Consumers today are mostly worried about gasoline prices approaching “unaffordable” territory, but there is another important fuel that is even outpacing that — diesel. To an extent, the impact of having more expensive diesel could be much more devastating than a crude shortage.

Figuratively, diesel is what powers the engine of the global economy; industries like agriculture, construction and transportation all rely on this fuel to survive. This means as long as diesel prices go up, the end products of those activities (i.e. food) will also cost more, as we’re seeing right now.

The chief economist at Moody’s Analytics estimates that 17% of the acceleration of goods price inflation is due to the higher diesel costs, which is significant and higher than that of gasoline.

Unfortunately, the days of expensive consumer goods are far from over, much of that can be linked to the knock-on effects from diesel. Below are some of the reasons why this fuel is likely to get much more expensive moving forward:

- Diesel – Driver of Economy

Diesel is getting increasingly expensive for the simple reason that it is critically important; diesel power is the driving force behind the world’s biggest economy, America, without which it would not be able to survive.

Boasting a combination of energy density, fuel efficiency, power and performance, diesel engines are the primary technology behind as many 15 key sectors of the US economy. Approximately 90% of the nation’s freight tonnage is being moved by diesel-powered trucks, trains, ships and intermodal systems.

Overall, diesel technology moves more than 80% of all cargo in the US, and more than 90% throughout the world. As such, diesel is easily the primary driver of the global economy, whether by truck, train, boat or barge.

Diesel power also provides two-thirds of the energy for machinery on America’s farms. It is also the dominant fuel source in the mining and construction industries, powering 60% of the equipment and using 98% of all energy.

Essentially, diesel is the lifeblood of America’s economic engine. So, it’s easy to imagine that even a moderate shortage of the liquid fuel could paralyze the global economy by disrupting the most essential of economic activities. The end result? Higher prices of everything, everywhere.

“Diesel is the fuel that powers the economy,” said Patrick De Haan, head of petroleum analysis at GasBuddy. Higher prices are “certainly going to translate into more expensive goods,” he said, since these higher fuel costs will be passed along to consumers.

2. Depleted Diesel Stocks

Since most of the products we consume are transported by trucks and trains powered by diesel engines, it’s natural that demand for the fuel will stay elevated for the foreseeable future.

Data from the US Energy Information Administration shows that distillate fuel (diesel fuel and other petroleum fuels that can be used in diesel engines) consumption by its transportation sector was about 44.61 billion gallons (1.06 billion barrels) annually, an average of about 122 million gallons per day (nearly 3 million barrels). This amount equates to 77% of its total distillate consumption, 16% of petroleum consumption, and on an energy content basis, about 27% of total energy consumption.

With high demand comes increased pressure on diesel prices, especially if supply is running low, and that’s exactly what is happening right now.

US distillate fuel stocks are sitting near its lowest in 14 years at 104 million barrels, with refiners unable to meet the recovering industrial demand. In fact, stocks have fallen in 60 of the last 96 weeks by a total of 69 million barrels since the start of July 2020, according to high-frequency data from the US EIA.

Inventories are on course to fall even further to a projected low of just 102 million barrels before the middle of the year, with a possible range of 97 million to 105 million barrels, based on seasonal trends over the last decade, the EIA estimates.

3. Shortage Everywhere

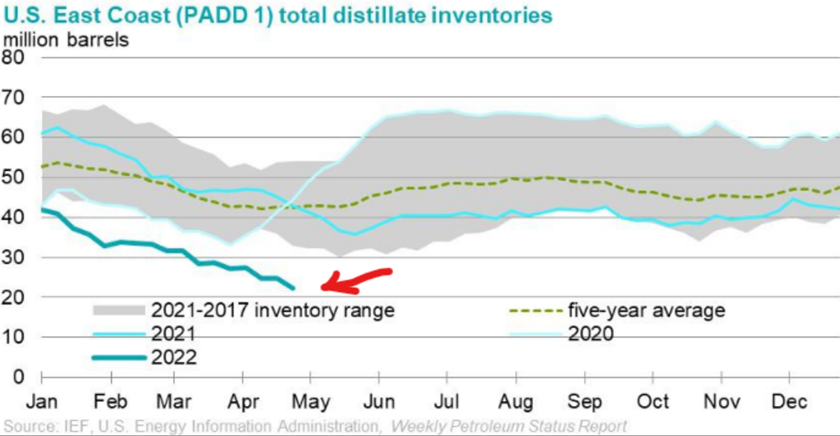

A recent Tweet from the Wall Street Silver community warned that: “We are looking at a nightmare in terms of global diesel shortage that will shock people starting June. Diesel inventory on the east coast is 18 million (about 3 days demand) as of today, we will run down to sub 10 million.”

Indeed, many parts of America are already being impacted by diesel shortages. The East Coast, in particular, has seen its diesel supplies hitting their lowest in almost 20 years, with supply issues haunting truck drivers in several states such as Maryland.

Europe is also being threatened by diesel shortages following the invasion of Ukraine by Russia, its leading diesel external supplier. According to the CEO of commodity trader Trafigura Group, Russia’s crude oil and petroleum products slid by about 2 million-2.5 million barrels a day since the invasion. At this rate, European diesel stockpiles are expected to fall to the lowest since 2018.

Even before Russia’s invasion of Ukraine, the fuel that runs the global economy was already in short supply due to the loss of refining capacity worldwide during the Covid pandemic, followed by the rebound in economic activities that drove up industrial demand.

“I’ve started to use the term diesel ‘crisis.’ It clearly is a crisis that’s happening before our eyes. I wouldn’t rule out lines, shortages or $6 [price] in places beyond California,” Tom Kloza, head of global energy research at OPIS, said during an interview with CNBC. “I wouldn’t say it’s a shortage yet. Europe, I think they’re headed for a shortage.”

4. Too Few Refineries

Demand and rising prices aren’t the only things fueling our fears of a global diesel crisis.

Supply, too, has become an immediate area of concern. At the moment, we simply don’t have enough refineries to turn oil into usable fuels.

In the US, more than 1 million barrels a day of its oil refining capacity — or about 5% overall — has shut since the beginning of the pandemic. Elsewhere in the world, capacity has shrunk by 2.13 million additional barrels a day, energy consultancy Turner, Mason & Co. estimates.

And with no plans to bring new US plants online, even though refiners are reaping record profits, the supply squeeze is only going to get worse.

“We are on the razor’s edge,” John Auers, executive vice president at Turner, Mason & Co. in Dallas, told Bloomberg. “We’re ripe for a potential supply crisis.”

The prevailing supply shortage isn’t hugely surprising given the reduced need for fuel during the height of the Covid crisis, when companies closed some of their least profitable crude processing plants permanently. Some plants had also been affected by fires, explosions and hurricanes, while others were just too expensive to fix.

Kurt Barrow, VP of oil and downstream at S&P Global Commodity Insights, told CNBC in March that “the global refining industry is down about 3.5 million barrels a day of refining capacity from pre-Covid levels, with about 1 million barrels a day of that in the US and another 600,000 barrels a day in Europe.”

By the end of 2023, as much as 1.69 million barrels of US capacity is targeted for closure compared to 2019 levels, according to Turner, Mason & Co.

Prince Abdulaziz bin Salman, Saudi Arabia’s Energy Minister, recently pointed out it is the refining crunch — rather than any shortage of crude — that is driving the surge in fuel costs to unprecedented levels.

“The bottleneck is now to do with refining,” Prince bin Salman said in a Bloomberg interview last week. “I did warn this was coming back in October. Many refineries in the world, especially in Europe and the US, have closed over the last few years. The world is running out of energy capacity at all levels.”

5. Russia Situation

Make no mistake, the ongoing war has only gone and added more “fuel to the fire” in this shortage problem.

Since Russia invaded Ukraine in late February, flows of diesel into the European continent saw massive disruptions, contributing to the high and volatile prices in what is already a market under severe pressure.

Shipments of diesel-type fuel out of Russia’s Baltic and Black sea ports were about 500,000 tonnes, or 14%, lower from February to March, according to data from Vortexa Ltd.

“When you take 600,000 barrels a day of Russian exports out of a tight market, that’s what adds pressure,” S&P Global’s Barrow said.

Russia currently ranks as the world’s third-largest producer of diesel, behind the US and Saudi Arabia, and used to send significant amounts to the European market; the UK, for example, relies on Russia for a third of its supply.

Should the EU proceed with further sanctions on Russia, namely a ban on Russian oil, then the situation could get even worse.

″The tightness in global supply will be exacerbated by the EU’s proposal to ban Russian oil imports,” said Stephen Brennock, an analyst at oil brokerage PVM.

“The ban, if approved, will have an outsized impact on product markets and especially diesel … .There is now growing anxiety that Europe might run out of diesel,” he added.

Richard (Rick) Mills

aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.