You can listen to the audio version of this article here.

Last week the cryptocurrency exchange FTX, which was recently valued at $32 billion, imploded.

While the tragedy continues to play out, let’s summarize what has happened so far:

- FTX is a cryptocurrency exchange, co-founded by Sam “SBF” Bankman-Fried. FTX enables customers to make leveraged bets (as high as 20 to 1) on cryptocurrencies.

- More often than not, it takes loans to make loans. FTX would make these loans to customers with borrowed money from various counterparties, one of them was a sister company, Alameda Research, which was purportedly created for the purpose of “arbitrage and market making” activities.

- When you lend money out, you want to have good collateral. The best collateral is cash (USD), but in the cryptoverse, stablecoins count, as do many cryptocurrencies themselves. The problem is that stablecoins have been shown to be, um, not so stable? And cryptocurrencies are inherently volatile, which makes them risky as collateral.

- FTX has its own crypto token, FTT. Like all crypto tokens, FTT has a price. Also like all crypto tokens, no one really knows what it’s worth, other than a great way to gamble on the number go up “technology.”

- At some point, FTX started accepting FTT as collateral. In the apt words of Matt Levine, accepting your own self-issued token as collateral is “very dark magic” and is almost certain to end badly.

- Turns out they didn’t just dabble in the dark arts; they swam in them. FTX started accepting lots and lots of FTT as collateral. Coindesk reported that FTT composed a large-ish amount (over 30%!) of Alameda Research’s balance sheet. Remember Alameda was a sister company of FTX, and one of the counterparties who enabled the loans to FTX depositors.

- And ended badly, it has. A competitor of FTX started dumping FTT, which caused its price to fall, along with other cryptocurrencies, including Bitcoin. The falling price of FTT cast a shadow on FTX’s reliability. Customers panicked and started withdrawing funds from FTX in record numbers.

- It has since come to light that FTX took customer funds and engaged in duration mismatch, making bets on venture capital, among other “risky bets.” This exposed FTX to a potential “run on the bank.” When customers came to withdraw their funds, the funds weren’t there. They were invested in some other venture.

- This meant FTX was faced with massive client withdrawals and rapidly falling prices of the collateral sitting on their balance sheet (namely FTT) at the same time.

- The CEO called it a “liquidity crunch” (euphemism). A more accurate description would be sudden death capital implosion (they were likely insolvent before they were illiquid, and likely within 24 hours). After a possible rescue from its competitor failed to materialize, FTX announced on Friday that it was filing for Chapter 11 bankruptcy.

- Everyone from retail clients, to celebrities like Tom Brady, to notable institutional investors like Sequoia Capital are likely to lose 100% of their investments. Regulators are circling the wagon and looking to investigate more.

For those that want all the details, we highly recommend Matt Levine’s ongoing coverage.

A Sign of the Times

This is sad, for many reasons. Not least of which is that many financial livelihoods have been ruined, or are in the process of being ruined, at this very moment.

It’s also sad because it’s a sign of the times we live in. Take the following story as an example.

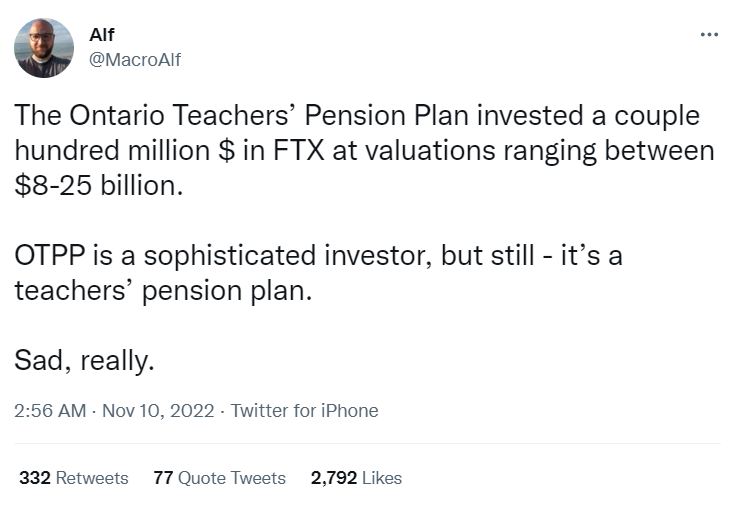

A disturbing aspect of the collapse is that among other large investors who were invested in FTX, was a Canadian teachers pension plan (!)

What type of world do we live in where a conservative pension fund would be investing in such a risky asset?

CEO Keith Weiner answered this question in his talk given at the New Orleans Investment Conference last month titled “How to Build and Destroy a Pension Fund System in 22 Easy Steps”.

Nowhere to run, nowhere to hide

The answer to why these institutions and individuals are speculating their way towards calamity is because of the Fed’s decades long falling interest rate policy. Everyone, especially pension funds, are desperately in need of yield, and will go to ever more dangerous lengths to acquire it.

Our centrally planned money and credit markets make it more and more tempting to go out on the risk curve in search of yield. As Keith has said before, “Capital gains are the surrogate to earning interest or dividends.”

Of course, going out on the risk curve means some of those riskier bets will not pay off, and they could turn out really bad. This is the whole idea of the Risk-Return Spectrum. Higher yields mean more risk. This is especially ill advised if you’re running a pension fund and can’t be taking big losses on your bets. But with so little yield available, there are simply no avenues for these institutions to earn sufficient returns without having to resort to speculation. FTX is yet more proof that speculation isn’t sustainable, and can blow up in a fantastic way. And it looks like some pension funds could be next.

Crypto Currencies in Crisis

This disaster is also sad because it taints an entire industry that was, at least at first, built upon the premise of providing an alternative to centrally planned money and credit. That would be the one thing cryptobugs have in common with goldbugs–they both agree there needs to be a monetary alternative to fiat currencies.

If there’s one silver lining, it’s that cryptocurrencies have raised awareness on the issues of money, finance, and banking to the mainstream level. We don’t always agree with their proposed solutions, but the fact that more and more people are inquiring into the nature of money and the dollar, could be a good thing.

It will be a good thing only if they rediscover the role of gold as money. That is what we are helping people to do, and while the cryptoverse is reeling from this news, we just made another big step forward.

If you are interested in learning how to earn a yield on your gold and silver, get in touch with us.

© Monetary Metals 2022