- Not Quite Normal

- Pause or Pivot?

- Economic Watch List

- Dallas and Writing…

“Every new beginning comes from some other beginning’s end.” — Seneca, the Elder

“Democracy is the theory that the common people know what they want and deserve to get it good and hard.” — H.L. Mencken

Welcome to 2023. It’s Forecast Season on Wall Street, the time when everyone tells us what to expect for the new year. Do they really know? Of course not. Forecasters don’t know, investors know they don’t know, yet we all go through this exercise anyway. It’s a bit odd when you think about it. I think much of it is about confirmation bias. We want to find a forecast that matches what we’re already doing.

The same happens in sports. No one knows who will win the Super Bowl. People can have opinions. Experts can have informed opinions, knowing each team’s players, strategy, and so on. But so many random factors can intervene, they’re all just opinions. Yet these opinions have real-money value in Las Vegas, where the casinos set a “line” against which you can bet on the outcome. That line will change as bettors/gamblers make their choices. Sportsbooks, like Wall Street, adjust to make sure they make money.

That’s the real point. We don’t need certainty so much as we need a baseline, a reference point to guide our decisions. Investing is about risk. How much risk should we take and in what direction is a continuum, not a yes/no decision.

In other words, forecasts can be useful even if they aren’t right. Rather than a long list, I’m going to give you a few specific predictions in which I have fairly high confidence and then review some other possibilities that flow from it.

So rather than a forecast, you can think of this as a kind of a watch list. I want you to go away knowing where to look… even if we don’t yet know what you’ll see.

The key to this year’s economy is in Jerome Powell’s hands. That’s certainly not ideal, but it is reality. I would much rather market forces be the key to understanding the future, but Powell is, unfortunately, in that role. To understand why, let’s look back a bit.

Twelve months ago, we were starting 2022, fully expecting inflation would keep rising and become a big problem. Excessive stimulus programs, pandemic-related supply chain disruptions, and insufficient energy supplies had combined to finally deliver the 2% inflation rate top central banks had been trying (and failing) to produce. But then, like the Mencken quote, they got it good and hard. It was hard because they distorted the economy and markets with ultra-low rates for a decade. Then they compounded that major policy error with even bigger policy errors (“It’s transitory!”), and here we are.

Last January, it wasn’t clear when (or if) the Federal Reserve would do anything about the rising inflation. A Russian attack on Ukraine wasn’t yet a big factor. It was feared and discussed, but various European leaders were talking to Putin, hoping to ease tensions.

Then after the invasion, another big surprise: the NATO countries and other democracies united to impose harsh sanctions on Russia, despite the near-certainty of negative effects on their own economies. Energy prices spiked, aggravating the already-rising inflation trend. Fed officials finally woke up in March and have raised rates at every meeting since then. They’re also slowly shrinking the balance sheet, i.e., “quantitative tightening” or QT.

I said back then Powell didn’t want to go down in history for letting inflation get out of control and would ultimately turn more hawkish. That proved correct. Inflation is still too high but receded quite a bit the last few months.

Note that this really didn’t qualify as a forecast so much as taking Powell at his own word. Not only do I still think we can take Powell at his word, but he now has several Federal Open Market Committee (FOMC) members singing from the same hymnal.

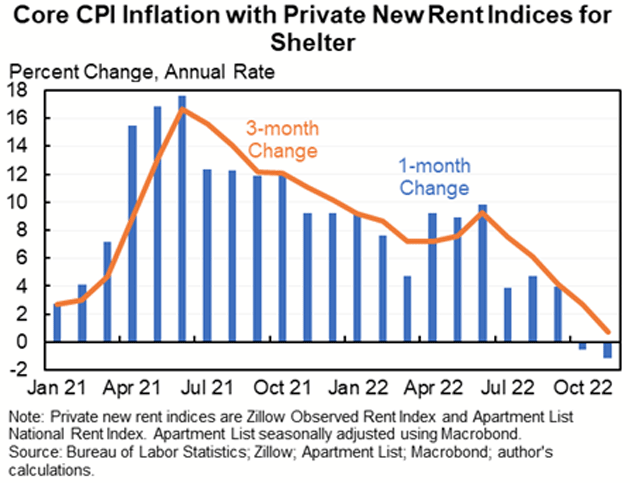

The Fed and other policymakers look mainly at Core CPI and PCE, which strip out food and energy prices. This leaves housing as the largest component. The way they measure rent is tricky because, in most cases, it changes only when leases come up for renewal. This gets worked into the indexes gradually, so the rates on new leases can be quite different. As we all now notice, they have been falling recently.

Economist Jason Furman tracks a modified Core CPI that substitutes “spot” rental rates for official calculations. This is a better way to think about where inflation (at least the way we measure it) is going. The improvement is quite evident in his chart.

Source: Jason Furman

What that tells us is that housing costs are going to be a significant disinflationary force in 2023. It doesn’t mean inflation is disappearing; housing is a big living cost, but not the only one. It simply suggests the worst fears likely won’t materialize.

I think data like this is what let the FOMC dial back the hiking pace to only 50 points in December, and if it continues, probably less in the next few meetings.

That brings us to my one specific forecast: I have been saying for over a year that I believe the Fed funds rate will get to 5%. I now believe it is entirely possible the Fed will not stop hiking until it gets to 5.5%. The operative word there is believe.

Minneapolis Fed president Neel Kashkari this week called for the Fed funds rate to be between 5.25% and 5.5%. When Kashkari, one of the most dovish FOMC members, is signaling almost 5.5%, Powell clearly has buy-in to go “higher for longer.”

That number isn’t random, by the way. Powell has said they want to see positive real rates across the whole yield curve. Inflation backing off to 3% or 4% while Fed funds is 5.5% would do it, even if long-term rates stay in a small inversion. It would be, if not exactly a “normalized” policy, much closer to normal than we’ve seen since 2008.

But this is also where we start seeing other problems. The economy—and certainly financial markets—no longer wants this kind of normalcy. It has adapted to free liquidity. Adapting back won’t be easy, and it certainly won’t be painless.

While I’m relatively confident in the forecast above, there’s a small chance the Fed won’t pause, or at least not for long. That could occur if something pushes the core inflation trajectory higher again. And for that to happen, rental rates and home prices would have to recover quite a bit, which seems unlikely unless mortgage rates fall. Not impossible, though. And that doesn’t even consider wage increases, which have been generous in many industries and even more so for workers changing jobs.

It’s also possible, though again unlikely, the Fed will actually pivot toward rate cuts and/or some other kind of easing. I think this will happen only if we enter a severe recession and unemployment spikes up to 2008-like levels.

Both those are what you might call “tail risks.” The baseline remains a Fed pause with the Fed funds rate above 5% and maybe 5.5%. What would happen next?

First, inflation will continue causing damage even if it drops all the way back to 0%, which it certainly won’t. That’s because inflation is a rate, not a level. If it rises 10% one year, then 0% the next year, living costs remain 10% higher than they were before. This has a cumulative effect as people keep spending more on gas, groceries, etc., and saving less. Wage growth helps, but for many, it’s still not keeping up with inflation. And higher wages can and do have their own inflationary effects.

Similarly, higher interest rates have an effect that intensifies with time. Debt servicing costs rise as households and businesses with floating-rate loans see them reset to higher levels. State and local governments have a lot of such debt, meaning they have to either raise taxes or reduce services. Not to mention the federal government’s borrowing costs, which will rise as Treasury securities mature.

Those two forces will hit the US hard in 2023, and I’m not sure we are prepared for the impact. Powell no doubt hopes they will produce the fabled “soft landing” in which growth slows enough to stabilize inflation but not raise unemployment too high.

That’s a nice thought, and I hope it happens. In fact, my friend Professor Harvey Campbell of Duke, who pioneered using the inverted yield curve as a recession indicator, thinks the yield curve signal may be less predictive this time. He sees a soft landing as quite possible. So much has changed since 2020 that using past performance to predict future results is especially hazardous now.

And while it’s almost become consensus, which makes me nervous, I still think we will see recession at some point in 2023, though not a severe one. Economic growth is slowing more than employment growth suggests. Only 2 of 18 manufacturing industry segments saw expansion in December (metals and energy), and 13 are in clear decline. That being said, manufacturing is only 10% of the economy

While I’m reasonably confident what the Fed will do, the Fed doesn’t control everything. Several other factors could change the outlook. We’ll need to watch them carefully as 2023 unfolds.

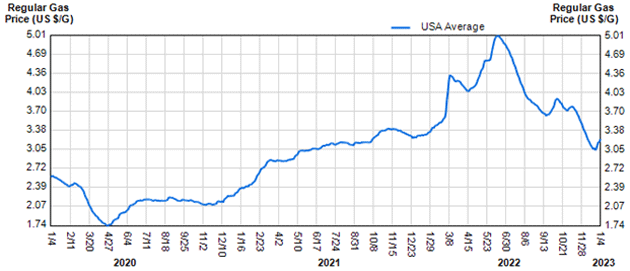

Energy Prices: Right now, people are feeling relieved as prices are more or less back where they were before the war spike. A mild winter in Europe is helping natural gas prices in particular. But don’t forget, energy was getting more expensive even before the war, and not just in Europe. Here’s a chart of US gasoline prices (actual pump prices, not wholesale).

Source: GasBuddy

Note that in 2021, retail gasoline rose almost 50% before the war had any effect. After the Ukraine invasion, it rose much higher. Now, it’s given up that gain but is still significantly more expensive than in early 2020, before COVID. It could easily rise more from here, particularly since the Strategic Petroleum Reserve is too low to repeat the kind of releases that helped in 2022. (I am currently working on a series of white papers on energy. It will come as no surprise that I’m very bullish on energy, which will make the Fed’s job of controlling inflation harder in the future.)

Higher gasoline prices aren’t part of the core inflation indexes but matter a great deal to inflation expectations and consumer sentiment. They produce a uniquely visible, repetitive pain that hurts lower and middle-class consumers the most. The Fed has no way to affect energy prices directly, and its indirect influence has long delays. Another energy spike will put the Fed in a really awkward position, under pressure to “do something” that would only make matters worse.

China: What happens in China is key to energy because it affects demand. Oil, natural gas, and coal production aren’t growing much and could easily go flat, if not fall. Renewable growth helps a little but not enough to matter in the short term (or even over the next five years). Demand, however, could rise sharply if China can endure its COVID wave and then increase energy imports as economic growth turns higher. Many of the close China watchers I follow are actually quite bullish: my friend and all things Asia expert Chris Wood writing in GREED & fear:

“The ‘good news’ now is that the virus will likely run through the population quicker than anybody can imagine. This should mean economic recovery by the second quarter, if not earlier. GREED & fear’s expectation is that demand should start to pick up, including potentially demand for property, after the Chinese New Year holiday, which this year ends on 27 January.”

Gavekal and others generally agree and are quite bullish on Asian equities. In fact, Chinese growth (or lack thereof) could be a key factor this year. By sheer size, it’s the global elephant in the room. Its large structural trade surplus means it competes for all kinds of commodity resources that are no longer available in abundance. China re-opening could produce demand in the millions of barrels per day equivalent. This will boost energy consumption throughout Asia. This is something else to watch.

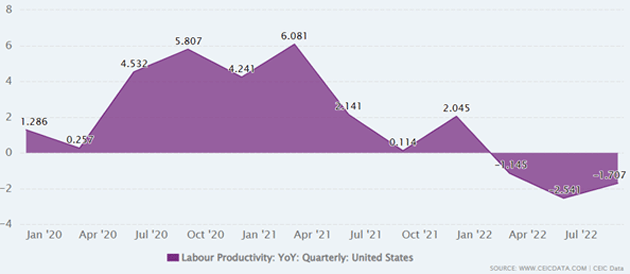

Worker Productivity: Back here in the US, much depends on the labor situation. While COVID certainly aggravated the worker shortage, it is really about demographics. The Boomer generation is retiring faster than younger generations are entering the workforce and gaining productivity. We no longer have the level and type of immigration that would fill the gap. A surprisingly large percentage of businesses need help they simply can’t find.

This is raising wages, particularly for service industry workers, with the happy effect of giving them more spending power. That’s one reason the economy isn’t already in recession. The bad part is it reduces growth prospects unless the smaller number of workers gains productivity. In fact, the opposite has been happening: productivity has been going sideways to down depending on the industry.

Source: CEIC

Remember, GDP is a function of the number of workers times worker productivity. Very simple equation. It is hard for GDP to increase significantly with negative productivity growth.

Low unemployment gives the Fed room to go higher and then pause for longer. And today’s headline unemployment number of 3.5% suggests a very strong, if strange, employment situation. The market, at least Friday morning, is loving this report. Can another 50 bps be back on the table?

Note on this employment number. The broader unemployment number of U-6 is back to 6.5%, the lowest since 1994. There were 700,000 part-time jobs added, which dropped the headline number, but the details do not suggest all that much strength. A mixed bag, but nothing to slow the Fed’s path to higher rates.

We need to make sure unemployment, much more than it usually is, is on our watch list in 2023.

Unstable Sandpiles: Long-time readers know about me and my sandpile stories. The most recent one is here. We are presently sitting amidst several large and growing financial system sandpiles, any or all of which could collapse at any time with potentially catastrophic effects.

Back in November, I wrote about the collapse of cryptocurrency exchange FTX. That sandpile was relatively small; the disturbing part is what it said about risk-taking in the markets. Here’s what I wrote:

“We already have the conditions for a major repricing of risk. In the same way people trusted FTX with their crypto, they’ve trusted CEOs to deliver strong earnings. They’ve trusted fund managers to buy the right stocks. They’ve trusted central bankers, regulators, and politicians to choose wise policies.

“All that trust comes easy in a bull market. Warren Buffett, who has seen more bulls and bears than most of us, famously said, ‘Only when the tide goes out do you discover who’s been swimming naked.’

“I’m very confident in saying many, many people are swimming naked in this market. It’s felt pretty good for quite a long time. But one reason it’s felt good is they aren’t really naked. They’ve had an unnaturally long high tide [of low rates, leverage, and an extremely easy monetary policy] to cover themselves. That tide will go out at some point. I don’t know if FTX will be the turning point, but it could be.”

This is my biggest fear entering 2023. Not that the Fed will make another mistake or inflation will get too high, but that the higher rates the Fed is (properly, if belatedly) using to fight inflation will set off a sandpile avalanche somewhere else. So many people and institutions are overleveraged. The sandpile walls are collapsing on them. Like the Fed, they have no good choices, but unlike the Fed, they have financial limits.

We are already seeing this in Silicon Valley, where years of cheap or free capital sustained companies that should have gone out of business long ago. Their ideas, while often noble and worth trying, just don’t work in the kind of “normal” economy the Fed is producing.

Every debt has two parties: borrower and lender. When the borrower defaults, the lender loses. But the lenders are often borrowers, too, in a vast web of interconnected global debt. Take out a few key connections, and it can all fall apart. I think we are dangerously close to learning how bad it can be.

In 2018, it was the widening of credit spreads that caused the Fed to reverse policy. Credit spreads are under pressure, but not like 2018. But given the abrupt nature of the rise in interest rates, the amount of floating rate loans coming due, etc., credit spreads must be on our watch list. You can bet the Fed has it very close to the top.

But even short of that extreme, I think the “repricing of risk” I mentioned in November will continue into 2023. Too many stocks are simply overvalued relative to the profits they can generate in this kind of economy. If you can get 4%–5% on Treasuries, why reach for yield in a risky stock market?

The good news: This repricing will, in due course, give us opportunities to take wise risks on solid businesses and assets. I already have my eyes on several candidates. This year will be a time to identify your own opportunities, even if it’s not yet time to grab them.

How about this for a New Year’s resolution? Let’s not miss the turnaround, which will eventually come.

I will be in Dallas for a few days to do some videos with my partners in my new oil fund (I am one of the general partners). And I am writing a series of white papers on energy in general. Next week, we will survey the forecasts of other people in the financial world whom I respect.

Speaking of productivity, losing access to my Outlook files has been an unmitigated personal productivity disaster. We just about have it fixed now. Hopefully, this afternoon. It shouldn’t be this hard to get back up, but it has been.

Let me start off the New Year by saying how grateful I am that you give me the gift of your attention. Attention is the most valuable commodity of this decade. I will do my best to honor your precious time.

And with that, it is time to hit the send button and wish you the happiest and healthiest of New Year’s in 2023. Don’t forget to follow me on Twitter!

Your always optimistic at the beginning of the year analyst,

|

|

John Mauldin |

P.S. Want even more great analysis from my worldwide network? With Over My Shoulder you'll see some of the exclusive economic research that goes into my letters. Click here to learn more.