AbraSilver Resource Corp. (TSX-V: ABRA | US: ABBRF) continues to remain my top gold and silver exploration investment for another year as the latest drill program, at its wholly-owned Diabillos silver-gold project in Argentina, has been proving additional mineralization well beyond past estimates!

These drill results build on past success and provide the basis for an increased resource estimate and an improved economic study due very soon.

The Diablillos project covers 80 square kilometres and hosts silver and gold mineralization in the fertile mining region of northwestern Argentina that includes the TacaTaca (First Quantum Minerals Ltd.), Lindero and Arizaro (Fortuna Silver Mines Inc.), Rio Grande (Regulus Resources Inc.) deposits.

The property has seen over US$50 million of exploration totaling over 100,000 metres of drilling in over 450 holes, and the company’s most recent drill program continues to extend the mineralization trend.

AbraSilver is preparing the Diablillos project for its next stage of growth.

Building and Improving on the Past: Summer Drilling

The company recently completed 20,000 metres of drilling in 77 holes and started a new 15,000-metre drill program to update and expand mineral resources, and improve the project's economics.

The company will use these results to update a 2021 mineral resource estimate which outlined 90,165,000 oz of Ag and 1,002,000 oz. Au in the Measured and Indicated category, and a further 3,181,00 oz. Ag and 66,000 oz. Au in the inferred category.

A 2021 Preliminary Economic Assessment (PEA) already estimated a positive economic for the Diabillos project with an internal rate of return (IRR) of 30.2% for an average annual production of 4.2 million ounces silver and 52,000 ounces gold over 16 years.

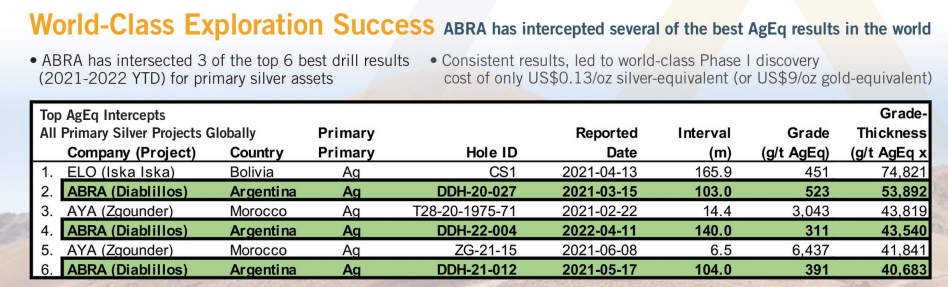

The summer drill program builds on a track record of exploration success where the company delivered some of the best drill results of any silver exploration company.

John Miniotis, president and chief executive officer commented in a recent press release:

"Over the past month alone, we have announced two holes from our Tesoro zone for which the mineralized intercepts rank among the best in the world over the past two years, in addition to discovering a brand new zone in the southwest located over 500 metres beyond the conceptual open pit boundary. By all measures, our 20,000-metre phase 2 program has been a resounding success, which we expect will result in a significant increase in the mineral resource estimate to be announced later this year."

Drill hole 22-041 returned 183 grams per tonne silver equivalent (AgEq) over 38.5 metres at (2.6 g/t AuEq or 119 g/t Ag and 0.91 g/t Au) starting at a depth of 74 metres. The hole included a 12.5 metre interval grading 350 g/t AgEq (5.00 g/t AuEq).

Drill hole 22-037 cut 289 grams per tonne silver equivalent (4.1 g/t gold equivalent -- comprising 185 grams per tonne silver and 1.48 g/t gold) over 155 meters starting at a depth of only 71 metres.

The hole included a 30-metre interval grading 609 grams per tonne AgEq (8.7 g/t AuEq or without the equivalent 238 g/t Ag and 5.3 g/t Au). This hole contains the thickest, high-grade silver-gold intercept ever encountered on the project.

In the northeast zone, DDH 22-031 lies roughly 350 metres beyond the current open pit boundary and hit a high-grade gold intercept of 3.25 g/t Au and 33 g/t Ag over 20 metres.

These results, combined with prior drilling in the northeast zone, demonstrate the large size of the gold-silver system, which extends for at least 500 metres beyond a conceptual open pit envisioned in the 2021 PEA.

In addition, the drill results show the potential for additional resources and could increase the resource footprint and improve the economics in an upcoming prefeasibility study “PFS”.

The company was encouraged by these results and announced a new 15,000 metre, Phase III, drill campaign commenced at Diablillos to test multiple high-priority targets. This program is already bearing fruit.

John Miniotis, president and chief executive officer, commented:

"We are very pleased with the excellent results received from our 20,000-metre phase 2 drill program. The drill program successfully demonstrated the robust exploration upside potential at Diablillos, where we have not yet reached the limit of the strike and depth continuity of several mineralized zones. We're looking forward to announcing our updated mineral resource estimate in October, and continuing to add value from our exciting phase 3 exploration program, which is currently drilling in the southwest zone, where hole DDH 22-019 recently intersected 87 metres of 346 g/t Ag near surface."

These drill programs serve more than just providing more resources but also provide critical data to envision a mine.

The Next Stage of Growth: Planning a Mine

This drilling is going into a new economic study which the company plans to deliver in the first quarter of 2023. The PFS will use more than 300 drill holes and 100,000 metres of drilling and two programs of detailed metallurgical testwork.

Several scenarios are currently being evaluated, which may result in an improvement in the economics of the project, including:

- Metallurgical testwork could improve the recovery rates for silver, increasing payable ore per amount of rock moved.

- Processing: studies are being conducted to determine the optimal throughput rate, which is expected to be above that reported in the preliminary economic assessment.

- Geotechnology and hydrology: An initial geotechnical drilling campaign has been completed. Preliminary results indicate that the company could improve access to deeper high-grade mineralization near the base of the open pit. The campaign is expected to determine the water availability for increased plant throughput.

- Optimising Capital expenditures and operating expenditures to focus on logistic costs

All this work will help to make the case for further funding and possible development to investors.

Strong Support: AbraSilver by the Numbers

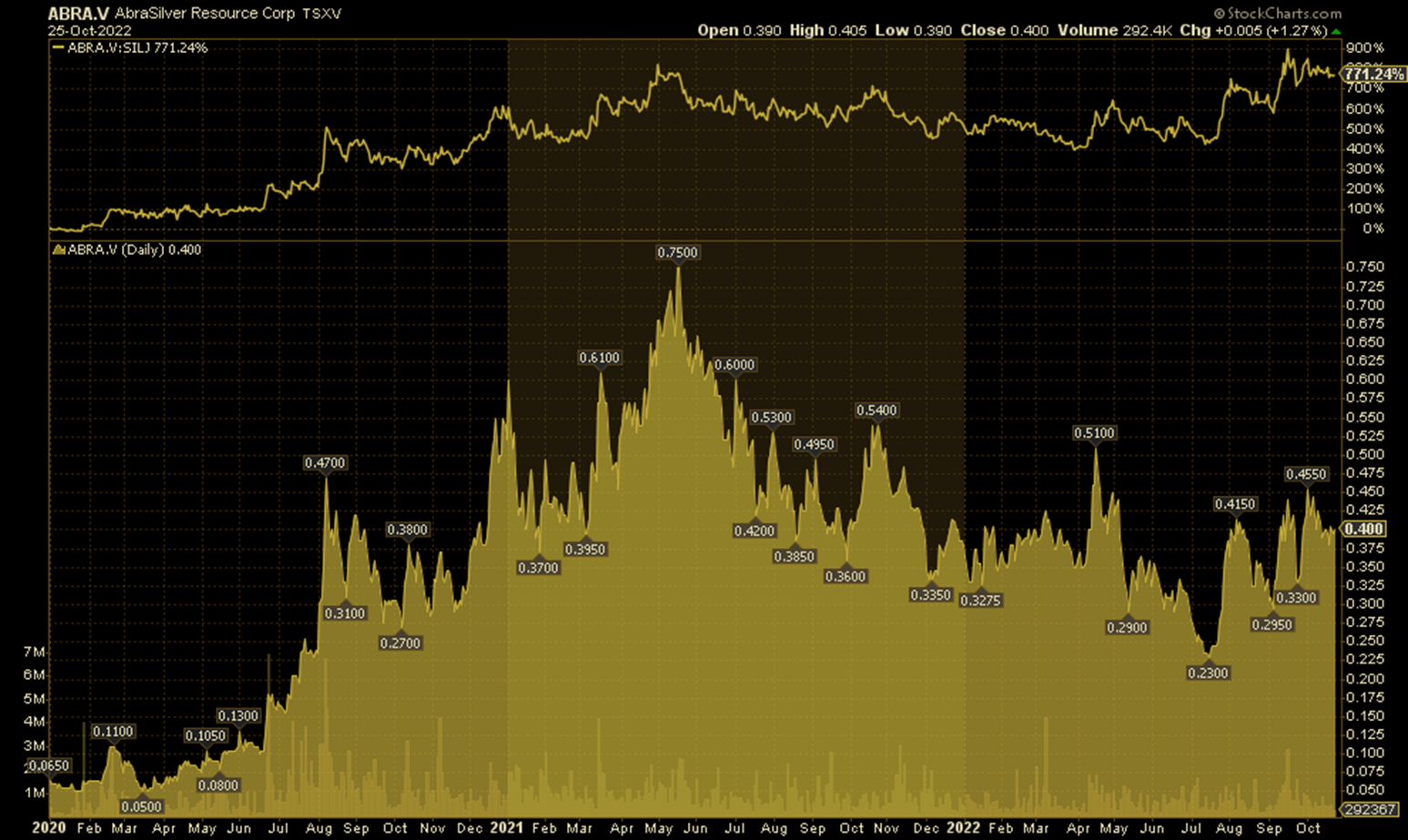

The strong drill results have helped the company’s stock performance amidst a weak market for junior mining companies. In July 2022, the company’s shares were trading around 24 cents CDN and on the back of the drill results the share price reached 42 cents on Sept. 15.

With the upcoming PFS, the company is in a position to sustain and continue to foster the Diabillos project and the company's market value. The company has $17 million in cash on hand to fund further work as it follows up on its successful summer program.

The company has strong shareholders such as Eric Sprott who owns 64,481,500 shares, representing 12.6 percent of the outstanding shares on a non-diluted basis.

In addition, the Diabillos project is part of EMX Royalty’s (NYSE:EMX) portfolio. SSRM (formerly Silver Standard) sold its 1% NSR on the Diablillos project as well as the remaining obligation of a US$7 Million payment which is due in 2025 (or upon commercial production) to EMX.

Partners make the difference in mining. AbraSilver has an invested interest from a growing royalty company that just started receiving payment from one of its flagship Gedikpete asset and EMX is also benefiting from an ~80% increase in its royalty at the Caserones Copper Mine in Chile.

Set for Growth When Gold Prices Return

The one thing that distinguishes companies, and especially mining companies, is that they are putting in the work when markets are asleep or times are tough. This effort sets a company apart and prepares them for appreciation when the market returns while giving investors in a difficult market environment an exciting exploration investment which is out-performing its peers.

I have been continually adding to my holdings since AbraSilver’s IPO several years ago. AbraSilver remains my top gold and silver exploration investment which can grow even larger as we near a few key milestones. These rich key catalysts will propel analyst revaluations and I expect a friendly response in its share price as the project size and economics become even more attractive!

Key catalysts for growth and market revaluations include:

- An updated resource estimate expected this Quarter

- PFS released in Q1 2023

Success in mineral exploration is often like the growth of a bamboo shoot. It takes years of care and cultivation seeing little growth. But those years of effort eventually result in explosive growth. With more catalysts coming soon, AbraSilver is very well positioned to capitalize on their exploration success.

To continue your research and learn more about AbraSilver, please visit AbraSilver.com

This report’s analysis was produced with the work of Nicholas LePan, GoldSeek.com

To Stay Connected:

- Twitter: @GoldSeek

- E-mail List: Sign-Up Here

Disclosure: Goldseek.com employees own shares of AbraSilver Resources

Legal Notice / Disclaimer: This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. GoldSeek.com, have based this document on information obtained from sources it believes to be reliable but which it has not independently verified; GoldSeek.com makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of GoldSeek.com only and are subject to change without notice. GoldSeek.com assume no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, we assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information, provided within this Report.

Additional Disclosure: The owner, editor, writer and publisher and their associates are not responsible for errors or omissions. The author of this report is not a registered financial advisor. Readers should not view this material as offering investment related advice. Authors have taken precautions to ensure accuracy of information provided. Information collected and presented are from what is perceived as reliable sources, but since the information source(s) are beyond our control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The information presented in stock reports are not a specific buy or sell recommendation and is presented solely for informational purposes only. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise outside of the trading timeframe listed above. Nothing contained herein constitutes a representation by the publisher, nor a solicitation for the purchase or sale of securities & therefore information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The companies mentioned herein may be sponsor of GoldSeek.com. Investors are advised to obtain the advice of a qualified financial & investment advisor before entering any financial transaction.