The US stock-market action last quarter proved a roller-coaster ride. Big US stocks first surged to record highs on hopes for more huge pandemic-stimulus spending from Congress. Then with little progress on that front, the stock markets plunged again. Q3’20 proved a chaotic quarter leading into this week’s US elections. Its winding-down earnings season shows whether corporate profits are justifying lofty stock prices.

With all the often-surprising election results naturally dominating market news flow, it’s important to keep our eyes on the fundamental ball. While stock traders salivate for another big spending bill or more Fed quantitative-easing money printing depending on the new balance of power in Washington, stock-market levels are ultimately dependent on earnings. The government has pulled out all stops to radically boost them.

After March’s brutal stock panic triggered by states’ draconian lockdowns to slow the spread of COVID-19, the Fed flooded the US economy with epic amounts of money. After slashing interest rates back to zero, in just 3.0 months this panicking central bank radically expanded its balance sheet by 66.3%! The US-dollar supply skyrocketed 2/3rds higher as the Fed conjured up $2,857b of new money out of thin air.

Not to be outdone, Congress passed the gargantuan record $2,225b CARES Act pandemic-stimulus bill in late March! It directly paid Americans with helicopter money, and provided vast loans for businesses that could be turned into grants if they followed all the rules. That epic pandemic-stimulus spending was expanded by $484b in late April with the Paycheck Protection Program. Together they added up to $2,709b.

With literally trillions of dollars thrown at the ailing US economy, US GDP in Q3 skyrocketed at a dazzling record 33.1% annualized pace! But that was a rebound off of Q2’s record 31.4% annualized plummeting driven by those lockdowns. Despite all that astounding Fed money printing and government spending, the US economy still actually shrunk 2.9% year-over-year by the end of Q3! It was barely treading water.

But in early September the flagship S&P 500 benchmark stock index (SPX) soared to new all-time-record highs, before slipping merely 6.1% by quarter-end. That colossal deluge of new money certainly helped levitate the stock markets, which are the core linchpin of Americans’ economic sentiment. But with extreme bubble valuations exiting last quarter, foundational corporate profits weren’t justifying such lofty stock prices.

The 500 elite SPX stocks averaged trailing-twelve-month price-to-earnings ratios of 32.8x at the end of September! That’s well into formal bubble territory which starts at 28x historically. If these companies are weighted by their market capitalizations instead, that metric looked even more dangerous at 36.8x. That made Q3 earnings crucial. Would they surge enough on that liquidity deluge to make stellar stock prices righteous?

Every quarter I wade through the latest operating and financial results from the 25 largest stocks included in the SPX. These behemoths effectively are the US stock markets, commanding an incredible record 43.0% of the SPX’s total weighting as Q3 wrapped up! All investors need to care about how the big US stocks are faring, as some combination of them dominate almost all portfolios including retirement accounts.

The leading SPX ETFs are wildly popular, led by the gargantuan SPY SPDR S&P 500 ETF, IVV iShares Core S&P 500 ETF, and VOO Vanguard S&P 500 ETF. A staggering $297.7b, $220.8b, and $159.8b of investors’ capital was deployed in these colossal investment vehicles this week! The SPX companies are required to report their latest results by 40 calendar days after quarter-ends, in the form of SEC 10-Q reports.

It’s an exceedingly-important time for speculators and investors to understand how the big US stocks are actually doing fundamentally. The stock markets are drenched in euphoria surrounding the elections, on hopes for more huge Fed money printing and more huge pandemic-stimulus spending. But if that flood of liquidity doesn’t pan out with the gridlocked-government status quo continuing, fundamentals will matter again.

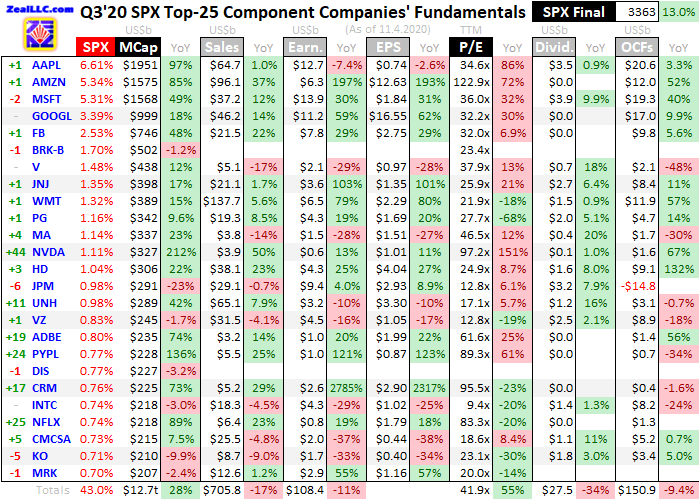

This table outlines key fundamentals of the 25 largest companies in the US stock markets. Their stock symbols are preceded by how their rankings within the SPX shifted in the year since the end of Q3’19. After the symbols these companies’ actual percentage weightings within the S&P 500 at the end of Q3’20 are shown, along with their market capitalizations in billions back when that reporting quarter was ending.

Their market caps, as well as their other fundamental data, are followed by year-over-year changes from the ends of Q3’19 to Q3’20. Looking at market-cap changes offers a purer read on companies’ values than stock-price changes, normalizing out some manipulative effects of corporate stock buybacks. They are done to artificially boost share prices and earnings per share, maximizing executives’ compensation.

Quarterly revenues, GAAP corporate profits, earnings per share, trailing-twelve-month price-to-earnings ratios as of quarter-end, dividends paid, and operating cash flows generated are shown. These key data are also followed by YoY changes. Blank fields mean a company hadn’t reported that particular data as of this week. Warren Buffett’s Berkshire Hathaway is the main culprit here, it hasn’t released Q3 results yet.

Berkshire likes to push that 40-day SEC deadline, reporting on the last Saturday before it arrives. Some companies have goofy fiscal quarters offset from calendar ones, making them harder to compare with peers. Adobe’s quarters end one month before calendar ones, while Walmart, NVIDIA, Home Depot, and Salesforce.com have quarters running one month after. So their latest-reported quarters are included here.

Percentage changes are left blank if they are misleading or not meaningful, primarily when data shifted from positive to negative or vice versa between Q3’19 to Q3’20. In a quarter where the S&P 500 itself surged 13.0% YoY, its top 25 companies’ results sure didn’t justify such big gains. Excluding the market-darling mega-cap tech stocks everyone loves, the biggest and best US companies are seeing business weaken.

Even as Q3 ended well before this week’s post-election euphoria on pollsters being horribly wrong on their blue-wave-sweep predictions, the extreme narrowness in these stock markets was stunning. The Big Five mega-cap technology stocks Apple, Amazon, Microsoft, Alphabet, and Facebook are universally adored and owned. Together these behemoths commanded a staggering 23.2% of the entire S&P 500!

Wall Street calls them the stay-at-home stocks, with businesses that have benefitted greatly from this new cloistered world defined by fears of catching COVID-19. People need upgraded Apple devices to work at home and be entertained at home. Americans are ordering everything they can online, fueling enormous growth for Amazon. Working remotely from home is also driving soaring demand for server-based services.

That’s really boosting the massive cloud businesses of Amazon, Microsoft, and Alphabet. Companies are advertising heavily on Alphabet and Facebook looking for new customers, as many Americans are deeply struggling financially with the US economy so hobbled by infection fears. And with most normal in-person gatherings taboo these days, Facebook usage has soared as people try to stay in touch with their friends.

Other stay-at-home tech stocks have proven the fastest climbers in the SPX’s ranks over this past year. NVIDIA produces fast graphics processors in heavy demand for gaming, which is the leading form of in-home entertainment. Adobe’s software is facilitating this white-collar work-from-home reality. PayPal is seeing big transaction growth from the major shift underway of buying virtually everything possible online.

And Netflix is bringing the streaming television and movie entertainment for the people not spending their evenings playing video games. The radical changes society is undergoing in this pandemic have heavily driven traders’ capital flows into the big US stocks! But it has exacerbated a stunning bifurcation, which is readily apparent across the Big Five mega-cap tech stocks and the next-largest 20 SPX companies under them.

The beloved Big Five again command a shocking 23.2% of the SPX’s total weighting, well exceeding the 19.8% of the next 20 stocks. That hasn’t proven a problem for years now, but eventually the torrid growth in these huge companies will stall out. Any material selling in them is a serious risk for the SPX as a whole since they dominate its weighting. The concentration in a handful of stocks has never been higher.

Overall revenues among the SPX top 25 in Q3’20 fell 17.2% YoY to $705.8b. But that decline is overstated, because Berkshire Hathaway hasn’t reported its latest results yet. Neither has Disney, which is trying to usurp Netflix’s streaming throne with its fantastic Disney+ service. Disney hasn’t reported its Q3 either yet, because that actually ends its fiscal year. SEC 10-K annual reports are due 60 days after quarter-ends.

So excluding Berkshire and Disney from Q3’19’s results, the SPX top 25’s sales only fell 8.1%. But that is still considerable in light of the trillions of dollars of money printing and government spending fueling that skyrocketing Q3 US GDP growth. Americans love spending money when they can, so falling revenues at these big US companies implies many people are struggling financially. This economy is wildly uneven.

The bifurcation between the Big Five and the next 20 SPX companies is astounding. Those elite mega-cap techs enjoyed colossal 17.9% revenue growth last quarter, compared to scary 19.0% shrinkage for the rest of these biggest US companies! Corporations can’t withstand falling sales for long without doing big layoffs to slash costs. Those leave more people without sufficient incomes, forcing overall spending lower.

This could spiral into a vicious circle spawning a full-blown depression, which is what the Fed is so darned worried about. The more people without normal jobs, the less they can buy from companies cutting their sales and profits. The less companies make, the more people they have to fire. The lower their earnings, the more overvalued stock markets become upping the odds for a new secular bear further damaging sentiment.

Major stock-market weakness scares the remaining Americans blessed to be doing fine in this pandemic, leading them to pull in their horns on spending. That further erodes corporate fundamentals. All of this can cascade in a devastating negative feedback loop. Neither the US economy nor the stock markets can thrive for long if Apple, Amazon, Microsoft, Alphabet, and Facebook are the only companies doing great!

GAAP corporate earnings among the SPX top 25 without Berkshire and Disney actually rose 3.4% YoY to $108.4b. But that is ridiculously pathetic given the US economy rebounding by a third last quarter per that record GDP report. And that slowly-rising profitability certainly isn’t universal, with all the growth coming from those Big Five mega-cap techs. Their earnings skyrocketed 31.1% YoY to $52.0b, almost half the total!

The next-20-largest US companies suffered 13.5%-lower profits last quarter. Weaker earnings coupled with higher prevailing stock prices naturally mean higher valuations. The SPX top 25’s average TTM P/Es soared 54.9% YoY to 41.9x at the end of Q3’20! This small group of companies encompassing almost 4/9ths of the entire S&P 500 are trading at super-dangerous bubble levels. That guarantees a bear.

These extreme overvaluations are even more stunning considering the trillions of dollars of Fed money printing and pandemic-stimulus payments deluging into Q3’20. How much lower would corporate profits had been without that epic liquidity flood? And how long will that fuel increased consumer spending that bolsters companies’ top and bottom lines? Probably not long with so many incomes still heavily impaired!

Much of recent months’ euphoric stock-market action, as well as this week’s in the wake of the elections, resulted from traders’ hopes for another huge round of pandemic-stimulus spending. That definitely isn’t a sure thing unless either Republicans or Democrats fully control the presidency, Senate, and House. But instead of the false-prophesied blue-wave sweep, gridlock still reigns greatly lowering the odds for any big deal.

Best case for these lofty stock markets is Congress approving another CARES-Act-style spending bill that helps struggling Americans. But after they spend all that new money within a couple months of getting it, that still leaves weakening corporate profits driving up valuations. And there’s an increasing chance a Republican-controlled Senate and Democrat-controlled House will continue to refuse to agree on anything.

Trillions of dollars of new spending can delay the inevitable valuation reckoning for these stock markets again, but probably not for long. And if that hyper-anticipated next round of pandemic stimulus fails to materialize, corporate earnings will continue to deteriorate forcing stock prices to mean revert far lower to better reflect profits even sooner. Big US stocks’ fundamentals certainly aren’t justifying their lofty prices!

On the dividend front, the top 25 SPX companies reported 31.5%-lower dividends from Q3’19 excluding Berkshire and Disney. Again that was heavily bifurcated, with the Big Five mega-cap techs seeing 5.4% dividend growth even though only Apple and Microsoft actually bother paying them. The next-20-largest SPX companies saw their dividends collapse 39.3% YoY! That’s partially from the changing SPX-top-25 mix.

The largest US companies’ operating-cash-flow generation in Q3’20 mirrored the rest of their results. Excluding Berkshire and Disney, that only slipped 4.2% YoY to $150.9b. But all that growth again came from the Big Five mega-cap techs, where OCFs surged 18.5% YoY. That compared to 20.7% shrinkage for the next-20-biggest SPX stocks! That doesn’t include the OCFs reported by the money-center banks.

Mega-banks’ operating cash flows are incredibly volatile and complex, swinging wildly from very positive to very negative quarter to quarter. So they skew these comparisons. The Big Five tech behemoths accounted for 52% of the SPX top 25’s OCFs last quarter, along with 38% of revenues and 48% of profits! So again if their high-flying businesses slow, stall out, or even reverse, the whole SPX is in a world of hurt.

The more that revenue, earnings, and operating-cash-flow growth are concentrated into fewer stocks, the more brittle stock markets become. And the Big Five aren’t only vulnerable to something impacting their amazing businesses. The sizes of their sales, profits, and OCFs have grown so incredibly massive that big growth from such high levels is getting ever-harder mathematically. That could turn sentiment against them.

These mega-cap techs dominating and driving the entire US stock markets averaged TTM P/Es of 51.5x as Q3’20 ended. That means at current earnings and stock-price levels it takes these companies almost 52 years to earn back the prices traders are paying for their stocks! The historical fair-value average for the broad US stock markets is 14x earnings, although tech stocks have usually enjoyed a growth premium.

But will traders be willing to pay 40x, 50x, or more for these elite market darlings if their revenues and earnings growth slows? The Big Five’s average sales and profits last quarter ran $53.1b and $10.4b, which are colossal numbers to keep seeing double-digit growth from. Thus even if this pandemic craziness persists, it’s going to be increasingly impossible for the mega-cap techs to continue reporting fast growth.

So make no mistake, today’s stock markets remain very dangerous and at risk for an imminent major selloff! Despite the trillions of dollars of Fed money printing and government spending so far, earnings are nowhere near high enough to justify these near-record-high stock prices. This week’s euphoria on a gridlocked US government hopefully preventing Biden’s enormous tax increases will likely start fading soon.

While another huge pandemic-stimulus-spending bill from Congress could delay this reckoning by a few months, anything big passing is far from certain. Eventually speculators and investors are going to have to face the ugly reality that corporate fundamentals come nowhere close to justifying these high prevailing stock prices. They must mean revert way lower to restore reasonable multiples of underlying earnings.

That is going to have to take the form of a long-overdue major bear market. These subtly begin way up near euphoric highs where everyone is convinced the party will go on forever. Bears are cunning and devious initially, taking their sweet time to keep people fully invested despite dangerous valuations. That eventually inflicts the most pain possible on the greatest number of traders before bears return to hibernation.

The classic bear-market strategy is selling stocks and holding cash. If a bear market cuts stocks in half, holding cash through it doubles purchasing power so twice as many shares can be bought back once it runs its course. But cash not only doesn’t appreciate, the Fed’s wildly-unprecedented pace of money printing is rapidly eroding the US dollar’s value. This epic currency debasement changes bear strategy.

That naturally leads to much-higher gold investment demand, driving the yellow metal’s price higher as bears ravage bubble-valued stock markets. As gold powers higher on balance, the major gold stocks tend to leverage its advance by 2x to 3x. While gold and its miners’ stocks have been correcting out of extremely-overbought levels in recent months, they remain the best destinations for capital in stock bears.

Since the Fed can’t artificially stave off the long-overdue bear forever, it’s essential to cultivate excellent contrarian intelligence sources. That’s our specialty at Zeal. After decades studying the markets and trading, we really walk the contrarian walk. We buy low when few others will, so we can later sell high when few others can. We can help you both understand these markets and prosper in them, even during bears.

We’ve long published acclaimed weekly and monthly newsletters for speculators and investors. They draw on my vast experience, knowledge, wisdom, and ongoing research to explain what’s going on in the markets, why, and how to trade them with specific stocks. As of Q3’20 we’ve recommended and realized 1178 newsletter stock trades since 2001, averaging outstanding annualized realized gains of +24.0% over that multi-decade span! Subscribe today and take advantage of our 20%-off sale!

The bottom line is the big US stocks’ just-reported Q3’20 results certainly don’t justify their dangerous bubble valuations. All the revenues and earnings growth remained concentrated in the handful of market-darling mega-cap techs. The rest of the elite US stocks suffered sharply-declining sales and profits last quarter. That was despite a record GDP surge fueled by trillions of dollars of money printing and spending!

Whether US lawmakers can work together to pass another huge pandemic-stimulus-spending bill or not, eventually these lofty stock prices must reasonably reflect underlying corporate profitability. That means they need to mean revert far lower in the long-overdue next bear market. And with pandemic fears still retarding Americans’ spending and weighing on big US stocks’ earnings, that serious selloff could start anytime.

Adam Hamilton, CPA

November 6, 2020

Copyright 2000 - 2020 Zeal LLC (www.ZealLLC.com)