The US Federal Reserve announced this week what many market participants were expecting — a series of interest rate hikes starting next year.

On Wednesday a majority of the Federal Open Market Committee (FOMC) forecasted three quarter-point rate increases in 2022, a tightening of monetary policy after holding borrowing costs near 0% since March 2020.

The new projections would see interest rates rise to 0.75% by the end of next year, with another three increases slated for 2023 and two more in 2024, bringing the federal funds rate to 2.1% by the end of that year.

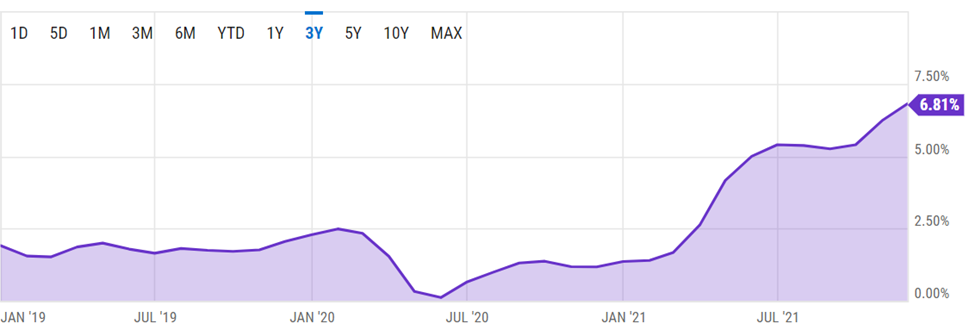

The Fed is reacting to higher-than-expected inflation which officials previously argued would fade as supply chain pressures owing to covid-19 eased. Instead inflation has soared, with the US Consumer Price Index reaching a 30-year high of 6.8% in November fanned by a continuation of the pandemic, supply chain bottlenecks and strong demand for goods and services amid unprecedented fiscal and monetary policy support.

US Consumer Price Index YoY, Y Charts

US Consumer Price Index YoY, Y Charts

The pace of the rise suggests the US Federal Reserve is well behind the curve in controlling price increases, led by “the essentials” of food, transportation and shelter.

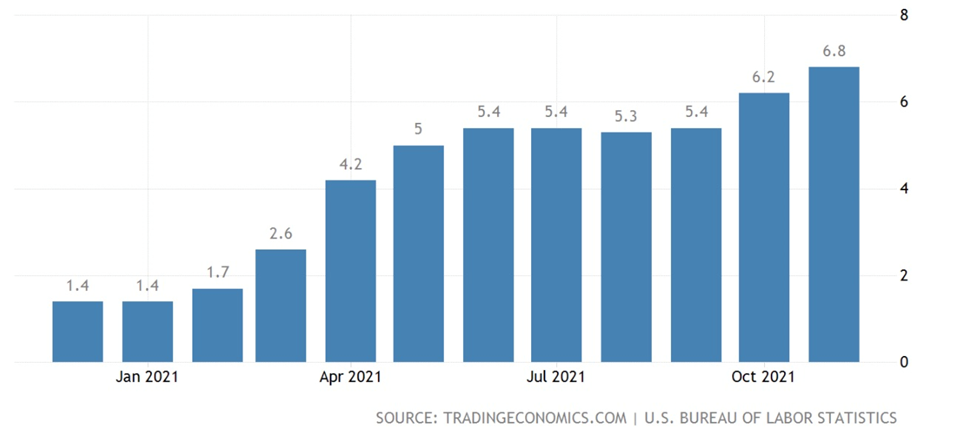

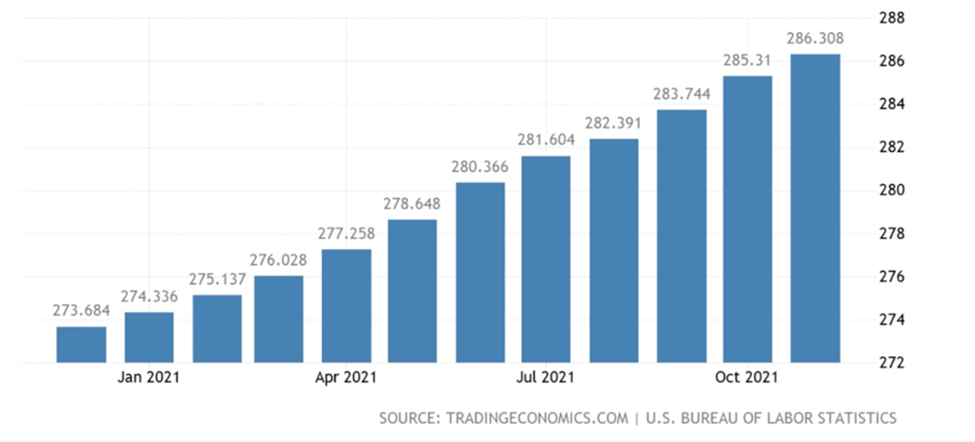

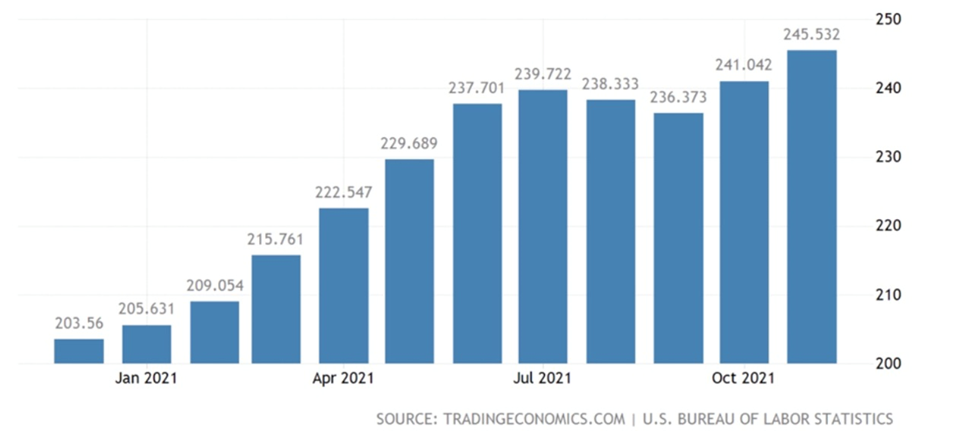

Energy costs recorded the biggest gain, 33%, including a 58% increase in gasoline and a 25% increase in natural gas; shelter costs rose 3.8%, the most since 2007; and food prices vaulted 6.1%, the highest since October, 2008 (the CPI for meat rose 16% year over year).

Food inflation. Source: Trading Economics

Food inflation. Source: Trading Economics

CPI housing utilities. Source: Trading Economics

CPI housing utilities. Source: Trading Economics

CPI transportation. Source: Trading Economics

CPI transportation. Source: Trading Economics

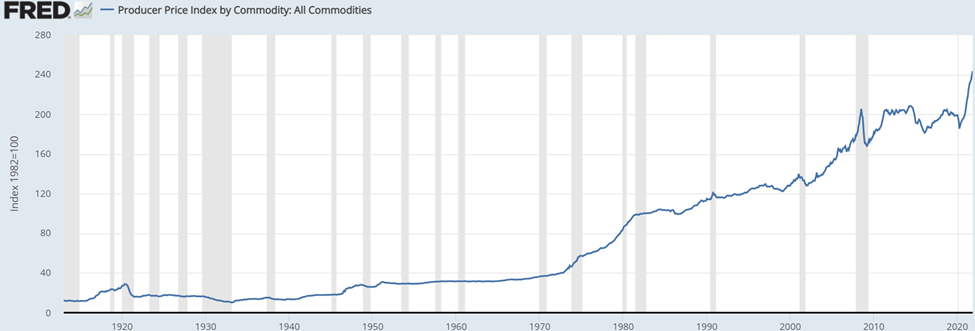

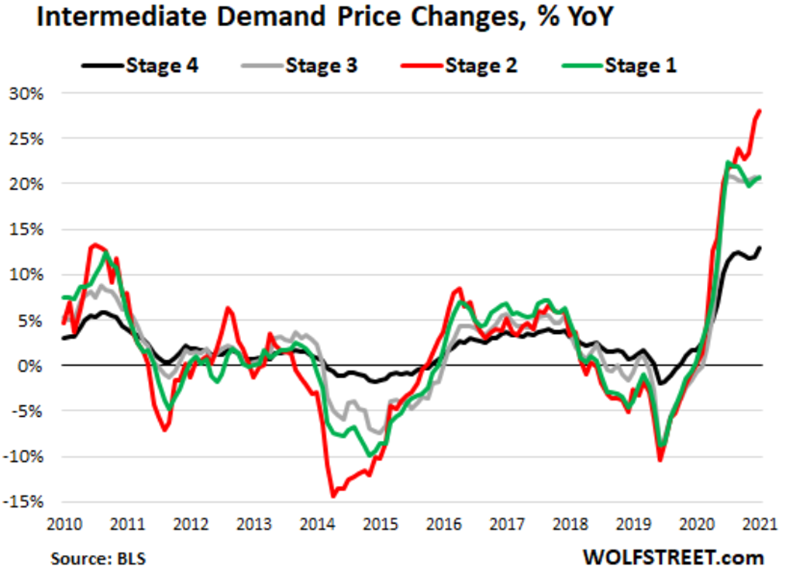

The producer price index in November climbed 9.6% from a year earlier, the largest in figures going back to 2010, and well above October’s 8.6%.

Further up the producer price pipeline, inflation is raging at 28%, notes Wolf Street.

Excluding food and energy, the inflation metric known as core CPI went up 4.9% compared to 4.6% in October, the highest since June, 1991.

It’s important to note, the Federal Reserve doesn’t count food and fuel in its regular inflation forecasts, preferring the “PCE inflation” metric. As the name suggests, the Personal Consumption Expenditures price index measures changes in the prices of consumer goods and services. Thus the Fed is deliberately understating the real inflation rate (how they can exclude food and gas prices is beyond comprehension) which have actually increased about 10% year over year and are heading higher.

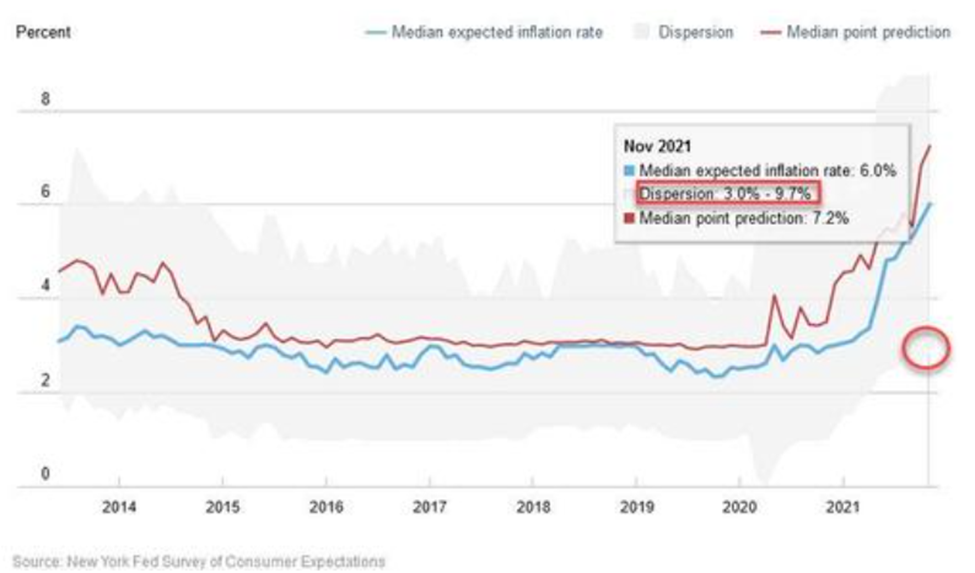

The New York Federal Reserve’s November survey of consumer inflation expectations hit a new all-time high of 6%, up from 5.6% in October, with at least a quarter of survey respondents seeing inflation surging to double digits.

Zero Hedge reports consumers now expect most expenditures to rise by around 10% in the coming year, with gasoline prices expected to go up 9.1%; food prices to increase 9.2%; medical costs to climb 9.6%, rent to rise 10%; and the cost of a college education expected to surge 9.1%, the highest since 2015.

This is a far cry from the central bank’s PCE inflation estimate for 2022 of 2.6%.

The Fed’s governing body also said it will double the pace at which it is scaling back its monthly purchases of Treasuries and mortgage-backed securities (the so-called “taper”) to US$30 billion a month, meaning the quantitative easing program will end in early 2022 rather than mid-year as previously planned.

In our last article we argued the taper will not quell rising prices, and in this article we will attempt to show that modest interest rate adjustments of less than 1% will have little to no effect on skyrocketing inflation.

The Federal Reserve is severely constrained in how much it can raise interest rates, due to ballooning debt. The national debt is now over $29 trillion, and heading higher, much higher. The Fed can telegraph its intentions all it wants, the fact remains that at such unsustainably high debt levels, the interest payments will eventually cripple the federal government.

According to the Committee for a Responsible Federal Budget, each 1% rise in the interest rate would increase FY 2021 interest spending by roughly $225 billion at today’s debt levels. On a per-household basis, a 1% interest rate hike would increase interest costs by $1,805, to $4,210.

For round numbers, let’s just say a 0.75% interest rate hike would increase the interest costs per household by $1,400.

The latter will hit the consumer right in the pocketbook, as will higher interest rates on mortgages, car loans and credit cards, which will all go up following the rise in the federal funds rate.

Corporations will also feel the squeeze. The interest on their loans will increase, forcing them to hike prices. Again the consumer pays. In the worst cases, companies will lay off staff, hurting workers and pushing the most vulnerable into severe economic hardship.

Food

Does the Fed really think that raising interest rates by <1% is going to stop food inflation? Skyrocketing prices of everything from meat and eggs to dairy and pasta, both in Canada and the United States, is only partially due to supply chain disruptions.

Food inflation is also being driven by record-high fertilizer prices and climate change.

Higher input prices are usually passed onto the buyer of meat, fruits and vegetables, for the rancher/ grower to preserve his profit margin. In November the Green Markets North American Fertilizer Index hit a record high, rising 4.4% to US$1,094 per ton, surpassing the previous week’s record and its 2008 peak.

According to BNN Bloomberg, the fertilizer market has been pummeled this year due to extreme weather, plant shutdowns and rising energy costs — in particular natural gas, the main feedstock for nitrogen fertilizer.

Modern farming simply cannot do without fertilizer; its higher cost must be borne by producers and so higher food prices are likely going to be “baked in” for several years. Everyone from ranchers to farmers, greenhouse growers and orchardists will be affected.

As for climate change, we know that higher temperatures lower crop production, droughts like we experienced this past summer ruin crops and cause feed prices to soar, leaving ranchers no choice but to cull their herds. The prices of staple crops like corn, wheat and soybeans have all tracked higher.

Desertification, a process whereby land in arid or semi-dry areas becomes degraded is a global issue with more than half of Earth’s arable land affected. Currently 12 million hectares of arable land is lost to drought and desertification annually. The issue is said to affect 1.5 billion people in over 100 countries.

Desertification is made much worse by climate change.

Ranching and farming, through extensive energy inputs like diesel fuel, lights, heating, etc., generate high amounts of carbon dioxide. Farming also releases methane from cows and cow manure, and nitrous oxide from fertilizers. Both are heat-trapping greenhouse gases.

We can’t forget fish and shellfish. As the ocean warms it causes acidification, which stunts the growth of corals. The destruction of coral reefs is a major problem, since they provide critical habitat and food for so many species in the reef ecosystem. If current rates of temperature rise continue, the ocean will become too warm for coral reefs by 2050.

World fisheries are in a state of collapse — caught between plagues of jellyfish, overfishing, nutrient pollution, bioaccumulation of toxics in marine mammals, carbon emissions turning our oceans acidic, the oceans’ phytoplankton declining by about 40% over the past century, dead zones, garbage patches, increasing ocean temperatures and changing currents — our entire marine food chain seems to be in peril.

We at AOTH know that climate change is not going to stop, the Earth is going to warm until it starts to cool, as it has done in natural cycles for millions of years. As long as it does, food prices across the board are practically guaranteed to rise.

Grocery shoppers are also being hit with shrinkflation, whose effects are mostly borne by the poor and working poor.

According to The National Post shrinkflation is paying the same amount for a product, say a box of cereal, but getting less. Manufacturers do this to offset increasing input costs without increasing prices. A 2014 study published in the Journal of Retailing reported consumers are four times as sensitive to price differences as they are to changes in package size. Though consumers often express frustration when they notice downsized products these negative reactions are typically short-term. When manufacturers surprise people with higher price tags, however, they tend to lose market share: “There’s less of a risk to shrinkflation than to increase prices.”

Shelter

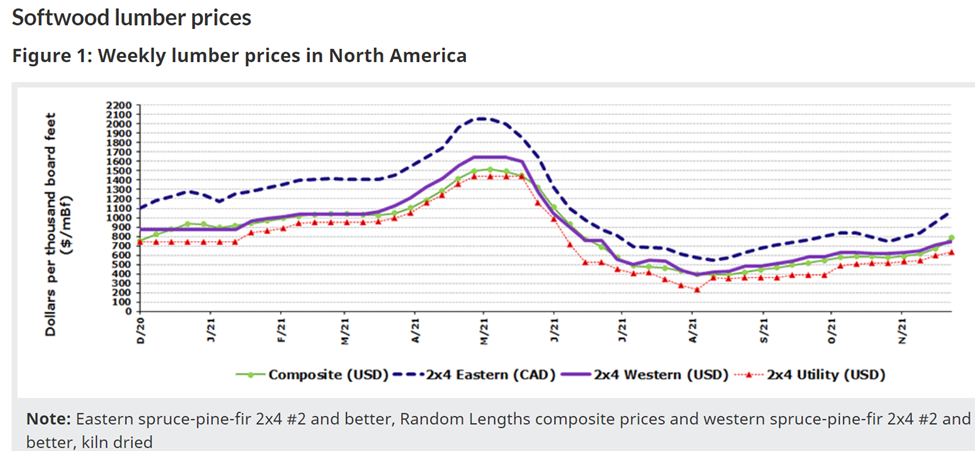

Anyone who tried to build or remodel a wood-framed house this year faced a horrible shock — lumber prices literally went through the roof. From a year ago this past June the popular building material rocketed 377%, partly due to high demand for renovations by covid-bound homeowners. Normally priced between $200 and $300 per thousand board feet, lumber futures hit an all-time high of $1,500 in March of this year and while they fell as low as $450 in October, lumber has bounced back up to $1,119, as of time of writing.

US lumber futures. Source: Trading Economics

US lumber futures. Source: Trading Economics

In British Columbia there has been a lot of press about the impacts of over-logging on towns like Merritt recently hit by devastating floods. In 2018 Grand Forks launched a class-action lawsuit against the BC government and several timber companies, alleging that excessive logging caused the displacement of thousands of people and millions of dollars in property damage.

Ripping out too many trees and root systems leaves the land exposed and vulnerable to flooding. The “atmospheric rivers” we saw moving across the Pacific Northwest dumping record-breaking amounts of rain will only become more frequent as the planet continues to warm, causing unstable weather.

Before the atmospheric rivers we had the “heat dome” which sucked all the moisture out of the forests leaving them vulnerable to forest fires.

Out-of-control wildfires, evacuation orders, and dangerous to breathe smoke that blankets communities for weeks, are now annual events in the BC Interior. According to the CBC, nearly 8,700 square kilometres of land were burned in 2021 due to wildfires, making it the third worst year on record.

Lumber prices will likely be pressured in coming years with regular forest fires, along with a shorter logging season. When humidity and temperatures reach a certain point, it becomes too dangerous to log and the bush gets shut down. Climate change can also reduce the amount of logging being done in the fall, when roads are late to freeze up, and in spring, when the thaw, or “breakup”, comes sooner than normal.

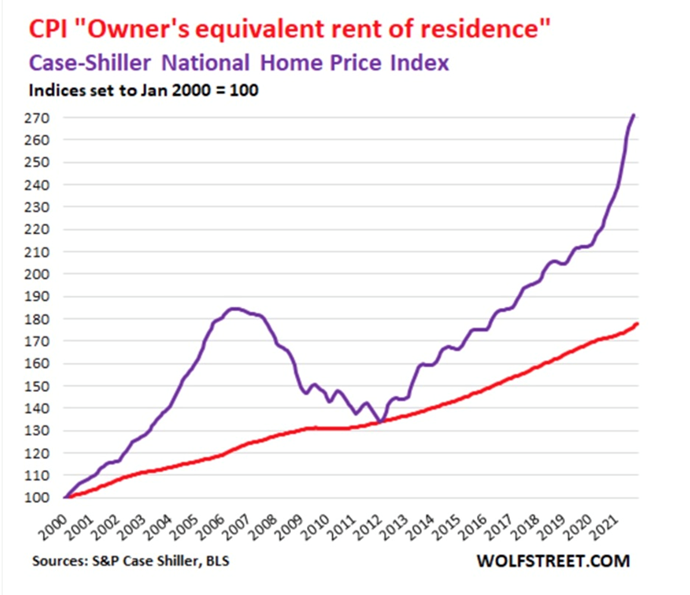

Wolf Street reports “actual home prices have spiked by historic amounts,” with the Case-Schiller Home Price Index which tracks price changes of the same house over time, soaring 20% year over year. The “owner’s equivalent of rent” which measures the costs of home ownership (red line in graph below) is also tracking higher.

Transportation

This year China and Europe experienced an energy crisis.

Flooding across China’s key coal-producing provinces, resurgent demand for Chinese goods in the wake of pandemic easing, and market distortions including power rationing and price controls, were behind an energy shortage that pushed coal and natural gas prices to record highs.

In Europe, a colder-than normal last winter depleted natural gas inventories, causing electricity prices to soar, as demand from rebounding economies surged too fast for supplies to match, BNN Bloomberg reported.

Oil reportedly extended gains to the highest in three weeks, Thursday, as US crude stockpiles dropped the most since September, and the dollar gained, bolstering commodities.

The usual energy market dynamics are being overshadowed by the global transition from fossil-fueled energy generation to renewable power sources namely wind, solar and hydro.

As governments and institutional investors divest themselves of funds that traditionally flowed into fossil fuels, i.e. coal/ oil & gas producers, or pipeline infrastructure, they are trying to bring on renewables to replace the lost output.

However, with no easy way to store the energy generated from renewables, utilities are finding they must continue to utilize “dirty” coal and natural gas, despite commitments to lessen their dependence on fossil fuels to fight climate change.

The problem was made worse this year by low output of hydro and wind power sources, due to unexpectedly low wind speeds and little rainfall.

The problem isn’t about to sort itself out anytime soon, because even though solar and wind power are getting less expensive, many parts of the world still depend on coal and natural gas as a primary source, or as a backup.

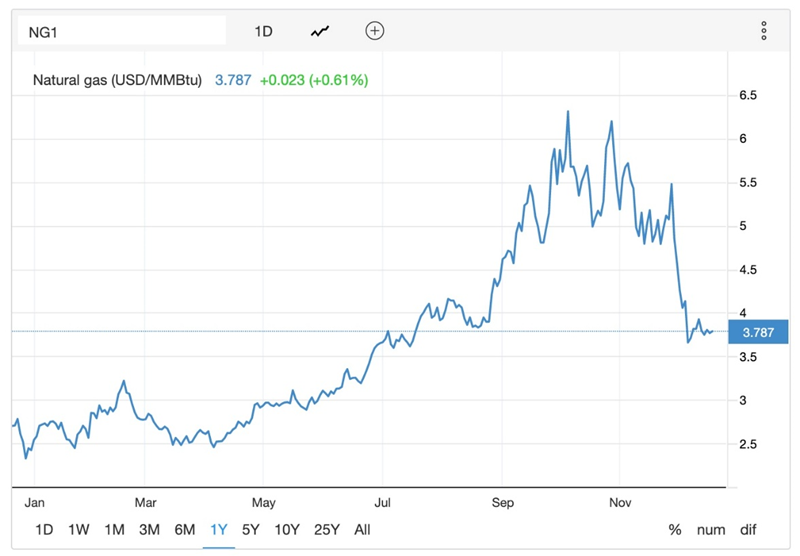

The obvious example is the United States. With 40% of the country’s electricity now generated by NG, higher gas prices will inevitably push up electricity and heating bills. US natural gas futures more than doubled this year, although in recent weeks they have fallen. Concerns about tightness in the US gas market have virtually disappeared following a so-far warm winter heating season, which has dampened domestic demand, with inventories currently in good shape for the winter, according to Trading Economics.

We know this can change in a hurry, if the northern polar vortex breaks down as it has been doing almost annually. This sends a column of freezing-cold Arctic air down to southern latitudes. As shivering residents crank up the heat, natural gas supplies get depleted and electricity prices inevitably rise.

Like higher food prices, more expensive power is baked-in with climate change. The chances of a run on electricity for a cold winter, or the need for more air conditioning during a summer heat wave, become greater with each passing year.

US natural gas futures. Source: Trading Economics

US natural gas futures. Source: Trading Economics

Minerals

Eventually renewable energy will out-compete fossil fuel sources with lower prices, as more wind and solar capacity comes online. What is not going to catch up is the unbelievable demand for electrification and decarbonization minerals needed for the shift away from fossil fuel-powered transportation and energy.

According to Bloomberg New Energy Finance (NEF), by 2030 consumption of lithium and nickel will be at least five times current levels, demand for cobalt used in EV batteries will be 70% higher, and copper, manganese, iron, phosphorous and graphite — all needed in clean energy technologies and to expand electricity grids — will see sharp spikes in demand.

High demand is occurring at the same time as a supply crunch is taking hold, particularly for copper, lithium and nickel, which is shoring up prices and driving the valuations of deposits containing these metals higher.

Added to these structural supply deficits, supply chain bottlenecks relating to the covid-19 pandemic have further pressured prices, as has resource nationalism. Top copper producer Chile has proposed legislation that would see copper mine profits taxed at 75%. In Peru, the second-largest copper mining country, the new leftist government led by Pedro Castillo is seeking to impose a 70% tax on copper mining profits, which would discourage further spending on existing and future projects.

Not helping to ensure a steady supply of metals, is the anti-mining Biden administration.

The Department of Justice and the US Army Corps of Engineers slammed the brakes on two proposed mines in Minnesota, both of which have faced resistance from environmental groups, Indian tribes and other communities. Twin Metals seeks to operate a large underground mine near a wilderness area while PolyMet is attempting to open an open-pit mine in the headwaters of the St. Louis River.

In September a congressional committee voted to block Rio Tinto from building its Resolution copper mine in Arizona.

And of course Northern Dynasty’s Pebble project in Alaska has taken the full brunt of environmental attacks for years.

When resource nationalism and anti-mining decisions combine with structural deficits and steady demand for electrification & decarbonization metals like copper, nickel, lithium and cobalt, mineral price inflation is practically a given going forward.

An American spring

For months Fed Chair Jerome Powell has downplayed the inflationary spiral that has gripped the American economy. However, recently Powell said that the Fed should stop calling inflation “transitory”, and he even admitted the heavy burden of higher prices on lower-income people.

“We understand that high inflation imposes significant hardship, especially on those least able to meet the higher costs of essentials like food, housing, and transportation,” the central bank chairman said.

Many will remember the influence of high food prices on the Arab Spring that sparked protests and riots in Egypt and Tunisia, among other Middle Eastern countries.

Arguably the same thing could happen in the United States in the coming months, if the Fed fails to control inflation. With 38 million people living below the government’s poverty threshold of US$25,000 for a family of four (nearly 12% of the population) that is a very large group of people that could take to the streets if essential goods keep climbing beyond their reach.

We at AOTH believe this is a distinct possibility given there are so many price pressures not related to covid that are likely to keep food, energy, transportation and mineral costs higher.

They simply cannot be tamed with the weak policy response the Fed is suggesting, i.e., raising interest rates 75 basis points within a year.

We actually have a precedent on which to buttress our argument.

Then-Fed Chair Janet Yellen’s decision to hike interest rates in December 2015 had a muted effect on inflation, with the CPI sitting around 0.5% in 2015 and actually rising, not falling, to 2% in December 2016.

We aren’t the only ones skeptical of the Fed’s inflation-fighting plan. In a column, Peter Schiff writes that to truly take on inflation, the central bank needs to push rates at least as high as inflation, meaning 7% “using the government’s cooked CPI numbers.”

Recall the plan is to raise rates 2% in three years. The Fed also needs to shrink the money supply by trimming its $8.7 trillion balance sheet, bloated by quantitative easing, Schiff states.

Phoenix Capital Research via Zero Hedge points out the scary risk of corporate debt default considering there is currently more than $7 trillion of debt that was issued when rates were effectively zero. When the Fed raises rates, bond prices will fall and yields will rise. “And if they rise enough, the investors begin to default.”

A rise in interest rates will not be welcomed by Wall Street since it threatens to derail the more than a decade-long bull market that has been based on near-interest-free loans.

But as we have shown, the poor have more to fear than the rich when it comes to rising rates and inflation. Consider: higher interest rates mean it is harder to finance a house, a car, a credit card, and an education. Low-paid jobs could be at risk if corporate debt gets more expensive and companies have to lay off staff.

Hiking rates may have the desired effect of cooling the economy and lowering consumer borrowing and spending, but unless inflation goes down, the poor will continue to bear the brunt of higher prices. Even if inflation is cut in half next year, it will still mean prices will have risen 15% in two years!

The consumer can’t handle that kind of pressure and it’s not going to stop. In reality the Fed has no control over the rising prices of food, natural gas, gasoline, housing and minerals. In fact the federal government’s decarbonization agenda is stoking demand and making minerals inflation a permanent feature of the economy.

Between that and the Biden administration’s reluctance to lift tariffs on imports from China, meaning higher prices for cheap Chinese goods like those found in Walmart, the government is only making it harder for the poor and the working poor to make ends meet. If nothing changes I fear a reckoning is coming soon.

Richard (Rick) Mills

aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.