It’s very interesting—too interesting for the Fed’s liking. The Fed is a lone ranger, trying to send interest rates down, but it finds itself surrounded by outlaw vigilantes in the bushes of financial markets who are shooting interest rates up. The Fed has lost control of the markets. It’s a dark day in the Fed world.

Bond guru Jeffrey Gundlach says, in a video linked to below, that the reason interest rates are going up since the Fed set out on a path to lower them is that bond investors are starting to worry about how we are going to finance the nation’s massive deficits.

Currently, he says, having a lot of experience with bonds may not even be a positive because experience makes you think you can map where the present action is going to go based on normal dynamics. We are in a time of abnormal dynamics where bond interest is not going where experience says it should, which would be where the Fed says it should. Bonds may not even do what we normally expect them to do in a recession.

Meanwhile, Adam Taggart’s guest, in an interview linked to, says that the dynamic has changed so much in a vigilante rebellion against the Fed that bonds are basically uninvestable right now. Adam suggests we may face a situation where …

Central banks have to abandon their inflation-fighting mandate because, at the end of the of the day, their supreme priority is to keep the [government] debt serviceable because, if that is no longer the case then bond vigilantes take the market market yields much higher. Then the debt service gets even worse, and you get this vicious cycle.

Then, asking his guest if that is the precipice we are caught on right now, the guest responds …

Yeah, that is…. We’re already seeing bond volatility get back to problematic levels…. The mistake this time was that the rules are different when you have debt-to-GDP at 130%.

Bond investors are already seeing the writing on the wall. They are already fearing, as Gundlach says, that the federal government will get caught in that vicious cycle of more and more expensive debt as the government continues to pile on more debt. It appears to me they’ve lost faith with the Fed’s ability to bring the cost of that debt service down, but there is another big, integrated piece to the puzzle—inflation.

The first episode of this kind of interest rebellion, Taggart’s guest says, was in 2019 with the repo crisis—a Fed fail I reported and prognosticated about at length, leading up to it and then going through it, where the Fed was forced back to QE by financial markets in order to end the turmoil in financial markets that came from its tightening.

Control was wrested from the Fed by banks driving interbank lending rates into the stratosphere after the Fed had claimed its QT would continue indefinitely on auto pilot and be as boring as watching paint dry. QT did the exact opposite and blew out interbank lending as market forces took over. The Fed didn’t want to lose face by going back to QE, so it kept insisting it was not doing QE, in spite of its huge bond buying until—as it did with its argument that inflation was transitory—it finally gave up the insisting and just went full QE, backed by the excuse Covid created.

A different kind of financial war

Now we see a different kind of turmoil building in financial markets in response to Fed easing where bond investors don’t believe the Fed has beaten inflation, and they don’t believe Treasuries with such high and constant government debt requirements can continue to justify the lower rates the Fed is pushing for. Remember that most interest rates are pegged off of Treasury bonds—particularly the 10YR. So, when bonds don’t cooperate, then no interest rates cooperate.

What we’re seeing right now is a bond investor rebellion against the Fed’s belief that it can lower interest rates. Even though lower rates are necessary to make the government debt payable, investors are seeing the unmanageable debt as demanding higher interest to compensate for the risk of spiraling out of control. So, we have entered the first stage of that vicious spiral that Taggart mentioned.

The last time debt-to-GDP was at this level was after World War II and it was 110% debt-to-GDP…. Just entitlements and the interest are at 100% of receipts.

In other words, we are more out of balance than we have ever been—even worse off than we were after fighting a long global war. It was easier to grow our way out of that imbalance after WWII because we were entering a period of huge economic expansion, manufacturing and selling to a rebuilding world after the war. That would push GDP into growth, making the debt-to-GDP ratio less threatening. This time is likely the opposite.

Bond yields keep marching higher in spite of the central planners’ wishes. We’re now at a critical point. The Fed is caught in the trap I’ve long said it was creating for itself, where its long regime of low interest rates would create inflation that would force it to raise rates above what the government (and everyone else) can afford for its debt. Now, as the Fed tries to lower rates to make that debt more serviceable, bond investors are fighting back and saying, “No way because we don’t believe inflation is done with you; so you’re not done with it.”

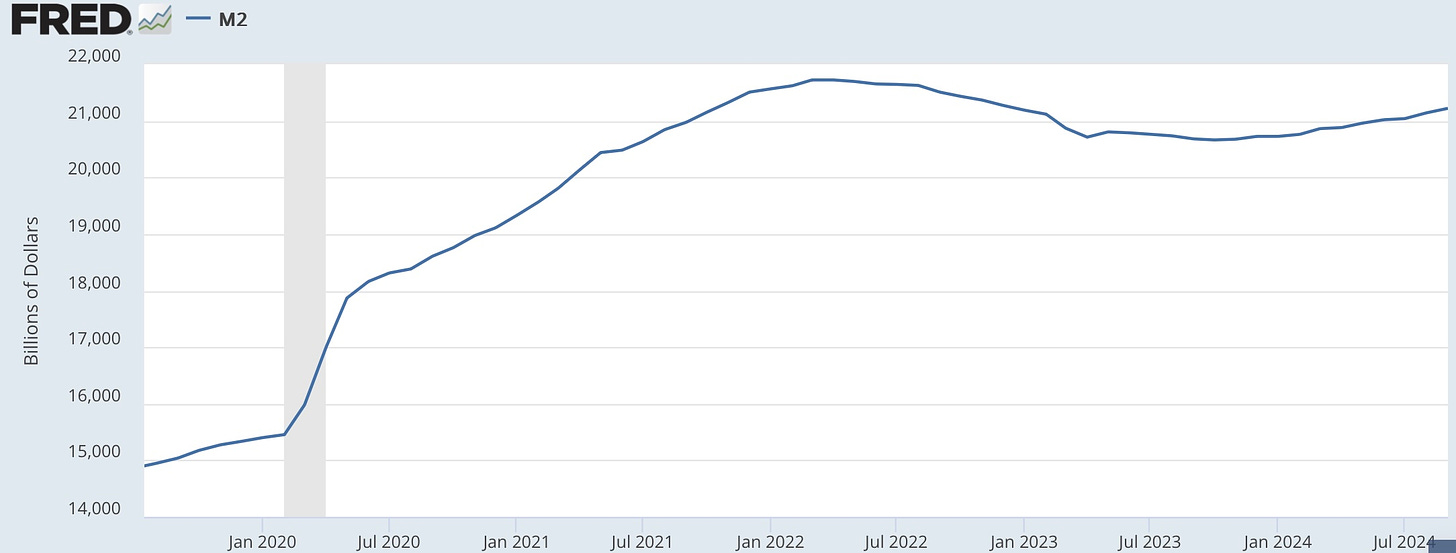

If the Fed continues to lower rates, bond investors know inflation returns with a vengeance, demanding higher rates to fight inflation. The bond vigilantes are already pricing that in, which isn’t letting those rates fall. At the same time, both presidential candidates are determined to raise deficits even more while the Fed is trying to purchase less government debt in order to reduce its balance sheet and curb the growth in money supply as another way to keep inflation down. Even that QT by the Fed is failing, and money supply has been growing in spite of it:

Federal Reserve Bank of St. Louis

So, that is another aspect of the financial market that is not cooperating with the Fed. Continued QT should continue to shrink money supply. You can see that money supply grew immensely during all the QE and low interest that accelerated during the Covid fiasco, skyrocketing in Trump’s final year, and then continuing up through Biden’s first two years. That is the normal relationship.

Then the Fed started QT because of the high inflation it had created, and it started raising interest rates. For a while that worked to bring money supply down. That is also the normal relationship. Less money theoretically equals less inflation as dollars become more rare; so, that is one means by which the Fed wins its war on inflation.

Now, however, that is clearly no longer working. Throughout 2024, money supply has been growing in spite of continued QT. That even started before the Fed started lowering interest and before it slowed its rate of QT.

The Fed has lost control of the war

Nothing, it would seem, is cooperating with the Fed. We’re in an early state of financial rebellion against the central bank. If the Fed wants to make the US debt serviceable, it will have to lower interest and send inflation much higher. That will make real yields on recent bonds negative. Bond investors, at current interest levels will get killed.

Someone’s gonna get hurt, and someone’s gonna bleed a lot.

Bond investors appear to be sensing their own slaughter coming and so are pricing in higher yields now, anticipating the inflation is coming and will eat away at their investment because the Fed will be forced to keep reducing interest to keep the government solvent. If the Fed does get interest down, then inflation rises, so bond investors lose to inflation.

There has also long been a concept that says the only way the federal debt remains payable is if we inflate our way out of it with very high inflation. Since the debt is priced in today’s and yesterday’s dollars, making the dollar worth less down the road by increasing the supply of dollars reduces the burden of the debt.

The Fed, in other words, must allow high inflation in order to inflate away the debt. Bond investors may fear the Fed will be forced to that path. The fact that the Fed has lost control to such extent that yields are going opposite of the way the Fed is trying to send interest rates on the government’s behalf, says the Fed has lost the trust of bond investors. The investors know that interest rates are either going to go up to fight inflation; or, if the Fed doesn’t fight inflation, inflation will rip their heads off on the value of any bonds they buy now, so they’re starting to price all of that in now.

The vicious cycle accelerates out of control if the bond vigilantes start pricing in more and more interest because of how they see rising interest making the government’s problem worse and worse, especially if they fear the Fed has lost the ability to control bond investors. It’s like a panic attack in bonds where fear of losing control, drives more fear, pushing things further out of control.

We see this new dynamic killing the Fed’s intentions already: Bonds have been acting in this highly unusual way since the Fed’s first failed rate cut—completely disobedient to the Fed’s will. (That’s why I call it a “failed rate cut.”) As a result, mortgage rates have been rising at a time when the housing market is already frozen over, tightening the housing market even worse, and we see that in the latest headlines, too. Other interest rates that are pegged to bonds are crippling consumers at a time when they are more reliant on credit to cover the higher prices that their wages won't cover.

What all of this means is that the bond vigilantes are forcing financial conditions to get tighter, which could have the effect of forcing inflation down, but also forcing us into that recession the Fed wants to think it has avoided because, ultimately, we don’t ever get inflation down without creating a recession. Bond investors have seized the reins.