The US stock-market action last quarter was dumbfounding. Big US stocks rocketed higher despite this global pandemic ravaging the US economy, which collapsed by a third in annualized terms! That makes understanding their fundamentals more important than ever. The winding-down Q2’20 earnings season reveals whether those massive stock-price gains were actually justified by underlying corporate profits.

Last quarter proved this country’s worst in history economically, with US GDP crashing at a brutal 32.9% full-year pace! 3/4ths of that plummeting was driven by personal consumption cratering. Tens of millions of Americans were receiving unemployment payments. When spending wanes, corporate earnings have to follow. Consumer spending dominates the US economy, driving about 7/10ths of all economic activity.

Americans pulled in their horns in Q2, both due to draconian government lockdown orders and serious COVID-19 fears. The uncertainty this pandemic and governments’ heavy-handed reactions to it caused are off-the-charts extreme, radically unprecedented in our lifetimes. Yet the flagship US S&P 500 stock index (SPX) still magically soared 20.0% in Q2’20! This disconnect between markets and the economy is epic.

Some of those colossal gains are explainable by the preceding stock panic. From mid-February’s pre-pandemic all-time-record peak to the end of Q1, the SPX plunged 23.7%. Big mean-reversion bounces are normal and expected after those exceedingly-rare extreme selling events. Far more important was the Fed’s astounding record money printing in Q2, a desperate attempt to stave off a full-blown depression.

The Fed reports its balance-sheet levels weekly. From their last weekly read in Q1 to their final in Q2, the Fed’s balance-sheet skyrocketed 34.8% or $1,828.0b higher! That is crazy-extreme, as close to hyper-inflation as this 106-year-old central bank has ever dared tread. Quantitative easing, which is quite literally conjuring money ex nihilo to use to buy and thus monetize bonds, is a powerful stock-market levitator.

As of the middle of this week, these trillions of dollars the Fed blasted into the system have pushed the SPX back up within just 1.7% of new record highs! Can the big US stocks’ fundamentals possibly justify trading at levels last seen before this pandemic severely hobbled this country? That logically seems like quite a stretch, with entire major industries being slowly strangled by radical changes in consumption habits.

All investors need to care how big US stocks are faring, as some combination of them dominate almost all portfolios. The leading SPX ETFs are wildly popular, led by the gargantuan SPY SPDR S&P 500 ETF, IVV iShares Core S&P 500 ETF, and VOO Vanguard S&P 500 ETF. These colossal investment vehicles commanded a staggering $292.5b, $208.3b, and $156.3b in assets this week! Their market footprint is vast.

Their top 25 components effectively are the US stock markets, accounting for a stunningly-top-heavy 41.8% of the total weighting of the entire S&P 500! So every quarter I wade through the latest quarterly results of these behemoths, to see how they are actually faring fundamentally. Given the unprecedented chaos slamming the economy in Q2’20, there’s probably never been a more important quarter to analyze.

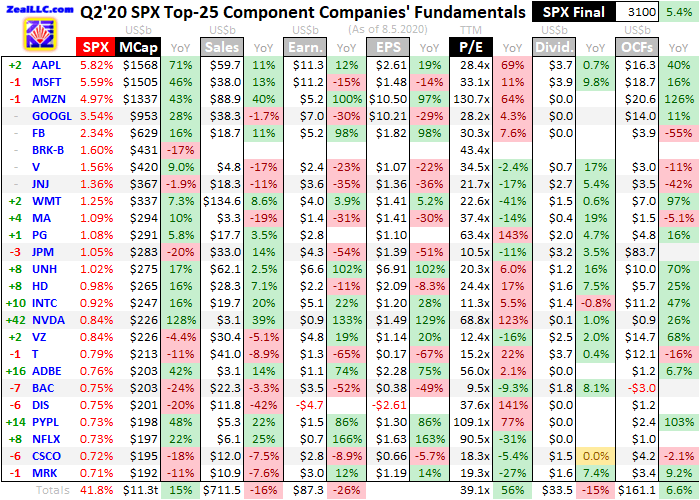

This table outlines key fundamentals of the 25 largest companies in the US stock markets. Their stock symbols are preceded by how their rankings within the SPX shifted in the year since the end of Q2’19. After the symbols these companies’ actual percentage weightings within the S&P 500 at the end of Q2’20 are shown, along with their market capitalizations in billions back when that reporting quarter was ending.

Their market caps, as well as all their other fundamental data, are followed by year-over-year changes from the ends of Q2’19 to Q2’20. Looking at market-cap changes offers a purer read on companies’ values than stock-price changes, normalizing out some manipulative effects of corporate stock buybacks. They are done to artificially boost share prices and earnings per share, maximizing executives’ compensation.

Quarterly revenues, overall corporate profits, earnings per share, trailing-twelve-month price-to-earnings ratios as of quarter-end, dividends paid, and operating cash flows generated are shown. These key data are also followed by YoY changes. Blank fields mean a company hadn’t reported that particular data as of this week. Warren Buffett’s Berkshire Hathaway is the main culprit here, it hasn’t released Q2 results yet.

That’s not unusual, Berkshire usually reports on one of the first couple Saturdays in the second month after quarter-ends. Some companies have goofy fiscal quarters offset from calendar ones, making them harder to compare with peers. Adobe’s quarters end one month before calendar ones, while Walmart, Home Depot, NVIDIA, and Cisco have quarters running one month after. So their latest quarters are included.

Percentage changes are left blank if they are misleading or not meaningful, primarily when data shifted from positive to negative or vice versa between Q2’19 to Q2’20. In a quarter where the S&P 500 itself climbed 5.4% YoY, its top 25 companies’ results were fascinating and ominous. Excluding those market-darling mega-cap tech stocks everyone loves, the biggest and best US companies are generally struggling.

The capital deluging into so-called stay-at-home stocks benefitting from this pandemic is sure evident in the ranking shuffling among the SPX top 25. The big US stocks with the largest relative market-cap gains propelling them up the S&P 500 ladder were these kinds of companies. With people spending far more time at home, home-improvement projects had a higher priority driving Home Depot up through the ranks.

People working from home and kids doing school at home required lots of upgraded technology, which included Intel’s central processors and NVIDIA’s graphics processors. A far higher proportion of shopping done at home catapulted PayPal way higher, and with far fewer opportunities for entertainment Netflix naturally saw a big surge. This pandemic has radically changed how we are living and spending money.

The flood of Fed-spawned capital goosing stock markets concentrated in these elite top 25 companies of the S&P 500. They again commanded an immense 41.8% of the entire SPX’s weighting! That was the highest I’ve seen in the 12 quarters doing this research thread. And based on longer SPX datasets, this top-heavy weighting is the most-concentrated on record! Fewer stocks are carrying the entire markets higher.

The SPX top 25’s $11.3t total market capitalization surged 14.8% YoY, dwarfing those 5.4% gains in the S&P 500 itself from the ends of Q1’19 to Q1’20. And these latter broad-market gains were largely driven by those big US stocks’ ones. So these lofty stock markets sure wouldn’t have looked anywhere near as good without all that capital rushing into big US stocks. If they materially falter, the SPX is in serious trouble!

On the Q2’20 corporate-results front, that gigantic Berkshire Hathaway is the largest US company after the beloved mega-cap tech juggernauts. Berkshire owns lots of businesses which collectively put up big numbers. Since Berkshire’s Q2’20 results haven’t been released yet as this essay is published, we need to exclude Berkshire’s Q2’19 ones when comparing the totals. So all those are recast as ex-Berkshire.

The gaping bifurcation between the mega-cap techs and the rest of the big US stocks continued to widen last quarter. Apple, Microsoft, Amazon, Alphabet, and Facebook fortunately happened to be major beneficiaries of the stay-at-home trend to minimize potential COVID-19 exposure. Apple device sales surged dramatically as people replaced aging technology to make work and school at home more efficient.

Microsoft, Amazon, and Alphabet really benefitted from businesses massively accelerating their shift to moving computing needs into the cloud. The more people work from home, the more important having secure professionally-managed servers accessible from anywhere becomes. And with shopping shifting abruptly out of potentially-contaminated meatspace into the virtual world, Amazon’s sales just skyrocketed.

Facebook saw engagement rise too. People stuck at home really needed to connect with friends and peers like never before, and struggling businesses really needed to get their ads seen. It is stunning how the same elite mega-cap techs that dominated the stock markets before this pandemic are seeing some of the biggest benefits from it. So it’s more important than ever to break out the Big Five techs’ results.

On the revenues front, the top 25 SPX companies saw their sales drop 9.6% YoY in Q2’20 excluding Berkshire. That portends much-lower earnings, since corporate profits leverage revenue trends in both directions. Without those mega-cap techs, the big US stocks’ revenues situation looks far worse. The huge pandemic tech spending catapulted the Big Five’s Q2 revenues an astounding 17.8% higher YoY!

But the next 20 largest S&P 500 companies saw their total Q2 sales collapse 19.3% YoY. And these cover a broad array of industries. Going deeper into the SPX below the top 25, other data indicates the revenues situation is even worse. If sales don’t bounce back strongly in Q3 and Q4, corporate earnings are going to take a big hit regardless of how the Big Five fare. And the pandemic’s dire economic impacts linger.

Indeed the SPX top 25’s earnings reflected and amplified their sales trends last quarter. This entire elite group of big US stocks saw total profits fall 16.6% YoY ex-Berkshire. But again the divide between the Big Five mega-cap techs and everything else was enormous. Apple, Microsoft, Amazon, Alphabet, and Facebook enjoyed collective earnings rising 3.7% YoY. That’s a heck of an achievement in this environment.

But the rest of the top 25 saw their total profits collapse 28.4% YoY last quarter! There’s no way their stock prices should’ve rallied given such weak underlying fundamentals. Ultimately stock prices have to gravitate towards reasonable multiples of companies’ earnings. Extreme Fed money printing can short circuit that necessary fundamental connection for a season, but eventually profits determine stock prices.

Ominously the SPX top 25’s trailing-twelve-month price-to-earnings ratios soared dramatically higher by the end of Q2’20, even before its weak profits were reported. Together these elite companies averaged trading at a dangerous 39.1x earnings! For the past century and a quarter historical fair value for stock markets has run near 14x, and twice that at 28x is where formal bubble territory begins. We’re far beyond that!

Wall Street makes tens of billions gathering assets and charging commissions on them. The professional money managers are paid based off percentages of capital they are running. So they always have huge financial incentives to keep people fully invested no matter what, risks be damned. These guys will never recommend selling, no matter how overvalued and close to imminent bear markets stock prices are getting!

They’ve long used a ridiculous fiction called forward earnings to rationalize excessive valuations. Classic trailing-twelve-month P/Es look at the last four reported quarters of actual hard GAAP earnings compared to prevailing stock prices. There is no guess work in that. But when those valuations grow dangerous, the Wall Street analysts switch to talking forward earnings. Those are based on estimates of the next four quarters.

That conceit is totally fake, no one can predict what’s going to happen in earnings over the coming year. The shocking events of Q2’20, which would’ve seemed utterly impossible to all of us back in January, prove that in spades. And forward-earnings estimates have forever proven far too optimistic as a whole. An investment industry that needs to keep people fully invested perpetually paints the future as rose-tinted.

So with valuations at bubble extremes even in the Big Five mega-cap techs, analysts have pushed this forward-P/E farce to ludicrous degrees. Over the past few months, they have started proclaiming that big US stocks are undervalued based on blended 2021 and 2022 earnings! They brazenly assume the post-COVID-19 world is going to quickly return to pre-pandemic levels of economic activity. That isn’t too likely.

Wall Street’s effective censorship of even discussing legitimate trailing-twelve-month P/Es is only going to worsen as corporate earnings fall. Asset gatherers and commission takers can’t admit stock markets are dangerously overvalued, which portends a major bear market to force stock prices lower long enough for underlying corporate profits to catch up. But it is foolish to ignore the warning signs of excessively-valued stocks.

We don’t have to exclude Berkshire Hathaway from the dividend comparison since it doesn’t pay them. It is ironic Warren Buffett loves and praises other companies paying dividends, but has steadfastly refused to pay them to his own shareholders! Overall SPX-top-25 dividends paid in Q2’20 fell 15.5% YoY. That is mostly due to a different mix of companies though, as stay-at-home stocks displaced bigger dividend payers.

Only Apple and Microsoft pay dividends among the mega-cap techs, and those climbed 5.2% YoY in Q2. The rest of the SPX top 25 actually saw their total dividends collapse 20.0% YoY. Companies with falling revenues and earnings can borrow money to maintain dividend levels for a while, but ultimately dividends must be supported by profitability. So we’re likely going to see a big wave of dividend cuts in the near future.

Operating-cash-flow generation was the one brighter spot among the big US stocks last quarter. Their OCFs surged 13.5% YoY excluding Berkshire and the volatile mega-banks. That came mostly from stay-at-home companies doing booming business in Q2 contrary to the shrinking economy. The Big Five techs saw 26.4% YoY growth in OCFs, while the rest of the top 25 only managed a comparatively-weak 4.6% gain.

But all the big US stocks were hoarding cash like crazy, trying to increase their flexibility and strength to weather these dark times. The SPX top 25’s total treasuries soared 24.1% YoY to $779.5b excluding Berkshire! That’s a vast pile of money to keep operations running even as business slows for many if not most sectors. The Big Five’s cash piles only grew 9.3% YoY, but they accounted for 5/8ths of the SPX top 25’s total.

The scramble for cash was most evident in the next 20 largest US companies after the mega-cap techs. They frantically grew their cash balances 58.6% higher YoY! Plenty of this came from new borrowing including tapping lines of credit. The SPX-top-25 mix also played a role, with more cash-rich companies climbing into the ranks booting out cash-poorer ones. But there’s definitely a concerted effort to build up cash.

So the big US stocks’ Q2’20 fundamentals were generally quite weak. While the market-darling mega-cap techs did great as stay-at-home demand massively boosted their revenues, most of the rest of the elite stocks suffered. This insane pandemic environment does not bode well for corporate earnings outside of the handful of obvious winners. And Wall Street’s oft-hyped V-out economic recovery is a total fantasy.

Tens of millions of Americans are still out of work. The trillions of dollars of federal stimulus authorized by the CARES Act has largely run out. Q2 would’ve looked very different on the economic and earnings fronts had that vast money not deluged into the system. That included the $600-per-week federal bonus payments on top of state unemployment, which expired last week and Congress can’t agree to renew them.

Entire industries dependent on gathering people together in bigger groups are failing before our eyes. Airlines, cruise ships, sports, concerts, and restaurants are stuck in an unthinkable nightmare. Together those industries employed tens of millions of Americans who are really going to struggle to find jobs. And if they aren’t making money, they sure aren’t going to be spending to buy products the SPX companies offer.

Ominously the Fed’s epic money printing that catapulted the S&P 500 higher in Q2 stalled out in mid-June. Ever since then the Fed’s balance sheet has drifted sideways to lower. That greatly compromises the odds that these Fed-goosed stock markets can keep levitating near record highs with falling corporate earnings and bubble valuations. The reckoning is still coming, stock prices have to reflect economic reality.

That is going to have to take the form of a long-overdue major bear market. These subtly begin way up near euphoric highs where everyone is convinced the party will go on forever. Bears are cunning and devious initially, taking their sweet time to keep people fully invested despite dangerous valuations. That eventually inflicts the most pain possible on the greatest number of traders before bears return to hibernation.

The classic bear-market strategy is selling stocks and holding cash. If a bear market cuts stocks in half, holding cash through it doubles purchasing power so twice as many shares can be bought back once it runs its course. But cash not only doesn’t appreciate, its value is rapidly being eroded at a wildly-unprecedented pace from the Fed’s colossal panicked money printing. The world is being flooded with new dollars!

Thus a far-superior strategy is to weather this overdue and necessary stock bear in gold and the stocks of its miners. Gold tends to power higher on balance in strong bulls after stock panics, and there is nothing more bullish for gold than astounding currency debasement. That has really helped fuel the recent gold rush, leaving gold and its miners’ stocks extremely overbought. But they should be added aggressively in selloffs.

At Zeal we started aggressively buying and recommending fundamentally-superior gold and silver stocks in our popular weekly and monthly newsletters back in mid-March after gold got sucked into the stock panic. Their absolute unrealized gains were running as high as +205% this week! As of the end of Q1, all 1149 newsletter stock trades recommended since 2001 have averaged annualized realized gains of +18.7%.

That’s more than double the long-term stock-market average, driven by a studied contrarian approach. That’s why our newsletters have been blessed with much success over the decades. They draw on my vast experience, knowledge, wisdom, and ongoing research to explain what’s going on in the markets, why, and how to trade them with specific stocks. Subscribe today to see our current trades and enjoy 20% off!

The bottom line is big US stocks’ just-reported Q2’20 results revealed plunging sales and profits. The only bastion of strength was the mega-cap techs, which saw exceptional stay-at-home demand for their goods and services. Even before those generally-weak Q2 earnings came out, valuations were already up deep into dangerous stock-bubble territory. These stock markets have radically disconnected from reality.

The Fed’s trillions of dollars of money printing in just a few months drove this epic anomaly. But that has since stalled, ramping the odds a major reckoning is nearing to hammer stock prices low enough to again reasonably reflect underlying corporate earnings. Sales and profits aren’t going to rebound quickly with this pandemic still raging. Stock prices have a long ways to fall to manifest this darker COVID-19 economy.

Adam Hamilton, CPA

August 7, 2020

Copyright 2000 - 2020 Zeal LLC (www.ZealLLC.com)