That’s pretty ugly when you consider how ugly GDP looked at a growth rate (adjusted for inflation ) of -1.4%! Then that got kicked in the snout to -1.5%, but that’s not the half of how ugly it really was. What if it really was the first quarter of a covert recession? I am about to show it likely was and that the prior quarter’s growth spurt was the actual oddity.

Now, I say “covert” only in that it seemed to sneak up on everyone I read, and most economists claim the -1.4% print for Q1 2022 was just an anomaly. Nevertheless, a few more notable people than I have finally started to state the same position I have been staking out since the start of the year (and forecasting prior to that).

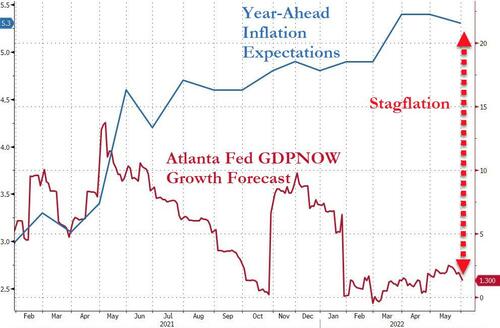

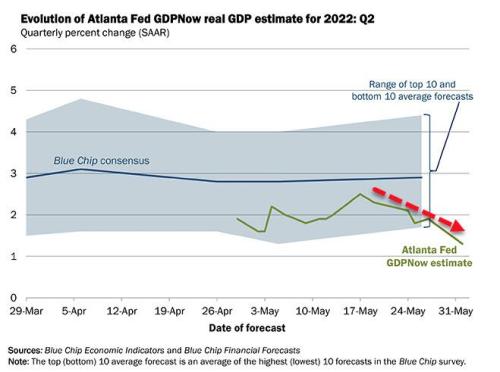

This past week, even the Federal Reserve moved closer to my own view. The Atlanta Fed revised its GDPNow forecast for the present quarter downward considerably to +1.3%; and, as you see, it’s been revising it down for four out of its last five revised estimates:

You may recall, when I was forecasting last year that GDP would turn negative in the first quarter, I kept pointing out how the Atlanta Fed was slowly catching down with its own Q1 prediction towards what I was predicting until it revised its forecast all the way down to zero GDP growth. Even then I brashly claimed they were overly optimistic and that the real number would come in negative because the Fed hates to raise unnecessary alarms, so it tilts positive. Then the real print came in, confirming that at -1.4%.

Here are the reasons given for the present downgrades of the second quarter:

The nowcasts of second-quarter real personal consumption expenditures growth and real gross private domestic investment growth declined from 4.7 percent and -6.4 percent, respectively, to 4.4 percent and -8.2 percent, respectively.

Well, those downgrades are all right where it counts the most in a consumer-driven economy. And, with inventories reportedly being filled back up again (I’m not sure after all the prior talk of shortages how much I believe that, but so corporate reports said), private investment may go lower still.

The GDPig farts in your general direction

While I already warned there is not enough lipstick in the world to make the GDPig look pretty, several commentators have tried. A number have pointed out how the pig’s plunge headfirst into the outhouse basement last quarter was only due to inventory or trade, bringing in a lot of imports that get subtracted out of GDP, which they say will reverse in the present quarter. I, on the other hand, don’t believe Q1 set us up for Q2 to restore something, I think Q1 took back something that Q4 falsely gave. Q4 2021, in that case, was the one-off. That view about how imports work is also a common misunderstanding of what is actually happening when imports get subtracted.

I said back when Q4 2021 was first reported this last January that inventory’s majority contribution to inflation-adjusted GDP growth (+6.9%, revised now to 7%) was likely due to businesses stocking up in a piggish hoarding battle against other businesses because of all the shortages we were starting to see. I argued it was just commerce pulled forward from 2022. As such, I said that would almost guarantee my prediction of a negative 1st quarter in 2022 as the purchases that are pulled forward don’t happen later on; and I think that is exactly what we, then, saw happen in Q1 2022.

The Bureau of Economic Analysis (BEA) noted about Q4 2021,

The increase in real GDP primarily reflected increases in private inventory investment, exports, personal consumption expenditures (PCE), and nonresidential fixed investment…. Imports, which are a subtraction in the calculation of GDP, increased.

Normally, imports get subtracted out of those inventories because they are not made domestically, and the BEA shows imports subtracted more out in the fourth quarter than previous quarters. That should be a wash, though, because imports are only subtracted out as a form of accounting reconciliation. They are included in the inventory totals that get reported and then subtracted out by the BEA. They cannot really make GDP go up or down because they are NOT gross DOMESTIC product.

It’s supposed to work like this: If the $30,000 “made in America” car you just purchased had $10,000 in foreign parts, your purchase should only contribute $20,000 to GDP. Part of the car reported as a $30,000 sale was not made in America so it should not count in US gross domestic product because those parts were already counted as GDP of the country in which they were made. So, with each GDP report, the sum total of all imports get subtracted out to make sure we’re not piling up credit for the production of things that were produced in other countries. That way we only credit our own domestic production for as much of the car as we actually built (or as much of the value as we added).

This gets muddy because it’s hard to tell if the imports get subtracted from GDP in the same quarter in which the sale of the car or it s storage in inventory got added to US production data. If the imports happened in the same quarter in which the car’s total value was added to gross domestic production, then imports going up or down do not really add or subtract from GDP; they are just subtracted out as a form of accounting reconciliation that removes components that should never be included as US domestic production in the first place.

I’ll note that the movement of imports was seriously delayed by all the transportation issues in the fourth quarter, and the transportation problems seemed to be far more bogged down on the import side than the export side. As you will likely recall, overseas transportation was a snarl (especially inbound). The BEA indicates there were a lot more imports subtracted in the 4th quarter, which I find odd given the huge shipping snarls that were supposedly causing shortages. Even if that is accurate, they were a wash because the BEA was only subtracting out what it had added under total inventories. It was only subtracting out the things that were not produced domestically. The Federal Reserve states unequivocally that imports make no difference in GDP at all:

The current textbook and classroom treatment of how international trade is measured as part of GDP can lead to misconceptions if not properly explained…. Imports have no impact on GDP…. In the expenditures equation, imports … are subtracted. On the surface, this implies that an extra dollar of spending on imports … would decrease GDP by one dollar…. However, this cannot be correct because GDP measures domestic production, so imports (foreign production) should have no impact on GDP…. When the Bureau of Economic Analysis (BEA) measures economic output, it categorizes spending … as C, I, and G [Personal Consumption, Investments (including inventory) and Government purchases]…. As such, the value of imports must be subtracted to ensure that only spending on domestic goods is measured in GDP.

The Federal Reserve Bank of St. Louis

In other words some of the goods that are counted under personal consumption and some that are counted under investments and government purchases are imports (i. e., not made domestically), so the total of all imports has to be subtracted back out because they don’t belong there. It’s done this way because it is far easier to subtract them out in aggregate based on import records than to try to figure out what part of every little thing sold in America was imported.

Because imports get subtracted out at the end in aggregate, it really makes no difference to GDP how high or low the import number was. It APPEARS it does because you cannot see where imports were included in C, I and G. They’re just baked in. So, all you see looking below the hood is the line where all imports for the quarter get subtracted out. It’s a wash BECAUSE, if the value of imports subtracted from the BEA’s total of C, I and G was exceptionally high, it should only be because the imports included in the C, I and G numbers were equally high. And, if imports subtracted are exceptionally low, they are supposedly equally low in what got originally included in C,I and G. So, it is an accounting mechanism that just washes imports back out of the GDP total.

To be clear, the purchase of domestic goods and services increases GDP because it increases domestic production, but the purchase of imported goods and services has no direct impact on GDP.

I’m not sure how clear that explanation was, but it is probably about as clear as anything from any quasi-government, fascistic private agency ever is … and I tried to streamline it more by omitting all the Fed’s inserted explanatory detail.

HOWEVER, the lag between when an imported part came into port and someone bought the product that included that part could easily be a year right now! That’s because, even once the part finally gets to port, it gets buried in the backlog of stacked containers and then sent by delayed trains and then sits in the auto manufacturer’s warehouse until other needed parts arrive then finally gets made into a car and shipped toward a consumer back through snarled transportation. So, the aggregate import adjustment works out over a long period of time, but not necessarily in the right quarter, especially in the early estimates. That is partly why they’re called “estimates.”

Because of how complex the logistical log jams and supply-line breakages manifesting all through the global economy have become, it’s a hard to parse out what the numbers mean. Even the US government experts admit the numbers are hard to sift out of the collective data in the BEA’s revised report for Q4 2021 just due to Covid:

In the fourth quarter, COVID-19 cases resulted in continued restrictions and disruptions in the operations of establishments in some parts of the country. Government assistance payments in the form of forgivable loans to businesses, grants to state and local governments, and social benefits to households all decreased as provisions of several federal programs expired or tapered off. The full economic effects of the COVID-19 pandemic cannot be quantified in the GDP estimate for the fourth quarter because the impacts are generally embedded in source data and cannot be separately identified.

US Bureau of Economic Analysis

It is the same with how embedded imports are in the manufacturing data. I won’t pretend I know with any more certainty any more than the BEA does about the granary detail in their own numbers, but here is what I’ll note: The quarter before (Q3 2021) experienced a decline in GDP to a fairly low 2.3% real GDP growth. I don’t think it makes any sense to believe all those Covid problems and related shortages due to shipping and production delays suddenly made business massively better in the fourth quarter or that the termination of forgivable loans and grants and social benefits made the fourth quarter boom. All those things should have made the quarter worse. Yet, it did boom according to the GDP number that was delivered.

So, I find it a lot more reasonable to think that the peculiar positive bounce in the 4th quarter is the odd GDP number — the one-off — because it makes little sense with the massive delays and all the Covid shutdowns in the surrounding business environment. I think the next quarter righted the distorted (overly positive) accounting of Q4, and the present quarter may right it some more. I think GDP growth was probably closer to zero in the fourth quarter, but the massive disruptions of shipping in parts and then production of goods from those parts and then shipping out finished product is creating huge misalignments between domestic sales and reported imports.

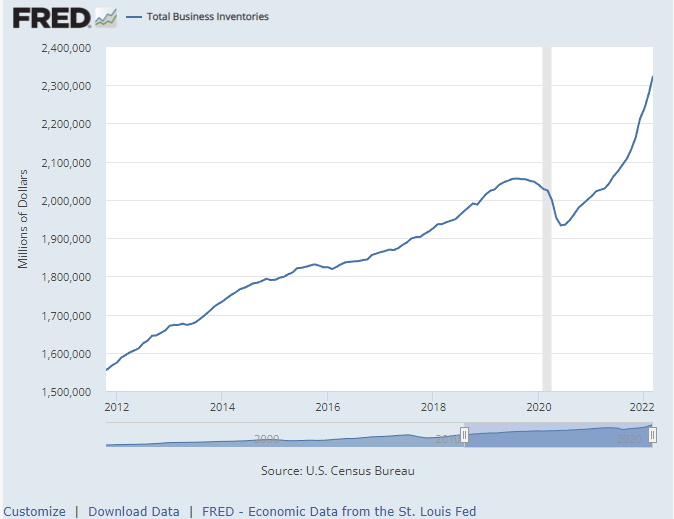

You can see in the following Fed graph that total business inventories grew consistently since the end of the Great Recession, then fell rapidly prior to the Covidcrash and then plunged even harder immediately after the period that was finally designated as a recession — perhaps due to consumer hoarding or perhaps due to production being shutdown in the lockdowns or people not returning to work or all of the above. Since then, inventories have recovered remarkably, even though we had all kinds of supply issues and transportation issues and partial lockdowns since then.

How is that possible? It doesn’t seem inventories went up just because consumers weren’t buying (resulting in a backup in the warehouses) based on the retail data I went over in my last article. (See “The Retail Apocalypse was Bloodier than it Looked.”) So what gives? I see that the graph gets steeper right as inflation got steeper. (You can also check out that last article to get a fuller picture of how statistics are deceptive right now due to extraordinary inflation, From my extrapolations in that article, consumers were apparently buying a little more and paying a lot more.) The inventories in the graph are measured in dollars that are not adjusted for inflation.

Rapid changes in inflation as well as massive transportation and production snarls are creating a lot noise in the numbers, making it reasonable in my opinion to ask, which quarter, Q4 or Q1 was more accurately representative of the condition of our economy and which was more distorted by the churn and noise?

Let’s see if we can sort out the truth a little better by taking a closer look at Q4’s huge GDP growth where the BEA tells us,

Within retail, inventory investment by motor vehicle dealers was the leading contributor.

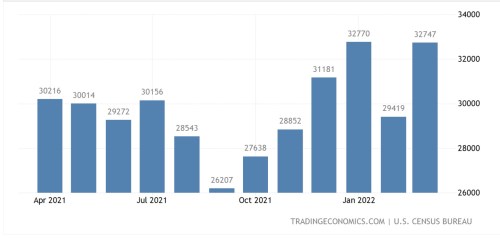

OK. Since that is the biggest factor, let’s dig into that. We know sales of motor vehicles perilously declined in the last quarter of 2021, so how could it have been the leading contributor to GDP growth? We also know those sales didn’t do much better in the first quarter of 2022. Let’s look to another source of conflicting data, which proves vehicle sales slumped considerably during ALL of the last several months from where they were a year ago, particularly in the fourth quarter of 2021 (and this is measured in units sold, not dollars, so inflation has no distorting effect). This is the actual movement of produced units:

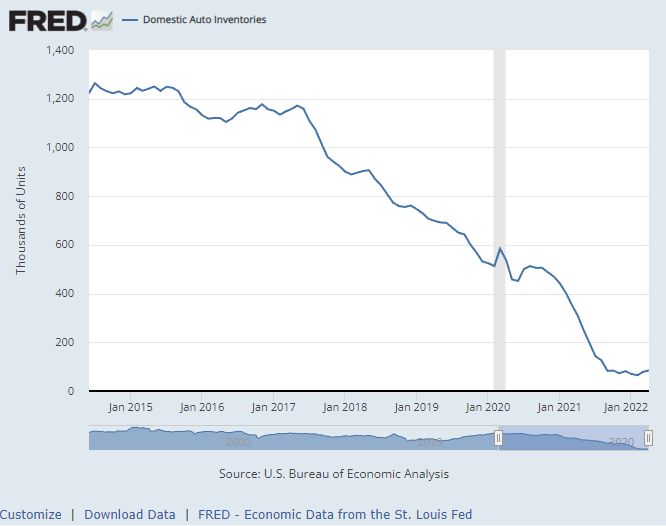

I don’t see anything in the Fed’s numbers there that squares with the Bureau of Economic Asininitity’s assessment. The supposed main contributor to GDP growth in Q4 was actually way down in units sold. Now, you might say, “Well maybe the dealers bought a lot and they stayed in inventory because no one bought them. Look again. Here is what the Fed says auto inventories looked like during that same period:

Down even worse! Absolutely hideous! Inventories of domestically produced cars fell off a cliff throughout 2021 and bottomed out in a deep pit! So, sales were down because inventories (stored production) were way down in Q4 of 2021 and Q1 of 2022 — WAY DOWN! As in further down than they have been since Ford upgraded the Model T! Dealers were, in fact, complaining that sales were way down because they couldn’t get cars. Yet, the BEA says the major contributor to GDP was domestic auto production? How on earth can that possibly be true?

The second graph reveals just how extraordinarily unable dealers were to get domestic autos, and we know that was largely because many cars weren’t getting produced domestically due to unavailable computer chips and other parts because many imported parts were getting stranded in shipment because ships were not clearing ports. We heard that all year. So, it makes sense that the severe lack of inventory due to stopped PRODUCTION was the reason unit sales fell so precipitously. People wanted cars, but there was practically nothing to buy! That’s why car prices rose so much.

So, how could dealer inventory be one of the leading causes of GDP growth in the fourth quarter of 2021 when it NEVER LOOKED SO UGLY? Yet it was according to the BEA.

Let’s see: fewer cars were produced Domesticly due to shortages of parts, inventories were bleak at a level that would have made Henry Ford concerned, and sales were every bit as bleak because you cannot sell what you do not produce! By December 2021 dealer inventories were depleted all the way down to only 20% of their pre-pandemic level while sales slid down a similar slope and while US production fell due to those nefarious computer chips.

I look at all that and say, “These numbers are a huge mess. They do not add up to autos being the leading contributor to Q4’s huge GDP GROWTH. This is one brutal pig of a GDP mess-up. Something stinks and stinks bad.”

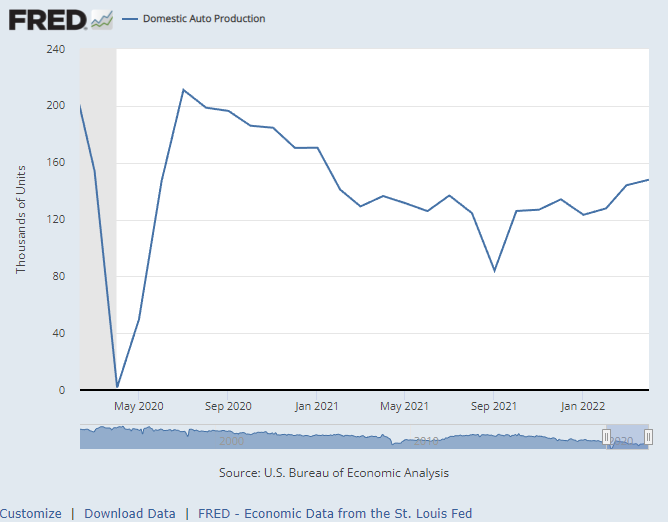

Clearly, the big boom from autos in Q4 GDP had NOTHING to do with US production rising (production being the “P” in GDP. US domestic production of cars stank like a hog farm in the final quarter of 2021. To verify all of that, here’s what US auto production (in units sold, so inflation has nothing to do with it) looked like:

It tanked in September then recovered to a totally flat low that remained about the worst in history until February of 2022! (If you average the minuscule bump in December with the subsequent dip, it was flat, and the only two exceptions for how low domestic auto production remained throughout the entirety of 2021 is the total shutdown that happened due to Covid in 2020 and the crash in 2008 (which is the dip that shows up in the long-term blue graph along the bottom! But, hey, auto production was the “biggest contributor to positive GDP in Q4 2021” … because that makes sense! Good grief!)

Imports, on the other hand, actually went up, exactly as the BEA said, but that is totally irrelevant because they are not domestic product so they simply get subtracted back out. That is why the subtraction number was so much larger. Imports went up like the following graph shows, and then were subtracted back out to neutralize their effect on GDP:

Now you can see why the subtraction of imports is irrelevant by seeing how they first added to the numbers included in the GDP calculation, then merely got subtracted back out. And the Fed states outright they don’t add anything to GDP because they are not domestically produced. If they were off in timing, that’s noise, but looking at all the underlying facts, as I did above, shows the noise, if it happened anywhere was in the BEA’s totally bizarre claim about domestic auto production adding to GDP in Q4. It is simply impossible for that to have been true, and shame on economists for not catching that and widely reporting on it. Domestic auto production was down — WAY DOWN. Domestic auto inventories were down — WAY DOWN. And sales in dollars were … WAY DOWN!

Hence, my renaming of the BEA as the Bureau of Economic Asininity.

Lipstick applied with a shovel!

So total vehicle sales (in units, not inflated dollars) throughout the fourth quarter — domestic and imported — stank like a pig’s hoof. Inventory of domestically produced cars stank like a pig’s breath, and production of cars domestically stank like the south end of a pig throughout the fourth quarter. You can insert the lipstick as a suppository to try to cover that smell up, but it really doesn’t make the rest of the pig smell any better. So, something is seriously wrong at the BEA. One has to believe it cannot be this stupid, so must be outright lying.

Autos didn’t boost GDP by being good! And I’m going to provide a whole lot more evidence of that for the one area the BEA said contributed the most to GDP growth because if they got that wrong, nothing they said is to be trusted as credible in the slightest.

The Bureau of Economic Asswineness couldn’t stop themselves from smearing lipstick on this pig from head to foot:

Private inventory investment helped boost real GDP growth in Q4 2021, led by business investments made by motor vehicle dealers, according to the BEA.

Oh my gosh! It is so easy to prove the outright lies here. With production well known to be way down, and inventories tanking, what exactly did dealers invest in? More sugar for the coffee area? Here comes the perfumed lipstick in what they use as evidence where it just gets more bizarre:

The demand for new cars continues to surge as some drivers are waiting six to nine months just to get their new vehicles and dealers face record-low inventory levels. In fact, the total sales for new vehicles was forecasted to reach nearly 1.25 million cars in December 2021, down 20.5% from the year before

They make it sound as if inventories are at a record low because cars are getting scooped off the showroom floor; but why did no economist ask, “How do you square your claims?” Dealers led GDP with huge inventory investments (unless the investments were all sugar and coffee), but inventories were at record lows?

As for the implied demand, inventories were low because production was abysmal. Yes, demand continued to surge — but only in the sense of people really wanting to get their hands on a car — but no one was able to buy because inventory was dead.

Presented in the context of explaining the boost to GDP, they note sales were “forecast to REACH nearly 1.25 million cars in December,” said as if that was a “reach” — a good thing — but then they add that number would be actually be down (if even attained) by more than 20% year on year! It starts off sounding like “Wow, cars must have been selling like hotcakes because they were flying off the showroom floor to where inventory couldn’t keep up and where sales was REACHING to grasp 1.25 million!” Then you get to that last little bit that total sales, if they even hit that mark, would be down 20%. OH, so that’s why GDP was up because sales were down 20%, at best, and inventory was still at record lows???

Excuse my dizziness, but I feel sick when I try to digest this swine slop of numbers.

Here’s the truth: People could not get their hands on the steering wheel of a new car because there were no cars! Buyers were, in fact, waiting six to nine months to feel the keys hit their greedy little hands because supply was at “record lows” — gross domestic production was down! Drivers weren’t waiting for nine months because demand was so hot it was sucking up all of the abundant supply. We know that because sales were DOWN. Yet, all of that we are told “led” growth by helping to “boost real GDP.”

The lies here are unreal! And why did no one rip all of this to shreds?

I feel like I live in Wonderland where what I wonder is how much the Biden administration is coaxing the BEA to try to make the numbers look good. Production, DOWN. Sales DOWN. Inventory DOWN. All quarter long. Buyers waiting forever only because cars can’t be found. But, hey gross domestic production in cars … BOOMING!

OK, but it gets worse! Let’s look at the part where analysts reporting on all of this applied their own lipstick to the pig with a long-handled shovel because no one wanted to get close to the pig. Get a load of this hogwash:

“Retailers continue to sell most vehicles nearly as soon as they arrive in inventory,” Thomas King, J.D. Power president of data and analytics, said at the time of the release. “This December, a record of nearly 57% of vehicles will be sold within 10 days of arriving at a dealership, while the average number of days a new vehicle sits on a dealer lot before being sold is on pace to fall to 17 days, a record low and down from 49 days a year ago.”

Wow! That sounds so stinkin’ lovely, doesn’t it? Talk about the art of lying with statistics! They probably just forgot to mention that dealers “continued to sell most vehicles nearly as soon as they arrived” because there weren’t any vehicles on the lot to sell and there weren’t any arriving! “57% of vehicles sold within 10 days” because they practically stood alone on the barren lots! And, thus, the time vehicles remained on the lot fell to a “record low” only because the one vehicle that actually made it to the lot was surrounded by seven starving sales people and fifty hungry customers fighting over it like hogs in a trough fighting over a single cob of corn! The car’s lucky it made it off that stockyard in one piece.

One almost has to scream about the sheer levels of pork blubber in these positive statements about GDP. So, the real truth for Q4 GDP was that it was wonderful because it sucked pigs’ feet; and that imports subtracted nothing off the GDP figure because they are IMPORTS, not domestic production; so things were great! Hallelujah! If only we could always have times when there are no cars to sell so that 57% of the nine cars available would fly off the lot because then GDP would go through the freakin’ roof!

Oh, my gosh. How is it possible no one caught these mammoth discrepancies!?

NONE of the underlying data — NONE –speaks of the strong economy we were told we had in Q4 with 7% inflation-adjusted GDP growth. Why a I screaming and underlining? Because no on is seeing it even when it sits right in front of them and screams at them! The underlying data — forget the totally bogus Q4 GDP report — screams of bottlenecks and surges, causing epic distortions in the data.

What I see in every one of those graphs is an auto industry in a deep slump with a January bump in actual units sold. And the bump was reported the bad quarter! Probably because the total sales that came through in the Fed’s graph were a shipload or two of imports that shouldn’t count in GDP anyway. Even with the bump, auto sales are still down in a hog wallow. (Down last fall about 25% from their peak a year ago in units sold and then only seeing a minor rise in January — the bad quarter — that quickly faded.)

Oh, the other good news there was that …

A recent report by Edmunds found that a record 82.2% of people shopping for a new car paid above sticker price in January, compared to just 2.8% one year ago.

Well, hallelujah all over again! That is a good economy! Prices inflating and people still screaming for the opportunity to pay more! That certainly speaks of a scorching hot economy. (Oops. It was only because they were all so desperate to become the proud owner of the one new car in town!) We may get to Weimar yet! Better bring a wheelbarrow load of Benjamins if you want to buy that one car because the competition is stiff, so everyone is bidding up the asking price. There’s your stinkin’ good economy!

Bouncy pig

So, where does that leave us now? Leaving Motown, which is Notown for the time being, let’s consider that what goes up comes down and did in Q1, and what falls down can bounce back up some, but lower than the height from which it fell. So, if this was just some surge piling up in inventory due to imported items making it through and then not making it through, and all getting logged in weird order so that things are not reconciled in the correct quarter, we could get more of that. However, this pig’s bowels are still clearly not moving smoothly. So, I think any rise, if we get one in Q2, will be nothing but more noise out the back end of the pig.

Thus we see this argument:

Ian Shepherdson of Pantheon Macroeconomics said last quarter’s shortfall was partially a result of companies importing more to rebuild inventories, and growth could rebound in the second quarter of 2022.

So, again, we have someone saying the Q1 shortfall in GDP was due to imports when imports have nothing to do with gross DOMESTIC product. He is not recognizing that imports are supposedly only subtracted back out because they were baked into the other numbers that we’re added in first. The idea he’s expressing is that those inventories have been rebuilt now, so the imports won’t be happening again and, therefore, won’t be subtracted from Q2 GDP. But, again, imports are supposed to be a wash in GDP, though granted, the import subtractions MIGHT not happen in the same quarter where they were included in all the other purchases during chaotic times like this.

What I’m saying is that inventories are going to continue to falter and surge and falter again as China now reopens, sending an entire armada of ships full of imports our way, clogging up ports on this side. That may distort the reconciling of imports in GDP. There is no way of knowing how those surges will pass through and whether or not all the numbers get added and subtracted in the same quarter; but the overall picture is clearly one of a seriously plagued and cracked global economy that is grossly malfunctioning and affecting the US as much as any nation, making it ridiculous to err’ on the side of believing the quirks in the numbers were Q1’s low report and not Q4’s absurdly incongruent-with-ALL-of-the-underlying-facts high report. (And, bear in mind, the end of Q4 is when I originally predicted we’d be sliding into recession. We’d be starting this year already in a recession.)

So, sure the Q1 imports could suddenly stop because they were just a temporary rebuild that is now over, and they could have been subtracted from a different quarter than when they were added in; but they are a wash over the long haul. So, I think that’s a wishful basis for saying GDP will pop back up in any MEANINGFUL or honest way. More likely, imports were a long clog finally passing through that may well clog again. They are clouding the picture, which is why I started by saying we are already in a covert recession people are not seeing because of the huge distortions in the top-line numbers that a belied by much worse underlying facts.

In this kind of environment, I’m going to say that any good GDP numbers are the anomalies in an overall very bleak situation for US production and transportation. There will be surges, but the system is badly mired. And it is far more likely that the noise is upward chugs in GDP due solely to imports getting clogged again so they do not bring down the final GDP number by reconciling in the proper quarter, not due to US production rising. And that’s true noise.

Deceived by the covert nature of all of this (or outright lying), Barron’s also says …

“The economy is not falling into recession. Net trade has been hammered by a surge in imports, especially of consumer goods, as wholesalers and retailers have sought to rebuild inventory,” [Shepherdson] wrote in an analysis.

That’s a tidy argument full of nonsense considering that imports are not domestic production in the first place and, thefore, according to the Fed do not affect GDP at all because, to the extent that the import subtraction was unusually high, the hidden import inclusion was unusually high — though it may not be getting reconciled in the right quarter. (But who knows which way that would tilt things when you have no way of knowing at present what that quarter’s correct offset for imports that were included in the gross sales numbers should have been?)

While such errors may help move the headline number up for Q2’s GDP, so many other factors are weighing against the economy that I doubt the counter-bounce will help enough to turn GDP positive. Even if poor accounting of the imports does take us back to a positive number, I think we’ll be right back for a second dip following that because what really matters is not the data surges, which are filled with noise right now that even the BEA cannot parse.

What matters is how badly broken the economy is in fundamental ways. It can’t produce like it used to because it cannot get enough workers. Where it has workers, it cannot get enough parts for them to build with. The parts makers are having a hard time getting the raw resources and paying a fortune to get them. And, where things do get built, the economy can’t seem to move them through to the consumer. So, if a rise in reported GDP this quarter winds up being due to imports slowing down as Barron’s suggested, we’re in a recession anyway — one in which imports are just clouding the picture with noise because they have nothing at all to do with GDP. If the present import anomalies do anything to GDP it has to be that they ACTUALLY bring it down but ONLY because things cannot get produced domestically (as we saw ALL of last year with autos) if they are lacking critical imported parts; so production stops. It will not be because imports make any difference in the calculation of GDP if properly reconciled.

These kinds of back-and-forth surges don’t speak of a smooth-running or healthy economy, but something more like an engine stalling and surging and stalling again as it runs out of fuel and starts sucking air. We may lurch up and down as the engine falters, but the lurching is, in itself, damaging, not positive, so it will happen along a declining trend.

If it’s fair to call it “nothing but noise” when GDP goes down — purportedly due to imports rising, as some mistakenly claimed with Q1 GDP. It would be equally fair to call it “nothing but noise” when GDP goes up due to imports falling. That is because the impact of imports on reported GDP is ALL noise. This pig bounces. To listen past the noise of accounting oddities, you have to scrape off the lipstick and look deeper, as I did above, at what is really happening in US production and sales.

It will be another matter as to when NBER — the great judge of great recessions — says the right time is to call the start of the recession– the first fallen quarter, or the next one to fall after the slight bounce if the bounce some are predicting even happens.

As I said in a Patron Post, this pig is parked. It’s hunkered deep in mud of its own making now, and it’s not about to rise in any sustained way for a considerable time due to widespread employment constraints, extreme price constraints, especially in energy, resource constraints and shipping constraints. All of that cannot possibly equal truly growing production in the overall economy.

For example, Stephan Gleason at Money Metals notes with all the same misunderstanding,

Optimists, however, say the GDP number may not be as bad as it looks.

They point to issues including inventories as well as imports and exports. Someone needing to purchase a new stovetop for their kitchen, for example, may have to wait a year to get it due to supply chain constraints. That hurts sales, without a doubt. Imports are up while exports are down, which also affects GDP negatively.

There we go again. Aside from the import misunderstanding or the possible import timing noise, please tell me how not being able to get what you ordered is good for the economy? Is it less recessionary? If the ports get plugged up does that mean GDP was actually “not as bad as it looked?” Stores cannot sell refrigerators that didn’t arrive. That IS just bad GDP, and plugged ports happen to be the reason it’s bad. The fact that there is a reason doesn’t make it less bad!

Think through this “optimists'” view that GDP would actually be really good if people could just get what they wanted to buy because the supply-chain breakages weren’t there. How does that make the picture any better when the supply-chain problems ARE there and aren’t going away anytime soon? This kind of thinking is laughable or would be if it were not so all-out cryable.

Bringing it home

I know the feeling. We ordered a set of kitchen dining chairs last September and were disappointed that we were told they wouldn’t arrive until December. Then it was January. Now we’re in May and have been told we might see them by June … or July. That doesn’t speak of an enonomy that is functioning at all, regardless of what the surges and new stoppages do to the data stream.

I ask you from that experience, does that sound like a problem going away or one getting worse? We’re still waiting for the domestically produced chairs we dropped a $500 deposit on. It will probably be a year before we get the ones we ordered. What will happen if we order something else now? What if we order imports? How much longer will it be with that packed Shanghai port I showed you in my last Patron Post now that they are reopening? Will that just mean more massive jams further down the line? Either way, I still don’t have chairs, the US factors made no money and the US retailer made no money.

Our furniture delays from a US factory were supposedly due to Covid leaving the factory short on help. Do we have strong reason to believe those Covid days are now past? In short, it’s a colossal mess. So, yeah a lot of what we see in the numbers is just noise, but the noise is more likely in any numbers that look good. In our case, we’re not only not going to be ordering more furniture anytime soon; we might actually claw back the deposit on the order we already put in and forget about the furniture. That means retail goes down, not up. That is the state of our economy — dysfunctional, unable to deliver goods, whether imported or made domestically.

I’m laying that out as an example of what drives people to use the money they have left from the government’s helicopter money to bid up prices, such as they did on those few cars they could get their hands on. That was not a measure of a strong economy at all, but a desperate economy. Prices are measured off the last average price; so, in a low-volume situation, prices can rise a lot due to very few purchases when people are bidding up very few available items. People find someone who promises them delivery in a month at an extra $500 on the order, and they go for the company that can get its hands on the short supply and make it happen. So, that little dip we saw in inflation could easily surge if we get more of those kinds of shortages, as seems likely once the new sanctions start depleting those reportedly stacked inventories.

The pig cosmetologists

It’s no wonder that Jamie Dimon revised his weather forecast from an economy with “storm clouds on the horizon that might just dissipate” to a “hurricane is right out there down the road coming our way.” This from the prophet who foretold in January our arrival into the strongest economy he had ever seen! I think he better stay in the business of making profits and out of the business of trying to be a prophet. Though right at the moment he’s not doing all that splendid at either, which is shameful if you cannot turn a great profit (down 42% YoY) during the best economy you’ve seen in your life! But that’s just one more measure of how the lipstick is being smeared everywhere. The biggest shortage we face is truth … and people willing to see a pig for a pig.

The Dimon is hedging his bets either way, saying the hurricane could be …

a minor one or Superstorm Sandy. You have to brace yourself.

Way to go out on a limb and call it, Dimon, having missed it so badly in January. It could be a small hurricane or a Cat 5!

Well, if you look at the barometric pressure drop inside the eye of that storm, I’d say it looks like, at least, a Category 4:

Want to see the schematic of a stagflationary recession?

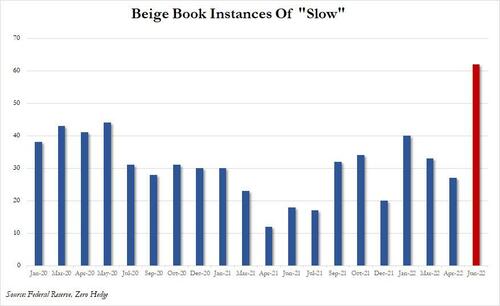

That’s why Zero Hedge also reported that the number-one concern in the fretting Fed’s “Beige Book” has moved from being shortages to inflation, which is now being joined by reports of an economic slowdown:

Likewise, this double dip into contraction in the Empire Fed’s Manufacturing Survey, doesn’t look like escape velocity from recession to me:

Surprise, surprise! That number came out a lot worse than economist were expecting. Of course, they weren’t expecting the Great Recession either. They must work for the government as mortuary cosmetologists, trying to make the corpse look nicer.

And what was this recessionary plunge back to the level of Q1 made of?

- New orders from April to May fell 34 points to a negative 8.8 level.

- Shipments sank at the fastest pace since the pandemic, down 50 fathoms from where the top antenna scraped the sky in April to the top being 15 fathoms underwater.

- General business conditions from April to May chilled 36 degrees to a minus 11.

So, you tell me: is the economy sliding into recession, or was Q1 just a one off? Looks to me like it was the trend. Q4 was the one-off.

Aaaand … here comes the lipstick:

So yes, the -1.4% reading for GDP is shockingly bad on the surface. But in some ways its [sic.] so bad its [sic.] comical…as in not believable.

If you can’t believe the pig is that ugly, just laugh at it as comical, I guess.

In fact, this guy spins it as good news, using a familiar trope that no longer applies:

…because bad news for the economy is good news for changing the Feds [sic.] tune on raising rates…which investors could actually applaud with a rally.

Oh, that again. Except that it only worked when the Fed didn’t have a care in the world about inflation.

Sorry, Charlie, this ain’t Chicken of the Sea; it’s Pig in a Blanket. The Fed isn’t changing its tune this time until it sees inflation on the run because inflation is rooting everything up with its dirty snout. Those days when bad news put the Fed back into hyperdrive are gone because more money will only create hyperinflation when it is Fed into an economy incapable of producing at full speed because it can’t even get the raw materials or the raw labor it needs in order to produce things and is often incapable of delivering what it does produce.

[Bridgewater’s co-chief investment officer Bob Prince] said the US is currently experiencing a “monetary inflation.” He said the huge injections of stimulus from the government and the Fed during the pandemic had boosted spending, but he said this was now pushing up prices rather than adding to real growth in the economy.

So, even if the Fed stopped hiking rates right away, which it won’t, it certainly isn’t going to start pumping more of the old QE in that drove markets up now that it is clearly getting blamed for the inflation that is frying everyone, especially when it is becoming obvious that QE is so long-in-the-tusk past diminishing returns into negative return that it now hurts the economy, rather than adds to growth, doing such things as causing people to not work, so not produce and not transport while building money supply so fueling inflation. Not going to happen.

The good news for Charlie’s outdated perspective is that he can hope the economy crashes so hard it will crush inflation and, therefore, will get the Fed to stop tightening; but it is still unlikely to run back to QE when the heat is on until inflation is dead.

Somehow, I don’t think stocks are going to find that kind of bad news to be good news, because it is a long and very painful and unpredictable ride getting there. Will it matter if inflation is down if the economy is crushed, and will the Fed be ready, then, to ramp it all back up again, having fought such a worrisome battle that directed so much blame its way as we are now starting to hear? These times are altogether different.

Charlie continues,

The best quote I have seen from another market expert is that this report is “Noise, NOT Signal”.

Lipstick, Charlie. That’s all you’re applying here. The truth is … the good data is the noise. Who is to decide whether Q4’s sudden GDP rush up almost three times higher than Q3 wasn’t the noise, especially when people are blaming imports for the drop in Q1 when imports are not even part of GDP; they are merely factored back out because they’re not supposed to be in GDP in the first place. Supposedly, the BEA only factors out what got wrongly included. So, if there is noise, it is the talk about imports being the reason GDP fell in Q1. Imports are not supposed to be in Q1 GDP in the first place. Nor Q4. Imports actually ARE noise that the BEA is trying to filter out.

Again, imports are only subtracted out because they already added to GDP in order to neutralize their positive effect. Granted, we cannot tell whether they get subtracted in the same quarter where they add to consumer, investment and government expenditures. Look around you, Charlie. Stop and smell the flowers. Did you smell anything other than the hog manure you’re growing them in?

That negative GDP, Charlie said, explained why the S&P was up because it meant the Fed would back of tightening because it wouldn’t want top tighten when we’re going into a recession. Are you kidding, Charlie?That is practically the Fed’s modus operandi. It seems they love to tighten into a recession. They did it when they, as Ben Bernanke confessed, tightened into the Great Depression. They did it when they started tightening on housing and took us into the Great Recession. So, if the stock market is counting on the threat of recession to stop the Fed. Forget it. The Fed doesn’t see that -1.5% as any more real than you do, Charlie.

I have no doubt the S&P went up that day because it’s still floating on old Fed hopium and anticipating another hit, but FedMed is in short supply right now because the superhero Fed is telling us it is going to become Inflation-Fighter Fed! The market is delusional for fighting the Fed now it’s about to start its greatest tightening in history and has no way of saving face if it backs down before it even starts with inflation burning like the desert sun. Why would you take them on their word when they promise to do QE and then not take them on their word when they promise its opposite, QT. They followed through disastrously with that promise in 2018, and they didn’t even have inflation to battle back then. We all know the Fed, politically, has to fight inflation, even if it cannot do much about it. Inflation is ripping into everything right now. Even Janet Yellen had to say on Wednesday she was wrong about inflation. They don’t like to say they were wrong, Charlie.

Someone begs to differ with you, Charlie, and with all those S&P investors:

Bob Prince told Bloomberg TV on Tuesday investors are being too optimistic about the path for inflation and rates. When asked if he thinks stagflation will hit the US, Prince said: “We’re on the cusp of it, yeah.”

And then Charlie (whose name isn’t really “Charlie” because he isn’t really a tunafish) said, when the market fell the next day …

It’s hard to say exactly why there was a change of heart when the vast majority of experts I follow believe the weak print of Q1 GDP is downright laughable.

Only if pigs could fly, Charlie. It was the strong print of Q4 that was laughable. Of course your experts believe it was the weak print in Q1 that was laughable. You’ve chosen them based on what you like to hear. There was a change of heart because the move up was pig-headed in the first place. Maybe chickens of the sea, like your experts, can fly; but pigs can’t fly. Going up is not their thing. They prefer to hunker down and wallow.

Or to put it this way…if this report was a sign of more economic damage to come, then there is no way that the GDPNow Q2 forecast from the Atlanta Fed would be as high as +1.6%.

Now, THAT is laughable! Did you happen to notice that in Q1 the Atlanta Fed’s GDPNow forecast was 1.4 points too high even on the last day of their forecast? Did you notice which way their forecast is now consistently moving, Charlie?

Nor would the Blue Chip Consensus panel of economists see growth almost twice that level at +2.8% for the current quarter.

Twice as laughable. Did you notice how wrong the “Blue Chippers” were on Q1? They were higher than the Atlanta Fed, and the Atlanta Fed was higher than reality. Besides, they are economists, who generally have a lousy track record of seeing a recession coming, even when they’re standing in the middle of one — especially the Blue Chippers. They’re the worst. As Ben Bernanke.

The point being that there is not much reason to call for a recession and bear market at this time.

In a pig’s eye! Covid still surging in spots around the world and spinning off new variants, while China, the world’s manufacturing engine and shipping hub, is still dictatorially committed to closing entire ports and manufacturing cities if Covid rises above zero again. A whole slew of ships about to make their way through Shanghai in disorderly fashion so they can plug up LA again. The biggest and broadest sanctions in Earth’s history. The most violent European war since WWII against an invading superpower that keeps threatening its neighbors with its abundant nukes with the action and NATO’s involvement only intensifying. The highest inflation most people in the US and many other parts have ever known. Already the worst drought the US has been in since the Dust Bowl … with the hot season just about to begin — so bad that Hoover Dam may be only a few months from shutting off its generators for the first time in its history when we already have electrical shortages routinely now in Texas and California (but, hey, we’re switching to elective vehicles, so that’ll help! (Power production is already down 33% because the lower water has less force: “Are we concerned? Yes,’ Reclamation official says.”) Crops planted late because of bad weather in the midwest (the US breadbasket) and under fertilized because the war cut off natural gas used to make fertilizer in Ukraine. Those food shortages not set to show up until fall when the late summer harvest is done, even though food prices are already soaring. The onset of what is predicted to be a worse-than-normal hurricane season. And the rapid declines in several business metrics shown above which are why the Atlanta Fed is revising downward. Nah, I don’t see any forces give us much reason to call for a recession. From my perspective, the laughable part is that most of the US thinks we’ll avert one for another year or two when we’ve already had negative GDP, and I see every reason to think things are only going to get worse this year.

And no reason to call a bear market? Russell 2000 already deep in a bear market for many months now. Nasdaq deep in a bear market for the last two or so. S&P dipped in for an afternoon. FAANGs all nothing but a row of cracked teeth now. Many major corporations down 50, 60, 70%. Jamie Dimon’s own major bank stock down 25%. Whoever gave the S&P permission to be the only index to call a bear market? Most of the market has been venturing far into the bear’s forest for months. But investors will do anything to deny hearing or believing anything about a bear market. If the S&P closes down 20%, they’ll say, “Not long enough. It was just a test — a one-off” or “The Dow isn’t there yet.”

Please! Spare me the lipstick. The market’s bear isn’t any prettier than the economy’s pig.

But Charlie can’t stop himself:

Right now the 10 Year Treasury made big news by rising to 3%. Yes, that is nearly twice the level as the start of the year…but it is WELL under the historical average rate of 4%…and EONS lower than that stagflationary period of the 70’s and 80’s.

Yeah, except that it sits on the most massive level of debt ever seen — debt that, like in the last housing crisis, was only made possible by interest being down (this time) to almost zero for years! So, good luck with ever managing the historical average of 4%! At that point, everything will become disorderly. It has also risen faster, I believe, than any time in history and completed its inversion after the recession began because, until that time, the yield curve was under total Fed control for two years.

One can only stand so much of this lipstick. Even when applied with a shovel, it does not improve the look of the pig nor greatly mask the smell of the world’s biggest manure pile. Paint the pig pink, but it’ll still stink. We have no hope of avoiding recession. However, even the noisy numbers are likely to wind up there this quarter just as they did last with Q4 being the actual one-off. What’s laughable to me is people saying, “Well, maybe we’ll end up in a recession in a year, maybe two” when we are already wallowing in one if you talk in meaningful terms that real people experience and not just noisy numbers (or stop distorting the noise to have meanings you want it to.

Better get your cob of corn while you still can because this pig isn’t just ugly. It’s about to get real mean.

Liked it? Take a second to support David Haggith on Patreon!