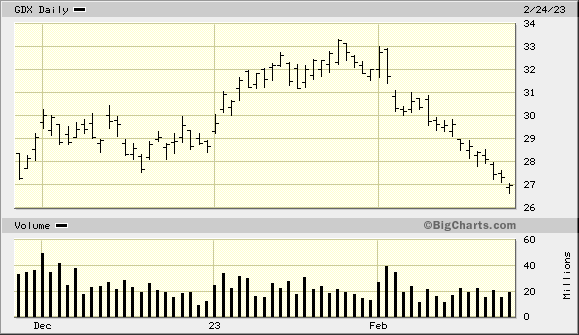

Whatever enthusiasm investors have remaining for their gold stocks holdings must be waning rapidly, if not already dissipated. Below is a year-to-date chart (source) for GDX (VanEck Gold Miners ETF) showing the latest swoon in prices…

|

|

As of Friday, GDX index of gold mining shares closed at 26.99, which is below where it was three months ago near the end of November 2022.

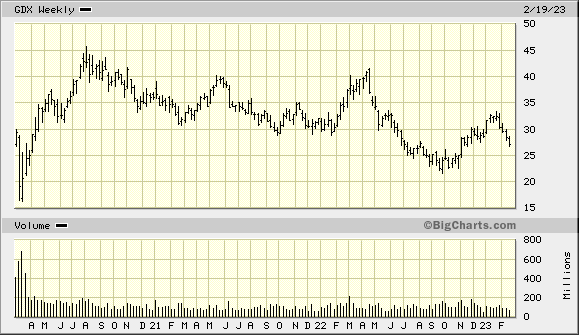

Here is another chart which shows GDX prices for the past twelve months…

It would appear that whatever upside momentum was apparent since last November has reversed to the downside. For some additional perspective, here is a three-year chart of GDX…

|

|

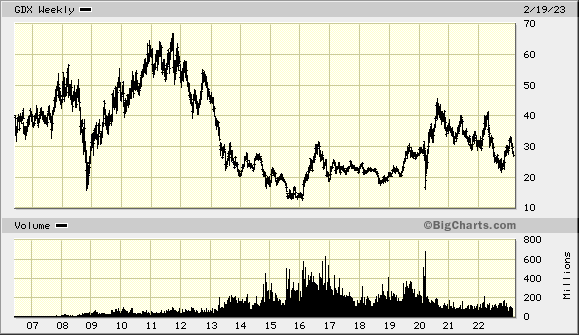

When prices for gold mining shares bottomed (likely just temporarily) in October 2022, they were lower than at any time since the March 2020 collapse at the onset of the Covid pandemic.

After the subsequent, short-lived recovery rally that culminated in a price peak four months later, gold stocks have declined in deliberate fashion. The 30-month downtrend is well-established and we will probably soon revisit the lows seen this past October.

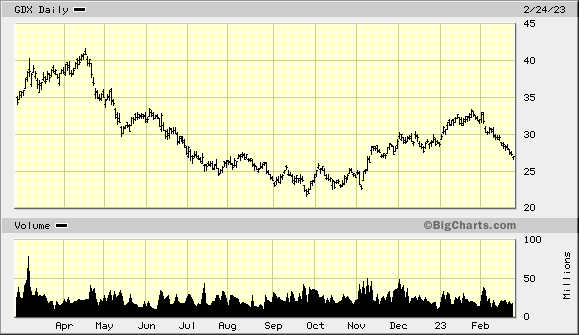

At current prices, gold stocks are down forty percent from their highs two and one-half years ago. Below is one more chart for GDX, this one dating back to 2007…

|

|

As can be seen on the chart, gold stocks are currently down sixty percent from their peak prices in 2011. How much worse can it get? A lot more than most investors think; or want to believe.

In fact, things are already much worse for the holders of gold stocks.

Most investors in gold mining stocks do so for reasons independent of ordinary gold mining activity itself…

- Gold stocks, for most investors, are more appealing and convenient than dealing in the physical metal.

- They are seen as being a ‘proxy’ for gold itself.

- Some expect the mining shares to appreciate in value considerably more than the physical metal (relatively fixed mining and production costs coupled with ever higher gold prices leads to ‘leveraged’ earnings and profitability).

For this article, we will focus on the third reason: the potential for leveraged gains in gold stocks vs. gold bullion.

Here is a chart (source) of HUI, a broad based gold stock index compared to the price for gold bullion…

HUI (NYSE Gold Bugs Index) to Gold Ratio

The above chart is a stark and dismal refutation of the argument favoring gold mining stocks over gold bullion. Historically speaking, the leverage as worked very well in reverse.

In other words, gold stocks have declined more than gold on the downside, while not doing as well on the upside.

For more specifics about the horrible underperformance of gold stocks compared to gold, see the article Gold Stocks Are Worse Than Gold.

CONCLUSION

Short term reversals to the upside in gold stocks are not indicative of any long-term change in direction.

Gold stocks are in a twelve-year downtrend in absolute terms and have underperformed gold bullion for more than than twenty-five years, dating back to 1997 – three years prior to the beginning of gold’s decade-long run from $250 oz. to $1895 oz.

If you thing gold is going up in price, buy gold! (also see Gold Stock Charts – All Negative)

Kelsey Williams is the author of two books: INFLATION, WHAT IT IS, WHAT IT ISN’T, AND WHO’S RESPONSIBLE FOR IT and ALL HAIL THE FED!