Retail was a bloody mess! But revenue looked pretty good … considering! So, what was all the red about, and why all the screaming on the stock exchange? Some of the biggest retail stocks got butchered after reporting higher revenue. Hold it! That doesn’t make sense. Why were corporate owners running out of their stores like a monster was raging inside?

Well, I’m going to break all of that down for you. Things are simply not what they appeared …

First, the good news:

Americans outspent inflation by a good margin in April. “Real” spending on goods – what consumers buy at retailers, adjusted for inflation – rose for the month but was down from the stimulus-miracle peak last year.

The related bad news was that …

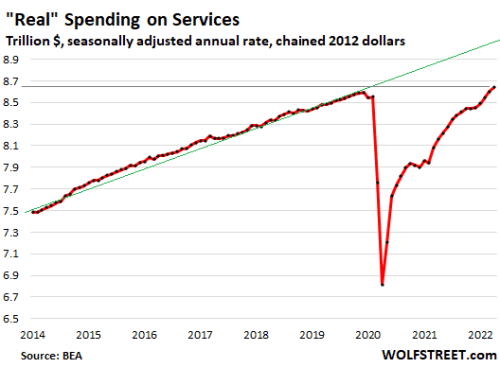

total spending on services, while it rose a nubbin, was still a great leap below its former trend and barely above where it peaked before the Covidcrash, so spending on services has a lot of catching up left to do:

That’s in total dollars spent, so if you adjusted it for population growth (per-capita income), it would be well below where it was at the start of the Covidcrisis, which is partially why it is well below the green trend line because the slope of the trend line is in good part established by population growth — the more total population, the more total dollars spent. That is why the Fed is supposed to increase the amount of money in the economy as needed to avoid deflation due to fewer dollars being available per person if they don’t expand money supply to keep up with population. (The doesn’t mean, however, they need to increase it enough to create 2% inflation, nor especially to create more than 8% as they apparently love to do.)

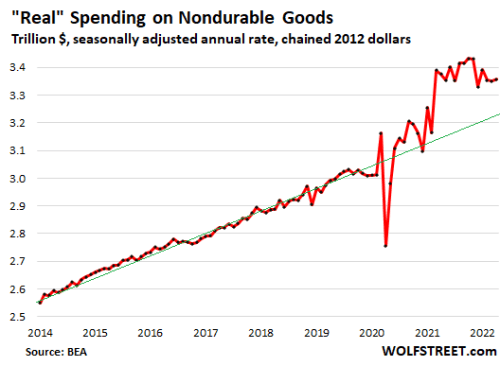

Moreover, while overall real spending (i.e., adjusted for inflation) on non-durable goods — like food, fuel and household supplies — fluttered upward an almost invisible tick, it’s still on a generally downward slope from its post-Covid reopening rampage …

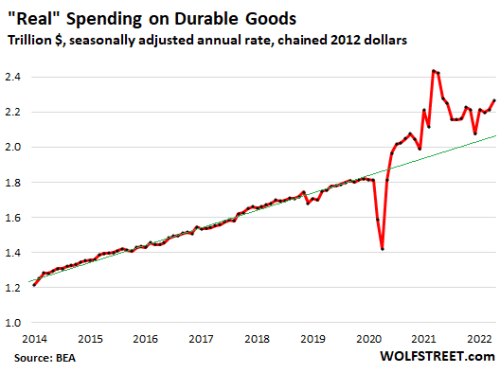

… though spending on durable goods — like refrigerators — could be moving back to a rising tend after almost touching down on the old trend:

Still, both kinds of spending are well above the longstanding former trend, even after being adjusted for inflation. In fact, one could say they look stellar in total inflation-adjusted dollars spent when compared to the long previous trend. However, things get a little dicier as you look behind the retail veil.

The mess behind the mask

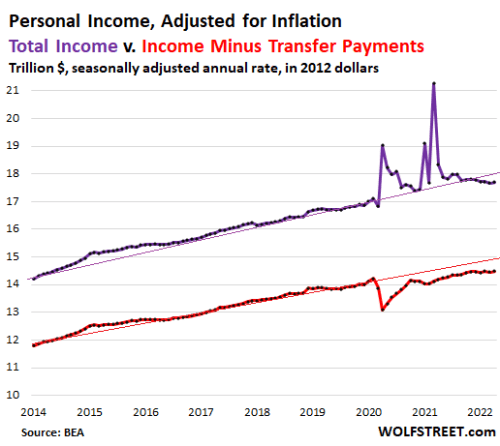

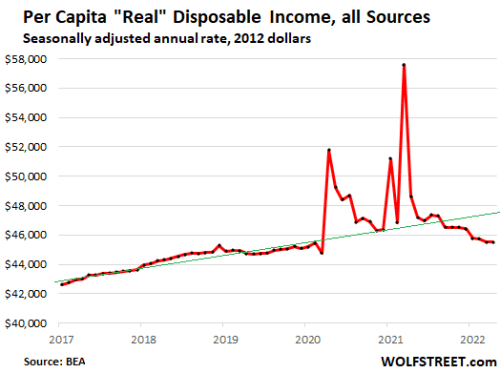

For starters, let’s look at the condition of the consumer where real income, less transfer payments (which are social security, unemployment benefits and other government checks), is flat-lining at best and slowly losing ground from its pre-Covid trend:

On a per-person basis (i.e., adjusted for population growth), after-tax income is doing much worse and looking quite anemic (even with all the transfer income included):

If that were your hospital chart, and the green line represented your former trend in health, you wouldn’t be feeling too good about your future.

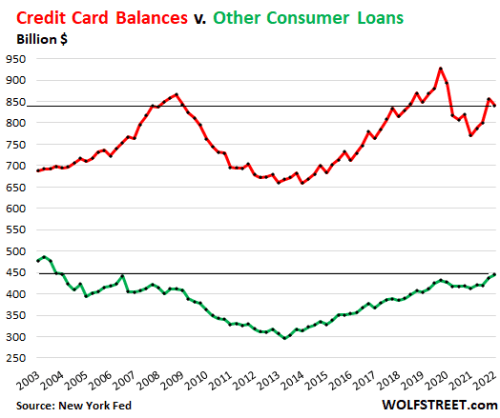

It’s not surprising then, that people (“consumers”) are back to borrowing more to sustain the spending shown above (albeit the following is not adjusted for population) …

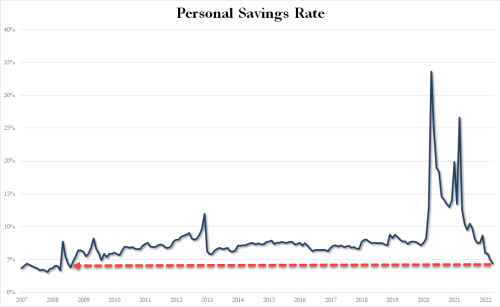

… to where savings are now doing quite poorly:

(The savings rate doesn’t need to be adjusted for inflation if income keeps up with inflation because the rate would just be a percentage of a greater number of dollars. Nor does it need to be adjusted for total population because it’s an average.)

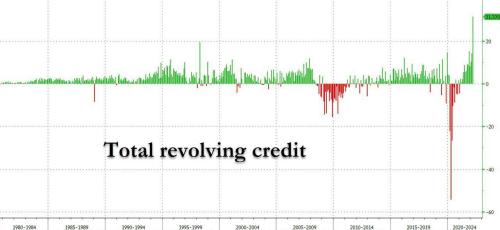

In fact, as you can see, the savings rate hasn’t looked that bad since the pit of the Great Recession. So, that’s now a truly bad number. That’s not how much money people have in savings, but how much of their income the average person is putting away each month. However, with current total consumer debt climbing at an apparently steeper rate than population and the average savings rate plunging to the lowest since the worst of the Great Recession, it’s reasonable to infer (info the Fed does not make readily discoverable, though it easily could from all of its member banks) that total personal savings are likely dwindling. Otherwise, people would not be so rapidly ramping up purchases on credit just as variable interest on credit cards is rising quickly. The savings rate includes everyone, including the fabulously wealthy, so an average below 5% looks anemic since it likely means the bottom half of the population isn’t putting away anything at all.

In point of fact,

The average amount of personal savings (not the rate but the total in the bank) dropped 15% from $73,100 in 2021 to $62,086 in 2022

The average, again, includes the 1% and the billions they have squirreled away (or whatever part of their billions classifies as “savings.”) And that’s not adjusted for inflation, which would devalue those savings more.

To confirm what I’ve extrapolated about the condition of the consumer, the growth in credit-card debt has never looked anywhere near this extreme: (It is clearly way beyond the rate of population growth.)

So, where is the retail apocalypse hidden?

With all those sales at the top of this article, one might naturally conclude that, in spite of the apparent declining state of the “average person” as a ready-and-able consumer of goods, retail sales did splendidly well because people were willing to sustain their lifestyles on credit, unsustainable for the long haul as that is. To spend above the old trend, even when adjusted for inflation, consumers had to buy more goods or better goods, as well as paying generally 8.3% more on average for anything they bought.

Now I’m going to show you where the bodies are buried in this retail apocalypse even though revenue was reported as seeing positive growth, which investors liked until they turned over a little earth and looked beneath the surface. Turns out the revenue growth reported by corporations like Walmart and Target was actually all about inflation. The numbers are not inflation-adjusted that I can tell, and I spent an hour on multiple search engines, using multiple terms and going through mutliple pages of results on each one, but I could not find one page that suggested any of these companies report revenue adjusted using inflation-adjusted accounting or that the law requires they do. (I checked just because I wanted to make sure before taking this further.) And why would they? They don’t adjust their expenses down due to inflation. Those are what they are. Inflation is a part of what they are. Labor, for example, is reported higher due to labor inflation.

So, if you were to adjust the reported revenue gains for inflation, they would show most of the major retailers had negative real revenue growth year over year, consistent with my Q1 recession prediction and continued belief now that we’ve seen the negative real GDP number (more about that in my next post).

It turns out that cuteness hides a multitude of sins. The real truth beneath the nice fasçade shows up quite clearly in the pounding some of the biggest retail stocks took in May from their rabid investors:

For the past couple of months, inflation has been hurting the economy…. Amazon (AMZN), Apple (AAPL), Walmart (WMT), Target (TGT), and a slew of others have all fallen in stock value. Headlines are talking about a “Retail Apocalypse,” as inflation is hammering the retail business. Interest rates have risen so fast that it is beginning to hurt the economy. The sentiment of the market, as a result, is very bearish. Talk of recession is growing. Many are saying that we may already be in a recession.

Thank you. Glad to see many are catching on … at last. To be fair, those retail stocks melted down in this great market conflagration because their profits (earnings per share) were down, not because their gross revenue was down, and their profits were down, even though their gross revenue was up, because their expenses were up.

Here is where you find some of the dirt behind their ears. The kinds of expenses that have risen are both their operating expenses and their cost of goods sold. The deeper truth is the mega-retailers were not able to pass on all of the inflation they experienced in what they paid for what they sold and in what they paid for labor, lights, etc. That is likely why spending looked positive from the consumer side, even though consumer inflation (CPI) is hot. In order to maintain sales revenue, retailers took a hit from producer price inflation by not passing along the full cost increases they were experiencing. If they had, CPI would have been hotter still (to match the higher rate of increase in producer prices paid by retailers).

You’ll recall I’ve been saying those PPI numbers are hotter than CPI, so they represent inflation that has not passed on yet to consumers. If we think about the present situation, its not hard too see that retailers will not likely be able to keep taking it on the chin by not passing along the full producer price increases they re experiencing (made hot by the producers’ own rapidly rising costs for the resources they use, the energy they consume, and what they have to pay in transportation costs).

Here is the short of it all added up: Consumers bought a little more stuff and paid a lot more for it, so consumer spending went up even more than inflation. Thus, retail revenue went up; however, it did not even go up as much as consumer inflation (up 4% by Target, 2% by Walmart). That means retailers sold more stuff (given the growth we see on the consumer-spending side), but they made a lot less money on it. The increase in the number of items sold made up some for prices not being marked up as much as overall CPI (which includes energy, housing, etc.), but not enough to keep their total revenue growth up with CPI.

That’s why earnings were way down. The fact that CPI went up more than 8% YoY, but revenue went up by those lesser amounts (since 100% of retail revenue comes from the goods CPI measures) indicates not all inflation was passed along. I mean, doesn’t that have to be the case? If consumers on average paid 8.3% more for everything in their lives based on CPI plus bought more items, but revenue for the retailers was up only 2% or 6%, depending on whom we’re talking about, apparently without being adjusted for inflation, wouldn’t that say their increase in revenue was not even as much as general inflation? Their revenue needed to be up 8.3% just to keep up, so no wonder they lost a bundle on the profit side.

Clearly there is something not right with that overall picture, and the numbers are a little foggy, but that’s why their stocks experienced something akin to a retail apocalypse on the owner’s side. Owners lost a fortune, showing up first in the profitability of the company they own, then moving on to the stampeding sell-off of their ownership where it counts most.

Retailers are not Laffing, neither are their owners

So, what’s stopping retailers from passing along their full cost increases? Well the increase in revenues due to increases in prices works like the Laffer Curve in taxes. There is an area at the start of that bell curve where, the more you raise taxes, the faster government revenue grows, and then there is a range were the curve starts rounding off and more increases in taxes bring in smaller and smaller revenue gains (but still gains), and then you clear the top of the curve and more taxes actually start causing negative revenue “gains” (i.e. a losses) in total revenue, even though you’re charging more because you’re so destroying the incentive to work that people stop producing, so taxe revenues fall the more you raise taxes.

The same is true for price increases. At some point retailers start seeing a lot less gain in revenue than they are adding in price increases, so they know they are near the top of that curve, and they rue going over the top and actually seeing less revenue from each price increase because they are losing customers faster than the price increases compensate. So, if retailers are not passing on all of their price increases, that indicates they may already be seeing that fall-off approaching where raising prices hurts business more than it helps revenue, actually diminishing the bottom line even more. (And they’re battling competitors also reluctant to lose customers.)

However, retailers just experienced a jarring wake-up when stock valuations took a massive hit because retailers chose to absorb those cost increases (reporting lower earnings). You can be sure they now feel much more pressure to pass along more of those cost increases. That’s why I have been saying, inflation may have taken a breather, but there is a lot of pressure backed up the pipeline that now really wants to push through. The mayhem in stock valuations of major retailers is the evidence of that extreme back pressure. It means corporate owners are selling out because they are unhappy with being the ones to take the hit. (And I say, “Good riddance because stockholders were WAY overpaid in dividends and overvalued stocks anyway. So, get real with the rest of us, who will eventually buy up the bargains you leave behind.)

Thus, valuations are coming down to square with the greatly diminished profits allowed in this scorching inflationary environment. You see, with inflation so hot, you have to really look carefully at statistics to see if they are inflation-adjusted in order to recognize if they are hiding some of the ugly. In fact, here is a realization you might find weird as I summarize all of the above: Inflation is actually the red-hot lipstick that is hiding the ugly on this pig. It’s because retailers couldn’t (or, at least, didn’t) pass along all their producer price inflation and inflated operating costs that their revenues were up even as their profits (expressed as earnings per share) were WAY down and are projected to fall even harder, even though total consumer spending was up by more than overall consumer inflation (because they stopped saving and started using more credit)

Taking inventory of the situation

Soaring costs and swollen inventories have retailers on the ropes, and investors fear that the punishment won’t ease anytime soon.

Inventories got reported as being swollen, apparently with some shiploads of imports that finally made it through. Some analysts have speculated those swollen inventories will cause price reductions in order to have inventory blowout sales because of the cost of soaring inventory. That is part of their basis of hope for thinking inflation will now back off; and that could be IF those inventories are swollen because retailers have hit that point where raising prices is starting to slow consumer purchases.

However, it’s clear that making those cuts will mean making even less in profit margins on items they’ve already bought at greater inflation rates than they’ve passed along (and likely less in earnings per share) in the next quarter. Selling what they did at the price they did already wounded retailers badly with investors when they did not pass along the full increase in their cost of goods sold or their operating expenses. They can’t keep taking it on the lam.

That is why retailers are on the ropes. If they lower prices to blow out some of that inventory, they may lose more interested stock investors, so their stock values may fall further. That will mean the stockholding CEOs and the rest of the executives see their net worth fall even more. They’re caught in the crush now between rebelling investors and rebelling customers. There is simply no assurance that works out nicely. That is one reason why this high inflation can rip an economy to shreds and the stock market to shreds at the same time, as I warned last year it would do. Now, we’re seeing how that plays out in real time:

It was “an absolute bloodbath for retail”

Bloomberg described the initial carnage among the largest retailers as …

a disastrous few days that sent giants like Walmart Inc. and Target Corp. to their worst stock-price drops since 1987.

That’s pretty bad. So, the retail apocalypse, instead of being seen in the closing of brick-and-mortar stores, as it was prior to the Covidcrisis, is now seen in fleeing owners, running out of inflation-scorched stores almost like they are fleeing fire sales.

In all, some $550 billion in market value was erased from consumer stocks over the past five days, adding to the downward pressure on a market already strained by fear of inflation and rising interest rates. On Friday, the S&P 500 — weighed down by the heavy losses in its consumer sectors — briefly dipped into bear-market territory, a 20% decline from its most recent high.

High inflation and soaring interest I said all of last year and part of 2020 would evolve into the story to watch. Now we are seeing just how bad it can become. Over half a trillion dollars got blown away in less than a week. You see, businesses, consumers, and the stock market, all get ravaged by this kind of inflation. While consumers spent more in inflation-adjusted dollars as shown above, they appear to have done so by ratcheting up their debt and greatly cutting back on their savings rate. Businesses still lost massive corporate value because they had to deeply cut their profit margins to keep those sales up there. As a result, government will eventually see a decrease in corporate tax revenue, too.

Bloomberg called it a “meltdown,” and if it continues even at a slower pace in the months ahead, I don’t think the word “apocalypse” will be overreaching. Here’s another word an analyst had for it:

“This week has been an absolute bloodbath for retail,” said Neil Saunders, an analyst at GlobalData Plc. “To a certain extent, I think that’s the rebalancing of expectations, and people seeing more crimp on profit.”

And it looks like deeper slowing could easily happen:

The cost of finding new goods to sell and getting them into stores is surging as fuel, labor and other expenses climb. Walmart and Target both slashed their forecasts for profit this year as inventories ballooned and price increases failed to keep up with rising costs.

Some retailers came out all right; but, overall, the streets were littered with wounded investors and were as red as the sunset. The ferocity can be seen in how the tallest giants with the broadest experience and deepest pockets wound up the bloodiest of all:

Walmart and Target are seen as some of the savviest supply-chain managers in the business, and they’ve been contending with disruptions since the pandemic began. Even so, they were caught flat-footed when oil prices surged after Russia’s invasion of Ukraine.

Even for these behemoths, there is only so much one can absorb from the continuing onslaught from the tariffs of the Trump Trade Wars, followed by Covid lockdowns, followed by more partial lockdowns, followed by massive transportation logjams, followed by the war in Ukraine, followed by all of its attending sanctions, all wrapped up in a whirlwind of fire called an “inflation inferno.” There is more than abundant reason, if one is simply realistic, to believe that all of the inflation hasn’t worked through yet. So, more inflation because even then …

Price hikes won’t be able to cover the full brunt of this challenge.

Even with more price hikes, retailers will be getting pummeled by their owners. Oh, and what about the facts that we are now just again entering drought season and fire season and hurricane season. I’m not just reaching for whatever bad news possibilities I can find here. I’m saying we already know this is viewed as likely being a worse hurricane season and a worse fire season because it is already a worse drought season.

What does that mean to retail? Well, it means it is likely to make food shortages worse for retailers that sell food items, and it is likely to bring a host of problems with energy costs, transportation issues, etc. I’m not reaching; we’ve already been told many times that is what the next few months appear to have in store. It is truthfully more accurate to say, “If we’re lucky, those prospects won’t happen” than it is to consider them remote possibilities.

This is the climate disaster forecast we’ve already been given to work with. It may be wrong, but right now it is looking quite probable for this year. So, I’m just saying factor in a little more of that than usual just to be realistic, and recognize the shortages from sanctions have also barely begun to pass through because those “inventories are bloated” still, due to all the ships that had already sailed months ago finally making it through US ports with items ordered as far back as last summer that were delayed in production then delayed a lot more in transport. This inventory burst in imports was the backlog of ancient orders finally getting through, leaving retailers now flooded because they ordered more form other sources when shelves were in danger of running bear.

That might be a good thing because it will give us a temporary buffer from the shortages and even a temporary buffer from inflation, but for how long? The fear of those shortages a few months down the road, which are still building, might make retailers less likely to start having those inventory blow-out sales some are postulating because today’s blowout may be tomorrow’s empty shelves.

When inflation is this bad, you always have to look behind the mask of gross revenue to see just how gross the situation really are. Revenue can rise even when profits plunge. Many a business with massive revenue went bankrupt. And that is the case right now. Revenue can rise just from inflation since it is measured in dollars. So can numerous other statistics that now have to be carefully looked at where once we might have ignored inflation’s role as just being a 2% given. Even if revenue rises by more than inflation, profits can be digging a deep hole. As they say, you cannot make up a loss per unit sold on volume. Revenue is far less meaningful than profits, and retail profits just got a punch in the mouth that didn’t leave retail smiling too pretty, bloody, broken teeth and all.

Liked it? Take a second to support David Haggith on Patreon!