The time has come to cite the many reasons why Gold has risen, and why Gold will continue to launch to much higher levels. The USGovt debt and USTreasury Bond default, in my opinion, deserve the lead factors along with powerful price inflation. These factors are not featured in the press. The Jackass has stated for the last five years, to impatient clients and frustrated colleagues, that the Gold price will not break above the $2000 mark with moment in a sustained manner until the USGovt debt is widely perceived to be on a crash course toward default. WE ARE THERE, as even the prestigious St Louis Fed has publicly gone on record to call the USGovt debt as unsustainable. The picture of default is being painted.

- Growing perception of USGovt debt default and USTreasury Bond default. The $34 trillion debt will never be repaid. The borrowing costs are over $1.2 trillion annualized.

- Growing perception of monetized USGovt debt and monetized USTBond refunding. A severe shortage of foreign bond investors has become an acute problem.

- Growing perception of constant status for higher price inflation. The actual CPI is at least 5% to 6% higher than reported.

- Growing trend of grand wealth transfer, from USTreasurys to Gold in banking systems. This phenomenon is an historic factor, seen once per century.

- Growing trend by bank depositors to remove funds from banking system, and to invest in the more stable Gold. Individual account holders are very worried.

- Progress with BRICS nations in creating non-USD payment systems, which resulting in heavy volume of USTreasury Bond sales. They are all de-Dollarizing to remove risk.

- Growing resentment by victims of Dollar Weaponization, to avoid the USDollar in favor of Gold for trade payments and reserves management. The USGovt has weaponized the USD and attacked any nation operating to the contrary.

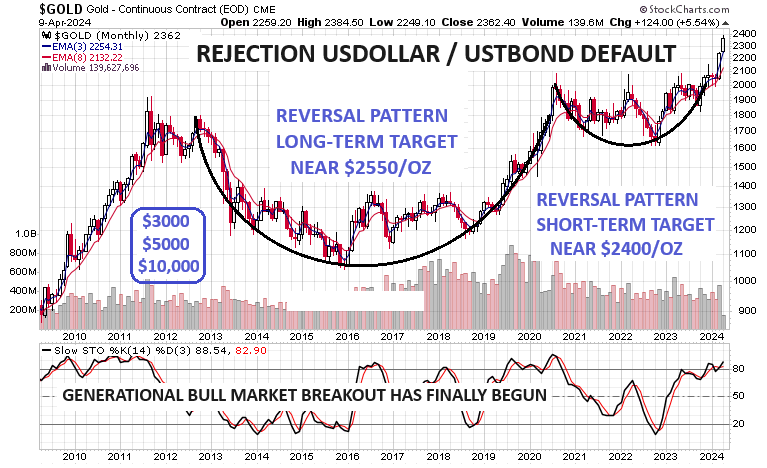

- Hidden agenda by Western central banks to escape grotesque insolvency by investing heavily in Gold, then sending price to $3000, then $5000, then $10,000. Former BIS Chairman Zijlstra outlined this plan in the 1990 decade. In fact, the USFed has handed the USDept Treasury a ripe $120 billion loss from its Balance Sheet. It is insolvent.

- Growing perception of the inflationary depression in the USEconomy and Western Europe, evident by false statistics on price inflation. The depression began with the 2020 economic lockdown. Subtract at least 6% from GDP (economic growth) to enter reality, from the false inflation measures. The United States is caught in the deep clutches of an inflationary depression.

- The big insolvent banks have gone long in Gold, while depleting the GLD Fund as price suppression tool. They have $740 billion in unrealized asset losses. They must purchase Gold slowly, since any rapid sale of USTBonds will cause a bond default.

- China and Japan are supporting their Yuan and Yen currencies with Gold purchases. Furthermore, China and India are supporting the Gold price after every strong slam by the US-UK bankster criminal set, which use naked short methods.

- Shift of geopolitical and financial power from West to East in sunset of the King Dollar. The global revolt has substantial momentum. The US-UK banksters have abused their position as masters of the USDollar. The East will develop a fair equitable system based upon the Gold Standard.

- Growing movement for a valid hard asset foundation for the global monetary system. The movement has many participants, considerable momentum, and will not be stopped. The Von Mises Corollary states that a paper basis is followed by a metal basis.

- Failure in trust of all things American: banking practices, financial market controls, economic statistics, warfare, news networks, social nonsense, political fascism.

- Long list of mothballed mining projects, each to take almost two years to resume output. Several big mines were shut down, from the fake COVID threat. They will reopen gradually when the higher precious metals prices are perceived to be stable.

- The explosion of Global Debt in relation to GDP, at over 330% currently, and rising. The ratio has doubled in the last two decades.

- Rapid introduction of Gold-backed digital currencies in the de-Dollarization revolt, which include the Gold Token. Several nations will launch their versions.

- The power of On-Demand liquidity for XRP by Ripple Tech with gold basis. It will become a favorite among the vehicles for Blockchain Platforms.

- Rising specter of war in multiple regions across the globe, as Globalist fascist regimes are deposed, while waging war to maintain the grip on power. Each war will appear, only to be suffocated, not to proliferate. Wars waged by the US-UK-NATO axis, will see the Israeli War as the cabal’s last war.

- Dark Money will find a path to Gold, from money laundering caches, from drug cartels, from Langley warehouses of shrink-wrapped massive stores.

GOLD BULL CHART

The greatest wealth transfer in history has begun. It has years more to be completed. The deep irony is that the big banks, led by the hidden initiative of the central banks, will ensure the march to much higher Gold price, multiples higher. The catapult has been built.

SILVER NEXT

The foundation has been constructed. Gold first had to break down the castle gate like a battering ram. Next the Silver price will force an historical short squeeze based upon a large-scale covering rally. The Fibonacci signposts will be scribed. The new energy and technology patents will be rolled out, which will foster a renaissance in economic development. This chart displays the most promising potential for a massive price increase, which will be sustained.

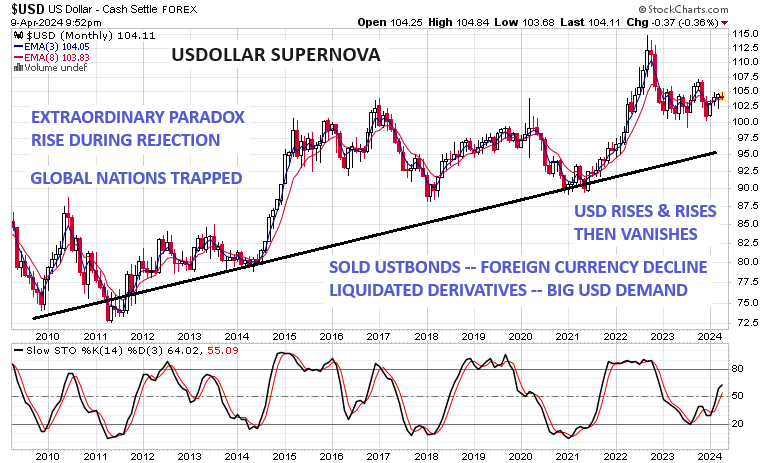

RISING USDOLLAR PARADOX

The SuperNova will be a remarkable phenomenon to observe. Foreign central banks must sell, discharge, unload, and abandon the USTreasury Bonds held as FOREX reserves. In so doing, they reduce their USDollars held in reserve, which form the basis for their currencies. The paradoxical consequence: their foreign currency declines versus the USDollar. The Japanese financial crisis will become a case study. Derivative liquidation sustains the rally, as demand rises for USD required to complete the liquidation. Refer to Bond derivatives and the Petro-Dollar derivative contracts. The USDollar will rise and rise, then rise some more, before it vanishes. Gold takes its place across the entire globe. The process will be disruptive, painful, gradual, and violent.

DARK MONEY FACTOR

The March 2021 failure of Silicon Valley Bank exposed the Sinaloa cartel, which funneled $billions via New Hampshire trusts. The Credit Suisse bank failure in 2023 followed the Russian Military smash of money laundering centers in Ukraine. Half of Bitcoin is dark money, the other half legitimate (e.g. Asian) funds which strive to avoid the USD ferrymen extortionists. Narco money laundering could be over $800 billion per year, with Langley a monopoly player, also Colombia, Eastern Europe, and the Chinese. The Jackass estimates that narco funds form a vast war chest of at least $10 trillion globally. Dark narco funds found their way into the US Stock Market, with the FANG-MAT companies, with clear Swiss banker collusion. This deployment of narco funds enabled the creation of executives like at Amazon and FaceBook who assisted in the stolen 2020 election. Narco funds are reported as integral in building BlackRock, the private equity firm closely aligned with the Globalist cabal. All Dark Money funds might be participating in the Gold market, as they exit the King Dollar realm, sensing a destructive climax in the next several months. They also might suspect some later attempts at confiscation, thus the shift to Gold as safe haven.

home: www.Golden-Jackass.com (new website)

subscribe: Hat Trick Letter

Jim Willie CB, editor of the “HAT TRICK LETTER”

Use the above link to subscribe to the paid research reports, which include coverage of critically important factors at work during the ongoing panicky attempt to sustain an unsustainable system burdened by numerous imbalances aggravated by global village forces. The historically unprecedented ongoing collapse has been created by compromised central bankers and inept economic advisors, whose interference has irreversibly altered and damaged the world financial system, urgently pushed after the removed anchor of money to gold. Analysis features Gold, Crude Oil, USDollar, Treasury Bonds, and inter-market dynamics with the US Economy and US Federal Reserve monetary policy.

HAT TRICK LETTER PROFITS IN THE CURRENT CRISIS.

“Jim Willie’s proprietary contacts in highly strategic positions around the world help him better predict the future with an accurately as high as 90%. That is astounding! The Hat Trick Letter is my secret sauce to better understand what is really happening, so I can make better financial decisions during this tumultuous period.”

(PaulK in Kentucky)

"I have continued my loyal patronage of your excellent commentaries not so much because of my total agreement with your viewpoints, but because you have proven yourself to be correct so often over the years. When you are wrong, you have publicly admitted it. You are, I suppose by nature, an outspoken and irreverent spokesman for TRUTH against power, which differentiates you from almost all other pundits on world affairs."

(PaulR in Hawaii)

"For over five years I have been eagerly assimilating any and all free information (articles, interviews, etc) that Jim Willie puts out there. Just recently I finally took the plunge and became a paid subscriber. I regret not doing this much sooner, as my expectations were blown away with the vast amount of sourced information, analysis tied together, and logical forecasts contained in each report."

(JosephM in South Carolina)

"A Paradigm change is occurring for sure. Your reports and analysis are historic documents, allowing future generations to have an accurate account of what and why things went wrong so badly. There is no other written account that strings things along on the timeline, as your writings do. I share them with a handful of incredibly influential people whose decisions are greatly impacted by having the information in the Jackass format. The system is coming apart on such a mega scale that it is difficult to wrap one's head around where all this will end. But then, the universe strives for equilibrium and all will eventually balance out."

(The Voice, a European gold trader source)

Jim Willie CB is a statistical analyst in marketing research and retail forecasting. He holds a PhD in Statistics. His career before the newsletter launch in 2004 stretched 24 years. He aspires to thrive in the financial editor world, unencumbered by the limitations of economic credentials. Visit his free newly revamped website to find articles from topflight authors at www.Golden-Jackass.com. It now has a hyphen in the URL address. For personal questions about subscriptions, contact him at JimWillieCB@gmail.com.