The downgrade of the US government credit by Moody's amplifies the concerns of rising US government debt. Nations with rising debt will also see a downgrade in the credit rating of their treasuries. Trump and his unilateral trade war are all about reducing the US government debt. From a short-term perspective, all asset classes will be highly volatile, including the gold price. From a long-term perspective, Team Trump has to ensure that there is a significant reduction in US debt. If the USA is unsuccessful or any hints for it, despite the trade war, then the pace of rise of gold and silver will double.

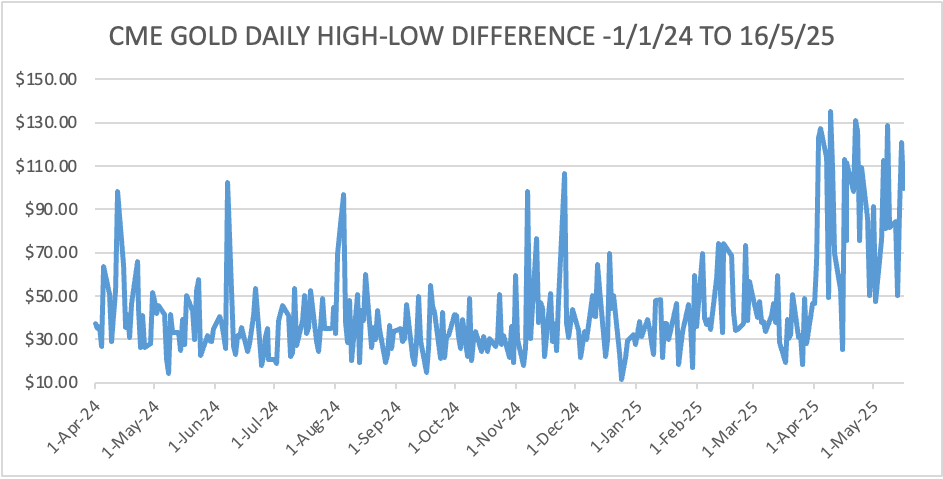

- Average high-low gap (from 1st April 24 to 16th May 25): $44.13

- Average high-low gap (from 1st Nov 24 to 16th May 25): $52.64

- Average high-low gap (from 1st Jan 25 to 16th May 25): $57.83

- Average high-low gap (from 1st March to 16th May 25): $69.25

CME daily high-low price gap is seeing a rising trend after November 2024, US president elections. Gold price rise has been accompanied by rising intraday price range. Day traders are making good money or can make good money in intraday trading of gold. In my view, the flips flops or fear of flip flop by Trump and this team will ensure rising trend in daily high-low price gap in near dated CME gold futures.

The Golden Rule to follow, which nobody follows, is to never carry forward an intraday gold trade into the next trading day. In my view, losses are made by those gold traders who carry forward their intraday gold trades to the next trading day. Be precise about your period of trading/investment and follow it strictly with strict stop losses.

For example, a trader makes a regular profit in gold trading for say three continuous months. At the end of three months, he will consider himself the king of trading. He will significantly increase the number of lots per trade after three months, thinking he will get an invincible profit. The day the person gets a few days of overall intraday trading losses, it will trigger a chain reaction to the extent of capital erosion. I am writing this as I have seen this happening to some of my close friends this year.

There is no major US economic data release till 27th May. USA and UK are both closed on 26th May. It will be a technical trade till 27th May. Position squaring and rebuilding for June month can begin anytime.

SPOT GOLD – current price $3211.40.

- Spot gold needs to trade over $3201.60 to rise to $3251.10, $3271.20, $3305.20, and more.

- A mild sell-off will be there if spot gold trades below $3201.000.

- Crash or sell off will be there if spot gold trades below $3186.00 in the USA session and tomorrow the whole day.

- There can be some very sharp two-way price moves.

- Views are intraday.

Disclaimer

The investment ideas provided is purely independent view point and are solely for collective learning and for academic interests. There is no commercial benefit accruing or have deemed to accrue to me out of providing such investment ideas.

The investment ideas shared here cannot be construed as investment advice or so. If any reader is acting on these advices, they are requested to apply their prudence and consult their financial advisor before acting on any of the recommendations made here. I am not responsible to anybody in the event of profits and losses (if any) upon acting on such advice.

I hope that our reader is aware about this well aware of the risk involved in trading in commodity derivative trading.

Disclosure: I trade in India's MCX commodity exchange. I have open positions in India's MCX commodity future. I do not trade in CME future or OTC spot gold and spot silver.

NOTES TO THE ABOVE REPORT

- ALL VIEWS ARE INTRADAY UNLESS OTHERWISE SPECIFIED

- Follow us on Twitter @chintankarnani

- PLEASE NOTE: HOLDS MEANS HOLDS ON DAILY CLOSING BASIS

- PLEASE USE APPROPRIATE STOP LOSSES ON INTRA DAY TRADES TO LIMIT LOSSES.

- THE TIME GIVEN IN THE REPORT IS THE TIME OF COMPLETION OF REPORT

- ALL PRICES/QUOTES IN THIS REPORT ARE IN US DOLLAR UNLESS OTHERWISE SPECIFED.

- ALL NEWS IS TAKEN FROM REUTERS NEWSWIRES.

- TECHNICAL ANALYSIS IS DONE FROM TRADINGVIEW SOFTWARE