As reported in my new Daily Doom news section, which I try to update twice daily, real GDP fell even further for a second quarter in a row. While we all know what that means, you can count on the Federal Reserve, the federal government and even economists regularly quoted in the mainstream financial media to do their best to explain that harsh reality away, and the set of blinders that will keep them and those who follow them from seeing the truth will be the labor market. They will claim we cannot truly be in recession because the unemployment rate is so low. Let me, among other things, show you how bogus that is. In fact, it is proof of their total blindness or abject stupidity … or possibly blatant dishonesty. (You be the judge.)

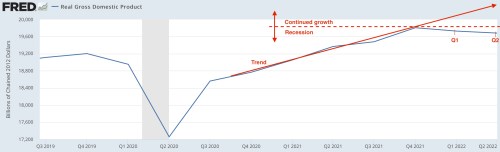

First, let’s look at the Federal Reserve’s graph of real GDP, just updated today, so we can use their accepted numbers with my additions in red to prove we have been in a real recession since the start of the year with this second quarter taking us deeper into recession. Even IF the change in GDP had not been negative in the second quarter, but had simply held flat, we would still be at the Q1 level, and GDP would, therefore, still be in recession from where we started the year. That is not how the NBER defines a recession, but it is how I define it based on the simple fact that it means the economy has receded and remains below where we were at the start of the year; therefore, we are in a “recession” — a prolonged period where production had receded from where it was … even if it didn’t recede further.

Federal Reserve Bank St. Louis

Federal Reserve Bank St. Louis

But I don’t need to rest on my definition that simply rests on the literal meaning of the word “recession.” The second quarter GDP report today affirms my nearly solitary argument all year long that we have been in recession all year … even by the rule-of thumb definition almost everyone goes by, including usually the NBER, the organization tasked with making the official (always retroactive) declaration of US recessions.

That definition is, of course, two consecutive quarters of declining real GDP. (Since Gross Domestic Product is measured in dollars, it must be adjusted for inflation in order to show us whether actual “production” is up or down, not just simply up because prices are higher so the dollar measure of goods produced is higher. What GDP is all about is how much the nation is producing, not what price the stuff is selling for, so price changes must be factored out. It’s just vastly easier to measure production in dollars of items sold than in units of items sold.)

Today, we finally got to see clearly that the economy has been receding like an ebb tide for the past two quarters. By my literal definition, it won’t be out of that “recess” until it has recovered to its last high, which is where it was at the start of the year. So, even a slight positive would have still left us in a recess. Anything below that dotted line means we are are in a sustained recess where we are putting out less than we were, so are in a slump. Regardless, even by the common definition of continued decline, todays Real GDP report says the decline in the first quarter was not a fluke. This is not just a continuing slump, but is a deepening slump. In fact, the change in the rate of decline is so subtle, you can hardly see where the line bends at Q1.

The cost of intentional blindness

What I really want to do in this article is focus on the lies or gross ineptitude of the federal government, the Federal Reserve, and especially the mainstream financial press in how they report this stuff. I walked out into the weeds a little on that topic in a recent article, titled, “Economists and Financial Analysts are Not the Brightest Fish in the Sewer System” where I noted the following based on their retail reporting that completely missed the effects of inflation in distorting the numbers:

The people who write financial news are apparently clever enough to type, which makes them theoretically brighter than the proverbial apes who, given infinite time, will eventually manage to hack out Hamlet. Many are even treated by their colleagues as if they are “analysts” or “economists.” Yet, the most basic concept of economics went right through their heads without hitting a single synapse like a neutrino through a thin layer of jello.

I confess that I have, over the years, come to the conclusion that economists, by and in large, know less about the real economy or basic math than anyone. Thus they are the one group of people least likely of all professionals to see a recession, even when it is already chewing the flesh off their toes like a school or piranhas. They will look down and marvel at the reddish color of the water and the pretty flashing fishies in the froth and tell us there is no trouble in site. By the time they predict a recession it is already over. They are like weather forecasters who tell us tomorrow what today’s weather will be after the picnic has already been rained out.

And now we know they did exactly that once again because almost nary a one of them saw we were in recession, while the bravest among them “predicted” we MIGHT (like 50% chance) enter a recession late in the year or next year. Oh, my gosh, how weak they are!

In that article, I noted how nearly all the economists and analysts relied on as experts in the financial media reported the economy was still basically strong because sales were still rising, so the consumer was still strong. That kind of lame thinking, when I hear it, puts my two ears and head between the jaws of a vice. It is hard to believe so many “experts” can be so far off on something so obvious.

To the mainstream press, “retail sales rose more than expected in June as consumers remain resilient.”

“No,” I countered, after referencing a couple of other articles making the same claim,

Consumer spending did not hold up. The numbers clearly show a picture of consumers buying LESS STUFF. They CUT BACK considerably on how much they bought. That is not “holding up.” It’s just that the price went up so much that they still had to shell out more money to get LESS stuff.

The numbers PROVED that consumers had to CUT BACK on the amount of stuff they purchased, but it’s hard to get yourself to cut back as much as you need to; so, they still spent a little more than they had spent, but to buy less stuff that they either needed or wanted. And that means less to be produced because there is less need to replenish inventory, even though the dollars spent on sales went up, therefore declining GDP.

The math here was simple, as I laid it out, but the mainstream financial press missed it entirely as did the government and the Fed, who ALL kept using the retail data to say the consumer was still strong. While most of the press was parroting the Fed and White House, I wrote the following about what should have been obvious to all of them as to where those retail figures were really pointing us (and it is my goal here to kick them in the shins and get them to start actually thinking, instead of parroting) because this should have been simple for them to see:

It is all the smoke and mirrors of inflation. The telling downfall will show up in the GDP report for the past quarter because the GDP numbers that everyone goes by ARE adjusted for inflation. So, when “real GDP” hits the headlines, retail will be a negative component. Adjusted for inflation, since “production” is measured in dollars whose value is eroding under inflation, real production will have gone down. That is not the measure of a strong economy.

And here we are! If they did the simple math, instead of seeing what their rosy glasses want to show them, they would have known in advance that today’s GDP report would show a decline in US production … at least in as much as the retail sales and retail inventory side of GDP shows because retail sales grew less than inflation pushed up the prices of those things bought.

Of course, the stock market also rallied a week ago when this news broke because, “Hey, good news in retail!” But then, today, the stock market also rallied because, “Hey, terrible news for domestic production, which means the Fed will stop raising interest rates and will start financial easing again!”

Talk about dumb! Even if the Fed stops raising interest rates or stops raising them in such big jumps, the only reason it will do so is because, yes, we are IN a recession, not just heading into one; and, whether in one or heading into one, a recession means earnings will go down … and layoffs will go up, taking consumer spending further down. Oh, but the fantasy-ripened minds of those who have never lived through a stagflationary recession, who have only traded when the Fed could constantly suppress interest and print money because inflation remained low, keeps them floating in poppy-field dreams.

The Fed is not going to pivot. That is to say, is not going to rush back into money printing; and, even if it did, the result of that would be worse than the present recession. It would not bring people back to work, but would bait them to remaining unemployed by collecting the government dole likely to be part of such monetary mania (as in 2020) under Democrats, making production even worse because fewer would be producing. That would press GDP, the measure of production, even lower.

We would enter a hyperinflationary cycle by trying to use money printing to stimulate an economy that money cannot fix because the inflation is based on shortages and on there already being too much money in circulation. Money-printing cannot solve supply problems that are due to lack of people willing to work, broken transportation links, Covid shutdowns, wartime blockages of supply routes, and sanctions cutting off vast amounts of resources and products. Adding more money into that inflationary chemistry of scarcity will only create the hyperinflation commodities cycle I warned about earlier in the year. (See: “THE INFLATION MONSTER: It’s Much Worse than we Thought … but Wait until this Little Monster Grows Up!“)

The blind kept leading the blind

They just kept doing it. Subsequent to my laying out how the basic math proved GDP would decline further due to those actually dismal sales numbers, the mainstream press continued the glib reporting on those number with new examples of just how unthinking they are … and so did the Fed. Let’s start with the Fed:

No, it clearly wasn’t different this time. Less than ten days after Bullard made that inane claim, the official GDP report proved national production is still declining.

Actually, it was different this time, but in a way Bullard completely missed, even though he sits in a better position to see it than almost anyone in the world, other than the other members of Team Powell. I could go hoarse from stating over and over how it is different this time, and most of my readers don’t need to hear it; but, for anyone just falling upon these pages: The Fed COMPLETEY controlled the yield curve for two years by hosing up more than half of all new Treasury issuances. So, it OWNED the market, leaving the yield curve Bullard is talking about unable to reflect the recession in advance. It could only leap to show recession after the nation was already in recession because Bullard & Buddies didn’t release their grip on Treasuries until well into the first quarter of this year. So, the yield curve arrived late to the party.

One wonders how the Fed, of all institutions, would not recognize that yield-curve control does make the yield-curve’s ability to predict a recession different; but only in that it means it can’t predict anything until the Fed relinquishes that control. Then it will move quickly to catch up with what is happening. However, those who cannot think but who just repeat theory don’t reason their way to that fairly straightforward understanding. Common sense does not exist in egghead world.

Is this outright deceit on Bullard’s part or total Fed ineptitude? They break the gauge; then, when they free it up to work after it is too late to warn us of anything, they claim it’s recessionary signal is false! It’s not false; it’s late.

And the financial media never does figure it out!

Unbelievable!

Fool me once, shame on you. Fool me ALL THE TIME, and dang I’m dumb!

It must be rush hour on the highway to financial hell because the nonsense just kept coming:

One day before today’s GDP report, Reuters noted,

The shape of the yield curve, which plots the return on all Treasury securities, is seen as an indicator of the future state of health of the economy, as inversions of the curve have been a reliable sign of looming recession….

The part of the U.S. Treasury yield curve that compares yields on two-year Treasuries with yields on 10-year government bonds has been inverted for most of the past month and is around the most negative its been since 2000 on a closing price basis.

Then the article went on to note how the Fed is dodging the curve’s well-known predictive qualities by focusing on the tiny segment at the shortest end of the curve that hasn’t inverted (effectively raising the bar for the curve to indicate anything):

Fed economists have said … that near-term forward yield spreads – namely the differential between the three-month Treasury yield and what the market expects that yield to be in 18 months – are more reliable predictors of a recession than the differential between long-maturity Treasury yields and their short-maturity counterparts. That spread has not gone negative, though it has narrowed significantly….

In other words, they are going to deflect to the tiny segment that shows what they want to project. “Nothing to see here, Folks. Ignore that inversion between the 2yr Treasury and the 10yr. Focus on the part where nothing bad is happening.”

Blinders! Complements of the Fed, which has one of the most notorious reputations for failing to see ANY recession coming … ever … and this is why. So, why does anyone listen to them on the timing of a recession? And, yet, the financial media endlessly rests on every word the Fed feeds them. Truly, the Fed has NEVER predicted a recession and has most often tightened all the way into the middle of one! One should not even ask what the Fed thinks on this matter. They have a perfect track record of not knowing!

If the Fed’s FOMC, which sets the Fed’s interest-rate targets for monetary policy, was a convention of meteorologists, they would be standing in the middle of a monsoon in their drenched business suits with raindrops blurring their vision, saying, “No sign of rain anytime soon!”

This is what they do. All the time! Yet, everyone keeps trusting them anyway. So, the one thing that was most predictable of all was that Bullard, as a Fed spokesperson, would say, “The yield curve is not right in predicting a recession.” Less than two weeks later we know we are already half a year into one that the NBER, if it can manage to avoid dishonesty, will eventually declare. (But, if it doesn’t, I can and will tell you below exactly what it will hang that false claim on.)

How the will avoid the truth at all cost

Look at how the laggards now report today’s second quarterly real GDP print:

First, the headline:

“US economy shrinks for a 2nd quarter, raising recession fear“

Raising recession fear!

Even with two quarters of real GDP decline fully in the bag, the most these cowards can say is that this raises the fear there might be a recession? Look folks, falling GDP is falling production, whether you decide to label it a “recession” or not! The label you officially put on it does not change the impact of what is actually happening in the slightest. So, why fear a mere label?

When you know you already have the reality, what does it matter whether or not someday the NBER decides to CALL it a recession? The reality is that the US economy is declining! The reality is the first quarter wasn’t the fluke many maintained in order to avoid facing the truth about a recession. Declining economic output — domestic production — hurts jobs. It means consumers are already buying less in real terms because we’re talking real GDP. It means layoffs are coming, which means more decline in GDP to come.

Moreover, the Fed is still tightening in big steps because it got a late start on combatting inflation, so the decline can only get worse as the Fed continues to try its best to “slow the economy” that is already going downhill. That is why they have to tell you the economy is NOT going downhill. By legal mandate, they have to fight inflation and can’t let you think they are tightening hard when we are already half a year into recession. (Or they’re just that dumb. Again, you decide.) Soft landing? Please! They will be landing inverted on the tarmac.

Yet, look at how the financial news strains its hardest to avoid using the “R” word because, God forbid we should actually say it:

The U.S. economy shrank from April through June for a second straight quarter, contracting at a 0.9% annual pace and raising fears that the nation MAY be approaching a recession.

(emphasis mine)

We’re half a year into actual declining production, and the closest they can bring themselves to using the actual “R” word is to say a recession MIGHT be coming. Well, not even quite saying “coming,” but “approaching,” which sounds a little less certain to me than “coming.” The first implies it may eventually arrive, the latter only that it MAY eventually get close. It may approach us.

At least, now they have to finally admit,

Consumers and businesses have been struggling under the weight of punishing inflation and higher loan costs.

No more of last week’s baloney about how the consumer is still “resilient” or last month’s blind deceit that claimed the economy is still fundamentally “strong” when the first quarter of falling GDP should have made it obvious to everyone that that certainly wasn’t true. The consumer has not been resilient for a few months now, and the economy has been declining all year. Let’s just say it as it is.

The Fed is hoping to achieve a notoriously difficult “soft landing”

Little late for that since there is a lag between the Fed’s actions and any impact on the real economy. Fed actions can hit the stock market the second they are even talked about, but changing things on Main Street takes months of changed policy. This economic decline is the pileup of wreckage from trade wars damaging supply lines back in the Trump years, Covid lockdowns all over the world back in 2020, forcing business closures, subsequent partial shutdowns throughout the Biden years, and now sanctions dogpiling on top of the damage, and it is most of all due to the damage from inflation, itself, which Fed policy during the last two years constantly stoked. Since we have already been in decline for months, where will we be by the time the Fed stops tightening, and how much further will the real economy decline after the Fed stops?

The naysayers may claim, “Oh, but Fed tightening will stop the inflation side of the problem.” But ask them how it stops inflation. It does it by slowing the economy — an economy that is already underwater.

As for those who think the slowing economy is good news because it means the Fed will go back to money printing, the Fed will ONLY do that once it has figured out we are in recession and the economy needs a boost. By mandate it is not free to start slacking monetary policy until its statistics show job growth is in decline, and it has already said it is willing to let job “growth” decline because the labor market, it believes, is overly tight right now.

The Fed has already told everyone it will be slow to assume the economy is tightening enough for it to stop its own monetary tightening. Even getting to that realization doesn’t mean it goes back to easing unless it can see that it has damaged the economy so much it must reverse itself. Taking this as bad news is good is hoping the wreckage will become so bad the Fed is forced to save us again. However, even when the wreckage is too obvious to deny, it will be almost impossible for the Fed to justify monetary stimulus if inflation is still singeing your ear hairs. The Fed will be highly reluctant to start goosing the stock market again when inflation is still hot.

“Oh, but inflation may be going down by then.”

Think of what that means: If the reason for inflation has nothing to do with an overheating economy, as clearly it does NOT, given GDP has been falling for two straight quarters, then taking economic activity down further half a year into decline in order to get inflation to start to decline, means plunging us into a deep freeze. The only way the Fed is freed from its legally mandatory inflation tether to start easing again is if gets inflation to turn around, but inflation has been going hotter and hotter the whole time the economy has been running cooler and cooler. We now know that from the data.

The Fed’s favorite word.

The Fed is “data-dependent,” remember? So, how does Papa Powell go before congress and say to angry politicians who would like to be re-elected this year, whose constituents are alarmed about inflation, “We’re OK to start lowering interest now because our data shows inflation is down to 6%?” How do you maintain any credibility with that argument when everyone knows even 6%, if it gets that low months from now, is hot? Yet, to get down to an annual rate of inflation of 6%, the Fed would have to get monthly inflation below 1% for the rest of the year! Like that’s going to happen.

How do you make that argument if inflation is still a lot hotter than that? How abysmal does the economic plunge have to get before the economic downturn shrivels inflation enough that the Fed can finally attempt to make an argument before congress that it is OK to go back to easing even while inflation is above its “symmetric” 2% target? You’re going to tell a nation suffering the inferno, “We’re going back to QE again because the economy is crashing so hard we have no choice” and think you can pull that off as a soft landing?

This has gone beyond ludicrous; and, yet, most of the financial world was blithely acting today as if a soft landing is still a reasonable likelihood and more free Fed float for stocks is coming because bad news is back to being good news again because … “Fed!”

“Squirrel!”

The only way this inflation goes down is with the economy because that’s already been going down the while inflation was still rising the whole time. That means stocks have further to fall due to certain economic wreckage ahead. The longer investors try to ignore the truth, the worse they will get their zombie heads caved in.

But it gets worse: If the Fed does do the unlikely and squarely faces public outrage by returning to QE or ZIRP in the midst of scorching inflation that is still rising 6% by, say, the end of the year (extreme best-case scenario under current tightening), that will be an unmitigated disaster and an impossible sell to a public that is already NOT “resilient,” thanks to inflation. You want to see things fly apart, tell all the people you’re going to flood the economy with more of that foundational stuff modern money is made from (bank reserves that determine how much money banks are allowed to create through loans) and floor interest rates again the second the public feels a hint of a less scorching scirocco wind that gives hope inflation may be letting up a little toward the end of an insufferable summer. Tell them you’re going to turn it all back on high again! See how that flies!

Stock investors and financial writers think that’s going to work?

As even AP notes,

In the United States, the inflation surge and fear of a recession have eroded consumer confidence and stirred anxiety about the economy, which is sending frustratingly mixed signals.

Does the Fed want to mix up the confusion even more by saying, “First we continued tightening hard when we all knew the economy had been falling for six months, and now we’re going to start stimulus while inflation is still burning your faces off?”

Oh what fun that will be to behold! Powell better keep a hidden pair of scissors to cut the rope that will loop his neck if he tries that.

Jobs, jobs everywhere and not a job to spare

Yet, this is where AP follows the Fed right off the rails once again by just parroting what the Fed says as assurance:

Fed Chair Jerome Powell and many economists have said that while the economy is showing some weakening, they doubt it’s in recession. Many of them point, in particular, to a still-robust labor market, with 11 million job openings and an uncommonly low 3.6% unemployment rate, to suggest that a recession, if one does occur, isn’t here yet.

Well, then, lets make sure we keep tightening hard until it is here! This labor market situation is a blind spot that is so big you could run a freight train through it. It is also where the NBER may try to hide the recession with gross misguidance, claiming its not really recession due to low unemployment — an argument the economists are already cuing up:

“The back-to-back contraction of GDP will feed the debate about whether the U.S. is in, or soon headed for, a recession,” said Sal Guatieri, senior economist at BMO Capital Markets. “The fact that the economy created 2.7 million payrolls in the first half of the year would seem to argue against an official recession call for now.”

If these people thought outside their college formulas and theories, they would reason their way to understanding that, in present circumstances, a tight labor market does not mean that at all. People may be stepping back into payrolls, but huge number still are not. As I pointed out in that article referenced above about economists,

None of these people seem to have the mental elasticity to stretch their brains around the outside of normal parameters at a time when we are clearly not inside of any normal parameters. We left Normal World years ago….

Today’s job situation has nothing at all to do with a booming economy. All those jobs are sitting there open because NO ONE WANTS THEM. The people who once filled jobs like that don’t want to work. That is not the sign of a strong jobs market. It is the sign of a very sick job market. What it means is that the labor market is no longer able or willing to supply labor. That’s called “broken.” It means production cannot increase, except by expensive automation, which takes time. If production cannot increase because labor does not fill the roles needed to make production increase, then gross domestic product cannot increase. If GDP doesn’t increase but actually goes down due to a labor shortage, we have a word for that: “recession.”

What you are really seeing is deep signs of stagflation. Production is down because labor supply is way down. Besides not being able to get parts and materials due to Covid- and sanction-related supply chain breakage, manufacturers also cannot get workers. That means gross domestic production HAS to fall. That means prices are likely to rise more due to scarcity. That is a recession by definition, and when it happens when prices are rising anyway because of scarcity worldwide, then you have a stagflationary recession.

The bottom line there is that, if workers don’t return to work, the ratio of producers to consumers will remain seriously deficient, which means there will not be enough goods or services for all of us who want to consume them, forcing prices to remain high, even as the economy shrinks because things are NOT getting produced so not getting bought and services are not being provided as abundantly.

What we are really seeing in those labor numbers is a badly broken labor market that is not able to deliver the one thing it is supposed to deliver.

“Economists and Financial Analysts are Not the Brightest Fish in the Sewer System“

You know, the logic here is not hard to follow.

The Fed and their mesmerized economists and their children in financial media who are following Pied Piper Powell are all believing the low unemployment means the jobs market is strong. NO, IT JUST MEANS PEOPLE DON’T WANT TO WORK. GDP for a second quarter just proved unemployment is NOT down because the economy is so hot. It’s just down because few people want to go back to work after the Covid lockdowns. They’re not unemployed. They’re out!

A great many have stopped working for a variety of reasons, including early retirement, causing well-known demographics to arrive early. Because the labor pool isn’t there — or is highly reluctant to return — production will not be there either until people get desperate enough that they are forced out of retirement or out of whatever else they are doing besides working. You simply cannot have a healthy, productive economy when people are producing far less than they want or need to consume, especially not a time when war and sanctions and trade wars and Covid lockdowns mean ALL economies don’t have as much as they need or want to consume!

So, we are facing some terribly tough times ahead just when the Fed & Friends are falsely assuring everyone we may not really be in a recession yet and can still hope for a soft landing. Don’t follow the advice of Federal fools. The shortages will have to get tough to force people back into production, and then it will take time for production to smoothen out and ramp up to eliminate the shortages. Plus we have all those sanctions barring the doors when people are ready to work but need materials to work with. This is not an easy or quick restart even when it happens!

And, if the Federal government ramps up its spending, now that Manchin is giving the Dem’s the final hold-out vote they need, where are the workers going to come from to accomplish all those things? Expect higher labor costs to pull them back in, and more demand for limited resources, so higher prices for another round as the Fed creates the funding to make all of that happen. We are talking one colossal mess here, and the financial media doesn’t get it at all.

Years of profligate spending and monetary madness have created this impossible scenario, which is why I said at the start of this blogging adventure many years ago, the Great Recession never ended: we just plowed all of its problems forward to face another day, which would make them so much worse when that day finally came.

That day has come.

As if to verify what I wrote in the article I just quoted about lack of mental elasticity, the AP reports,

In the wake of Thursday’s second straight negative GDP report, Biden downplayed the news, pointing to continued low unemployment and strong hiring.

Just as expected! That they would argue from out of their own blind spot is so predictable.

Don’t believe Biden’s platitudes:

Even as we face historic global challenges, we are on the right path and we will come through this transition stronger and more secure.

In spite of the president’s void assurances, at least one economist seems to finally see through the endless nonsense:

Joshua Shapiro, chief U.S. economist for the economic consulting firm Maria Fiorini Ramirez Inc. “An economy rapidly losing momentum combined with aggressive monetary tightening is not a recipe for a soft landing or any other type of happy ending.″

Absolutely true … and obvious.

But others?

“We’re not in recession, but it’s clear the economy’s growth is slowing,” said Mark Zandi, chief economist at Moody’s Analytics. “The economy is close to stall speed, moving forward but barely.”

Growth? Whether you want to officially declare this a “recession” based on technicalities or not, there is no “growth.” How do you get from clearly declining GDP to say, “growth is slowing” or close to stalling or “moving forward but barely“? This garbage is so ripe it’s hard to even stand near it. I don’t know what it tastes like as it comes out of their mouths, but clearly production is in retreat, whether you CALL it a “recession” or not. It’s not “close to stalling.” REAL production is actually falling. You may decide not to call that a recession based on some technicality, but it is still a decline in economic activity, regardless of what you call it! The only thing left to argue about is what the NBER is going to call it. There is no overall growth in declining real GDP.

Reading such cognitive dissonance mentally disturbs me. The inability of almost everyone in the financial press to use the “R” word is pathetic enough for its weakness, but to claim that the economy is just growing more slowly is astounding. These people are watching someone fall head-over-heals down a LONG set of stairs and reporting, “He’s rising less quickly now. He’s not climbing the stairs as quickly as he was.” Uh, sure. He’s negatively rising, and he’s been negatively rising for six months! If he doesn’t stop doing falling, his rate of rise is going to stall before you know it!

Mad hatters, all.

Markets reacted little to the news, with stocks slightly lower at the open.

And then a lot higher with the Dow closing up over 300 points and the NASDAQ 130.

Of course … because everyone is believing what they want to believe. We now live in a world bereft of truth.

However, we have seen that this inflation, the rise in interest, the move to Fed tightening, have all been relentless in forcing the stock market back to dealing with the reality of an economy that has been declining for months.

And notice how redundant the excuses get for trying to maintain the false rosy picture:

“It really was to script,” Zandi said of the report. “The only encouraging thing was that inventories played such a large role. They won’t play the same role in the coming quarter. Hopefully, consumers keep spending and businesses keep investing and if they do we’ll avoid a recession.”

That was exactly the same thing they argued for the previous quarter! It wall all in the inventories so the problem, they claimed, would resolve this quarter because inventories wouldn’t do that again! Now they report that inventories played an even larger role this time, but it is still all in the inventories and will, therefore, resolve by next quarter.

Retreading that argument for another round goes beyond daft to either being intentionally false or so wedded to market greed that you can see nothing else.

Most economists don’t expect the NBER to declare an official recession, despite the consecutive quarters of negative growth.

Not in the least surprising. Economists would be the last to know. They always are. But who cares what the NBER declares?

Since 1948, the economy has never seen consecutive quarterly growth declines without being in a recession.

So, with today’s data now in, betting we avoid calling this a recession is betting on a long shot. However, what difference does it make what the NBER decides to call the economy as it falls. It’s still falling! That is the only thing that matters about a recession anyway.

If avoiding the word “recession” as the label for this economic decline is the hill they want to die on, let them! Problem is these people that do their best to avoid the “R” word at all costs never do die. They are like zombies. They keep getting back up. They keep their jobs no matter how badly they fail and no matter how often, and they even keep their pubic respect, remaining the “experts” who get quoted endlessly as if they knew anything about recessions.

Clearly they don’t. Am I wrong in stating that merely days ago, most of these “experts” were predicting GDP would come in positive today, even though the Fed’s GDPNow forecast said it would be negative? (Meaning apparently the Atlanta Fed has tucked away an economist or two who actually knows something because their final prediction yesterday, after weeks of negativity was that GDP would come in at -1.1%.) Outside of the Atlanta Fed, I didn’t hear a single mainstream economist predict a negative number for today’s report. Where did the Atlanta Fed’s reported “Blue Chip” economists — a group they survey outside of their own calculations — end up in their predictions? +2%! The vast majority of economists I read were saying this quarter would prove positive but weak. That was never even remotely likely.

All who open their eyes to see the things they don’t want to see will find they have greater clarity. It doesn’t do any good to run around the haunted house with your eyes closed in order to not see the scary stuff. Closing you eyes doesn’t make the goblins go away. It just causes you to fall down the stairs (so others can say in great understatement about YOU, “Look at that person rise less quickly now”).

Still,

The feeling, though, on Wall Street is that the economy could well hit recession later this year or in 2023 but is not in one now.

Later this year? According to a recent poll, 65% of all voters believe we are in a recession now. Today’s data confirmed they are right. People on the street know in their gut what those who live in an updraft of merrily dancing theories cannot see. All the gleeful economists see is swirling cotton candy floating up into sunny skies above them.

I see this, and I see it clearly, and I hope you do, too:

You can refuse it because the cotton candy is prettier, rosier, and smells nicer; but this is what is actually right above you right now. If you’re one of the people who see with clarity, you could also look for a storm shelter, and that might be a lot smarter than pretending to believe what you want to believe and accepting the Fed’s assurances as confirmation that you’ll be all right. THIS is what is already there, and that black stuff ain’t cotton candy.

Hopefully, you are not among those listening to the Fed and feds and the financiers who led the nation into these ashen clouds. On the less than 35% chance that you are (based on the poll), it’s time to wake up and smell the GDP that’s right under your nose today. In the meantime, I am halfway through developing my prognostications for the second half of the year and early 2023 in my Patron Post, which I hope to publish this weekend for my patrons. I assure you the truth looks a lot darker than anything you read about the economy in the financial news, but who guided you last year to see the first half of this year as it actually turned out even when the world’s wealthiest banksters like Jamie Dimon, who are supposed to know something, were telling you in December we were entering the strongest economy he had ever seen!

Hopefully, you didn’t believe the Dimon and got out of stocks and bonds back when he said that nonsense and stocked up, instead, on some non-perishable food with a shelf life in the kinds and flavors you usually buy so — if the shortages don’t turn out as bad as I think they will — you’ll just be eating the stuff you ordinarily eat anyway and certainly bought at a cheaper price than you can today, as I said would be the worst you’d experience for mistakenly stocking up, should I prove wrong.

So, you can believe the writers and economists who paint the pretty pictures of blue skies if you want, but you’d better bring a raincoat to your summer picnic because it is just going to keep getting real — by which I mean a lot darker because of all the denial and lies that keep us from taking the actions we really need to take while keeping us doubling down on those that do us harm. Hope is not a plan.

Liked it? Take a second to support David Haggith on Patreon!

![]()