has failed expectations, with the gap between supply and demand having to be met by natural gas and coal, and consumers faced with horrendous power bills.

Germany’s US$0.45 per kilowatt-hour is the third-highest-priced electricity in the European Union (behind the Czech Republic and Romania) and more expensive than all the other G20 countries. How did this happen?

In 2011, after the partial meltdowns in Japan’s Fukushima Daiichi nuclear complex, Angela Merkel’s government immediately shut down almost half of the country’s nuclear power. Germany, overnight, decided 40% of its nuclear power capacity would be eliminated, and removed 8,800 megawatts (MW) from the grid; the remaining 12,700 MW of nuclear-supplied electricity will be gone this year.

In 2021, due to unfavorable weather conditions, the country’s production of wind and solar power for the first three quarters plummeted compared to the same period in 2020, with onshore wind producing 18% less, 14% less from offshore plants, and solar producing only half as much.

But the demand for electricity stayed the same. To meet it, utilities resorted to coal, so Germany’s coal consumption for electricity rose sharply. In the first nine months of last year, coal accounted for 31.9% of the electricity mix, compared to 26.4% during the same period in 2020.

Coal-fired power production is the worst form of electricity generation for the environment, despite power plant companies’ use of scrubbers and claims of “clean coal”.

France’s move away from nuclear power is also hastening a move backwards, to coal usage. With 17 of the country’s 56 nuclear power plants temporarily shut down for scheduled and emergency maintenance (the pipelines of four nuclear reactors cracked in December), the government wants to raise the number of hours its three remaining coal-fired power plants are allowed to operate.

French grid operator RTE has warned that renewables may not be effective if the winter is unusually cold, and the wind doesn’t blow enough in January and February.

Despite promises agreed to at last year’s COP26 climate conference, using more coal, not less, appears to be a global trend. According to the IEA’s ‘Coal 2021’ report, coal-fired power generation last year was on track to exceed 2020 figures by 9%, and reach an all-time high of 10,350 terawatt-hours. The two factors driving this, are the inability of renewables to keep pace with current growth in electricity demand (the so-called “thermal gap”), and record-high natural gas prices that are making coal more competitive.

The IEA predicts that demand for coal will hit a new all-time high in 2022 and remain constant through 2024, with China and India expected to be the world’s top consumers.

Back to Germany, the failure of renewables to meet power demand has not only resulted in higher coal usage, it has also increased the country’s dependence on Russia for supplying it natural gas for heating and power generation.

According to the Wall Street Journal, Germany for decades has imported cheap natural gas from Russia, therefore did not see any need to build the infrastructure to bring in more expensive gas from places like the US or Qatar; to this day, Germany has no LNG import terminal.

A two-decades-long decision to phase out nuclear power and moves to cut reliance on coal — all German coal plants are due to close by 2038 — to bring down CO2 emissions, means Germany is more dependent on Russia than ever.

The country is the biggest buyer of Russian natural gas in the world, drawing over half of its gas imports from there, compared to an average 40% for its European Union neighbors.

This makes it vulnerable to a decision by the Kremlin to “weaponize gas”, i.e., restrict supplies as it has done previously to countries in Eastern Europe. Most of Russia’s gas shipments to Europe are channeled through Ukraine, so if the Kremlin wanted to exert political pressure, it could literally freeze Europeans out of their homes and cut the lights — a scary thought considering that war between Ukraine and Russia may be imminent.

Although Russia has never restricted gas flows to Germany, that may be changing. According to the Journal, The International Energy Agency said earlier this month that Russia is in large part responsible for Europe’s gas shortage and that Gazprom, Russia’s state-owned gas exporter, had reduced exports to Europe in the fourth quarter at a time when prices were high. The Kremlin has denied using gas as a geopolitical weapon and says that it is delivering on all contractual obligations.

And then, just this morning (02.04.2022), there’s this:

Meanwhile Russian state energy giants Gazprom and Rosneft on Friday agreed new gas and oil supply deals with Beijing worth tens of billions of dollars.

The deals capitalise on Putin’s drive to diversify Russian energy exports away from the West, which started shortly after he came to power in 1999. Since then Russia has become China’s top energy supplier and cut its reliance on the West for revenues. Reuters, Russia and China proclaim ‘no limits’ partnership to stand up to U.S.

Dark side of green

Something nobody in the clean-tech, green-energy space likes to talk about is the “dark side of green”. This can be seen as a hidden cost of electrification/decarbonization.

Batteries for electric vehicles and grid-scale energy storage are great ideas, but we must remember, these are only devices to store energy. The electricity that goes into them has to come from somewhere. If it’s from coal, natural gas or oil, it’s not green.

Moreover, the extraction of minerals for battery components may be extremely polluting, depending on where the mining/processing takes place and how.

What’s the point of making “green” battery components when the refining process is so dirty?

In China’s Inner Mongolian city of Baotou, dozens of pipes churn out a torrent of thick black chemical waste that flows into an artificial lake filled with toxic sludge. A constant smell of sulfur pervades the apocalyptic scene. Most people in the West haven’t heard of Baotou but its mines and factories are one of the biggest suppliers of rare earth minerals used in a plethora of so-called green applications, everything from wind turbines to electric vehicles to nuclear reactors.

The ecological risks of rare earth mining aren’t confined to China, which mines and processes most of the materials.

This includes air pollution, biodiversity loss, desertification/drought, food insecurity (crop damage), loss of landscape/aesthetic degradation, soil contamination, soil erosion, waste overflow, deforestation and loss of vegetation cover, surface water pollution, decreasing water quality, groundwater pollution or depletion, mine tailings spills, and large-scale disturbance of hydro and geological systems.

In 2019 Malaysian environmental groups demonstrated over concerns about radioactive waste from Australian rare earths miner Lynas Corp’s processing plant located there.

In Indonesia, nickel is produced from laterite ores using the environmentally damaging HPAL technique. The advantage of HPAL is its ability to process low-grade nickel laterite ores, to recover nickel and cobalt. However, HPAL employs sulfuric acid, and it comes with the cost, environmental impact and hassle of disposing the magnesium sulfate effluent waste. The Indonesian government only recently banned the practice of dumping tailings into the ocean for new smelting operations, and it isn’t yet a permanent ban.

Most of four HPAL plants currently under construction, led by Chinese stainless-steel producers and battery makers, plan to continue the environmentally egregious practice of Deep Sea Tailings (DST), due to the much higher cost of managing the tailings on land.

Chinese nickel pig iron producers in Indonesia now are looking to make nickel matte, from which to turn laterite nickel into battery-grade nickel for EVs. The process however is highly energy-intensive and polluting, as well as far more costly than a nickel sulfide operation (up to $5,000 per tonne more).

According to consultancy Wood Mackenzie, the extra pyrometallurgical step required to make battery-grade nickel from matte will add to the energy intensity of nickel pig iron (NPI) production, which is already the highest in the nickel industry. We are talking 40 to 90 tonnes of CO2 equivalent per tonne of nickel for NPI, versus under 40 CO2e/t for HPAL and less than 10 CO2e/t for traditional nickel sulfide processing.

Mining practices in the Democratic Republic of Congo (DRC) have elevated the issue of “conflict minerals” to the public consciousness, with stories of armed groups operating cobalt mines dependent on child labor. Environmental standards are non-existent.

Rare earths mining and processing in China, the extraction and refining of laterite nickel in Indonesia, and cobalt mining in the Congo, are three good examples of the disconnect between the rhetoric being delivered lately regarding the so-called new green economy, and reality.

In many respects the widely touted transition from fossil fuels to renewable energies, and the global electrification of the transportation system, are not clean, green, renewable or sustainable.

Mining properly

As shareholders and institutional investors demand that companies place more emphasis on environmental, social and governance (ESG), the mining industry has had to overcome an often-checkered past regarding these issues.

For many years the industry as a whole managed to sidestep ESG, but the period of evading responsibility has come to an end and mining firms are increasingly being called upon to explain how they plan to incorporate ESG into their operations.

In fact mining executives have ranked ESG as the top industry risk for 2022. Among the trends that mining companies should take note of, and action on this year, are increased scrutiny of mining’s role in the “net-zero” transition; the rejection of “greenwashing”; and the focus on value chains.

Companies should expect more oversight of their impacts, as recognition grows that mining places additional burdens on local ecosystems and communities. Miners that try to push hollow sustainability claims will be called out, with growing ESG obligations and legislation leading to a rise in litigation.

Perhaps most importantly, there will be an increased focus on value chains. It is no longer enough for companies that procure raw materials to be responsible for their own operations, they are expected to manage ESG risk throughout their value chain.

As the authors of a recent article by ESG consultancy Sympact state, This not only means that procurement and product stewardship due diligence expectations are growing, but also that downstream customers will seek confirmation of mining companies’ own practices…

No matter your position on ESG, the trend is clear: ESG action is now considered critical to both business and social resilience and is increasingly integrated into board oversight responsibilities and executive compensation. Even if a company’s regulatory context or biggest investors don’t require action, a watchful global ESG community and a broad range of stakeholders and rights holders increasingly expect it. That makes inaction the greatest risk of all.

The question then becomes, how do we mine properly? How do mining companies uphold high ESG standards? To me, there is only one way this can happen, and that is to establish a North American supply chain that eliminates foreign-country risk — the risk that foreign mining companies and processors present to the environment, to their workers, and to communities that are living close to and downstream from their operations. Yes, accidents can still happen — look at the 2014 Mount Polley tailings breach in British Columbia — but they are less likely to happen if the supply chain is shortened, shipping distances are reduced, mining and refining is done locally, etc.

Instead we have the opposite occurring. The situation in Europe is demonstrative of how NOT to do things. Consider: Russia has Germany and other European countries over a barrel when it comes to natural gas. Meanwhile the United States and NATO are threatening Russia at its western border — to the Kremlin it’s no different from the Cuban Missile Crisis — only it’s American missiles pointing at them.

It won’t be Americans shivering in the dark when Russia turns off the tap, because the US is only in it for themselves. The Biden administration is against domestic mining, despite its supposed interest in reducing US dependence on China for its critical minerals.

Instead of building a “mine to EV” supply chain, Biden and his Democrats want to skip the mining and go straight to the cleaner, manufacturing-intensive electric vehicle-building, that will supposedly bring plenty of jobs.

In effect what Biden is saying, is that the US wants to replace China as the world’s supplier of batteries and EVs, create its own green “one belt one road” by sourcing its raw materials — lithium, graphite sulfide nickel, cobalt, etc. — from countries friendly to its interests.

The United States has plenty of EV metals but the White House and Congress have chosen not to tap them. Just recently, the Biden administration dealt its final blow to the Twin Metals copper-nickel project in northeast Minnesota, which has been in limbo since Barack Obama’s tenure as president.

Along with siding with, or not going against, mining opponents, the Biden administration is also practising resource nationalism by trying to exact a larger piece of the metals pie.

In September a congressional committee added language that would set an 8% gross royalty on existing mines and 4% on new ones. There would also be a 7-cent fee on every ton of rock moved.

France and Germany are rushing pell-mell into electrification before their energy infrastructure is able to handle the transition from fossil fuels to renewables. Nuclear is being phased out but coal and natural gas are needed to meet the electricity shortfall caused by not enough solar and wind power.

The upshot is a spike in commodity prices — something we predicted years ago, due to an under-investment in new mines required to meet the much higher demand for metals like copper, graphite, nickel and lithium, needed for the new green economy. Lithium prices, for example, just extended a 400% gain, with surging EV sales in China underpinning a five-fold gain over the past year.

Another dramatic price increase, natural gas, must be borne by electricity consumers, the average Joe and Jane, or more appropriately, Fritz and Heidi, over in Europe.

While European NG prices have come down since hitting a record 180 euros per megawatt-hour in December, they are still nearly eight times higher than a year ago.

EU natural gas prices. Source: Trading Economics

EU natural gas prices. Source: Trading Economics

On top of higher commodity prices which only make EVs more expensive and unaffordable to the masses, in North America there is no security of supply. We rely on China and South Africa for most critical metals, preferring to let them do the mining and smelting. According to the International Energy Agency, China processes about 90% of the world’s rare earth elements, along with 50 to 70% of lithium and cobalt.

When China threatened to restrict exports of rare earths during the Trump-era US-China trade war, end-users cowered. When China followed through on the threat back in 2010, the prices of most rare earth oxides went through the roof.

The only way for this to change is for mining companies to start exploring for and developing mines in Canada and the United States — lithium mines, cobalt mines, rare earth mines, nickel mines — really, anything that China controls.

Fracking changed the United States from being a net oil importer, to a net exporter. By developing a local green energy supply chain, from mine to battery to EV, and from mine to renewable energy facility, the country could get out from under China’s yoke and really do something green for the planet.

The way we do this goes back to what I said earlier about batteries: these are only devices to store energy. The electricity that goes into them has to come from somewhere. Coal and natural gas are dirty forms of electricity generation. Despite many believing that NG is required as a transition fuel as we move to full electrification, a lot of jurisdictions want to ban it. A few days ago Clean Technica reported on the growing number of cities that are phasing out natural gas from homes and buildings. Since 2019, 54 California cities have adopted the ban, and before you say, “oh well, California…” two weeks ago New York City banned gas in new construction.

Renewable energies are the sine qua non of the progressive left but as we have shown, wind and solar leave much to be desired as far as providing enough baseload power. Even with costs lowered to the point of being competitive with lowly coal, countries like Germany and France that are shutting down nuclear in favor of renewables are regretting their decisions.

Hydroelectric power is similarly cheap but comes with its own set of problems, namely environmental destruction through flooding, population dislocation and the building of dams which are extremely fossil fuel-intensive. The Hoover Dam for example required 5 million barrels of cement and 45 million tons of reinforcement steel, its 6.6 million tons of concrete enough to pave a road from San Francisco to New York City.

As we mentioned earlier, that leaves nuclear.

Uranium is the fuel needed to create the nuclear reaction that can either create nuclear power or nuclear weapons. To make nuclear fuel from uranium ore, the uranium is first extracted from the rock, then enriched with the uranium-235 isotope, before being made into pellets that are loaded into assemblies of nuclear fuel rods. In a nuclear reactor, several hundred fuel assemblies containing thousands of small pellets of uranium oxide are in the reactor core. The nuclear chain reaction that creates energy starts when U-235 splits or “fissions”, which produces a lot of heat in a controlled environment.

In a conventional nuclear reactor, the pressurized water reactor, fuel rods containing uranium pellets are placed in water. Visualized as a giant kettle, the heat generated from the pellets boils water to create steam, which turns turbines to generate electricity. But the downside of conventional nuclear power stations is the nuclear reaction also produces plutonium, which is highly radioactive, and other wastes, causing a problem for disposal. Strontium-90 and cesium-137, contained in nuclear waste, have half-lives of about 30 years, but plutonium-239 takes 24,000 years to fully decay.

When it works well, the nuclear reaction is an efficient form of energy creation. One uranium pellet weighing just 6 grams produces the same amount of energy as a tonne of coal. But it also leaves a lot of radioactive waste that needs to be incinerated, encased in concrete, or buried deep underground for centuries.

When nuclear power goes wrong, the fallout is catastrophic. Nuclear meltdowns like Chernobyl in Russia, Three Mile Island in the US, and Fukushima in Japan are burned into the collective consciousness and serve as constant reminders of the dangers of nuclear power that drive the anti-nuke movement.

While nuclear energy generation will never be without risks, proponents argue these are manageable and small compared to the risk of increased greenhouse gases that are warming the planet. Because nuclear does not require the burning of fossil fuels, it is always in the mix of energies required to make the transformation from an oil-based economy to one where renewable and nuclear energies make up a larger proportion of our global electricity supply.

Thorium reactors

Must we keep using uranium in our nuclear power plants, or is there another option? There is. It’s a little-known element known as thorium.

Some scientists believe thorium is key to developing a new version of cleaner, safer nuclear power.

While conventional nuclear plants are only able to extract 3-5% of the energy in uranium fuel rods, in molten salt reactors favored by thorium proponents, nearly all the fuel is consumed. Where radioactive waste from uranium-based reactors lasts up to 10,000 years, residues from the thorium reaction will become inert within 500. Lastly, because plutonium is not created as a waste product in a thorium reactor, it cannot be separated from the waste and used to make nuclear weapons.

Molten salt reactors (MSRs) are well suited to thorium fuel. In the Liquid Fluoride Thorium Reactor (LFTR), the fuel is not cast into pellets like uranium, but is rather dissolved in a vat of liquid salt.

A key advantage of MSRs is the reactor cannot melt down, as we saw in Fukushima when electric pumps were inundated by the tsunami, failing to cool the fuel rods, which overheated and caused radiation emissions. MSRs can also be made cheaper and smaller than conventional reactors, since they do not have large pressurized containment tanks, meaning they could be used in factory settings.

The portability of MSRs is another major advantage over the capital-intensive, permanent nuclear power plants we currently have.

Think about British Columbia’s energy needs. Instead of meeting them with the Site C dam, which comes with its own environmental problems – flooding a 100-km stretch of the Peace River Valley – how about deploying thorium reactors?

The Site C dam is slated to provide 1,100 megawatts of capacity – enough to power half a million homes. The same goal could be reached by using a similar thorium reactor to that being developed by Indonesia – a molten salt reactor capable of delivering 1,000 MW.

Another plus of thorium reactors is that nuclear waste (i.e. plutonium) from uranium fueled reactors can be recycled to recover the fissile materials needed to create the nuclear reaction. In this way, thorium reactors not only generate less waste than conventional reactors, but also help to rectify the nuclear waste disposal problem.

To learn about the fascinating history of thorium and its potential for nuclear power generation, read Uranium’s ugly stepsister

Conclusion

Replacing fossil fuel-generated power — coal, oil, and natural gas — 100% with renewables is untenable. Not only are solar and wind inappropriate for base-load power, because their energy is intermittent, and must be stored in massive quantities, using battery technology that is still in development, they just don’t have anywhere near the energy intensity provided by fossil fuels, or nuclear.

Nor can we bank on natural gas to see us through to a carbon-free future. NG is mostly methane, a potent greenhouse gas that the Intergovernmental Panel on Climate Change says is 86 times more damaging than CO2 over a 20-year period.

Thankfully, we have a third option, and that is nuclear. One uranium pellet weighing just 6 grams produces the same amount of energy as a tonne of coal. One tonne of thorium delivers the same amount of energy as 250 tonnes of uranium.

The fact is, nuclear energy must be in the mix when it comes to decarbonization and electrification. Renewables are great, but when it comes right down to it, they aren’t especially green, due to their tremendous land use requirements. Instead of covering hundreds of hectares with solar panels, the same amount of energy could be produced with one thorium reactor. And this would be baseload, not intermittent power, fed right into the grid with no need for lithium-ion batteries.

Speaking of which, prima facie, there is nothing wrong with batteries, but remember, they are simply a vessel for energy storage. Whether or not they can be considered green, depends on how the energy was created that went into them. If it came from coal, natural gas, hydro or conventional nuclear, that battery is neither clean nor green.

The raw materials must also be factored in. An EV battery doesn’t exist without mining, which can be sustainable, but often isn’t. If the cobalt was extracted using child labor in mines with zero environmental regulations, how green is that battery? Same goes for batteries made from laterite nickel that is processed in Indonesia using the environmental destructive HPAL method, and where the tailings are dumped into the sea.

Currently the supply chain for minerals is long. Metals are mined and processed thousands of kilometers from where they are end-used. Shipping the battery ingredients on container vessels, railcars and trucks, significantly increases the ecological footprint of mining them.

The way we’re going, the electrification and decarbonization agenda being pursued by many governments has the potential of ending up as a massive boondoggle.

Billions of dollars are being invested in renewables but what the politicians seem to forget, is that we don’t have the metals. To get them in the quantities required, mining companies need to go to places with minimal or zero environmental regulations. Without North American mines being developed, we will remain dependent on foreign mining and processing, and will not have control over these companies’ ESG.

A lack of investment in new mines means higher metal prices are likely to be with us for a long time. In the US and Canada, it can take 20 years for a mine to be developed.

Meanwhile countries in Europe are rushing headlong into electrification, phasing out nuclear and coal, without analyzing the consequences and protecting their populations from rising natural gas prices. As usual it’s the average citizen who will bear the consequences of this fool’s errand, in high power bills.

So what is to be done?

To start, we believe people are looking at the wrong ways of producing energy. To obtain clean, reliable baseload power, renewables aren’t going to cut it. Wind and solar only work when the sun shines and the wind blows, and while battery storage technology is advancing, arguably it will not be enough to completely replace fossil fuels, or nuclear.

There are many advantages to conventional nuclear power but just as many disadvantages, including the capital cost and time required for building new nuclear reactors, the danger of a meltdown and the problem of storing nuclear waste.

All of these issues can be eliminated by building thorium nuclear reactors. Use them to generate power that goes into lithium-ion batteries, the materials for which are sourced in North America. This way, ESG concerns stay local (i.e., the effects of mining on the environment and nearby communities), and most importantly, North American mines become the first link of an EV and renewable energy supply chain that cannot be severed on the whims of foreign suppliers.

We must also recognize that 100% renewable penetration is not feasible. Electric vehicles are best suited to cities where EV owners are driving short distances. While fast charging is most convenient for them, they can make do with slow chargers which prolong battery life.

Gasoline-electric hybrids are a good option for suburban dwellers, who have longer commutes and often require the convenience of a traditional gas fill-up. Moreover, current charging infrastructure in most suburbs is inadequate.

Rural areas are the most challenging with respect to EV penetration. Right now, I just don’t see electrification happening in small towns, where range-bound EVs have limited use. Those working in farming, mining and forestry need trucks and heavy equipment run on gasoline and diesel.

It might not be how environmentalists envision the future, but this is how we at AOTH believe we can clean up the planet and fight climate change, while successfully transitioning to a lower-carbon world.

Promises may be the life blood of politicians, but reality is where the rubber hits the road.

Richard (Rick) Mills

aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks.

Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.