The technical correction is over in gold, silver and copper. There will be sharp rallies as long as yesterday's low holds. I will prefer a buy on dips strategy as long spot gold trades over $1890-$1895 zone and spot silver trades over $21.90-$22.20 zone till next week

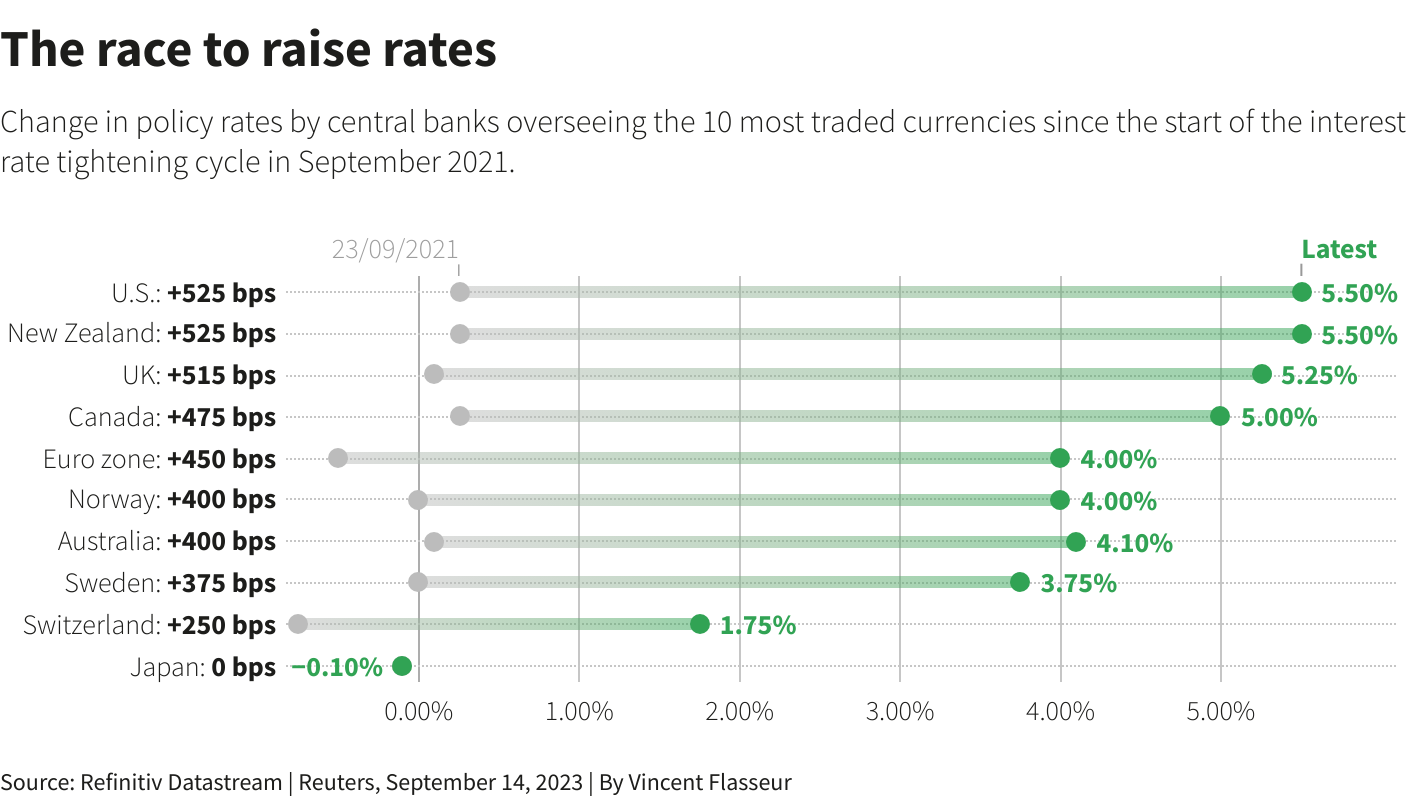

Traders are one again betting of an interest rate pause next week by the Federal Reserve. Volatility will be there on changes to interest rate outlook.

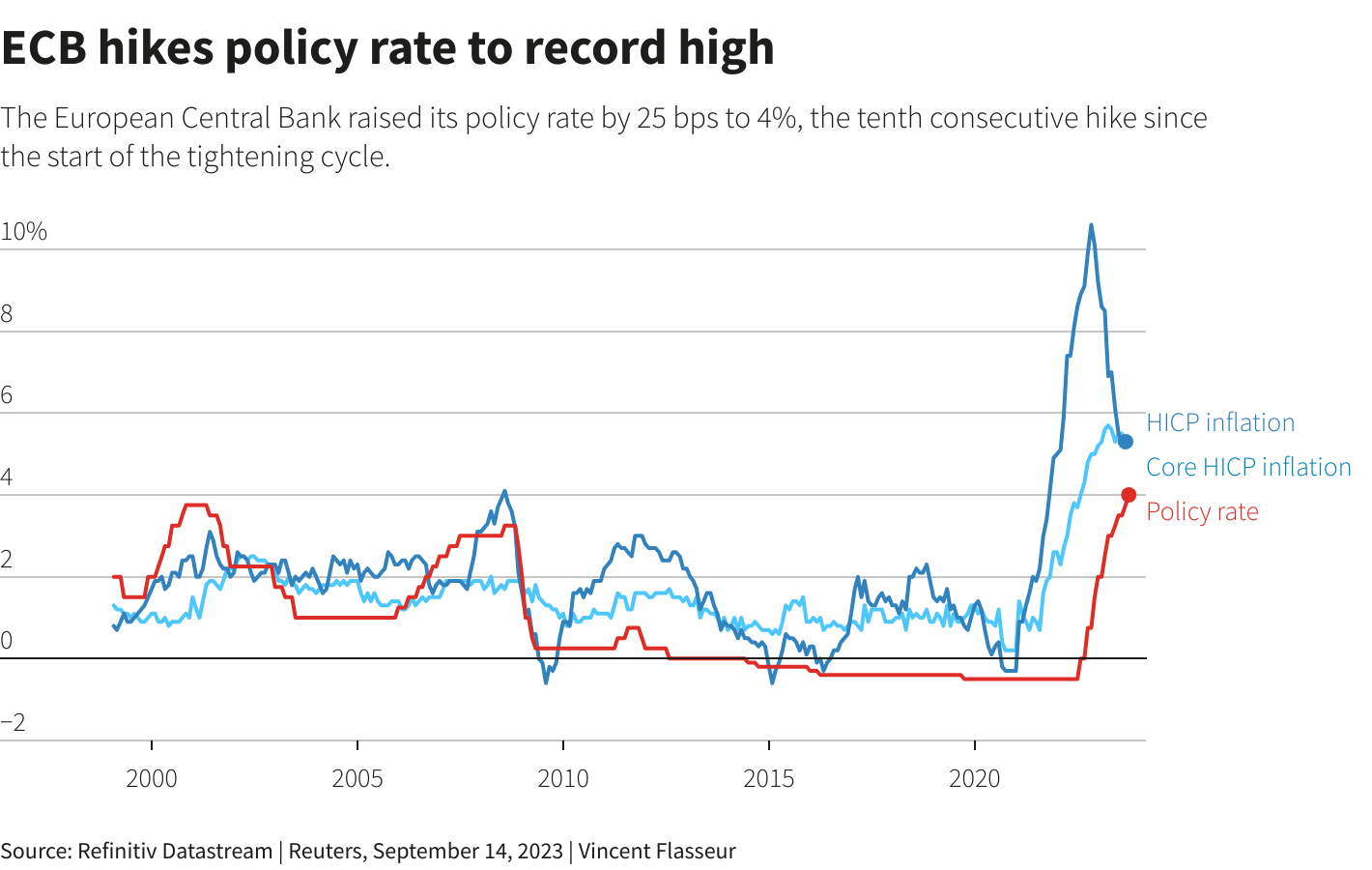

Interest rate hikes is near an end by the European central bank (after the ten consecutive hike yesterday). ECB will prefer growth over inflation for the rest of the year.

Impact of current crude oil price on inflation will be felt only in the first quarter of next year. If recession/slowdown comes first before renewed bout of inflation then most central banks will not raise interest rates. World will see a much longer interest rate pause period. I will prefer to invest by buying US dollar Index naked put options on or from second quarter of next year with varying strike price.

The general view is that the crude oil price induced subsequent inflation will not have any impact on interest rate hike decisions by most central banks. Global financial markets are nearing an interest rate pause period with passing of each month.

Use a buy on crash strategy in gold and silver and natural gas for Monday and next week. Look for signs of weekend profit taking in crude oil. There will be a technical breakout if copper and zinc rise today.

Spot Gold

- Daily support: $1902.70 and $1916.00

- Daily resistance: $1924.60 and $1939.40

- Spot gold can rise to $1936.10 as long as it trades over $1909.00.

- Mild sell off will be there if spot gold trades below $1909.00.

- Crash or sell off will be there if spot gold trades below $1897.40 till next week.

Spot Silver:

- Daily Support: $21.98, $22.32 and $22.60

- Daily Resistance: $23.28 and $23.93

- Spot silver can rise to $23.93 and $24.20 as long as it trades over $22.60.

- Sellers will be there only below $22.60.

Disclaimer: Any opinions as to the commentary, market information, and future direction of prices of specific currencies, metals and commodities reflect the views of the individual analyst, In no event shall Chintan Karnani have any liability for any losses incurred in connection with any decision made, action or inaction taken by any party in reliance upon the information provided in this material; or in any delays, inaccuracies, errors in, or omissions of Information. Nothing in this article is, or should be construed as, investment advice. All analyses used herein are subjective opinions of the author and should not be considered as specific investment advice. Investors/Traders must consider all relevant risk factors including their own personal financial situation before trading. Prepared by Chintan Karnani

Disclosure: I do not trade in spot gold, spot silver or comex future. I do trade in India’s MCX commodity exchange.

NOTES TO THE ABOVE REPORT

ALL VIEWS ARE INTRADAY UNLESS OTHERWISE SPECIFIED

Follow us on Twitter @chintankarnani

PLEASE NOTE: HOLDS MEANS HOLDS ON DAILY CLOSING BASIS

PLEASE USE APPROPRIATE STOP LOSSES ON INTRA DAY TRADES TO LIMIT LOSSES.

THE TIME GIVEN IN THE REPORT IS THE TIME OF COMPLETION OF REPORT

ALL PRICES/QUOTES IN THIS REPORT ARE IN US DOLLAR UNLESS OTHERWISE SPECIFED.